With a push from trade volatility, interventions and private investment, India is poised to become one of the global manufacturing powerhouses. Ashish Bhatia with Deepti Thore looks at recent efforts that need to be multiplied manifold to realise this aspiration.

India is at a crossroads! With its attractive propositions including land and cheap labour, the country has always received a healthy inflow of Foreign Direct Investment (FDI) barring exceptional years. Global manufacturers preferring to set up their export hubs and technical CoEs with huge sums ploughed into the country are a testimony to the favourable cost-benefit analysis. To become a hub for global manufacturing, however, the task is cut out ﹣ India must up its quality benchmarks and technological advancements before turning a net exporter. The think tanks expect the country to play a significant role in reshaping supply chains despite some eyebrow-raising big-ticket exits recorded from the country in recent times. It is estimated that the country could contribute more than USD 500 billion as an annual economic impact to the global economy by 2030. PM Narendra Modi, in 2019, shared the vision of India turning into a five trillion economy by 2023-24. Notably, the automotive components industry contributes 7.1 per cent of the Gross Domestic Product (GDP) in FY21 and 49 per cent of the manufacturing GDP besides generating employment for 50 lakh people. By 2026, the industry alone could grow to a USD 200 bn valuation.

Pronounced opportunity

The opportunity seems more pronounced with supply chain bottlenecks coming under acute pressure in recent times. The whole of the past two years has been about dealing with supply-chain bottlenecks forcing a global realignment. Exporting nations were forced under lock downs, to the skewed allocation of semiconductor wafers to non-automotive segments that in turn led to an acute crunch on the supply side of the automotive industry. The renewed vigour of India as an export hub is also credited to the importing nations looking at ‘China+1’ strategy or for that matter alternative procurement strategy as a whole to de-risk their supply chains. The disruptions at some of the high-traffic ports like the Suez Canal coupled with the recent turn of unforeseen events like the Russia-Ukraine war crisis continue to batter the supply chain. In the case of the latter, the Western sanctions on Russia, for example, have forced businesses to terminate bilateral trade agreements. This has brought the focus on alternative manufacturing powerhouses globally including aspiring countries like India be it in the capital goods or the IT services industry.

In case of emobility, efforts are underway to localise battery packs with many domestic players looking to set up their battery plants and semiconductor manufacturing facilities as suppliers look to attain economies of scale. The objective being to bring supply-side costs down before passing on the same to consumers to in turn lower the initial acquisition costs. The latter is the biggest deterrent in case EVs do not turn out to be a mass mobility option. Relaying the Government’s vision, Union Minister of Road, Transport and Highways, Nitin Gadkari has asserted on many occasions that India has the potential backed by the opportunity to become a global manufacturing hub for automobiles within the next five years. Pandemic induced supply chain bottlenecks have made countries realise their over dependence on select nations and a limited vendor base as severe threats to sustenance of the business. It has led to the emergence of alternative procurement strategies beyond ‘China+1’ to now ‘Russia+1’ for that matter with the turn of unforeseen events beyond the industry’s control. India must become a net exporter and make its way to the list of businesses looking at a plus one alternative anywhere across the globe!

