The automotive components industry has set expectations from the Union Budget 2022. Ashish Bhatia shares the industry’s wishlist from the annual spectacle.

The Union Budget 2022 will be presented in the parliament on February 01, 2022, by Union Finance Minister (FM) Nirmala Sitharaman amidst the third wave of Covid-19 having a direct bearing on the fourth quarter of FY2022 (Q4FY2022). As the annual spectacle nears the allocation reveal, for the automotive industry, its key stakeholders are ready with their wish list. Like every year, questions loom large on the direction the FM takes especially since it is the third calendar year on the trot that the industry is weighed down by the pandemic. Even though the industry is much more prepared this year, it is yearning for answers and a clear road map to align near-term recovery and propel long-term growth plans. Will it or won’t it come good for the automotive components ecosystem as a whole is the big question!

The Union Budget 2022 will be presented in the parliament on February 01, 2022, by Union Finance Minister (FM) Nirmala Sitharaman amidst the third wave of Covid-19 having a direct bearing on the fourth quarter of FY2022 (Q4FY2022). As the annual spectacle nears the allocation reveal, for the automotive industry, its key stakeholders are ready with their wish list. Like every year, questions loom large on the direction the FM takes especially since it is the third calendar year on the trot that the industry is weighed down by the pandemic. Even though the industry is much more prepared this year, it is yearning for answers and a clear road map to align near-term recovery and propel long-term growth plans. Will it or won’t it come good for the automotive components ecosystem as a whole is the big question!

Will it be tilted to address supply-side concerns or will it incentivise demand through direct and indirect measures and will the FM pull off the balancing act? A must to in turn boost the sectoral prospects and satisfy the stakeholders with a validation of the government continuing to extend support. Leading up to the budget, the government has made itself clear. It wants to emerge as a trusted partner in the global supply chain. The industry is hoping it walks the talk too with the fine print of the budgetary allocations reflecting it. In the words of Prime Minister Narendra Modi, the government is working to improve ease of doing business, simplify tax structures and make improvements in the context of retrospective tax. To make India an attractive destination for global investment, the government will look to walk the talk on home ground.

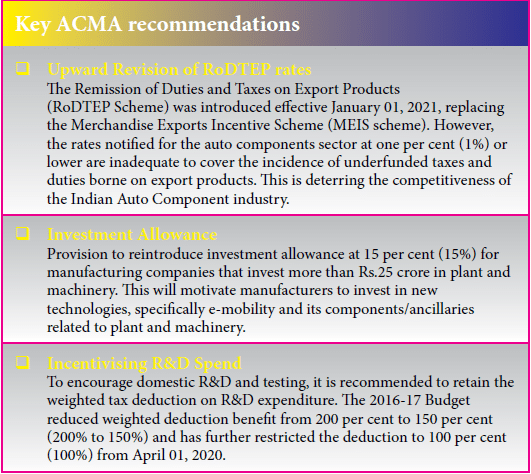

The Automotive Components Manufacturers Association (ACMA) as the apex body of the Indian auto component industry has emphasised the need for a uniform Goods and Services Tax (GST). It has also called for an enhancement of Remission of Duties and Taxes on Export Products (RoDEPT) rates along with measures to encourage capital investment in the auto components industry. Spearheading the recommendations for the forthcoming budget, Sunjay Kapur, President, ACMA emphasised, “The auto component industry, being an intermediary, has recommended for a uniform GST rate of 18 per cent on all auto components.” Deemed to have a significant aftermarket presence and operations, he admitted, that the industry was weighed down by grey operations and counterfeits for which he blamed the high GST rate of 28 per cent. “A moderate rate of 18 per cent will not only address this challenge but will also enhance the tax base through better compliance,” he explained.

Admitting to the automotive industry going through one of the most challenging, yet interesting times, ever, and disruptions due to the pandemic, new technologies and regulations redefining mobility, Kapur also drew attention to timely steps already taken by the government. “The recent policy announcements by the Government on the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) Battery, PLI for the auto and auto components and extension of the FAME-II scheme are indeed very timely measures and will facilitate the Indian automotive sector to become an integral part of the global automotive value chains as also staying relevant,” he expressed. ACMA, in addition, has separately notified the government on reducing the cost of doing business and hence enhancing the ease of doing business in India.

