India is the world’s second-largest producer of crude steel, with steel serving as an essential raw material for the automotive industry. Prateek Pardeshi assesses the scope of a gradual softening of prices and revival in favour of the automotive industry.

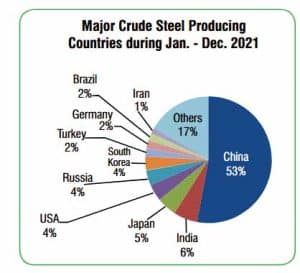

India surpassed Japan to become the second-largest producer of steel in the world in 2019. With an overall production of 118.134 Million Tonnes (MT), we are closing upon China far ahead as the leading crude steel production had a total production of 1032.8 MT in comparison. According to the Annual report 2021-22 published by the Ministry of Steel, the nation’s total finished steel consumption for the fiscal year 2021–22 was 111.8 MT, and that figure is expected to increase to about 160 MT by 2024–25; an estimated 250 MT by 2030–31.

India surpassed Japan to become the second-largest producer of steel in the world in 2019. With an overall production of 118.134 Million Tonnes (MT), we are closing upon China far ahead as the leading crude steel production had a total production of 1032.8 MT in comparison. According to the Annual report 2021-22 published by the Ministry of Steel, the nation’s total finished steel consumption for the fiscal year 2021–22 was 111.8 MT, and that figure is expected to increase to about 160 MT by 2024–25; an estimated 250 MT by 2030–31.

The Secretary of the Ministry of Steel, Pradip Kumar Tripathi drew attention to India attaining a milestone of 109 MT Steel production in 2019-20, before the pandemic set in. “We hope to increase the production of speciality steel from 18MT to 42 MT in the next 5 years through PLI Scheme. Our aim is to improve the cost competitiveness of the steel sector,” he said. To promote the steel industry interest, India has, in the past, leveraged forums like the Global Stainless Steel Expo held in Mumbai at Jio World Centre, in Mumbai. As of current, the automotive industry is hoping for prices to moderate in the absence of which operating margins are under pressure and any hike out will pass on the burden to the end customer. In this case, the tier suppliers are under pressure from Original Equipment Manufacturers (OEMs) to keep prices under check.

The Secretary of the Ministry of Steel, Pradip Kumar Tripathi drew attention to India attaining a milestone of 109 MT Steel production in 2019-20, before the pandemic set in. “We hope to increase the production of speciality steel from 18MT to 42 MT in the next 5 years through PLI Scheme. Our aim is to improve the cost competitiveness of the steel sector,” he said. To promote the steel industry interest, India has, in the past, leveraged forums like the Global Stainless Steel Expo held in Mumbai at Jio World Centre, in Mumbai. As of current, the automotive industry is hoping for prices to moderate in the absence of which operating margins are under pressure and any hike out will pass on the burden to the end customer. In this case, the tier suppliers are under pressure from Original Equipment Manufacturers (OEMs) to keep prices under check.

Automotive Steel

The automotive industry accounts for nearly eight to nine per cent of the overall steel volumes. To cater to this side of the demand, the Ministry of Steel has held numerous discussions with the Engineering Export Promotion Council of India (EEPC), various automobile manufacturers, and Indian steel companies to better understand the possibility of competitively priced domestic manufacturing and procurement of auto-grade steel in India. Rasika Chaube, Additional Steel Secretary back then launched a vision document 2047. She is known to have directed stakeholders of the industry to work in the direction of turning a net. She committed to the Ministry’s resolve in helping to increase the consumption of steel and stainless steel. It is known that to produce automotive grade steel, transfer of technology for production and other special steels could be facilitated by JVs with global leaders.

The automotive industry accounts for nearly eight to nine per cent of the overall steel volumes. To cater to this side of the demand, the Ministry of Steel has held numerous discussions with the Engineering Export Promotion Council of India (EEPC), various automobile manufacturers, and Indian steel companies to better understand the possibility of competitively priced domestic manufacturing and procurement of auto-grade steel in India. Rasika Chaube, Additional Steel Secretary back then launched a vision document 2047. She is known to have directed stakeholders of the industry to work in the direction of turning a net. She committed to the Ministry’s resolve in helping to increase the consumption of steel and stainless steel. It is known that to produce automotive grade steel, transfer of technology for production and other special steels could be facilitated by JVs with global leaders.  It is expected of the steel industry that the domestic demand for automotive-grade steel would be met domestically. This extends to electric steel, special steel and alloys. Here the Production Linked Incentive (PLI) scheme for the production of steel with an Rs.6233 crore outlay with incentive slabs from four per cent to 19 per cent is expected to have a direct bearing on the consumers for automotive bodies and components. As per the Rashtriya Ispat Nigam Ltd. (RINL), the need of the hour is to improve the supply of niche products through the network of OEMs, tier2 and tier3 vendors. Research and Development (R&D) efforts must be aimed at the indigenous development of austempered ductile iron technology.

It is expected of the steel industry that the domestic demand for automotive-grade steel would be met domestically. This extends to electric steel, special steel and alloys. Here the Production Linked Incentive (PLI) scheme for the production of steel with an Rs.6233 crore outlay with incentive slabs from four per cent to 19 per cent is expected to have a direct bearing on the consumers for automotive bodies and components. As per the Rashtriya Ispat Nigam Ltd. (RINL), the need of the hour is to improve the supply of niche products through the network of OEMs, tier2 and tier3 vendors. Research and Development (R&D) efforts must be aimed at the indigenous development of austempered ductile iron technology.

