At the ninth edition of CII Autoserve 2020, the call for buying and servicing in India for the growth prospects grew louder.

Story by: Deepti Thore

The stakeholders of the automotive industry are adapting to change in the aftermath of Covid-19. One such area is the aftermarket segment. Valued at an estimated USD 384.1 billion, it is expected to grow manifold. To tap the growth, the Confederation of Indian Industry (CII) organised the ninth edition of CII Autoserve 2020. Though held virtually, the call for buying, servicing in India for its growth potential had the industry in unison. Averred Nitin Gadkari, Minister of Road Transport & Highways and Micro, Small and Medium Enterprises, Government of India, “I am fully confident that the future of the Automotive Industry is very bright and the vision plan of Atma Nirbhar Bharat will only further propel the growth prospects of the automotive and the aftermarket segments.”

As the go-to event for the automotive aftermarket, the ninth edition succeeded in its objective as a month-long congress, held from November 23 – December 22, 2020, over the CII Hive Platform. Held with an objective to provide a platform to the stakeholders of the automotive industry, CII Autoserve 2020, made a case for learning and adopting best practices to be able to harness the growth potential envisaged. “The automotive industry is bouncing back and the global automotive aftermarket is anticipated to reach a valuation of over USD 513.1 billion by 2027 from the current USD 381.4 billion,” asserted Vipin Sondhi, Chairman, CII Trade Fairs Council and Managing Director and CEO at Ashok Leyland Ltd.

As the go-to event for the automotive aftermarket, the ninth edition succeeded in its objective as a month-long congress, held from November 23 – December 22, 2020, over the CII Hive Platform. Held with an objective to provide a platform to the stakeholders of the automotive industry, CII Autoserve 2020, made a case for learning and adopting best practices to be able to harness the growth potential envisaged. “The automotive industry is bouncing back and the global automotive aftermarket is anticipated to reach a valuation of over USD 513.1 billion by 2027 from the current USD 381.4 billion,” asserted Vipin Sondhi, Chairman, CII Trade Fairs Council and Managing Director and CEO at Ashok Leyland Ltd.

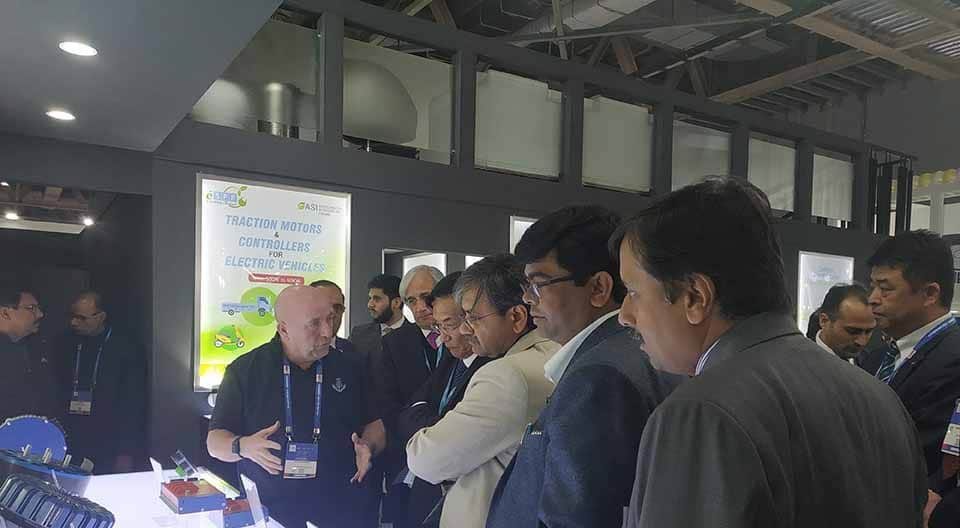

A sum total of more than 75 varied stakeholders as exhibitors assessed the impact of Covid-19 on the automotive aftermarket segment. From component and spare parts manufacturers, battery and battery charger companies, charging ecosystem providers, paint booth manufacturers, tyre and retreading equipment manufacturers to stakeholders of the equipment repair and maintenance segment showcased products, technologies, demonstration videos, and technical specifications to highlight their offerings. Exhibitors at the exhibition included Indian Oil Corporation Ltd. (IOCL), Tata Autocomp GY Batteries, Bosch India, Brakes India, Motherson Auto Parts, Uno Minda, TVS EuroGrip, Hella Lighting and Lumax Industries to name a few. Using a modern world approach, complete with the instant interactions suite of video and live chat, a B2B Lounge, Drop Message, email and SMS facilities ensured a seamless exchange. Government officials, decision-makers and technical experts from the industry, including the bus operators and automobile dealer community, transport and logistics companies besides the transport corporations also took part.