Admitting to the automotive industry going through one of the most challenging, yet interesting times, ever, and disruptions due to the pandemic, new technologies and regulations redefining mobility, Kapur also drew attention to timely steps already taken by the government. “The recent policy announcements by the Government on the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) Battery, PLI for the auto and auto components and extension of the FAME-II scheme are indeed very timely measures and will facilitate the Indian automotive sector to become an integral part of the global automotive value chains as also staying relevant,” he expressed. ACMA, in addition, has separately notified the government on reducing the cost of doing business and hence enhancing the ease of doing business in India.

Kapur hailed the focus of the government on the environment, energy security and vehicular safety fronts calling it imperative for the auto components industry to invest in newer technologies and create capacities to meet the growing domestic demand for such products. In the Union Budget 2022, as per Kapur, facilitating investments for capacity building and encouraging Research & Development (R&D) and new product development will be a step in the right direction. It will be interesting to see how the FM keeps aside fiscal concerns while allocating public spending to boost the demand sentiments.

Echoing a similar sentiment, Ashwath Ram, Managing Director, Cummins India Ltd. said, “India must continue its multi-year spend on infrastructure to sustain growth. We cannot slow down spending even if it is slightly inflationary in the short term. More support is needed for manufacturing as we are still reeling under the effects of Covid-19 to sustain long term growth and capital buildup.” Drawing attention to the importance of liquidity for manufacturers, he stressed the need to avail capital at cheaper rates to in turn invest in equipment for growth. To encourage exporters, Ram called for the need to bring in Special Economic Zones (SEZs) under RoDTEP and for the rates of payouts from the schemes to match the actual double taxation costs. He also called for extending the PLI scheme to manufacturers of electrolysers for H2, H2 in Internal Combustion Engines (ICE) and flex-fuel engine production equipment. He called upon the FM to look at export-focussed projects in manufacturing where there is a need to incentivise for better scalability and business sustainability.

Farrokh Cooper, Chairman & Managing Director, Cooper Corporation called for a balancing act. He said, “The forthcoming Union Budget for 2022 should emphasise measures to help the Indian economy recover from the pandemic and to boost consumption-led demand.” “The auto industry expects relief from the Union Budget in multiple areas. To achieve sustainable growth, business communities should be encouraged to invest more in industry and businesses,” he added. Cooper called upon the government to fix industry income rates for at least five years for industrialists to plan long-term financial and take appropriate decisions about investment in the respective industries.

Speaking for the Ministry of Micro, Small & Medium Enterprises (MSMEs), Yash Jinendra Munot, Vice President, Association of Indian Forging Industry (AIFI) said, this year, there are expectations of a good, progressive, and balanced budget from all MSME’s, including the forging industry, due to the rough patches the industry has seen with current chip shortages and the pandemic and keeping in mind that the industry has not fully recovered with the heavy investment done for BSVI implementation. He cited the large cash flow block with some value-added products at 28 per cent bringing attention back to the need for rationalisation of the GST rates (at 18 per cent). Additionally, he urged the government to look at reducing import duties on steel to meet the current shortfall and make Indian steel prices competitive under the ‘Make in India’ initiative. Munot backed the call for eligibility for a benefit on the duty structure.

He hailed the continuous efforts to simplify and streamline Indian tax laws, and going forward expressed the industry’s anticipation for consistency in tax and regulatory policies, as well as their interpretation, this year. To achieve Industry 4.0 capability, Munot called for the allocation of funds through FDI schemes and new investment allowances to further encourage investment in technology. He also called upon the FM to clear the scrappage policy at the Ministry of Finance level to further boost demand across segments of the auto sector besides quick implementation of incentives for scrapping old and purchase of the new vehicles going forward.

