A critical sector for Turkey, the automotive components ecosystem is well poised.

Story by: Deepti Thore and Ashish Bhatia

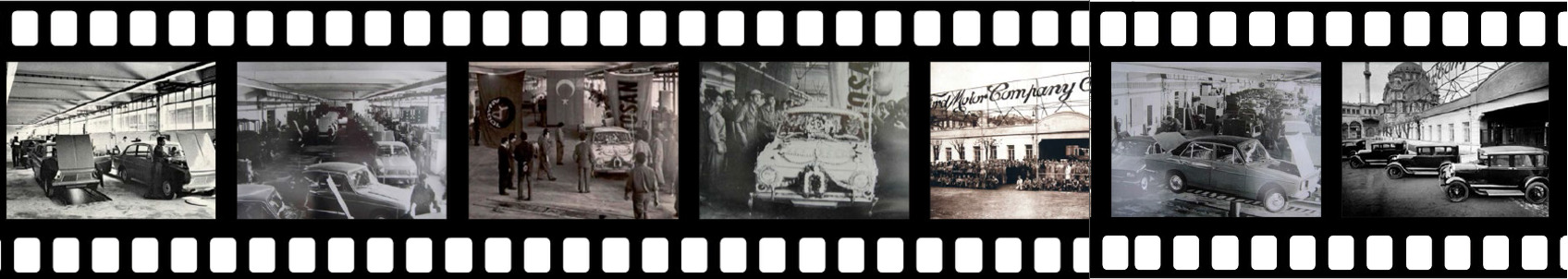

The growth of the Turkish automotive industry can be attributed to the developments that took place in the 1950s when the first Turkish automotive products were produced in 1954. Like most markets where the roots of the automotive industry are known to have been sown by their exposure to defence applications, the production of army jeeps from Willys Overland Ltd. is known to have set the ball rolling for Turkey’s automotive industry especially the components manufacturers. This investment was followed by key developments including the truck factory of Türk Otomotiv Endüstrisi A.Ş. in 1955, the second and third truck factories of Otosan and Çiftçiler A.Ş., and Istanbul Bus Karöseri Sanayi A.Ş. production of the Magirus buses, in 1963. The bus production was followed by the production of the first Turkish car at the Eskişehir State Railways Factory in 1961. Aptly named as the ‘Revolution’, it was limited to the production of four prototypes. Albeit with a production demand of an estimated 5000 units. The low demand, in turn, translated to Turkey finding it tough to attain the desired levels of economies of scale and hence breakevens. The challenge was addressed only half a decade later, in 1966, with the production of the Anadol car which helped the industry move towards healthier production scales.

The Tofaş and Oyak-Renault establishment in 1969 is deemed as a significant development that helped the industry come out of a cocoon. More recently, as per the report, “Turkish Automotive Industry Agenda” conducted by the Presidency of the Republic of Turkey Investment Office and EY in Turkey, the USD 15 billion OEM investment made between 2000 and 2018 in their Turkey operations is said to have significantly expanded the manufacturing capabilities. It is believed to have led Turkey to establish itself as a key part of the international OEM value chain.

With a stronghold in the automotive components sector, Turkey today develops competitive components for the pioneers in the automotive industry, by far the country’s largest. With an expanse concentrated mainly in the regions of Bursa, Marmara Region, the component industry has also shown signs of growth in regions like Istanbul, İzmir, Kocaeli, Ankara, Konya, Adana and Manisa. Producing components and ancillaries with a high degree of localisation looked at as highly advantageous, the strategy is said to have helped Turkey establish itself as a global automotive hub. An estimated 4000 auto component manufacturers are known to be operating in the country including an estimated 1,000 direct suppliers to Original Equipment Manufacturers (OEMs).