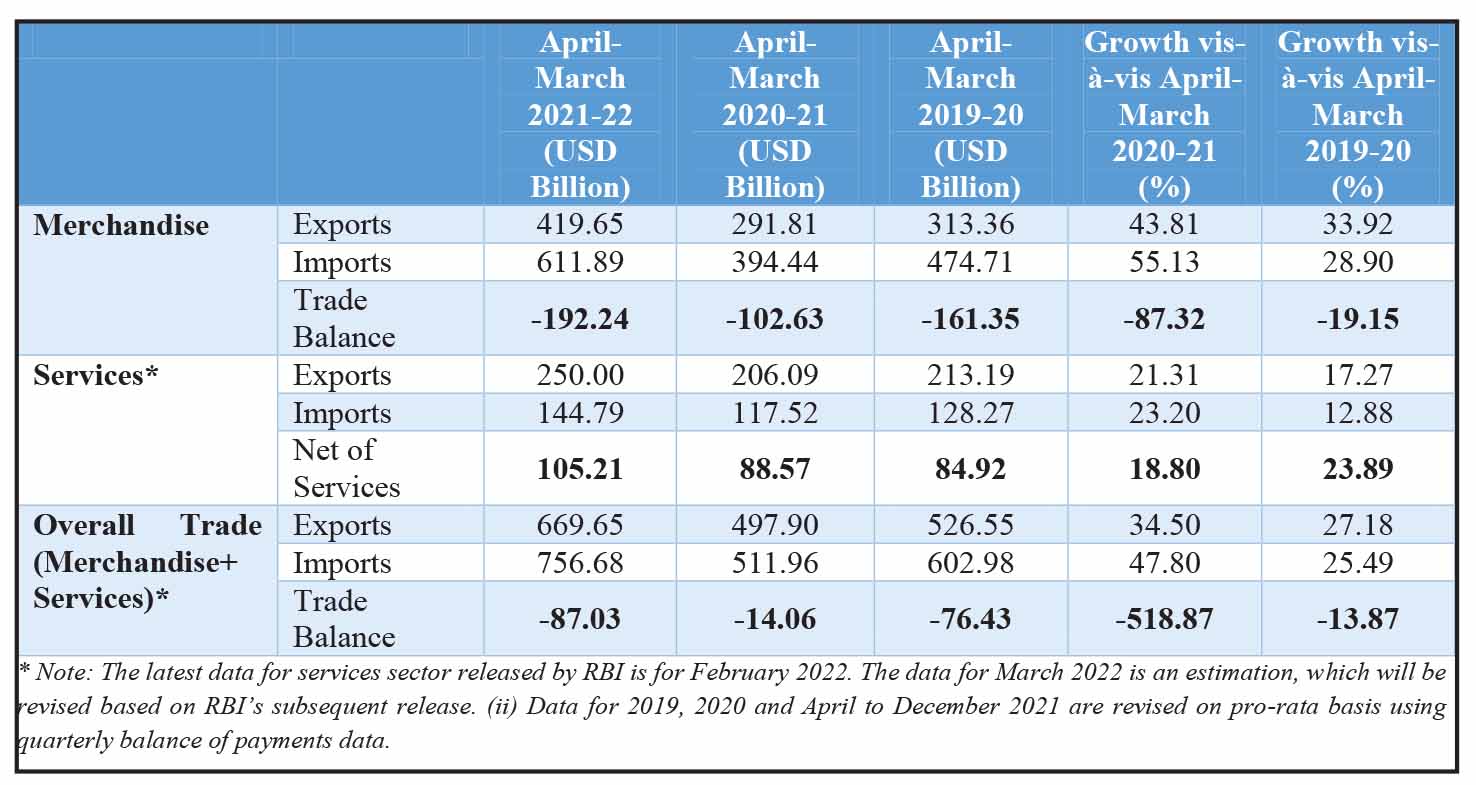

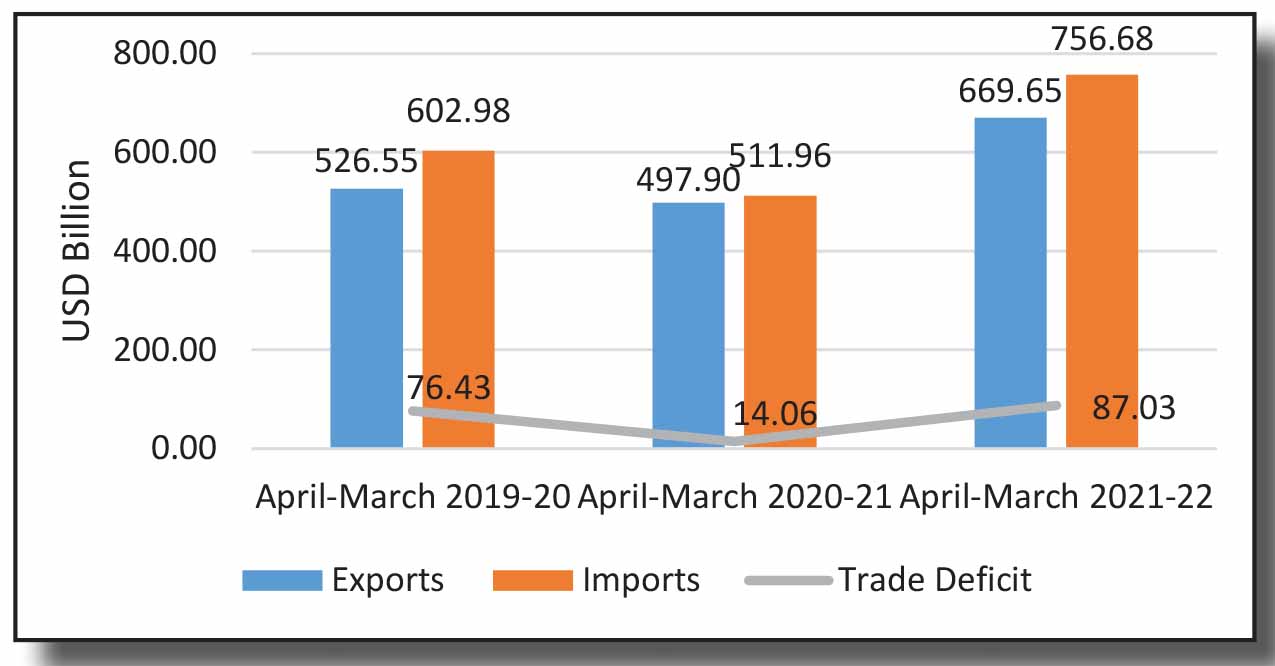

Exports performance

If one were to overlook the disruptions as a short term phenomenon, with buoyant sentiments and a hawk-eye view on the export growth prospects, the country has an outside chance to establish itself as a hub for global manufacturing and dethroning manufacturing powerhouses. In July 2021, said to have kick-started the recovery trajectory of exports, Indian exports are estimated to have breached the USD 54.95 billion mark, a jump of 23.24 per cent over the same period in 2019. Speaking at the Annual Assocham conclave, Minister of Commerce and Industry, Piyush Goyal, the country could well breach the USD 410 bn mark in exports this fiscal. The Union Minister had opined, that to become a USD five trillion economy, goods and services, need to contribute 20-25 per cent at an estimated USD one trillion each. Notably, the target is to grow exports to a point that it financially supports the country’s imports bill with crude oil imports being the costliest component. Here, the role of tier2s and tier3 districts is deemed crucial.

The push factor

Anil Valsan, Director Knowledge Leader – Advanced Manufacturing and Mobility Industry Market, Ernst & Young LLP

Government interventions like the ‘Make In India’ vision programme, and more recently the Production-Linked-Incentive (PLI) scheme announced for Champion OEMs and component suppliers are expected to further enable the industry to tap the presented opportunities in Advanced Automotive Technology (AAT) as a direct or indirect beneficiary. The Government’s ‘Make in India’ program is another key program which can put India on the world map as a manufacturing hub. According to the World Economic Forum study, India has three primary assets to capitalise on the unique opportunity to become a manufacturing hub: the potential for significant domestic demand, the Indian Government’s drive to encourage domestic manufacturing, and a distinct demographic edge backed by a capable, considerable proportion of the young workforce. Low corporate tax rates to 15 per cent for new manufacturing is another key enabler in this direction.

