Smarter auto electronics and electrical are taking centre stage. Ashish Bhatia looks at recent developments which suggest a growing impetus on resource allocation to build a robust ecosystem.

Automotive electronics have taken centre stage and will command a greater focus going forward too from key stakeholders. The recent supply chain bottlenecks owing to the shortage of semiconductor chips, known to have impacted business, are a testament to the rising electronic and electrical content per vehicle. It is also a sign of the growing OEM dependencies that need to be hedged by developing a wider procurement strategy as well as the industry turning self-reliant. The fact that such a sub-assembly can stall and or delay production cycles in the absence of a well-oiled, localised ecosystem has ensured this stream takes centre stage. Building on capabilities is in line with the collective vision of making India a global manufacturing hub for electronics and electrical. Sunjay Kapur, President, Automotive Component Manufacturers Association (ACMA) just ahead of the onslaught of Omicron had stated, “Despite the resurgence of demand for vehicles, supply-side issues of availability of semiconductors, increasing input costs, rising logistics costs and availability of containers, among others, continue to hamper recovery in the automotive sector.”

Automotive electronics have taken centre stage and will command a greater focus going forward too from key stakeholders. The recent supply chain bottlenecks owing to the shortage of semiconductor chips, known to have impacted business, are a testament to the rising electronic and electrical content per vehicle. It is also a sign of the growing OEM dependencies that need to be hedged by developing a wider procurement strategy as well as the industry turning self-reliant. The fact that such a sub-assembly can stall and or delay production cycles in the absence of a well-oiled, localised ecosystem has ensured this stream takes centre stage. Building on capabilities is in line with the collective vision of making India a global manufacturing hub for electronics and electrical. Sunjay Kapur, President, Automotive Component Manufacturers Association (ACMA) just ahead of the onslaught of Omicron had stated, “Despite the resurgence of demand for vehicles, supply-side issues of availability of semiconductors, increasing input costs, rising logistics costs and availability of containers, among others, continue to hamper recovery in the automotive sector.”

Additionally, the Production Linked Incentive (PLI) scheme has sought to incentivise ‘Component Champions.’ The scheme, hailed by the industry, is expected to encourage local manufacturing firms to expand as they gear to play their part as a vital cog in the ecosystem. “Together with the increased focus of the auto industry on deep-localisation and the recent announcements of PLI schemes by the Government on Advanced Chemistry Cell (ACC) Batteries and auto and auto components will facilitate the creation of a state-of-the-art automotive value chain and develop India into an attractive alternative source of high-end auto components,” he stated. To validate this direction of the industry, an ACMA leadership survey, brought to light how auto component manufacturers have now, by and large, recovered and the investment cycle has also commenced. “On the subject of auto component industry preparing to be future-ready, 60 per cent of the respondents mentioned that they were already equipped to be part of the EV supply chain, while the rest would be ready in the next two-odd years,” said Kapur.

Additionally, the Production Linked Incentive (PLI) scheme has sought to incentivise ‘Component Champions.’ The scheme, hailed by the industry, is expected to encourage local manufacturing firms to expand as they gear to play their part as a vital cog in the ecosystem. “Together with the increased focus of the auto industry on deep-localisation and the recent announcements of PLI schemes by the Government on Advanced Chemistry Cell (ACC) Batteries and auto and auto components will facilitate the creation of a state-of-the-art automotive value chain and develop India into an attractive alternative source of high-end auto components,” he stated. To validate this direction of the industry, an ACMA leadership survey, brought to light how auto component manufacturers have now, by and large, recovered and the investment cycle has also commenced. “On the subject of auto component industry preparing to be future-ready, 60 per cent of the respondents mentioned that they were already equipped to be part of the EV supply chain, while the rest would be ready in the next two-odd years,” said Kapur.

As of the first half of 2021-22 (H12021-22), the component import dependencies drew a focus on the rise in imports by 71 per cent from Rs.37,710 crore (USD five bn) in H12020-21 to Rs.64,310 crore (USD 8.7 bn). Asia accounted for 63 per cent of imports with Europe and North America at 29 per cent and seven per cent respectively. This is attributed to the growing domestic demand for luxury vehicles and high-end cars in the domestic market. On the brighter side, imports from all geographies witnessed a steep increase reflecting growth in domestic manufacturing activities.

In comparison to imports, exports showed positive signs with a growth of 76 per cent to Rs.68,746 crore (USD 9.3 bn) in H12021-22 from Rs. 39,003 crore (USD 5.2 billion) in H12020-21. Europe here accounted for 31 per cent of exports with an 81 per cent rise with North America registering a growth of 81 per cent to reach 32 per cent. Growth of exports to Asia stood at 25 per cent with a 73 per cent growth. The aftermarket in H12021-22 witnessed a growth of 25 per cent to Rs.38,895 crore (USD 5.3 bn) from Rs.31,116 crore (USD 4.1 bn) in H12020-21. Notably, sales to OEMs increased by 76 per cent from Rs.87,120 Crore (USD 11.6 bn) in H1FY21 to Rs.1.53 lakh crore (USD 20.7 bn) in H1FY22.

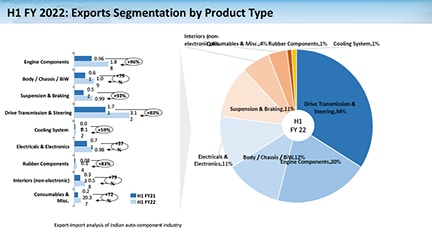

If one were to look at these figures more closely, as per ACMA data, imports segmentation by product type reveals electricals and electronics components imports grew by 72 per cent in H1FY2021-22 compared to H1FY2020-21, and accounting for seven per cent of the overall imports pie. Ahead of rubber components at six per cent and interiors (non-consumables and electronics) at four per cent. Engine components accounted for a majority at 32 per cent. Compared to imports, exports segmentation by product type (electricals and electronics) grew by 37 per cent in the same period. They accounted for 11 per cent of the overall exports pie ahead of interiors, rubber components and cooling systems. Drive transmission and steering accounted for a majority of exports at 34 per cent followed by engine components at 20 per cent.

Headwinds and tailwinds

Domestic demand continues to be strong. There is a surge in international demand (exports) with an increased focus on clean and new technologies. Ahead of the Union Budget 2022, an extension of Fame-II coupled with ACC and Auto PLIs and new entrants in the mobility space have been identified as tailwinds, mentioned Vinnie Mehta, Director General, ACMA at the periodic ACMA performance briefing. He also drew attention to chip shortage, increasing raw material prices, lower RoDTEP and high Goods and Services Tax (GST) on auto components as headwinds. Clearing the air, admitted Kapur, “There are more headwinds for now compared to tailwinds.” “We have shifted from just-in-time to just-as-is,” he concluded. ACI

Also read, ACMA applauds cabinet approval of PLI Scheme