Frontline components

Today, a lack of domestic car manufacturers is compensated by the presence of big names such as Toyota, Fiat Chrysler and Ford with their decades-old presence in the market. Volkswagen is the latest to join the bandwagon as the latter looks to set up a factory in the region. To help sustain growth, the local manufacturers have increased their capabilities manifold. Localised production of components spans full engines and engine parts, chassis and associated spares, batteries, suspension and transmission systems, HVAC, brakes, clutches, hydraulic and pneumatic systems, glass, security systems and safety parts, rubber and plastic parts and seats to name a few. Manufacturers, especially associated with the production of shock absorbers, brakes and clutches, piston rings, oil filters, bumpers, lights, signalling parts, glassware, additives, spark plugs, tyres, lights and catalytic converters are said to be frontrunners in realising the anticipated growth.

Technical Integration for EVs and Hybrids

E-mobility has taken Turkey by storm too. With its focus on building a sustainable transport system, Turkey is striving hard towards a new chapter. This drive, in turn, requires component manufacturers to increase their capabilities in the realm of components like electric motors, battery modules, battery management system, inverters and electronic control units besides an array of supporting components. For instance, Cummins Inc. recently introduced the new version of B4.5 and B6.7 EuroVI Phase-D engines to the Turkish OEMs for their intracity and intercity bus range. When integrated with a diesel-electric driveline, the engines are claimed to hold the potential of reducing fuel consumption and related CO2 emissions by as much as 33 per cent. Such collaborations are being looked upon to help Turkish OEMs graduate to electrification and fleet decarbonisation. Among next-generation products to fuel the emobility aspirations of Turkish manufacturers are integrated e-drive modules known to combine motor, transmission and inverter into a single lightweight system. The next-generation battery-electric systems are claimed to offer a high energy density for zero-emission designs.

Allison Transmissions’ AXE Electric Axle Series for the Turkish market is specially designed to fit between the wheels of heavy-duty trucks and buses in a bid to replace traditional powertrains. Compatible with the current vehicle frames, suspension and wheel ends they are said to be well-suited to most OEM vehicle assembly processes. The series features fully integrated electric motors, a multi-speed gearbox, oil cooler and pump, and is said to be suitable for full Battery Electric Vehicles (BEV), Fuel Cell Electric Vehicles (FCEV), as well as Range Extended Electric Vehicles (REEV). For instance, the H 40/50 with Flex EV, an electric hybrid system with a 16 km range, Allison is looking at potential expansion of its electrification portfolio. Ideal for transit bus, coach and public transport applications, the system features zero-emissions capability with the engine off, including on approaching, during, and leaving passenger stops for a quieter and healthier environment.

Allison Transmissions’ AXE Electric Axle Series for the Turkish market is specially designed to fit between the wheels of heavy-duty trucks and buses in a bid to replace traditional powertrains. Compatible with the current vehicle frames, suspension and wheel ends they are said to be well-suited to most OEM vehicle assembly processes. The series features fully integrated electric motors, a multi-speed gearbox, oil cooler and pump, and is said to be suitable for full Battery Electric Vehicles (BEV), Fuel Cell Electric Vehicles (FCEV), as well as Range Extended Electric Vehicles (REEV). For instance, the H 40/50 with Flex EV, an electric hybrid system with a 16 km range, Allison is looking at potential expansion of its electrification portfolio. Ideal for transit bus, coach and public transport applications, the system features zero-emissions capability with the engine off, including on approaching, during, and leaving passenger stops for a quieter and healthier environment.

Offering an EV charging solution from compact, high-quality AC wall boxes and reliable DC fast-charging stations with robust connectivity, ABB offers on-demand electric bus charging systems. The company’s connected chargers are said to offer ease of installation as the company commits to mobility transformation in Turkey. In its car charging portfolio, the company offers high power fast charging, DC fast charging, DC wallbox, EV Lunic wallbox and Terra AC wallbox. For heavy commercial vehicles, it offers connector charging, pantographs up/down and solutions for flash charging.

Offering an EV charging solution from compact, high-quality AC wall boxes and reliable DC fast-charging stations with robust connectivity, ABB offers on-demand electric bus charging systems. The company’s connected chargers are said to offer ease of installation as the company commits to mobility transformation in Turkey. In its car charging portfolio, the company offers high power fast charging, DC fast charging, DC wallbox, EV Lunic wallbox and Terra AC wallbox. For heavy commercial vehicles, it offers connector charging, pantographs up/down and solutions for flash charging.