Recently the government also approved the ‘National Manufacturing Policy. The main objective of this policy is to increase the sectoral share of manufacturing in GDP to at least 25 per cent by 2022; to increase the rate of job creation to create 100 million additional jobs by 2022; and to enhance global competitiveness, domestic value addition, technological depth and environmental sustainability of growth. PM Gati Shakti – National Master Plan (NMP) enabling integrated planning and coordinated implementation of infra structural connectivity, is also expected to lower logistics costs significantly thereby boosting the prospects of domestic manufacturers.

The development commissioners of various SEZs during March 2022 are also known to have approved the proposals of investments pegged at Rs.1719.45 crore which is expected to generate employment for up to 7,962 persons. Initiatives like the plug and play infrastructure being established in SIPCOT Industrial Growth Centre, Perundurai, Erode District project by State Industries Promotion Corporation of Tamil Nadu (SIPCOT) supported with the financial assistance of Rs.3.43 Crore under Trade Infrastructure for Export Scheme (TIES) are also being hailed as steps in the direction. Other resolutions of bottlenecks in bilateral trade, like that in the case of Indonesia, where a letter written to the Indonesian Trade Minister is known to have paved the way for the auto manufacturers held back due to market access issues. In other scenarios, negotiations continue on the Free Trade Agreements (FTA). “The significant gap between demand and supply has created room for a variety of products and services for instance changing consumer preferences,” stated Anil Valsan, Director Knowledge Leader – Advanced Manufacturing and Mobility Industry Market, Ernst & Young LLP, and Global Automotive & Transportation Lead Analyst. ACI

Also read, Committed to India