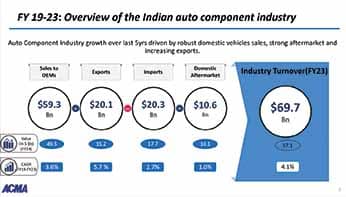

ACMA reassures continuity in robust growth backed by strategic investments in the auto components sector, writes Richa Tyagi.

In its findings shared at the Industry Performance Review for the first half of fiscal 2023-24 (H1-FY24), the turnover of India’s automotive component industry during the period April-September 2023 stood at an impressive Rs.2.98 lakh crore (USD 36.1 bn). This translates to a robust growth of 12.6 percent compared to the corresponding period (H1-FY23) in the previous fiscal. This noteworthy expansion is attributed to several factors, including steady vehicle sales, consistent exports, and a resilient aftermarket.

Vinnie Mehta, the Director General of ACMA further elaborated and shared that the auto component supplies to all segments of the industry including OEMs, exports as also the aftermarket remained steadfast. Besides the growth in the domestic indicators, exports grew by 2.7 percent to USD 10.4 bn while imports grew by 3.6 percent to USD 10.6 bn.

A net importer in effect, in the aftermarket, estimated at Rs.45,158 crore a growth of 7.5 per cent was registered. Component sales to OEMs in the domestic market grew by 13.9 percent to Rs.2.54 lakh crore, he added.

Shradha Suri Marwah, the President of ACMA and CMD at Subros Ltd., drew attention to vehicle sales across all segments, reaching pre-pandemic levels. She further cited that with the mitigation of supply-side issues witnessed during the pandemic such as the availability of semiconductors, high input raw-material costs, and non-availability of containers, the auto components sector witnessed a steady growth in both domestic and the international markets in H1-FY24.

Marwah expressed optimism for the rest of the current fiscal, citing the momentum gained from a successful festive season with significant sales across various vehicle segments. She underlined the industry’s commitment to investments for higher value-addition, technology upgrades, and localization to meet the demands of both domestic and international customers. “These strategic investments are crucial for staying relevant in a dynamic and competitive global market,” she asserted.

The use of vehicles for personal and commercial use has increased as the market stabilised after the pandemic. The growth in the aftermarket can be attributed to the increase in demand for used vehicles, the shift in preferences towards larger and or more powerful vehicles, and the increasing formalisation of the repair and maintenance market.

The President of ACMA acknowledged the successful mitigation of supply-side challenges including semiconductor availability, high raw-material costs, and container shortages, faced during the pandemic.

A positive outlook

In conclusion, the ACMA Industry Performance Review for H1 FY-24 presented a positive outlook for the Indian auto components sector. Despite challenges such as geopolitical uncertainties, global economic downturns, and high GST rates, the industry plans a substantial USD seven billion investment over five years. Positive factors, including anticipated GDP growth, infrastructure emphasis, stable international demand, technological focus, and government support for carbon neutrality, provide a favourable backdrop. The industry’s resilience, adaptability, and strategic investments position it for sustained growth, making it well-equipped to capitalise on emerging opportunities and contribute significantly to India’s economic development and global competitiveness. ACI

Key Findings

The key findings of the ACMA Industry Performance Review for H1 2023-24 provide a deeper understanding of the sector’s dynamics:

OEM Sales: Auto component sales to OEMs in the domestic market saw remarkable growth, reaching USD 30.8 bn, reflecting a notable increase of 13.9 per cent compared to the first half of the previous year. This surge is attributed to the consumption of higher value-added components and a market preference shift toward larger and more powerful vehicles.

EVs Gaining Traction: The supplies to the EV industry have increased more than 50 per cent in H1-FY24 as compared to H1-FY23 indicating a rising adoption of electric vehicles.

Surge in Exports: There is a significant growth in exports of auto components by 2.7 per cent, reaching USD 10.4 bn in H1-FY24, compared to USD 10.1 bn in H1-FY23. Notably, North America and Europe continued to account for a major share at 33 per cent each of the total exports, a testimony to global acceptance. Exports to Bangladesh, Nepal, and Sri Lanka have declined owing to muted economic activity in the region.

Imports: Despite encouraging localisation, China remains a primary import source. Imports of auto components grew by 3.6 per cent, reaching USD 10.6 bn in H1-FY24, up from USD 10.2 bn in H1-FY23. Asia dominated imports, constituting 63 per cent, followed by Europe (27 per cent) and North America (nine per cent), indicating the industry’s reliance on global supply chains.

Aftermarket: The aftermarket witnessed robust growth of 7.5 per cent, reaching USD 5.5 bn compared to USD 5.4 bn in H1-FY23. The aftermarket’s growth emphasises sustained demand for auto components beyond the initial sale, showcasing the industry’s role in providing reliable solutions throughout a vehicle’s life cycle.