A leader in electric propulsion technology, Magelec propulsion offers axial flux powertrain solutions and high-speed transmissions for passenger cars, commercial vehicles and buses and coaches. With core products like high-tech motors – axial flux permanent magnet synchronous motors which include drive motors, inverters, gearbox and drive system accessories, the company hopes to fill the void in EV and Plug-in Hybrid Electric Vehicles (PHEV) in Turkey.

Retarders

Frenelsa is a Spanish company producing electric retarders for buses, coaches and commercial vehicles. On an expansion drive in the Turkish market, the company’s retarders are suited to drivelines as active safety elements. Claimed to offer a notable reduction in the total cost of ownership, the retarders additionally help curtail driver fatigue. With a claimed 7x lifespan over service brakes systems including pads, the lining of the disc and drum brakes, its frictionless system is said to reduce dust emission too. The company’s F16 and F16C series are installed in the driveline of front-engine vehicles (trucks and buses), between the joints of the driveshaft. The retarder F12-40 S7 is claimed to be popular in minibuses, cash in transit vans, rescue vehicles and said to be suitable for different OEM chassis including Mercedes Sprinter, Volkswagen Crafter, Iveco Daily, Renault Marcott, Ford Transit among others. FF16 is specially built keeping in mind rear-engine buses and the FF8-65 series for light vehicles. Among other manufactures is German company Voith with a well-established range of state of the art products and services for the Turkish market since 2005. The company’s range of retarders includes water retarders that provide braking using the engine coolant and oil retarders that work independently of the transmission fluid.

Frenelsa is a Spanish company producing electric retarders for buses, coaches and commercial vehicles. On an expansion drive in the Turkish market, the company’s retarders are suited to drivelines as active safety elements. Claimed to offer a notable reduction in the total cost of ownership, the retarders additionally help curtail driver fatigue. With a claimed 7x lifespan over service brakes systems including pads, the lining of the disc and drum brakes, its frictionless system is said to reduce dust emission too. The company’s F16 and F16C series are installed in the driveline of front-engine vehicles (trucks and buses), between the joints of the driveshaft. The retarder F12-40 S7 is claimed to be popular in minibuses, cash in transit vans, rescue vehicles and said to be suitable for different OEM chassis including Mercedes Sprinter, Volkswagen Crafter, Iveco Daily, Renault Marcott, Ford Transit among others. FF16 is specially built keeping in mind rear-engine buses and the FF8-65 series for light vehicles. Among other manufactures is German company Voith with a well-established range of state of the art products and services for the Turkish market since 2005. The company’s range of retarders includes water retarders that provide braking using the engine coolant and oil retarders that work independently of the transmission fluid.

Safety systems

The automotive safety system market is estimated to grow to USD 169.46 Billion by 2025, at a CAGR of 9.36 per cent from USD 82.80 Billion in 2017. Here a healthy mix of active and pass safety systems is considered crucial for the vertical’s growth in the country. For instance, among crucial inclusions identified and catching on in the passenger carriers are the Fire detection, suppression and gas leak detection systems. Deemed as essential for the security of bus, coach among other commercial vehicles, the niche vertical has companies like Kidde Technologies Inc delivering advanced fire safety technology. The company offers such systems for bus, coach and commercial vehicles. Finding its application in European Union countries including Turkey, these extinguishing systems are claimed to protect the passengers by providing visual aid and audible alarms in the driver’s dash area. The detection solutions include armoured linear thermal detector, dual-band optical detector and gas detection sensor. The UNEC107 extinguisher is also effective in combating fire.

Dafo Vehicle Fire Protection supplies fire detection and suppression systems for buses, coaches and commercial vehicles. Covering EVs and HEVs, the company offers a full coverage interim multi-zone fire protection solution. Keen to promote its business in Turkey, the company is promoting fire risk analysis prior to the installation of the suppression systems. A pressureless cylinder with the capability of minimising the risk of injury is claimed to be effective on flammable liquid fires like petrol, diesel and hydraulic oils. The system offers easy refill on-site helping to save valuable time and cost. Belt Check offers seat belt control, tracking and in-vehicle data collection systems. With the likes of Isuzu as its clients, the company’s system communicates wirelessly using sensors placed in passenger seats together with micro-key and sensory modules installed in the lock mechanism to relay audiovisual alerts on unoccupied, occupied, buckled and unbuckled passengers etc.