The automotive Industry wishlist

Promoting capacity expansion and working on meeting the increased steel consumption by the automotive industry comes with its own set of challenges. The answer lies in a greater degree of collaboration among ministries, according to Rasika Chaube, Additional Secretary, Ministry of Steel, Government of India. “Interacting with various ministries allows us to better understand their requirements. Similarly, we request our stakeholders to produce similar metals that will meet their needs,” she mentioned. Several ministries, including the Ministry of Oil and Natural Gas, and the Ministry of Rural Development have collaborated thus far. To aid the progress, the Ministry of Road Transport and Highways and the Ministry of Heavy Industry are expected to join hands too. Recently, Union Minister, Nitin Gadkari committed to speaking to the Ministry of Steel at the 62nd ACMA Annual Session, in New Delhi. Among the top concerns was the need to look at taxation on the input material, work on ways to offset the jump in prices and extending GST benefit on the scrappage of vehicles.

Chaube drew attention to only 60 per cent utilisation of capacity at steel manufacturers. “This means we have a huge scope of dealing with higher demand, she explained. She admitted to steel contributing to carbon neutrality in comparison to the ferroalloy industry among other producers known to be carbon intensive in their value chain. However, the industry is gearing up for enhancements like green steel and green stainless steel to lower its carbon footprint. Here, the use of renewable energy sources with a potential of 40 per cent carbon emissions reduction was highlighted. The Ministry of Renewable Energy under the aegis of Prime Minister Narendra Modi is planning to meet a projected 500 gigawatts demand. Producers like JSW steel are known to have recently collaborated with German firm SMS group to reduce its carbon footprint with a USD 100 bn outlay that others must follow suit.

Chaube drew attention to only 60 per cent utilisation of capacity at steel manufacturers. “This means we have a huge scope of dealing with higher demand, she explained. She admitted to steel contributing to carbon neutrality in comparison to the ferroalloy industry among other producers known to be carbon intensive in their value chain. However, the industry is gearing up for enhancements like green steel and green stainless steel to lower its carbon footprint. Here, the use of renewable energy sources with a potential of 40 per cent carbon emissions reduction was highlighted. The Ministry of Renewable Energy under the aegis of Prime Minister Narendra Modi is planning to meet a projected 500 gigawatts demand. Producers like JSW steel are known to have recently collaborated with German firm SMS group to reduce its carbon footprint with a USD 100 bn outlay that others must follow suit.

Vision 2047

The demand for stainless steel is expected to grow by 19.5-21 per cent to 3.7-3.9 MT in fiscal 2022, supported by a low base, a stable macroeconomic environment, and normalised government spending, according to the Vision document 2047. According to industrialist Abhyuday Jindal Managing Director at Jindal Stainless, the Ministry has taken a number of steps to advance the steel industry, including the release of the National Steel Policy 2017. Then, the focus is on aspects like scrap recycling, quality control, and local production to meet the demand. orders, and so on. He stated that, that the industry anticipates the steel ministry’s continued assistance in achieving the stainless-steel vision of 2047. The stainless steel industry in India has sufficient production capacity, the stakeholders assure. According to K K Pahuja, President of Indian Stainless Steel Development Association

The demand for stainless steel is expected to grow by 19.5-21 per cent to 3.7-3.9 MT in fiscal 2022, supported by a low base, a stable macroeconomic environment, and normalised government spending, according to the Vision document 2047. According to industrialist Abhyuday Jindal Managing Director at Jindal Stainless, the Ministry has taken a number of steps to advance the steel industry, including the release of the National Steel Policy 2017. Then, the focus is on aspects like scrap recycling, quality control, and local production to meet the demand. orders, and so on. He stated that, that the industry anticipates the steel ministry’s continued assistance in achieving the stainless-steel vision of 2047. The stainless steel industry in India has sufficient production capacity, the stakeholders assure. According to K K Pahuja, President of Indian Stainless Steel Development Association

(ISSDA) , the stainless steel industry is dedicated to contributing to nation-building by providing sustainable solutions across the board. ACI

Trade dynamics

As per the Ministry of Steel, Annual Report 2021-22, Crude steel production stands at 118.134 MT slightly higher than 2020 which was around 100.256 MT. Finished Steel production for 2021 stands at 111.858 MT, while in 2020 it was 92.231 MT. While the production is on the boom, consumption in 2021 was 106.134 MT while 2020 accounted for 89.331 MT. The import in 2021 was five MT slightly higher than the previous year 2020 accounting for 4.4 MT. Lastly, the export in 2021 stood around 12.7 MT and in 2020 it was 10.1 MT. Earlier in October 2021, a Memorandum of Understanding (MoU) was signed between the Ministry of Steel and the Russian Federation for cooperation in the field of coking coal, which is used in steel production. The MoU will benefit the Indian steel sector by diversifying coking coal sources, which may result in lower input costs for steel players due to long-term commitments to supply high-quality coking coal to India (up to 40 MT by 2035).