Be it ICE or EVs, cooling solutions are vital for vehicle operations. Ashish Bhatia looks at the advancements made for both OE and aftermarket segments.

The engine cooling system market alone is projected to grow from USD 34.1 bn in 2023 to USD 49.7 bn by 2032. It translates to a Compound Annual Growth Rate (CAGR) of 4.8 per cent. Critical to the engine performance in this case, it is known to rely on the pumping coolant liquid. This is largely a case of water combined with an antifreeze solution that relies on unique cooling tubes. In certain cases, the air passes across cylinder casings with fins. Besides the implied heat elimination, it offers optimal operational temperature. These cooling systems take a whole new dimension in natural gas vehicles and electric vehicles. Visteon Corporation, Mahle GmbH, BorgWarner, Calsonic Kansei Corporation, Continental AG, Valeo SA, Delphi Automotive LLP, Denso Corporation, Sogefi, Schaeffler Group, Perkins Engines Company Ltd. among others are prominent players in the cooling systems domain.

New products

The objective goes beyond thermal management in today’s time. As emission compliances are strictly enforced with BSVI phase two (RDE) in India and the world contemplates the move to Euro7 levels, this is a focus area with plenty of resource allocation. After all, improvements in cooling systems have a direct impact on particulate emissions like NOx and CO. The growing focus on power-to-weight ratios driven by efforts to lightweight is resulting in sophisticated modules being developed. All of it without compromising the performance metrics of the engine or the battery pack. Reduced tailpipe emissions, and reduced parasitic engine load.