Dafo Vehicle Fire Protection supplies fire detection and suppression systems for buses, coaches and commercial vehicles. Covering EVs and HEVs, the company offers a full coverage interim multi-zone fire protection solution. Keen to promote its business in Turkey, the company is promoting fire risk analysis prior to the installation of the suppression systems. A pressureless cylinder with the capability of minimising the risk of injury is claimed to be effective on flammable liquid fires like petrol, diesel and hydraulic oils. The system offers easy refill on-site helping to save valuable time and cost. Belt Check offers seat belt control, tracking and in-vehicle data collection systems. With the likes of Isuzu as its clients, the company’s system communicates wirelessly using sensors placed in passenger seats together with micro-key and sensory modules installed in the lock mechanism to relay audiovisual alerts on unoccupied, occupied, buckled and unbuckled passengers etc.

Articulation systems and folding bellows

Jointech Vehicle System Co. Ltd. (JVS) offers integrated solutions for bus articulation systems. Keen to leverage the growth potential in Turkey, the company is banking on its range of mature, maintenance-free, high reliable and high load-bearing bus articulation systems. Finding application in the sustainable Urban Transit and Bus Rapid Transport system, JVS is among companies catering to OEMs with integration solution and technical support of articulated bus design and manufacturing. For instance, the company’s IK29H (Type L) series is claimed to be best suited for lightweight urban articulated buses across the ground clearances. The customised folding bellow design ensures compliance with overall bus body dimensions with a high degree of accuracy. The IK29F (Type A) series is suitable for 14-18 metres front and middle drive buses where there is a heavy-duty operational cycle requiring high reliability. The IK29F (Type E) series is suitable for 14-18 m large low floor front and middle drive buses including diesel, CNG, pure electric, dual-source electric and hybrid propulsions. The company also provides customised folding bellows claimed to be tear-resistant offering watertight climate insulation and noise reduction. Supported and protected by sturdy aluminium frames, t.hese feature self-adjusting wire trays and robust aluminium alloy profile floors are said to be suited to most articulated-joint transport systems.

Jointech Vehicle System Co. Ltd. (JVS) offers integrated solutions for bus articulation systems. Keen to leverage the growth potential in Turkey, the company is banking on its range of mature, maintenance-free, high reliable and high load-bearing bus articulation systems. Finding application in the sustainable Urban Transit and Bus Rapid Transport system, JVS is among companies catering to OEMs with integration solution and technical support of articulated bus design and manufacturing. For instance, the company’s IK29H (Type L) series is claimed to be best suited for lightweight urban articulated buses across the ground clearances. The customised folding bellow design ensures compliance with overall bus body dimensions with a high degree of accuracy. The IK29F (Type A) series is suitable for 14-18 metres front and middle drive buses where there is a heavy-duty operational cycle requiring high reliability. The IK29F (Type E) series is suitable for 14-18 m large low floor front and middle drive buses including diesel, CNG, pure electric, dual-source electric and hybrid propulsions. The company also provides customised folding bellows claimed to be tear-resistant offering watertight climate insulation and noise reduction. Supported and protected by sturdy aluminium frames, t.hese feature self-adjusting wire trays and robust aluminium alloy profile floors are said to be suited to most articulated-joint transport systems.

