After the rollout of GST back in 2017, the landmark one nation one tax continues to evolve. Prateek Pardeshi checks on the overhaul and compliances.

Who can forget the rollout of Goods and Services Tax (GST) on July 01, 2017, flashing on screens nationwide at the stroke of midnight? Nearing the fifth anniversary, the ‘One Nation One Tax’ regime continues to evolve with different tax slabs and the bifurcation of essential, luxury and sin goods. A recent joint webinar hosted by the Indo-German Chamber of Commerce (IGCC) and law firm Trilegal, drew attention to the most recent developments in the GST regime and their implications. Direct and Indirect! Building on the foundation were six major pillars. These span the recent developments in indirect taxes, inverted duty structures, RoDTEP, intermediary services, the establishment of distinct persons, draft policy of the data centres and change in rates. Presided by subject matter experts, the session focussed on key aspects of the GST known to have a direct impact on day-to-day business operations of the components industry too. Moderator Sabina Pandey, Regional Director Kolkata, Indo-German Chamber of Commerce set the tone of the discussion. She said, “One of our main tasks is to assist Indian and German member companies in settling trade disputes.”

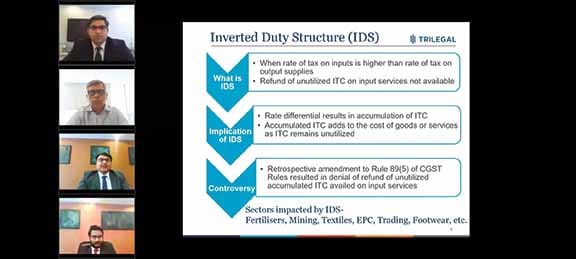

Implications of IDS

The retrospective amendment to rule 89(5) of CGST was cited at the forum. A reference was made to the denial of refund of the unutilised, accumulated ITC availed on input services. Shashank Shekhar, Counsel at Trilegal opined, “ITC on account of input services keeps on accumulating resulting in higher cost of goods and services.” Explaining the background, he opined that such an accumulation can be carried forward to the next financial year until such time it can be utilised by the registered person. The claim is known to be settled (refunded) in two scenarios: if the credit is accumulated on account of zero supplies or on the account of an inverted duty structure with a few exceptions under the law.

RoDTEP

RoDTEP came into effect from January 2021. MEIS violated 3.1A and 3.2 of the agreement subsidies and countervailing measures. Tushar Joshi, Senior Associate at Trilegal mentioned “RoDTEP aims to reimburse taxes and duties incurred by exporters such as local taxes, coal cess, mandi tax, electricity duties, and Value Added Tax (VAT) besides the state excise on fuel crucial for transportation,” explained Joshi. These are not refunded under any other existing scheme, he pointed out. The salient features of RoDTEP include the amendment by Foreign Trade Policy 2015-20, concerning para 4.01 (e). Additionally, informed Joshi, rebates under this scheme will be granted as a percentage of the export value. “The rebate will be given in the form of duty credit or e-scripts, which will be transferable, and can be used for basic payments in the form of customs duty only,” he stated. Moreover, a committee has been constituted by the government known as the RoDTEP Committee to look into priority interventions in the sectors covered under the scheme.

Draft data centre policy

As per GoI, the draft data protection policy aligns with the EU General Data Protection Regulation (GDPR) policy known to have come into force across Europe in May 2018. Speaking on the amendments to India’s data centre draft policy announced in 2020, Pranav Bansal, Senior Associate at Trilegal, said, “The proposed benefits suggested in the draft data policy can be divided into five divisions also applicable to the automotive sector as a whole.” “A favourable environment, conducive ecosystem, data centre economic zone, capacity building, and institutional mechanism are deemed crucial to its seamless transfer,” he opined. The GoI will undertake a mid-term evaluation of the policy and propose any modifications/ amendments if required. It will be followed by an end of policy period evaluation wherein such an evaluation will be carried out by an independent agency appointed by the Inter-Ministerial Empowered Committee/ Data Centre Facilitation Unit (DCFU).

Impact On Intermediaries

Intermediaries are seeking clarity. For example, in the instance wherein the Integrated Goods and Services Tax (IGST) is known to be paid as the Inter-State supplies of goods and/or services, governed by the IGST Act. Applicable on any supply of goods and/or services in both instances of import and exports, the CGST and SGST is payable on the services paid by an intermediary. The forum sought clarity on the Authority of Advance Ruling (AAR). For example, in Gujrat, clarity on applicability of CGST and SGST in comparison to AAR case-in-point Maharashtra levying IGST. The committee was urged to issue clarifications to avoid discrepancies.

Establishment of distinct persons

Under GST, to qualify as export of services, one of the conditions entails the supplier and recipient of service to not merely be the establishment of a distinct person. “Establishment of distinct persons” can be defined by two explanations to section 8 of the IGST Act. For example, in case there is an Indian company, and the branch office is situated outside India, or there is a branch office of a foreign company in India, these would constitute the establishment of distinct persons. According to the latest circular 161/17/2021 dated September 21, 2021, a clarification informs that out of the two entities, both of them have been incorporated, one of which is in India, and the other entity has been incorporated under the foreign laws implying the respective entities to constitute as separate persons. Thus failing to count as an establishment of distinct persons. The forum also sought clarity on recurring rate changes.