He hailed the continuous efforts to simplify and streamline Indian tax laws, and going forward expressed the industry’s anticipation for consistency in tax and regulatory policies, as well as their interpretation, this year. To achieve Industry 4.0 capability, Munot called for the allocation of funds through FDI schemes and new investment allowances to further encourage investment in technology. He also called upon the FM to clear the scrappage policy at the Ministry of Finance level to further boost demand across segments of the auto sector besides quick implementation of incentives for scrapping old and purchase of the new vehicles going forward.

Drawing attention to the automotive industry contributing 7.5 per cent to the GDP, Gajanan Gandhe, Country Head at Dana India, opined that there is immense pressure on the industry to recover. The need of the hour is a booster shot, he quipped. Setting aside the tremors of the third wave, Gandhe called it “interesting” times for the sector. He said, “The disruptions caused by the pandemic have led to emerging new technologies and regulations that are redefining the future of mobility. As the mobility industry shifts to place greater emphasis on green energy and electrified vehicle programs, the sector needs a strategic direction for an efficient recovery. The Union Budget 2022-23 could prove to be that booster shot that relieves the industry of some grave challenges and help with a resilient comeback.” Adding to the wishlist, Gandhe cited the need for a strategic, long term plan and outlay that aids year-long recovery and helps improve consumer demand that has collapsed. He advocated the need to look at multiple means, some of which, he added, is already being implemented by the GoI such as the PLI scheme, lower corporate income tax for new companies etc. Not mincing words, he said, however, more needs to be done.

In addition to the steps already taken by the GoI, Gandhe echoed the industry sentiment by urging a reduction of the GST like mentioned above leading to better compliances as the tax base improves besides seeking tax incentives for encouraging R&D investments too. He also called for the need to bring petrol and diesel under the purview of GST to help streamline the costs impacted by fuel. In addition to the industry’s demand for revisions to RoDTEP, he also called for the need for export subsidies to help manufacturers tackle counterfeit, forged products known to have spiked in the last two years. To boost the EV segment further, Gandhe called for encouraging investment in EVs through measures like reduction in GST for electric two-wheelers, and EV batteries. He also called for an increase in tax SOPs for EVs and charging units to push the sales. He hailed the GoI measures like PLI in the battery pack and cell manufacturing as a step in the right direction given that the battery accounts for over 40 per cent of the cost of the EVs, on average.

In addition to the steps already taken by the GoI, Gandhe echoed the industry sentiment by urging a reduction of the GST like mentioned above leading to better compliances as the tax base improves besides seeking tax incentives for encouraging R&D investments too. He also called for the need to bring petrol and diesel under the purview of GST to help streamline the costs impacted by fuel. In addition to the industry’s demand for revisions to RoDTEP, he also called for the need for export subsidies to help manufacturers tackle counterfeit, forged products known to have spiked in the last two years. To boost the EV segment further, Gandhe called for encouraging investment in EVs through measures like reduction in GST for electric two-wheelers, and EV batteries. He also called for an increase in tax SOPs for EVs and charging units to push the sales. He hailed the GoI measures like PLI in the battery pack and cell manufacturing as a step in the right direction given that the battery accounts for over 40 per cent of the cost of the EVs, on average.

On indirect measures to uplift the sector further, income tax for salaried employees has to be brought down, he opined. He also called for enhancing the tax-free Provident Fund amount and the increase standard deduction. He also urged the FM to boost investments in semiconductor chip manufacturing, high-end electronics controls, rare earth magnets and other critical components of EVs to make the country a significant source of low-cost manufacturing for exports other than China. Amarjit Sidhu, Executive Director, Detel urged the FM to include the EV industry in the priority sector lending list to boost e-mobility in India. He shared, “We expect the government to announce some specific SOPs, especially in the EV charging infrastructure segment. With the promotion of clean energy priority on the governments’ agenda, we would welcome it if the government could encourage various green technology policies and incentives to promote sustainability among EV automakers.”