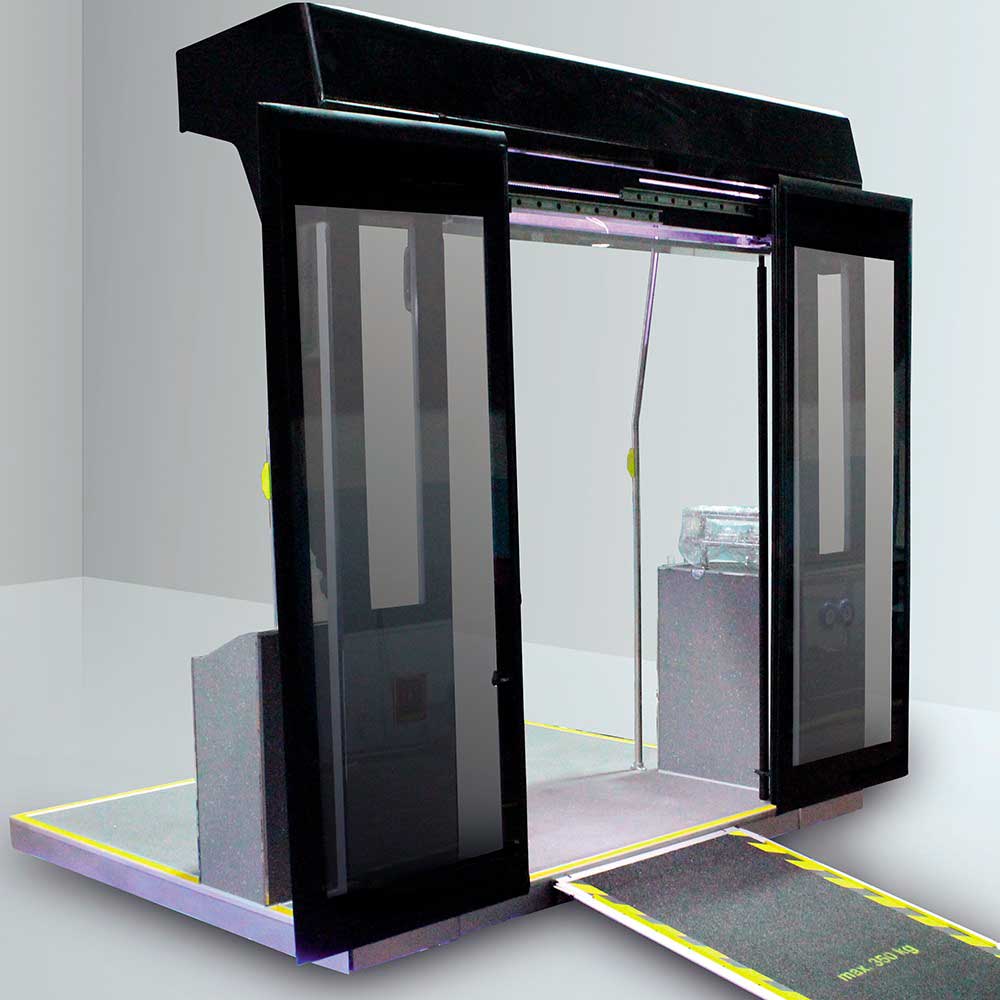

Door and Accessibility systems

The market for door systems is projected to be valued at USD 293.85 Billion by 2020. Based out of Bursa, Revar is leveraging the growth potential by serving end-users with valve and piston repairs. The company offers electric door systems, accessibility systems, luggage compartment systems, electric steps range, roof hatch, escape hatch and disabled or handicap entrance systems. Suppliers to Otokar, Karsan, Mercedes, Temsa and Isuzu among others in Turkey, the products have a 55 to 66 per cent coverage in the Turkish regions. Globally the coverage stands at two to three per cent. Given the rise in demand for electric product portfolios, the company is working towards manufacturing electronic components for electric door systems. Besides the company also manufactures manual lid systems, radiator lid, engine hood and luggage compartment covers. It is also working to meet the demand for automatic control of luggage systems in select markets.

The market for door systems is projected to be valued at USD 293.85 Billion by 2020. Based out of Bursa, Revar is leveraging the growth potential by serving end-users with valve and piston repairs. The company offers electric door systems, accessibility systems, luggage compartment systems, electric steps range, roof hatch, escape hatch and disabled or handicap entrance systems. Suppliers to Otokar, Karsan, Mercedes, Temsa and Isuzu among others in Turkey, the products have a 55 to 66 per cent coverage in the Turkish regions. Globally the coverage stands at two to three per cent. Given the rise in demand for electric product portfolios, the company is working towards manufacturing electronic components for electric door systems. Besides the company also manufactures manual lid systems, radiator lid, engine hood and luggage compartment covers. It is also working to meet the demand for automatic control of luggage systems in select markets.

