Besides, JETRO assists in business expansion of developing countries, promoting inclusive business, supporting export growth in developing countries through exhibitions in Japan, supporting industry growth in developing countries, promoting Japan’s direct investment in developing countries, organising foreign business missions and seminars and consulting services, launching SME overseas expansion platforms, developing and utilising global human resources, safeguarding intellectual property and assisting infrastructure improvement in developing countries. Moreover, it also contributes to trade policies and economic partnerships. In addition to assisting Japanese SMEs in exhibiting at major international fairs in developed countries, JETRO organises Japan-related fairs in emerging markets with low penetration of Japanese products and brands to raise awareness of Japanese manufacture, technology and services. The organisation that opened its latest office in Rabat, the capital of Morocco, last December, has a network of nearly 40 offices in Japan and 76 abroad in 57 countries. It is positioned to help both overseas and Japanese companies develop their business. In addition to their website, local offices offer trade and investment consultation services for businesses, trade associations and individuals right from simply providing a set of trade statistics to advising on specific procedures or strategies for exporting, importing or investing.

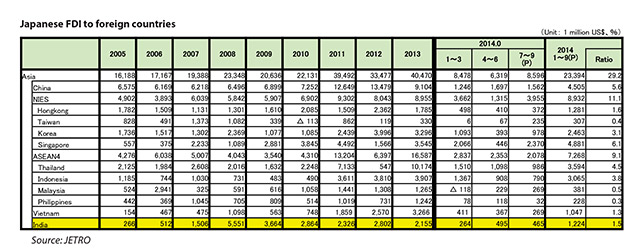

Outward FDI of Japan broke its record for the first time in 5 years, reaching $135 billion with an increase of 10.4%. While investment toward ASEAN marked a record high of $23.6 billion, those toward China decreased by 32.5% to $9.1 billion.

India Status

Till October, 2014 there were 3,961 business establishments all over India including 577 in Tamil Nadu – accounting for one-seventh of the total number. State wise, Tamil Nadu is the second highest, next to Maharashtra, which has 637 business establishments. According to Ishiura visitors from India

to Japan are increasing, denoting the rise of Indian business with Japan. “Of late, the eastern part of Tokyo area has the presence of the Indian community with an English medium Indian school established there. Traditionally, Indians were in Yokohama and Kobe but now they have spread to Tokyo, especially the eastern part.”

Preferred Nation

Japan Bank for International Cooperation (JBIC) brings out a study every year to find out the prominent overseas markets. According to the study, India is No.1 in the long term (up to 10 years) where the country can hope to make the most attractive investments. “Last year, for the first time, India became the No.1 market in the medium term also, which spans for about 3 years. In 2014, the figures show that India has been the most desirable destination, both long term and short term as well, for the manufacturing industry.” One possible reason for this positive trend is the decline in popularity of the Chinese market. Also, last year the Modi Government came to power; in Japan, the perception of Modi and his government is that they are pro-business. This also reflects in the medium term as there is an election after 5 years.

Even for long-term growth India is the preferred destination. The reason, according to him, is because many Japanese companies have already invested heavily in China. They feel that they have already invested in many areas even in ASEAN countries so they are looking at India for future markets. Though the investment of registered companies in India is increasing, it is not of the same magnitude as in China or Southeast Asia, he indicated.

Japanese Investments

Japanese investment in India is growing but it is not as much as in China or Southeast Asia. Sometimes big investments like Yamaha, Renault-Nissan etc have taken place and in these cases a huge amount of money from Japan has come to India. “India is one big domestic market; also it is possibly a good export base. I say possibly, because auto industry and IT are exporting a lot from India but for other industries India-based exports are not much as compared to China and Southeast Asia; but there is potential for exports from India to the Middle East or the African markets. Of course IT industries from India can cater all over the world. For the automotive industry, besides the huge domestic market there are some possibilities for the export market also,” he said.

Indian economy is just settling down. The auto industry witnessed the longest slowdown in its history in 2010-11 and till date passenger car and commercial vehicle segments are still not stable. Is this situation still attractive for investments from Japan? Ishiura says that the big players especially in the automobile industry have a global strategy so everybody is aware of what is happening. The passenger car market in India is a case in point; it may be slowing down but the potential is high. May be a slowdown of 1 to 3 years would happen but for the global car manufacturers, what is happening in India is not a big deal. The US market, European, Japanese or Chinese markets are much bigger when compared to the Indian market. “India is the future market. I don’t think they will rewrite the strategy for the market; a little modification might be done but not completely revamped,” he stated.

Does this mean that any kind of a situation is favourable for investments because of the market potential and the export opportunities available here? According to Ishiura, this is the basic scenario. “If we take each factor one by one then India is a very problematic market; problematic in the sense that doing business in India is not easy at all.”

