Automotive manufacturers are tapping into the mix of next-generation technological developments with localisation for vehicular platform consolidation. Ashish Bhatia looks at this strategy to manufacture drivetrains for the real demand.

Vehicular platform consolidation is a well known global practice aimed at reducing manufacturing and platform up-gradation complexity. It is also a way to reduce any redundancies that may exist. However, the practice continues to evolve with rigour and in some cases appears near perfected. From just underpinning one chassis to multiple bodies that lacked much flexibility, the approach today is far more flexible with mind-boggling permutations and combinations made possible by advanced engineering. It has made room for customisation to attain a whole new level as the ecosystem aligns itself with the evolving customer demands across segments. The core constituents of a platform which includes the drivetrain, chassis, steering and other components can today be shared between different vehicles in a modular approach.

The vehicles are no longer required to be of the same size to be able to do so. Original Equipment Manufacturers are taking along tier suppliers key to the new-age product development. After all the modular platforms share most components leading to higher efficiencies in the supply chain and presenting better chances of realising the desired economies of scale. Together, they are actively scouting for newer ways of tapping into this expansive mix of next-generation technological developments at their disposal. Localising it to meet the different demographic needs including different energy sources to meet the law of the land is the other layer that they are working on.

The strategy is to manufacturer drivetrains for the real demand.

This aspiration also means that the big guns are more open to collaborating with the emerging tech companies, automotive or non-automotive. The effort also extends to looking at modular platforms for the growing market of emobility, believed to be a well thought off investment. One that is both sustainable and makes for a profitable business case. Add to it, companies are also accelerating the go-to-market approach with shorter New Product Development (NPD) cycles known to lead this accelerated effort. From conceptualisation to commercialisation including assessing the feasibility of plug and play models.

New Product Development

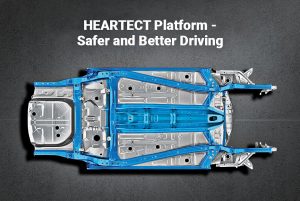

‘Heartect’ is Maruti Suzuki’s new-generation platform claimed to have been designed with a core focus on safety. It is known to have been built with advanced and high tensile steels and is said to feature a smooth continuous design for better impact absorption in case of a collision. It also offers better stability and control for enhanced driving performance and fuel efficiency. It underpins the SPresso, S-Cross, Wagon R, Ignis, Swift, Baleno, Dzire, Ertiga and the XL6. As part of the global new product development strategy – ‘Reimagine’, Jaguar Land Rover (JLR), for instance, will use the flex Modular Longitudinal Architecture (MLA). On the one hand, it will deliver electrified Internal Combustion Engines (ICE) and fully electric variants, on the other hand, it will use the pure electric biased Electric Modular Architecture (EMA) to support advanced electrified ICE. Aimed at attaining simplification at several levels, by consolidating the number of platforms and models being produced per plant, the company is looking to establish new benchmark standards in efficiency, scale and quality, in its case for the luxury segment. This approach is also expected to help rationalise sourcing and accelerate investments in local circular economy supply chains. It is also expected to curate a closer collaboration and knowledge-sharing with Tata Group companies with a common goal of enhancing sustainability and reducing emissions besides the objective of sharing best practices in next-generation technology, data and software development leadership. JLR is banking on “frictionless” access compared to companies solely relying on external partnerships.

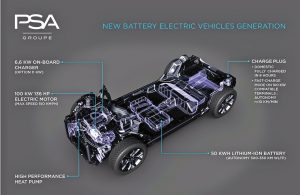

Groupe PSA is focusing on building its models on two platforms, the Common Modular Platform (CMP) besides the Efficient Modular Platform 2 (EMP2), allowing for an integration of the powertrains in its line-up spread across power sources. It is claimed to allow the Group’s plants to produce internal combustion, hybrid or electric vehicles on a single production line, depending on the demand. The new Efficient Modular Platform by PSA Peugeot Citroen is claimed to combine a diversified product range. If a fixed front end signifies standardisation, the diversity of plug and play modules are well highlighted by the short or long rear end, high or low driving position, multilink rear end or a flexible transverse beam, and powertrain. The company is claimed to have shaved off an estimated 70 kilograms through the use of innovative steel composites and aluminium. It is also claimed to have deployed advanced assembly processes and downsized modules. A 22 per cent carbon reduction has been achieved through fully redesigned aerodynamics, flat floor and the managed air inlet.