Automotive lighting

The global automotive lighting market was valued at USD 18,003.36 million in 2018 and is projected to reach USD 28,776.40 million by 2026 at a CAGR of 6.7 per cent from 2019 to 2026. Leveraging this growth potential, Ankara city-based Aygersan are suppliers for automotive lighting in CVs with the clientele list including companies like Daimler and Ford. Based in Taiwan, Super Lee is looking at Turkey with its range of universal lighting products including low beam and high beam lights for commercial vehicles along with bi-function headlights. With an R&D and manufacturing department headed out of Taiwan, the company is seeking opportunities for expansion in Turkey. It is confident of its signal lights, work lights, fog lights, daytime running lights, driving and auxiliary lights and other value-added services finding takers in the country.

The global automotive lighting market was valued at USD 18,003.36 million in 2018 and is projected to reach USD 28,776.40 million by 2026 at a CAGR of 6.7 per cent from 2019 to 2026. Leveraging this growth potential, Ankara city-based Aygersan are suppliers for automotive lighting in CVs with the clientele list including companies like Daimler and Ford. Based in Taiwan, Super Lee is looking at Turkey with its range of universal lighting products including low beam and high beam lights for commercial vehicles along with bi-function headlights. With an R&D and manufacturing department headed out of Taiwan, the company is seeking opportunities for expansion in Turkey. It is confident of its signal lights, work lights, fog lights, daytime running lights, driving and auxiliary lights and other value-added services finding takers in the country.

Automotive Glass

The global automotive glass market is growing at 7.28 per cent CAGR over the review period of 2019 to 2025. In Turkey, to leverage this growth, Ankara based Doraglass produces automotive glasses for passenger vehicles, commercial vehicles, heavy-duty vehicles and bullet-proof glasses for the defence industry. Laminated windshield, solar control athermic windshield, resistance heated rear windows, insulated double glass, concealed resistance heated windshield, laminated door glass, tempered door and side windows, aluminium / panoramic framed glasses, encapsulated elastic windshield, laminated side and rear windows besides solar control privacy side and rear windows are some of the products supplied by the company. Established in 2000, BTO Co Ltd., manufactures aluminium window frames with sliding and fixed glasses for all kinds of commercial vehicles, minibuses and buses.

Passenger Information Systems

The Passenger Information System (PIS) market is expected to grow from USD 23.8 billion in 2020 to USD 42.3 billion by 2025, at a CAGR of 12.2 per cent. Leveraging this growth potential, Istanbul based Polaris Elektronik with a wide range of PIS products offers front, side and Rear LED displays for public transport to make it easier for drivers and passengers to access information. ERA as the leading supplier in Turkey for automotive electronic products is a big exporter especially to the EU, Middle-East and other countries worldwide. The company offers a range of digital bus clocks and bus sign units.

The Passenger Information System (PIS) market is expected to grow from USD 23.8 billion in 2020 to USD 42.3 billion by 2025, at a CAGR of 12.2 per cent. Leveraging this growth potential, Istanbul based Polaris Elektronik with a wide range of PIS products offers front, side and Rear LED displays for public transport to make it easier for drivers and passengers to access information. ERA as the leading supplier in Turkey for automotive electronic products is a big exporter especially to the EU, Middle-East and other countries worldwide. The company offers a range of digital bus clocks and bus sign units.

Tractors

The Turkish market is fast turning into a chosen market for Tractor production owing to its low-cost model. Especially for Tractors with lower-rated engine power known to be sold with relatively lower profit margins. In unit terms, as one of the leading tractor markets, Turkey is flanked by Tractors supplied under brands like Armatrac, the export brand of Turkish manufacturer Erkunt Traktör Sanayi. Assembled in Sincan, on the outskirts of Ankara. Indian OEM Mahindra acquired the Turkish company in 2017 in a step-up drive to gain larger access to the Middle East and Europe, in a deal valued at USD 76 million.

