Manufacturing processes have come under a scrutiny lens again! Ashish Bhatia looks at the changes globally, influencing a re look for the better.

Shopfloors and processes underwent significant changes in the aftermath of COVID-19 and supply-chain bottlenecks taught more than a thing or two. Even as manufacturers did well to hedge themselves against over-dependencies, with heavy investments to introduce efficiencies for ‘Just-In-Case’ and automation on select product lines, there is a headroom for further improvement. Global OEMs led by Tesla more recently are claimed to have found some path breaking ways with a direct bearing on Turn Around Times (TAT) and go-to-market strategies. The debates sparked off as a result translated to the community revisiting the shop floor layouts and processes to check for redundancies and further scope of consolidation.

Tesla pilot

TSLA.O is Tesla’s new vehicle assembly system, unveiled earlier this year. While the industry digs deeper to classify it as radical, revisionist or derivative, the “unboxed” process as CEO, Elon Musk, calls it is a step in the direction of radically rethinking conventional manufacturing methods. The expected outcome is more affordable and profitable electric vehicles in the company’s case. With investors keenly watching the most valuable auto maker in its progress towards building an under USD 30,000 EV (Down from USD 40,000 at present), the unboxed assembly process seemingly holds the key as per media reports. Experts are keenly glued to discover the potential to dramatically lower production costs.

Tesla first revealed the process at its Investor Day on March 01, 2023. Deemed as a process capable of making next-generation Teslas “significantly simpler and more affordable.”

Estimates of the unboxed process holding the potential to cut production costs in half and reduce the factory footprint by 40 per cent seems like an evolutionary step in the direction of mass-producing at lower cost. The new technique-driven assembly is to be fully tested in 2024 at the new USD five billion Tesla plant in Monterrey, Mexico, which is where the OEM will build a new generation of sub-USD 30,000 EVs.

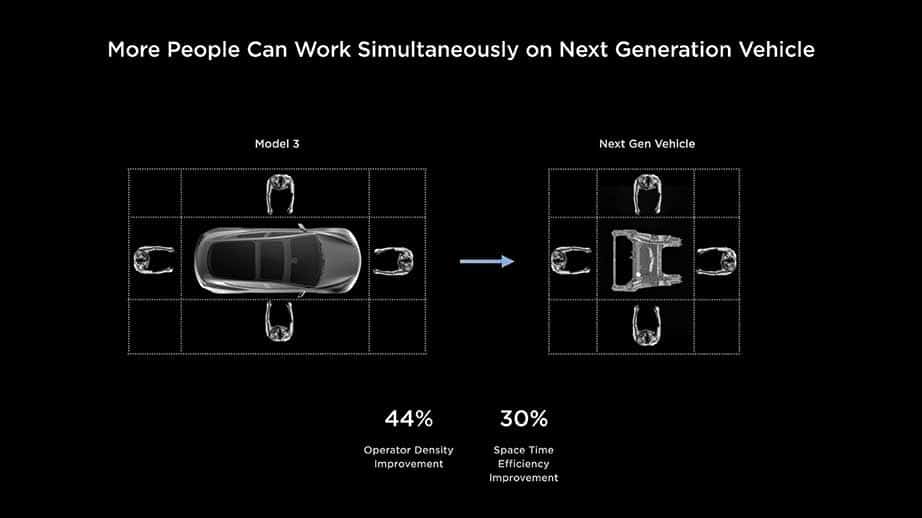

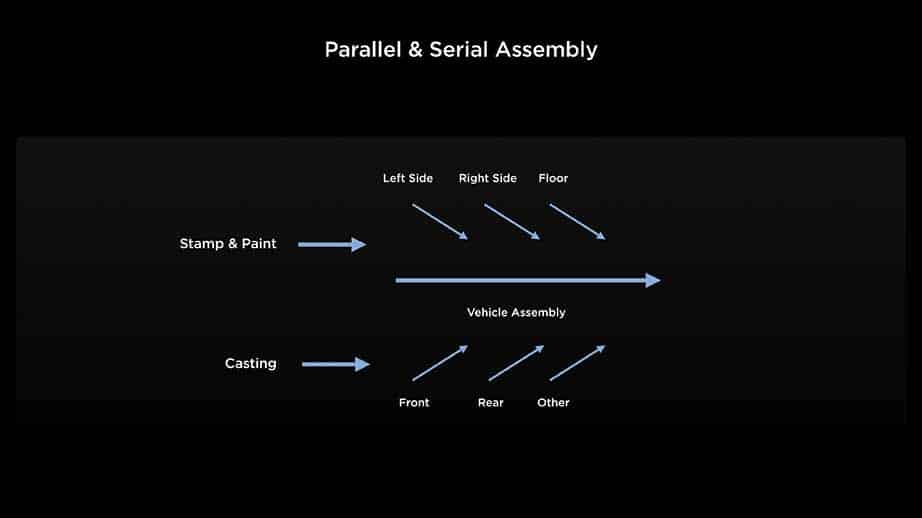

If Tesla succeeds, it could see widespread adoption across the board and an evolution from the Toyota production system. Timely implementation will be the litmus test for Tesla! Only time will tell if it proves to go beyond “modular” production to create new patterns of working, greater speed and reduced complexity. The use of large front and rear subassemblies built on single-piece underbody castings, which are then joined to a central structural battery pack is under test. And so is the process of body panels being painted separately, then joined together towards the end of the assembly process.

Eliminating redundancies

The unboxed process is said to have the potential to reduce or eliminate conventional processes that include stamping, welding and painting unfinished vehicle bodies. These are sent on the main assembly line with sub-assemblies like seats, engines and other components. The big question is whether the proposed model can go beyond the more comprehensive production management systems in place at major OEMs. Its dependency on ‘Just-In-Time’ for the final put-together mechanism is also a bone of contention for experts. Especially in the case of different models being produced on the same production line.

Tesla in its Q1 quarterly update admitted that producing electric vehicles profitably is a challenging endeavour. From requiring to rethink how vehicles are designed and produced from the ground up. The cost journey is nowhere near finished, and the company announced the transition to 48 Volt architecture for vehicle electronics (starting with Cybertruck). This also includes higher penetration of in-house designed controllers, cheaper, more scalable drive units and further innovations in the manufacturing process. “Cost reduction remains the main enabler of delivering on our mission,” the update reads.

Since Q1, the company continued to execute innovations to reduce the cost of manufacturing and operations. It expects the endeavours to result in gradual hardware-related profits coupled with an acceleration of software-related profits. With it,

Tesla aspires to sustain the highest operating margin in the industry. As per the outlook statement, the future developments centric on ramping production capacity, efficiency and output rates, supply chain, demand and market growth, cost, pricing and profitability, deliveries; statements regarding operating margin, operating profits, spending and liquidity; and statements regarding expansion, improvements and/or ramp and related timing at our factories are clearly “forward-looking statements” that are subject to risks and uncertainties but hinted at the direction the company is moving in.

In Q2, Tesla gave an update on breaking manufacturing boundaries with the Cybertruck. The company back then was testing Cybertruck vehicles around the world for final certification and validation claiming it to be the most unique vehicle to be produced in decades. Entailing trials and testing of new technologies, the Cybertruck as the first sub-19 ft. truck (fitting into a garage) with four doors and a six ft. bed is a testimony of the endeavours on fronts of vehicle engineering and manufacturing.

Fast forward to Q3, Tesla was able to produce over 430,000 vehicles with over 435,000 deliveries. The sequential decline in volumes is attributed to planned downtimes for factory upgrades on the aforementioned lines. Its 2023 1.8 mn volume target remains “unchanged” as of current and will continue to be closely monitored