On indirect measures to uplift the sector further, income tax for salaried employees has to be brought down, he opined. He also called for enhancing the tax-free Provident Fund amount and the increase standard deduction. He also urged the FM to boost investments in semiconductor chip manufacturing, high-end electronics controls, rare earth magnets and other critical components of EVs to make the country a significant source of low-cost manufacturing for exports other than China. Amarjit Sidhu, Executive Director, Detel urged the FM to include the EV industry in the priority sector lending list to boost e-mobility in India. He shared, “We expect the government to announce some specific SOPs, especially in the EV charging infrastructure segment. With the promotion of clean energy priority on the governments’ agenda, we would welcome it if the government could encourage various green technology policies and incentives to promote sustainability among EV automakers.”

Aaditya Thackeray, Minister Tourism, Environment and Climate Change Protocol recommends consistent and radical financial reforms, to facilitate EV transition and adoption in the country in his letter to FM Nirmala Sitharaman. Maharashtra recorded a 153 per cent growth in EVs over 2020-21.

- Priority Sector Lending

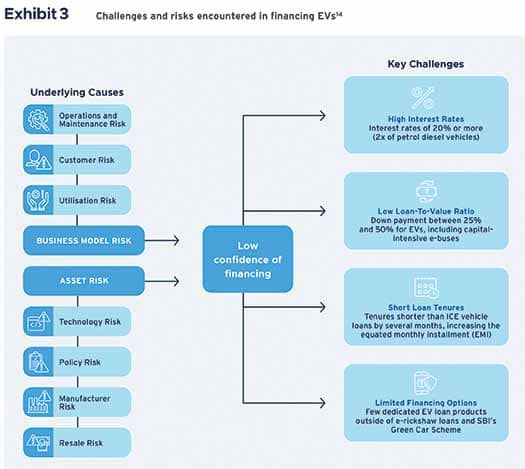

With the cumulative investment in EV transition between 2020-30 estimated at Rs.19.7 lakh crore (USD 266 bn), public and private sector lending banks are accelerating capital deployment to meet this potential. However retail lending to support customers and institutions in financing EVs has been slow to pick up. Banks and Non-Banking Finance Companies (NBFCs) currently hesitate to lend for EV’s due to perceived and real asset and business model risks.

-While financing is available, customers are unable to obtain interest rates and tenures comparable to internal combustion engine vehicles.

-The inclusion of EVs in the Reserve Bank of India’s (RBI’s) guidelines can encourage the financial sector to mobilise necessary capital.

- The liberalised and time-bound custom-duty regime

At present India’s supply-chain ecosystem and manufacturing process for EVs requires more international exposure.

-Pioneering companies like Tesla, BMW, Rivian, Audi must be given a time-bound concessionary customs rate for the import of vehicles for retail sale. This will drive the aspirational value in the market, boost investment in our supply chain, and encourage the startup ecosystem to follow the lead of such companies. A similar approach has been taken across emerging markets worldwide.

-The concessionary rate should be for a maximum period of three years or a defined import limit for any other company wishing to import vehicles for retail sale or import of international standard components for making an EV.

-The concessionary rate could also be given in return for a fixed investment guarantee in India’s auto supply chain or charging infrastructure which could be to the tune of the customs’ revenue the government forgoes relative to the current tax regime. This could be assessed annually.

-The current tax regime for importing CKDs, CBUs and SKDs are not well-aligned with the EV ecosystem. The assembly of EVs and ICE engine cars need to be differentiated given that every EV has a distinct framework. Therefore a broad-based standardisation in this regard in the customs duty code may not be feasible given the early stage of manufacturing development of EVs.

-The Government of Maharashtra will lead the way in the mass-scale adoption of EVs extending all possible support to the industry.

——

Drawing attention to the supply-chain bottlenecks, Prashanth Doreswam Country Head, Continental India and Managing Director, Continental Automotive India expressed hope on the PLI scheme further expanding this year. He cited the unanimous call for the reintroduction of investment allowance at 15 per cent for manufacturing companies investing more than Rs.25 crore in plant and machinery as a move that will complement the PLI scheme to attract more investments in the sector. Anurag Garg, Managing Director and Country Head, Vitesco Technologies, India urged the need to address the recurrent price hikes that OEMs are compelled to make. He explained, “The market is very volatile, and the automobile prices are increasing every three-four months due to incessant price hikes in metals and various other issues for which GST reduction is quintessential.” In addition to citing the common pain points echoed by industry peers, Garg welcomed the focus on renewable energy. “The Hydrogen Energy Mission and focus on solar energy will help meet our energy requirements in the future adequately,” he opined. “Ease of doing business” has been a buzzing phrase leading into the Union Budget 2022 and is expected to be addressed comprehensively too. It particularly came into light with Elon Musk, Chief Executive Officer at Tesla citing the delay in India rollout as a result of the pending resolution of issues with the government, engaging in his usual Twitter repartee that also got him attention from various state-heads in the country. A step in this direction would be hailed by both domestic and international component suppliers looking at India as their base.