Impediments

Asked to elaborate, he said there are so many factors involved. “I quote from the World Bank Studies published every year on doing business. End of last calendar they published the 2015 version of doing business in India. According to the study the comprehensive ranking of doing business in India went down to 142 out of 189 countries. When you consider BRICS, India is ranked last. Even smaller economies have a higher score than India. What is problematic is that when the World Bank first published its survey on doing business about 9 or 10 years ago, India’s ranking was not as bad as this; in the year 2006 the rank was 116. The point is that India is gradually going down. Of course it is very difficult to compare big countries like India with smaller countries like Singapore where administration is easier for the Government. It is easier to rectify and make institutional progress. India steadily going down is the problem. For instance, on the parameter of enforcing contracts, India is ranked 186 out of 189, which is worst; it’s a real problem for the businessman dealing with contracts for various requirements including construction permits. All these indicate that doing business in India is not easy. Of course, we have our own surveys made on the basis of questionnaires from Japanese companies that also show that doing business in India is not easy,” he mentioned.

Many business organisations point out that India has 4 areas of institutional problems. One is land related – the ownership of land for the manufacturing companies in terms of availability and cost. The second is the tax; India is tough on taxes as sometimes there are retrospective taxes, which is a surprising aspect for the international businessman. The third one is the labour issue. The fourth is the environment; of course, each country has its own environmental standards and own environmental regulations; but obtaining permissions take time in India. It’s not only JETRO but other foreign organisations also that try to tackle these 4 areas by various means.

“In southern India where I am responsible we try to negotiate in both directions. One is the State Government because in these areas it has an active role to play. Certain tax problems are also of the Central Government, which has to work together with the State Government to improve the business environment in the State. It’s not just for Japanese companies but for every business community. In addition, power shortage, condition of the road infrastructure, congestion at ports, documentation, condition of containers etc., that hamper export/ import affect the business. We are not just complaining but want to seek solutions with the Government by introducing our experience in the past, what we have done in other countries. We want to propose some solutions to them,” he said. The strategy for JETRO is simple; it needs to improve on these issues. Many Japanese companies have realised the potential of the Indian market and there is no dearth of intent there.

Amount of return on Outward FDI in 2013 totaled $68.2 billion. By region, investment returns from Asia was the largest, followed by North America, then Europe.

By saying this JETRO is not washing off its hands on issues. It believes that solving the problematic areas are the joint responsibilities of the Governments and the investing organisations. “Of course, it is not our responsibility fully; but when we invest we are committing to the economy, community or an individual of the country. We require mutual understanding so we try to bring in new ways of thinking to improve these areas; therefore, we are partly responsible. The Japanese company invests here to be a corporate citizen of the Indian business community. We need to interact with the State Government, sit together with the concerned persons and contribute our experience in Japan to improve on the systems in India. There are some issues with infrastructure; however, once it is developed it will ease a lot of difficulties. We need to be patient till the infrastructure gets ready. Even the power problem brings up challenges so we have to sit down and work together to improve the economic and institutional difficulties. There are solutions – let us share, work together to help all stakeholders; there are no shortcuts. We are not here today to leave tomorrow; investment is not like that. When we invest – there is a lot of money, energy and people involved,” reiterates Ishiura.

While Japanese companies are coming in to India despite several impediments, what is in store for India to welcome investments? To this Ishiura states that for some industrial segments, Japanese parts suppliers – their technology, quality and reliability – are very competitive. For any product quality, sustenance is the key and that’s why proven Japanese reliability is important. This holds good not just for the auto industry but for every other industry including machine tools, power plant etc. Interestingly, the balance between technology, quality and reliability of a Japanese organisation is getting better. In addition, the depreciating Japanese Yen and the relative exchange rate favours India, he said.

One of the issues that Indian companies face is in getting finance at a competitive rate of interest. While Japan gives quality and reliable products these companies are not able to really take advantage of Japan’s offering because of lack of finance available. Is there a solution for this? Ishiura says that there is no easy solution for an attractive interest rate. He opined that since the present RBI Governor came in inflation seems to be gradually coming down. “I hope the interest rate will come down again so that easy access to finance is possible. We understand that with a high interest model in India there is always pressure on the financial or banking side; this is because it is necessary to make some profit, after paying all taxes etc. But in Japan where interest rates are relatively low we don’t have much of a problem on the finance side. For Indian companies to access finance from Japan is not easy but there is a way. If they have some business in Japan that generates some money, then they can do it. But it should be a global or multinational company,” he said.

Asked about skill development and training, he said JETRO does not have a direct assistance programme. However, it facilitates through other Government agencies like Japan International Cooperation Agency (JICA), which is an Official Development Assistance (ODA) agency. There have been several programmes all over India assisted by JICA. For instance, IIT-Madras has a ‘Visionary Leaders for Manufacturing’ programme (VLFM Programme) assisted by JICA which has benefitted some big and medium size companies.

Promoting Business

During November-December 2014 JETRO organised buyer-seller meets in Chennai, Pune and Bangalore. It is planning for a similar meet during the next financial year. There is a delegation coming this month but it is not concentrated on the automobile segment fully. There will be about 30 companies in the delegation with 5 or 6 from the auto sector. Earlier, electronics companies were not given preference but now their turnover from the auto segment is over 60%. Therefore, electronics companies are considered as those supporting the auto sector.

Despite several impediments the Japanese organisations have reposed faith in India. And it will only continue to grow as there are advantages for both the countries. ACI