West Bengal based Ramkrishna Forgings Ltd. is confident of sustaining its upside momentum. Ashish Bhatia with Prateek Pardeshi cites the strong order book as testimony.

Gaining momentum is easier than sustaining it! However there are few exceptions who have succeeded at the latter too. One of the leading forging companies, Ramkrishna Forging Ltd. based in Kolkata, in West Bengal, makes for a good case study. The company has gained a strong upside momentum with a robust order book that consists of a partnership with the USA-based axle manufacturer for the Light Commercial Vehicle (LCV) segment on one end of the spectrum and an ~ Rs.750 mn valued order from an M&HCV major Original Equipment Manufacturer (OEM). The company is confident of sustaining the recent upside momentum longer with its three-pronged focus on keeping a customer-centric approach, ensuring continual system improvements and a long-term vision of staying committed to people development. Such strong ethos has the company winning accolades including the ‘Overall Supplier Excellence Awards for Eicher Engineering Components’ for the year 2021.

Gaining momentum is easier than sustaining it! However there are few exceptions who have succeeded at the latter too. One of the leading forging companies, Ramkrishna Forging Ltd. based in Kolkata, in West Bengal, makes for a good case study. The company has gained a strong upside momentum with a robust order book that consists of a partnership with the USA-based axle manufacturer for the Light Commercial Vehicle (LCV) segment on one end of the spectrum and an ~ Rs.750 mn valued order from an M&HCV major Original Equipment Manufacturer (OEM). The company is confident of sustaining the recent upside momentum longer with its three-pronged focus on keeping a customer-centric approach, ensuring continual system improvements and a long-term vision of staying committed to people development. Such strong ethos has the company winning accolades including the ‘Overall Supplier Excellence Awards for Eicher Engineering Components’ for the year 2021.

Today, the company is leading the forging segment supplying to a wide range of industries, including automotive, farm equipment, bearings, earth moving and railways besides supplying to non-automotive segments like mining, oil and gas, power and construction. Its exposure to these segments both domestic and global makes it stand out from competition giving it an edge to sustain the new found momentum. The company supplies to component manufacturers like Automotive Axels on one end of the spectrum and directly to OEMs like Tata Motors, Ashok Leyland and VE Commercial Vehicles on the other end. To optimise its global presence, the company is known to have opened offices in South America, Russia, Europe in addition to the USA, Mexico and Turkey. In Mexico, for instance, the company is known to have won Letters of Intent (LoIs) worth Rs.225 million per annum for a leading tier1 manufacturer of front axle beam.

Realising RoI

The three-pronged approach on customer centricity, continual improvements and community development for the long-run coupled with the upturn in the CV segment has enabled the company to be optimistic about future prospects as well. In the third quarter of 2021 (Q32021) the company won contracts worth Rs.22,000 lakh from a total of six contracts from across geographies and business verticals aided by acquisition of new businesses of front axle beams. Notably, the company engaged Pricewaterhouse Cooper LLP (PWC) for its ESG roadmap, integration and implementation. It expects to turn its manufacturing plants, Industry 4.0 compliant. A key Memorandum of Understanding (MoU) signed with ePropelled USA had the company venture into manufacture of its patented Dynamic Torque SwitchingTM (eDTS) motor technology. The foray into EVs is expected to aid light EV manufacturers in India with an innovative energy saving solution aimed at the high growth potential emobility market. Naresh Jalan, Managing Director, Ramkrishna Forgings Ltd. states, “With the Indian CV segment showing signs of uptrend we are optimistic about the opportunities it will present in the future. We have established a strong presence among domestic customers and are steadily cementing our position on the back of recent order wins.” For example, the Rs.750 million per annum order win from India’s largest M&HCV OEM, as per Jain, demonstrates superior product quality and strong execution capabilities. “We are seeing an increasing acceptance of our products from a wide range of customers across segments and geographies. We continue our growth trajectory on the back of new orders and expected repeat orders which will propel us to our target,” he mentions. The order win from the USA-based axle manufacturer for an estimated Rs.700 million over a five year period pertain to rear-axle applications. The order is expected to enable the company to strengthen its global footprint as well as help strengthen its positioning in the LCV segment.

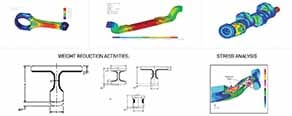

In a testimony of the company investing in capacity enhancement to meet the demand, the company is known to have gone through with its earmarked Capital Expenditure (CAPEX) for 2021. As a result it had commenced product dispatches. It is said that the sample supplies had the company confident of gaining new business ahead of winning the recently announced orders. It had expected a Return on Investent (RoI) with realisation of Rs.750 million over a three-year period itself. Lalit Khetan, Executive Director and Chief Financial Officer, Ramkrishna Forgings Ltd in a release claimed, “Major component manufacturers domestically as well as in exports markets have accepted our products highlighting our superior product quality. Our technologies and research and development have aided us in developing products that meet the needs of our customers, leading to the addition of new business.” He explains that the company’s ability to create new products had allowed it to broaden both the product and the customer base.

In a testimony of the company investing in capacity enhancement to meet the demand, the company is known to have gone through with its earmarked Capital Expenditure (CAPEX) for 2021. As a result it had commenced product dispatches. It is said that the sample supplies had the company confident of gaining new business ahead of winning the recently announced orders. It had expected a Return on Investent (RoI) with realisation of Rs.750 million over a three-year period itself. Lalit Khetan, Executive Director and Chief Financial Officer, Ramkrishna Forgings Ltd in a release claimed, “Major component manufacturers domestically as well as in exports markets have accepted our products highlighting our superior product quality. Our technologies and research and development have aided us in developing products that meet the needs of our customers, leading to the addition of new business.” He explains that the company’s ability to create new products had allowed it to broaden both the product and the customer base.

Earlier in the year, the company began supplying samples of warm forging processed parts known to be produced for a leading axle manufacturer in the country. The company also won an order to supply to a leading Asian truck brand (part of a global major) warm forging (precision forging plant) wherein, in phase-one, the company was projected to generate Rs.112 million in revenue per year and another Rs.150 million per year worth of revenue under discussion. The company at the start of the year also won an export order to supply spindle worth Rs.575 million over a period of three years from one of the largest tier 1 manufacturers in North America in the CV segment.

It is known that the company would follow up with continuous sample submissions of various other models for process validation ensuring the commencement of bulk orders. This is expected to have laid the foundation for the company to add to its product portfolio thereby increasing the number of products per customer. It is also banking on enhanced capacity utilisation, and disciplined cash management to turn into a net debt free company over the next three years according to the Chairman. The Company reported a turnover of Rs.60,605.44 lakh in Q3FY22 in comparison to Rs.40,217.10 lakh in Q3FY21 registering an increase of 50.70 per cent YoY and Rs.160,212.56 lakh in FY22 (nine months) in comparison to Rs.77,049.10 lakh in FY21 (nine months) registering an increase of 107.94 per cent YoY. In exports, the company registered a turnover of Rs.25,968.58 lakh in Q3FY22 compared to Rs.15,580.09 lakh in Q3FY21, growing at 66.68 per cent. In a nine month consideration, it grew at 128.27 per cent. ACI

Also read, MTS System Corporation plans big for the Indian market

Also read, MTS System Corporation plans big for the Indian market