The ICE is cleaner and more efficient than in the past. Ashish Bhatia looks at the evolving landscape and the drivers of change.

At the Bharat Stage VI (BSVI), it is safe to presume that the Internal Combustion Engine (ICE) is cleaner, greener and more efficient than in the past. Despite the emobility aspirations, Original Equipment Manufacturers (OEMs) continue to refine the ICE to offer their best version yet. These are designed and deemed fit for the vast universe of duty cycles across segments. In effect, it means that the automotive fraternity continues to make a case for its existence. To be fair, the industry must realise the returns on investment made on the transition from BSIV to BSVI. It is also a tried and tested technology with scope for further evolution.

To encourage indigenisation of the ICE like electric drivetrains, the industry will be incentivised. Arun Goel, Secretary, Department of Heavy Industries, Government of India, speaking on the much sought after approval of the Production Linked Incentive (PLI) scheme, emphasised on the outlay being aimed at just that. The Rs.25,938 crores for the auto and auto components sector is said to have been finalised in line with the extent of Advanced Automotive Technology (AAT) in the country. At three per cent, AAT in India is at the lower end of the spectrum when compared to 18 per cent globally. He added that AAT, case in point ICE, is a subset of the universe. Compressed Natural Gas (CNG), petrol, diesel and ethanol engine manufacturers, notably, are all eligible for incentives under the scheme, fixed at 18 per cent of the sales.

ICE components

Of the sales of the total components to OEMs in FY2021, engine components accounted for an estimated 24.38 per cent. This, at a time when sales to OEMs declined by three per cent, from Rs.2.87 lakh crore (USD 40.5 bn) in FY2020 to Rs.2.29 lakh crore (USD 37.7 bn) in FY2021. Of these, a bulk of the sales are accounted for by the passenger vehicle segment at ~ 38.1 per cent. Two-wheelers accounted for ~ 24.2 per cent followed by Light Commercial Vehicles (LCVs) at ~ 15 per cent and three-wheelers at ~ 10 per cent. The rest comprises sales of ICE components to Medium and Heavy Commercial Vehicles (M&HCVs), tractors and construction and Earth Moving Equipment (EME).

Improving Fuel Efficiency Of ICE

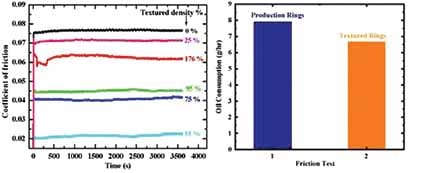

The International Advanced Centre for Powder Metallurgy & New Materials (ARCI), the autonomous R&D Centre of the Department of Science and Technology (DST) last year developed the ultrafast laser surface texturing technology. Claimed to improve the fuel efficiency of internal combustion engines, the laser surface micro-texturing is said to offer precise control of the size, shape and density. It is being looked at as a way to control friction and wear. A pulsating laser beam creates micro-dimples or grooves on the surface of materials in a very controlled manner. The capability to trap wear debris when operating under dry sliding conditions and effects like enhancing oil supply (lubricant reservoir) are claimed to lower friction coefficients besides enabling reduced wear rate. To test it, the texture surfaces are known to have been created on automotive internal combustion engine components, piston rings and cylinder liners using a 100 fs pulse duration laser. The micro dimples of 10-20 μm diameter, ~ five to 10 μm deep that were created with laser beams had a regular pattern. The created textures were tested in an engine test rig under different speeds and temperatures of coolant and lubrication oil. On testing, a 16 per cent reduction in the lube oil consumption with the use of texture on the piston rings was observed. The 10-hour lube oil consumption test showed a reduction in the blowby with textured rings. The fabrication of a pattern of micro dimples or grooves on the surface of materials is known to result in a change in surface topography, generating an additional hydrodynamic pressure, and in effect, increasing the load-carrying capacity of the surfaces.

In FY2021, engine (accounted for 20 per cent of exports) alongside drive transmission and steering (accounted for 32 per cent of exports) as the dominant segments. The two segments accounted for a cumulative 52 per cent of exports to regions like Europe and North America. It assumes significance, as the two (Europe and North America) account for 64 per cent of the exports as the biggest regions. Bullish on the prospects, Ashwath Ram, Managing Director, Cummins India speaking as an exporter of both finished goods and components, called it a large opportunity for Cummins. Especially North America. Ram drew attention to the global consolidation of capacities too. “By global consolidation, I mean, as companies continue to make investments in newer spaces, like CASE, they are not going to be able to keep making investments at the same rate in some of the older technologies in diesel, natural gas and those bases,” he opined. “There’s an opportunity to play a bigger role in more OEMs than what we’ve been playing in the past,” he explained referring to the 300 odd diesel manufacturers around the world known to be in similar talks with each other. On the imports front, in FY2021, the majority of imports, at 30 per cent, accounted for by the drive transmission and steering components were followed by the imports of engine components at 17 per cent hinting at the scope for localisation or realigning of the supply chain.

The quest for zero-emission

Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs) and Hydrogen Fuel-Cell Electric Vehicles are today synonymous with ‘zero-emissions’. Referring to zero tailpipe emissions, government interventions both nationally and globally seems to have tilted the scales in favour of these with manufacturers showing intent to reorient. In July 2021, the European Union (EU) had proposed a ban on the sale of new petrol and diesel cars from 2035. The move, aimed at combating global warming, proposed a 100 per cent reduction of CO2 emissions. In effect, getting rid of the ICE. The rollout of BSVI ICE in April 2020, is known to have reduced the NOx emission by 70 per cent in diesel cars, by 25 per cent in petrol cars. It is said to have reduced Particulate Matter (PM) in vehicles by 80 per cent.

Technologically agnostic

Those uncertain of the rationale behind axing one technology in favour of the other continue to remain technologically agnostic. These manufacturers are keeping a focus on components supporting their strategy. Others are striving towards 100 per cent electrification by 2035-40. The latter pool is in effect working on granular plans based on region, brands and models. Those working on fuel cell systems are benchmarking ICE on the fronts of performance and durability. These are being worked on to specially offer economically efficient solutions. As per Naga Karthik Voruganti, Research Analyst, Automotive & Transportation at Frost & Sullivan, globally, the trend of engine downsising will continue while the highly efficient Gasoline Direct Injection (GDI) engines to continue with higher adoption rates.

Markets like India, Eastern Europe and Asia-Pacific are said to be behind the developed nations as far as traction for electric and hybrid vehicles is concerned. This leaves room for refinement of ICE. As per a Ministry of Heavy Industries draft on measures for comprehensive development of the auto sector, the Government of India is committed to allowing the registration of ICE vehicles together with EVs for now. ACI

Also read, Safeguarding The Bottom Line

Leave a Reply