Among key sessions held over the course of the congress was a two-day conference. Themed as ‘Seizing Opportunities in New Normal’, it had the Union Minister Nitin Gadkari highlight significant achievements made by the automotive industry pertaining to design and manufacture. “The country is fast emerging as a global hub for automotive manufacturing,” he exclaimed. He promoted the use of flex engines and alternate fuels incidentally when the government is also known to be considering an advancement in the deadline of ethanol blending (at 20 per cent) in petrol, from the earlier set 2030 deadline. Gadkari apprised the gathering of the governments’ plan to install battery charging units across 69,000 petrol pumps in a pan-India move seen as an encouragement to the adoption of electric vehicles.

In line with the vision to make India more self-reliant, the automotive solutions portal – ASPIRE was positioned as being capable of boosting innovation and adoption of global technological advancements. R Dinesh, Chairman, Autoserve 2020 and Joint Managing Director, T V Sundram Iyengar & Sons urged the industry to ‘Buy in India; Service in India; Grow in India’ as the renewed mantra going forward. Rama Shankar Pandey, Chairman, Aftermarket Committee, ACMA & Managing Director, Hella India Lighting drew attention to the need for standardisation of services and products to support the growth of the aftermarket. A session on the ‘Impact of Covid-19 in Mobility and Automotive Aftermarket’ had Frank Schlehuber, Senior Consultant Market Affairs, European Association of Automotive Suppliers (CLEPA) term this phase for the industry as a transitional one. “The industry is fast moving towards automation, electrification and new powertrains,” he mentioned.

In line with the vision to make India more self-reliant, the automotive solutions portal – ASPIRE was positioned as being capable of boosting innovation and adoption of global technological advancements. R Dinesh, Chairman, Autoserve 2020 and Joint Managing Director, T V Sundram Iyengar & Sons urged the industry to ‘Buy in India; Service in India; Grow in India’ as the renewed mantra going forward. Rama Shankar Pandey, Chairman, Aftermarket Committee, ACMA & Managing Director, Hella India Lighting drew attention to the need for standardisation of services and products to support the growth of the aftermarket. A session on the ‘Impact of Covid-19 in Mobility and Automotive Aftermarket’ had Frank Schlehuber, Senior Consultant Market Affairs, European Association of Automotive Suppliers (CLEPA) term this phase for the industry as a transitional one. “The industry is fast moving towards automation, electrification and new powertrains,” he mentioned.

He suggested stakeholders benchmark with the European aftermarket segment claimed to be in a healthier state than OEMs there. Rakesh Kher, President – Group Aftermarket, UNO Minda drew attention to the automotive distribution market facing a downturn on both the supply side and the demand side. Barring the eastern region, he said the demand distribution, though varied, had picked up in other regions especially the southern and the western regions showing promise to start with.

Anjan Kumar, Regional President, Automotive Aftermarket – India, Bosch revisited the economic contraction in the early stages of the pandemic known to have negatively impacted the aftermarket. Urging the industry to stay in touch with the stakeholders digitally, he emphasised, it was the key to stay in business. Nagaraju Srirama, President and Director, JK Fenner (India) cited the period of the raw material shipped at the ports having no assistance for unloading, clearing or transporting the raw material. He called it a challenging period especially given the latter’s shelf life. A session on ‘Transitioning to Succeed in the New Aftermarket Landscape’ had Parthasarathy Srinivasan, Advisor, Business Development & Business Excellence, Rane Group share its learnings from efforts to stay connected to its retailer, dealers and mechanics. He suggested that data analytics is the key to attain efficient and productive growth in the aftermarket. Sanjay Datta, Chief – Underwriting, Reinsurance & Claims, ICICI Lombard General Insurance defined the role of the aftermarket in road safety.

Calling the aftermarket as a growth driver for the automotive industry, Anil Bhamre, Vice President (Aftermarket) – Sales & Marketing, Tata Autocomp GY Batteries added, “Tyres, batteries and lubes have benefitted the most.” Sanjeev Sharma, General Manager – Mobility Solutions and Fleet Management (Truck Bus Radial), JK Tyre & Industries called for seizing the potential opportunity, and use it to create efficiencies and inturn be profitable. The session on ‘Leveraging Change of Technology for Aftermarket Growth’ drew attention to software-enabled components used in putting together the automobiles. Alternative fuels, IoT driven systems, and the need to revive gaps between organised and unorganised sectors found a mention too. Srinivasa Raghavan, Managing Director, TVS Automobile Solutions spoke of technology graduating from offering convenience to leading the change in business models. “Aftermarket is not just about parts anymore. It is more about parts and services where technology itself has become a service,” he concluded. ACI