Consortium approach

In a rather bold and ambitious move, the Turkey Automotive Joint Venture Group (TOGG) as a consortium brings together five major Turkish companies. The move aimed at encouraging domestic manufacturing is specially focused on EVs. It is committed to launching a total of five EV models in a 15-year time span. To boost the objective of the startup consortium, the Turkish Government under the aegis of President Recep Tayyip Erdogan, President, Republic of Turkey has come forward and earmarked a fund of USD 3.7 million subsidies to the project under which he launched the country’s first domestic car on December 27, 2019. The quantum of the investment is expected to directly benefit allied industries including steel, advanced plastics and software. The government has also assured a production site to the consortium in Bursa. The Turkish Association of Automotive Parts and Components Manufacturers (TAYSAD) is determined to help further Turkey’s ambition of expanding as a global automotive hub, by 2030. Among homegrown component manufacturers leading the drive are Ege Endüstri into axles, Ege Fren into the brake and associated parts, Tirsan into cardan shafts, steering columns, double-joint shafts, transmission and axle components for CV applications, Kirpart into engine components and Mapa into clutch kits to name a few.

In a rather bold and ambitious move, the Turkey Automotive Joint Venture Group (TOGG) as a consortium brings together five major Turkish companies. The move aimed at encouraging domestic manufacturing is specially focused on EVs. It is committed to launching a total of five EV models in a 15-year time span. To boost the objective of the startup consortium, the Turkish Government under the aegis of President Recep Tayyip Erdogan, President, Republic of Turkey has come forward and earmarked a fund of USD 3.7 million subsidies to the project under which he launched the country’s first domestic car on December 27, 2019. The quantum of the investment is expected to directly benefit allied industries including steel, advanced plastics and software. The government has also assured a production site to the consortium in Bursa. The Turkish Association of Automotive Parts and Components Manufacturers (TAYSAD) is determined to help further Turkey’s ambition of expanding as a global automotive hub, by 2030. Among homegrown component manufacturers leading the drive are Ege Endüstri into axles, Ege Fren into the brake and associated parts, Tirsan into cardan shafts, steering columns, double-joint shafts, transmission and axle components for CV applications, Kirpart into engine components and Mapa into clutch kits to name a few.

Manufacturing and Export

In 2018, Turkey produced an estimated 1.5 million vehicles to become the world’s 15th largest automotive manufacturer; the fifth largest in Europe. With a six per cent Year on Year (YoY) decline in production in 2019, vehicle production in Turkey stood at 1.46 million units as per the Automotive Manufacturers’ Association (OSD) data. The report cites a four per cent decline in Passenger vehicle (PV) production YoY down to 983,000 units. Commercial Vehicle (CV) production saw a nine per cent YoY decline of which Light Commercial Vehicle (LCV) production dropped by eight per cent YoY with Heavy Commercial Vehicle (HCV) production contracting by 18 per cent on a YoY basis. Exports declined by five per cent to settle at 1.25 million units with PV exports down by five per cent at 828,744 units. Interestingly, as per the Automotive Distribution Report (ODD), the demand for vehicles powered by small engines is said to have increased. For instance, vehicles with an engine capacity lower than 1.6-litre surged 98 per cent YoY in February while the sale of cars with 1.6-2.0-litre engines nose dived by 13.9 per cent. Demand for cars with engines over 2-0-litres decreased by 29.4 per cent as per the report. Sales of diesel cars decreased by 43.4 per cent. Cars with automatic transmissions jumped by 71 per cent.

It is noteworthy that an estimated 85 per cent of the overall vehicles manufactured in the region is directed to the export markets. This includes 70 per cent to the European Union alone. Exports to countries such as Germany, France, Italy, Romania, the United Kingdom, USA, Spain, Iran, Belgium, Poland and the Russian Federation are known to comply with European and International standards. Given the proximity to the Middle-East and Europe, undoubtedly gives Turkey a distinct marketing edge over competing markets especially pertaining to benefits inherited in case of transportation and logistics. Testimony to its stronghold in the aftermarket space is an estimated 500 companies known to supply spares across engine parts, tyres and tubes, accessories for bodies, road wheels and parts, rubber parts for motor vehicles and transmission crankshafts. The high export potential, in turn, has helped Turkey attract high foreign investment. ACI

Leave a Reply