Inclusion of EVs in priority sector lending

Looking at the cumulative investment of USD 19.7 lakh crore between 2020 and 2030, there is a need for higher liquidity and a lower cost of capital for EV assets and infrastructure if EV sales were to reach a 30 per cent share as envisioned. NITI Aayog and the World Bank is expected to help meet the gap. To encourage the financial sector to mobilise the necessary capital, the inclusion of EVs in the Reserve Bank of India (RBI’s) Priority Sector Lending (PSL) guidelines has the potential to complement the USD 300 mn facility. PSL mandates banks to direct a specified percentage of bank credit to priority sectors. For example, Axis Bank and the United Kingdom’s Private Infrastructure Development Group (PIDG) announced a capital financing guarantee of Rs.1500 crores (USD 200 mn) for manufacturing, distribution and servicing of EVs, batteries, components and charging infrastructure. Financial Institutions (FIs) are yet to increase lending to the estimated level of Rs.40,000 crores (USD Five billion) by 2025 and Rs.3.7 lakh crores (USD 50 bn) by 2030.

The additional policy and market measures expected to benefit the sector include state-level fiscal incentives, open data on vehicle performance, industry-led buyback programmes, and loan guarantee facilities. In comparison, global government support to financing EVs includes a risk-sharing mechanism, interest rate-free loans, state EV authority in countries like Australia, the United Kingdom and the United States of America. That apart tradeable PSL certificates will allow banks with excess lending to sell credits to banks that are unable to meet requirements. The parameters to assess segments for PSL inclusion for EVs include the socio-economic potential, livelihood generation potential, scalability, techno-economic viability, and stakeholder acceptability.

The additional policy and market measures expected to benefit the sector include state-level fiscal incentives, open data on vehicle performance, industry-led buyback programmes, and loan guarantee facilities. In comparison, global government support to financing EVs includes a risk-sharing mechanism, interest rate-free loans, state EV authority in countries like Australia, the United Kingdom and the United States of America. That apart tradeable PSL certificates will allow banks with excess lending to sell credits to banks that are unable to meet requirements. The parameters to assess segments for PSL inclusion for EVs include the socio-economic potential, livelihood generation potential, scalability, techno-economic viability, and stakeholder acceptability.

Lending limits apply to EV segments with a higher variation of cost to concentrate priority sector lending towards mass-market adoption. The RBI could consider including all EV segments under the PSL guidelines. To boost PSL further, sub-target for clean energy solutions, the inclusion of EVs as an infrastructural sub-sector, a reporting loan category and loan guarantee programs have been identified as crucial elements. Complementary initiatives include product guarantees from OEMs to ensure financiers of product quality and performance. State EV policies are expected to engage OEMs, aggregators and e-commerce through state-level targets, interest rate subvention schemes to create a learning curve for financiers. E-three-wheelers here have been identified as high-risk segments. OEMs need to be incentivised to assure buybacks and warranties.

State EV policies of Assam, Goa, Gujarat, Himachal Pradesh, Meghalaya, Odisha, Rajasthan, and West Bengal were notified. Karnataka EV policy has undergone a set of revisions, including the announcement of capital subsidies for manufacturing and initial proposals for demand incentives and other concessions for EVs. Maharashtra EV policy is revised to offer the additional demand, supply, and charging infrastructure. ACI

———————————————-

Watch out for the Union Budget 2022 Auto Components Industry Special post the announcement on February 01, 2022, in our 8th Anniversary Issue.

Also read, On The Prowl For Opportunities