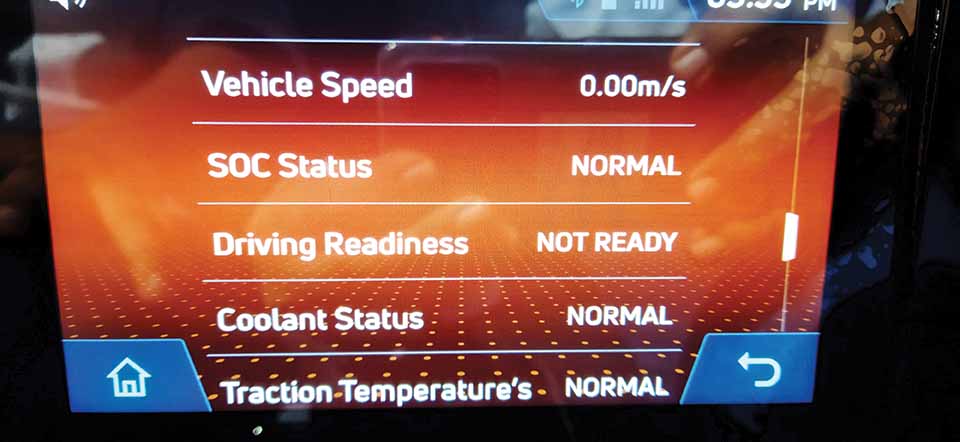

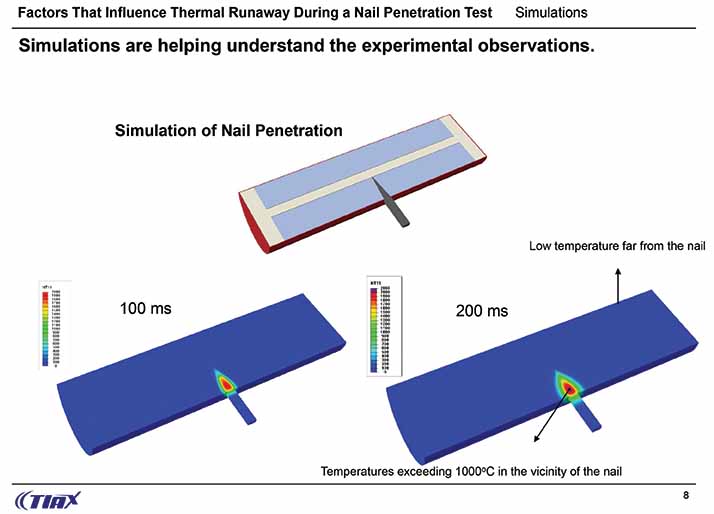

The matrix through multiple variants, for instance, bifuel vehicles on one hand has added to the complexity of the engineering, and on the other hand, opened up a plethora of opportunities to be tapped into for growth by the aforementioned players. The new breed of cooling systems has to be both efficient and refined to meet the performance requirements. The approach goes beyond regulations. As per Rajendra Petkar, Chief Technology Officer at Tata Motors,“There are several tests which are supposed to be done when it comes to the battery-electric vehicle. Tests are done at a component level like a battery or the BMS, and there are certain tests which are done as a part of the full vehicle. And the test includes the net penetration test, which is to check, whether there are going to be any thermal incidents, due to overcharging, and discharging through the vibration test.”

In the aftermarket, it is anticipated that motor cooling fans will climb the ladder of popularity. In the lubes category, Lumax Auto Technologies Ltd. (LATL), has launched a lubricant and coolants portfolio for all vehicle segments. The all-weather coolants will be sold under the ‘Smart Cool,’ ‘Ultra Cool,’ and antifreeze ‘Supreme Cool’ range. While Smart Cool is suitable for tropical weather conditions, Ultra Cool is suitable for all weather conditions and Supreme Cool is crafted for extremely cold weather conditions. The engine oil Ultra range uses mineral base oil and is designed to enhance power, performance and pick-up with a Group 2 base oil blend; and the ‘Supreme’ range, uses synthetic oil blended with Group 3 base oil and high-tech additives imported from the US.

The Grade 2 and 3 mineral oils are claimed to reduce exhaust emission levels and enhance engine life. Lumax will make these available across the 25,000 retail partners and distribute through a strong market network of over 340 channel partners of the After Market Division (AMD) of LATL. The aftermarket division of Lumax-DK Jain group is targeting to double its turnover through continuous product expansion, and this introduction is in line with this strategic intent. Sanjay Bhagat, Sr. EVP – Head Aftermarket Division – Lumax Auto Technologies in a company release states, “Positive market sentiment has given us the impetus to invest in future to deliver best-in-class products. With a long-standing relationship and strong presence in the Indian market, we are committed to strengthening the B2C offering to our customers and lubricants and coolants were obvious choices.”

Liqui Moly announced the expansion of its EV product portfolio for vehicles with Battery Coolant EV 200. The new Battery Coolant EV 200, acts as a thermal manager. The range between 15-40-degree Centigrade is ideal for lithium-ion batteries. “Thermal management is extremely important because it has an impact on the range,” states David Kaiser, Head of R&D at Liqui Moly. With the thermal management system, a distinction is made between direct and indirect battery cooling. This indirect system is more complex, as the vehicle batteries are becoming increasingly powerful and therefore significantly hotter.

Driving investments

The investments will be dictated by the call to reduce diesel and gasoline engines as the transition takes place. In recent times, resource allocation has ensured the development of liquid cooling systems, catering to high-performance bikes on the lower end of the spectrum and commercial vehicles on the upper end. The liquid-cooled solutions category is expected to dominate the revenue shares. Going forward, it is also expected to witness technical advancements. Liquid coolants are used in internal combustion engines in cars to control heat. The fluid stops the cooling system from degrading by eliminating the engine’s surplus heat and minimizing long-term harm to the motor. In the upcoming years, it is also projected that technical developments made by important players in the liquid-cooled engine would lead to abundant growth prospects.

Asia-Pacific is said to be a leading market, globally. It could well drive the demand expected to remain during the period of projection. The cyclical upturn and the growing impetus on higher compliances in India and China will be the drivers of this demand. While India registers a quick growth rate, China is known to dominate the market share after Europe is known to command the second-largest market share for automotive engine cooling systems. The critics of Euro7 are known to oppose the mandate owing to the cost-benefit analysis that is claimed to have led to the realisation of a disproportionate spend required offering a lower value addition for the stakeholders involved.

Despite being deemed in recession, the German automotive engine cooling system market is expected to significantly contribute over the long term. On the emobility front, the UK could well have a large-scale local battery manufacturing plant if the recent speculations come good. This could be a boost for large scale localisation of new cooling solutions. ACI

Also, read ExxonMobil partners with Mountain Goat

Leave a Reply