Efficient technology improvements are known to have been realised in resistance to friction, selective catalytic reduction, electric power steering and stop and start. CMP was launched in 2019. It covers the manufacture of all small city cars (segment B), entry-level and mid-range saloons (segment C) apart from the compact SUVs. It is also known to be available as of 2019 in an electric variant – eCMP. EMP2, a 2013 launch in the European market and 2014 launch in China market, known to cover compact and premium models (saloons, coupés, leisure activity vehicles, SUVs and light commercial vehicles) has in addition to the ICE variants made it possible for the company to produce new plug-in hybrid models.

In February 2020, Skoda Auto India introduced the ‘Skoda Vision IN’ under which it showcased the first model built on the Modular Transverse Matrix (MQB)-AO-IN modular platform aimed at building cars with conventional engines. Claimed to have been developed specifically for the Indian market it formed the underpinnings of the 2021 Skoda Kushaq. The company had previously also introduced the Skoda Enyaq iV, the first car based on the Volkswagen Group’s Modular Electric Drive Matrix (MEB). The company in its annual report has admitted to the increase in the volume of production and number of versions of its models going hand in hand with the demands for the expansion and modernisation of production. As a testament to the same being handled efficiently and without downtime, the parent plant Mlada Boleslav was able to parallelly produce the stream of vehicles based on the two platforms aforementioned. Skoda Auto in a remarkable feat manufactured the three-millionth EA211 engine in June 2020 and the thirteenth-millionth current generation gearbox at the plant in August.

In other recent developments, Kia India is reportedly preparing for the launch of seven new EVs. The new EVs are expected to be built on Hyundai Motor Group’s new electric Global Modular Platform (eGMP). It is expected to bear multiple offsprings across segments with offerings including long-range and high-speed charging capability owing to the new platform. The modular EV-only platform will produce 23 battery-electric vehicles by 2025. Great Wall Motors last year announced two new modular platforms. Codenamed ‘Smart Coffee’, it encompasses autonomous driving systems, electrical systems and smart cabins compatible with ethernet, 5G and Vehicle to everything (V2E) technology. The investments towards the two platforms underwork since 2015 are reportedly expected to form the basis of the new model development. The first platform, codenamed ‘Lemon’ is expected to be used for a subcompact to full-size model across a range of power sources. The second codenamed ‘Tank’ aimed at off-road vehicles is known to accommodate two to three-litre turbocharged engines.

According to a Frost & Sullivan report, while the initial investment required to develop a dedicated, scalable platform is significantly high, the excessive flexibility on offer is projected to offset the investment through economies of scale. According to Kamalesh Mohanarangam, Program Manager, Mobility Practice at Frost & Sullivan, manufacturers can look to overcome the challenges associated with Connected, Autonomous, Shared and Electric (CASE) mobility with this approach. It allows them to offer several models without significant investments. Here, suppliers, are required to ensure that fail-operational functionalities are built into the system to develop and offer products that address such an evolving hardware architecture and the software consolidation process. As the industry shifts towards CASE convergence, the study expects Return on Investment (RoI) to be realised only towards the end of the decade. The need of the hour is to also build end-to-end software platforms that are both scalable and modular. ACI

According to a Frost & Sullivan report, while the initial investment required to develop a dedicated, scalable platform is significantly high, the excessive flexibility on offer is projected to offset the investment through economies of scale. According to Kamalesh Mohanarangam, Program Manager, Mobility Practice at Frost & Sullivan, manufacturers can look to overcome the challenges associated with Connected, Autonomous, Shared and Electric (CASE) mobility with this approach. It allows them to offer several models without significant investments. Here, suppliers, are required to ensure that fail-operational functionalities are built into the system to develop and offer products that address such an evolving hardware architecture and the software consolidation process. As the industry shifts towards CASE convergence, the study expects Return on Investment (RoI) to be realised only towards the end of the decade. The need of the hour is to also build end-to-end software platforms that are both scalable and modular. ACI

Read more on Vehicular Platform Consolidation at /https://autocomponentsindia.com/vehicular-platform-consolidation/

Leave a Reply