Happy Forgings made its debut on the Indian bourses on December 27, 2023. Deven Lad looks at the strategy behind opting for the IP route.

Happy Forgings Ltd. is a case study for aspiring entrepreneurs. A forged components manufacturing company, it created a buzz late last year when it got a nod for its Initial Public Offering (IPO). The company shares were listed at an 18 per cent premium on December 27 with the Rs.1009 crore IPO known to have been subscribed over 82 times between December 19-21, 2023. For the record, the company had fixed the price band at Rs.808 to Rs.850 per equity share. A visibly happy Ashish Garg, Managing Director, Happy Forgings Ltd., expressed his gratitude to the subscribers. He said, “I am grateful to take our company public as the IPO process happens only once in the entire journey of a company.” Garg related to the significance of the listing as a company with a humble start in the business of manufacturing bicycle pedals. Since then the company has charted a long journey to emerge as the second-largest producer of diesel engine crankshafts in the country. The public issue of Equity Shares comprised a fresh issuance of Equity Shares aggregating up to Rs. 4,000 million and an Offer for Sale (OFS) of up to 7,159,920 Equity Shares.

Early roots and verticals

Founded in 1979, Happy Forgings is a leading heavy-forging and high-precision machined component manufacturer. With the fourth-largest manufacturing capacity in its segment (as of FY23), the company boasts of four income verticals: Automotive (43.7 per cent of FY23 revenue), Farm equipment (36.8 per cent), Off-highway vehicles (15.9 per cent) and Industrials (3.7 per cent). The over four decades of experience across manufacturing and supply of quality and complex components to customer specifications has the company, engaging in engineering, process design, testing, manufacturing, and supply of a variety of margin-accretive and value-additive components. The Company with this backdrop has emerged as a key participant in the local crankshaft manufacturing market, with the second-largest production capacity for commercial vehicles and high-horsepower industrial crankshafts in India.

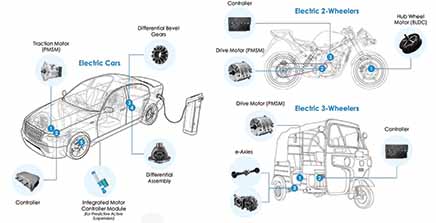

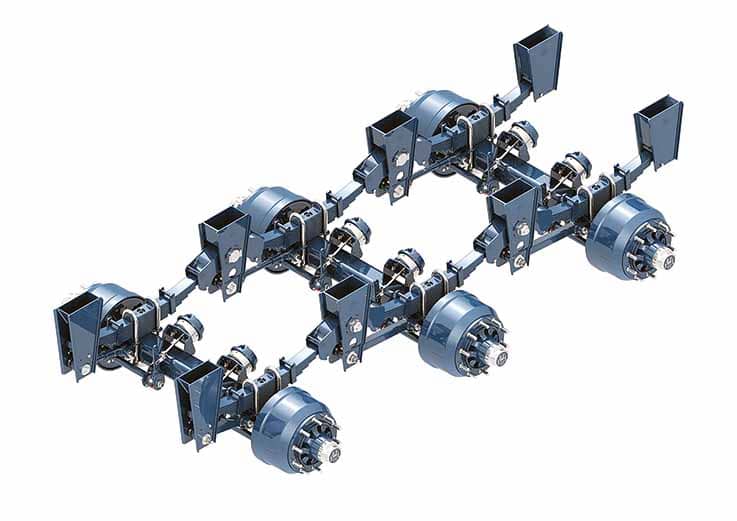

HFL’s primary focus is to produce value-added products that can increase margins according to Garg. This focus has resulted in the company’s transition from a forging-led business to a manufacturer of machined components. The portfolio offers a wide range of heavy forged and machined products, including crankshafts, front axle beams, steering knuckles, differential cases, transmission parts, pinion shafts, suspension products, and valve bodies, serving a diverse customer base across various industries. A testimony to its market acceptance.

Core revenue

As of September 30, 2023, its top 10 customers have remained with the company for at least 10 years. Ashok Leyland, American Axle, JCB India, Mahindra & Mahindra are among the top clientele who also happen to be the major revenue drivers for FY23. Notably, the largest client contributed an estimated 15 per cent of the total revenue. Talking about the business contributors segment, Garg informed, “Today, our business is divided into two sectors – automotive and non-automotive. The automotive sector contributes 40 per cent to our business, out of which commercial vehicles hold a major share.”

The company is known to have entered the commercial vehicle business in 2011 and on boarded clients like Ashok Leyland and American Axle. “Since then, we have been providing a CV product range to these clients and have established a significant share of business with them. The non-automotive sector contributes to 60 per cent of our business,” he mentioned. Garg went on to cite the revenue from the non-CV segments For instance, the foray into the SUV segment had the company collaborate with M&M. “Our common platform D22 is used on the new Thar, new Scorpio, and XUV 700. We have already launched our products and are scaling up production. Going forward, we expect to hold a substantial share of the SUV market,” he claimed.

Speaking on the non-auto segment, Garg mentioned that the company commands a 50 per cent market share in the farm equipment sector where it supplies to leading manufacturers like Swaraj, Sonalika, Escort, and Kubota. Furthermore, it has successfully acquired clients such as John Deere and Mahindra in the domain. “We are optimistic that in the future, the farm equipment sector will continue to grow. On the export side, we are witnessing good traction from our farm equipment customers who are based overseas,” Garg opined.

Financial snapshot

HFL’s revenue from operations scaled up by 39.12 per cent to Rs 11,965.30 mn in Fiscal 2023, up from Rs 8,600.46 mn in Fiscal 2022. The restated Profit After Tax (PAT) rose from Rs 1,422.89 mn in Fiscal 2022 to Rs.2,087.01 mn in Fiscal 2023. The revenue from operations for the six months ended September 30, 2023, was Rs.6,729.00 mn with a restated profit of Rs.1,192.99 mn. “Over the past 10 years we grew at 17-18 per cent CAGR and profit growth was better at around 24-25 per cent. Going forward, we expect to be able to maintain a similar set of growth rates if not better. With the primary fund raising happening in the company we’ll be able to do better than what we have done historically,” opined Garg. Speaking highly of the financial health of the company, Garg spoke of outperforming industrial peers.

Roadmap

Leveraging the ‘Make in India’ initiative, the company is all praises for the government interventions. The significant investments made as a result of a buoyant sentiment are claimed to have yielded positive results. The company has witnessed a surge in exports too, and is confident of the government’s continued support aiding future growth.

Several cyclical industries, particularly commercial vehicles, farm equipment and off-highway vehicles, affect its performance admitted Garg. Confident of growing irrespective, he exclaimed, “This industry is cyclical, but our production lines are fungible. We’ve achieved growth by expanding our customer base and increasing our market share, even during economic cycles. As a result, our company has outperformed our competitors.” The company is banking on three manufacturing facilities, two of which are located in Kanganwal with the other in Dugri, both in Ludhiana, Punjab. As of September 30, 2023, the total installed capacity for forging and machining is 120,000.00 MT and 47,200.00 MT, respectively, annually as an indication of growth appetite

Leave a Reply