Clarity on slabs/rates

On the GST slabs, the recurring changes were scrutinised. Pranav Bansal cited the recent changes in rates. For example, solar-powered based devices (solar modules) that command a six per cent SGST and CGST with a 12 per cent IGST are up marginally by one per cent compared to 2017. GST on specified renewable energy devices and parts has increased from five to 12 per cent in a major change. GST on ores and concentrates of metals such as copper, and aluminium rose from five per cent to 18 per cent last year. As per reports, a panel of ministers set up to review rates might look at raising the minimum threshold from five per cent to eight per cent as well as propose a single 15 per cent slab derived from the merger of the 12 per cent and 18 per cent slabs. Inflationary concerns could delay the former! The panel was formed last year was asked to look at rate rationalisation, review the exempt goods in a bid to expand the tax base and garner the required resources.

Key Changes

While many challenges are known to have been overcome under the aegis of the GST council, a lot more remains to be done. Effective January 01, 2022, a monthly filer failing to file the GSTR-3B for the preceding month will not be allowed to file GSTR-1 for the subsequent month. To be implemented through the GST portal, the checks for the same will be automated requiring taxpayers to comply with Rule 59 of the CGST rulebook. It is also crucial to avail the E-Way Bill (EWB) generation facility to be blocked otherwise. On the availability of input tax credit, any availment of input tax credits by the recipient contrary to legal provisions in GST will be subjected to action by the tax administrations in accordance with the law. Efforts have been made in the past to also improve the filing experience with the revamped and enhanced version of GSTR-1/IFF. Among the module wise functionalities now made live on the GST portal span across registration, returns, advance ruling, payment, refund and more. For example, taxpayers have been mandated to authenticate Aadhaar failing which files revocation application in form REG-21 would not be possible. Both enrollment and e-KYC are now mandatory. Taxpayers with an aggregate turnover exceeding rupees five crores are required to file ITC-04 on a half-yearly basis. To account for the merger of banks, only 17 agency banks are now made available on the portal for easing the filing of returns.

Among underlying demands of the industry, the inclusion of petroleum products, including petrol, and natural gas are yet to reach any conclusion. Recently, Pankaj Chaudhary, MoS, Ministry of Finance, in a reply to the Rajya Sabha, is known to have drawn attention to the GST Council not recommending the inclusion of petroleum products and natural gas under the GST. He cited that the inclusion of petroleum products was dependent on the GST Council which is known to include representatives of the state. The timing of such changes, if approved, need to be watched closely!

Industry Focus Areas

o Inverted Duty cycle

The Inverted Duty cycle (IDS) refers to the rate of tax on inputs that is higher than the rate of tax on output supplies. Here, the refund of unutilised Input Tax Credit (ITC) on input services is unavailable.

o Implications of IDS

The Input Tax Credit (ITC) on account of input taxes keeps on accumulating resulting in higher cost of prices. The accumulated ITC adds to the Cost Of Goods or Services (COGS) as ITC remains unutilised. Retrospectively, the amendment to Rule 89(5) CGST, resulted in denial of refund of unutilised, accumulated ITC availed on input services which in effect are higher than the rate of tax on outward supplies.

o RoDTEP

In the case of Remission of Duties and Taxes on Export Products (RoDTEP), the Government of India has recently replaced its old incentive structure, the Merchandise Exports From India Scheme (MEIS). The World Trade Organisation (WTO) is known to have declared the old MEIS system to be a WTO violation.

o Data Centres

Recently, the government introduced a data localisation policy, meaning all the data collected by the usage of mobile phones, social media, needs to be stored within the jurisdiction of India. Moreover, the government is in the process of notifying data protection law which will apply to various sectors such as automotive components.

Procedure To Generate An E-script

o Every individual has to make a declaration on the Shipping Bill (S/B).

o It is then processed in the ICEGATE system by the customs department.

o The claim is only allowed after filling out the export general manifest.

o Further, a scroll will be generated, which contains all the details of the shipping bill and duty credit associated with those.

o After this electronic duty credit ledger containing details of S/B, one can generate an E-script with one-year validity.

Pain Points Of RoDTEP

o RoDTEP is restricted to only input embedded taxes, thus the rate of the rebate is lower than MEIS.

o The range varies from 0.5 per cent to 4.3 per cent depending upon the sector.

o All sectors belonging to iron and steel and pharmaceuticals are excluded from this scheme.

o Also if any individual faces higher duties that are higher than the rebate which is granted in that aspect, representations can be made to trade bodies/export councils and RoDTEP committee for determination of ceiling rates.

New GST Reforms

GST reforms have come to the fore again. Ashish Bhatia with inputs from Prateek Pardeshi highlights the implications.

Hailed as a landmark reform by GoI, Goods and Services Tax (GST) challenges came to the fore once again in Union Budget 2022-23. The FM lauded the GST council for enabling the GoI to overcome an initial set of challenges and building a fully IT-driven and “progressive” GST regime. In sync with the industry, the FM admitted that challenges remain. Resorting to overcome them in 2022-23, the FM lauded the buoyant growth in collections and hailed taxpayers for their cooperation. Notably, 16 per cent of the government revenue is attributed to GST and the net can be widened in all probability. Claiming to have struck the right balance between facilitation and enforcement, the FM, credited it for resulting in better compliances.

Hailed as a landmark reform by GoI, Goods and Services Tax (GST) challenges came to the fore once again in Union Budget 2022-23. The FM lauded the GST council for enabling the GoI to overcome an initial set of challenges and building a fully IT-driven and “progressive” GST regime. In sync with the industry, the FM admitted that challenges remain. Resorting to overcome them in 2022-23, the FM lauded the buoyant growth in collections and hailed taxpayers for their cooperation. Notably, 16 per cent of the government revenue is attributed to GST and the net can be widened in all probability. Claiming to have struck the right balance between facilitation and enforcement, the FM, credited it for resulting in better compliances.

Also read, Economic Package in First Tranche to Benefit Machine Tool Industry