From being considered a healthy alternative to China in the aftermath of the Covid-19 epidemic, the Indian automotive industry was faced with an uphill task of crisis management.

Story by: Ashish Bhatia

Towards the fag end of January, in the aftermath of the Covid-19 outbreak in China, highly import-dependent countries began scouting for alternative manufacturing and assembly units to de-risk their supply chain ties. To overcome the deadlock in their supply chain, they leaned to countries with relatively normalised supply chains and production capacities. India was counted among countries like Taiwan and the United States of America (USA) as being more suited to serve the needs of the global automotive clientele. As the chants of “China’s loss could be India’s gain,” were seen gathering momentum, the stakeholders of India’s automotive industry sprung to look at ways to engage the small, medium and large enterprise community in an adverse time for its neighbouring country. The opportunity to serve a global automotive clientele presented itself as a means to revive business and hedge severe losses accumulated along a period of a prolonged economic slump worsened by the softened market sentiment in the domestic market. Just as global companies appeared to have found the perfect solution to reduce supply chain bottlenecks, covid-19 was pronounced as a pandemic. Instead of embarking on the journey of global outreach, India faced an uphill task of supply chain crisis management.

Neha Anna Thomas, Senior Economist, Frost & Sullivan: Economies across the globe face unique risks and implications based on ties with China and other factors. From 2.9 per cent global GDP growth in 2019, growth is expected to slide to 1.7 per cent or less in 2020 should a severe pandemic scenario unfold.

The severity

For the supply chain crisis management, India did not have to look far beyond the manufacturing slowdown of Wuhan-based Dongfeng. China’s third-largest automobile group by sales and partner to global OEMs including Honda, Nissan, PSA and Renault. With a combined annual production of six lakh vehicles per annum, Dongfeng resumed production after a long hiatus of nearly 50 days towards the end of March. According to the China Passenger Car Association, the halt in production by such key players’ led to 215,000 vehicles being manufactured in February. In effect, it resulted in an 80.6 per cent decline in comparison to the previous year (February 2019). China’s February manufacturing Purchasing Managers’ Index (PMI) is known to have hit an all-time low level of 35.7, confirming a sharp contraction in factory activity. The reported levels were said to be worse than the previous low reached at the time of the global financial crisis in November 2008. PMI in 2008 dropped to 38.8. Speaking on the extent of global severity as a result of an overt dependence on China, opined Neha Anna Thomas, Senior Economist, Frost & Sullivan, “Economies across the globe face unique risks and implications based on ties with China and other factors.” “From 2.9 per cent global GDP growth in 2019, growth is expected to slide to 1.7 per cent or less in 2020 should a severe pandemic scenario unfold.”

Rajeev Kapur, Managing Director, Steelbird Group: I propose a two weeks’ shut down to avoid the long-term economic collapse. We are all prepared and we can bear the brunt of the shut down; However, god forbid if Covid 19 goes beyond control we will not able to face the economic consequences.

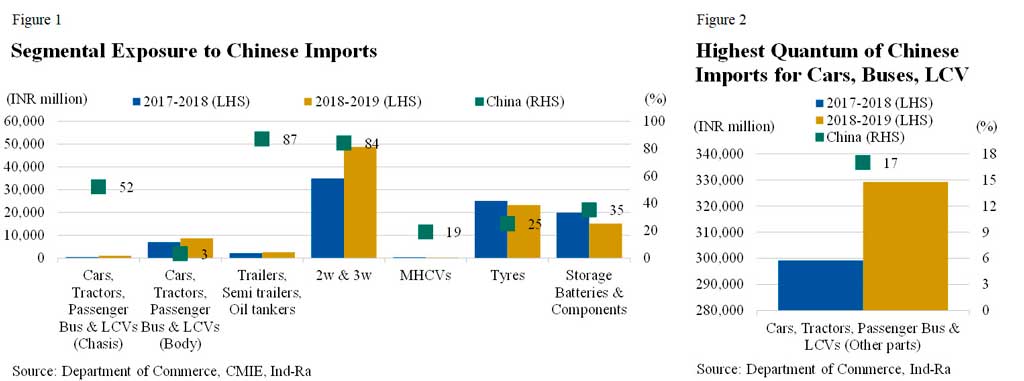

According to an India Ratings and Research study, Indian auto ancillaries and OEMs have an estimated 27 per cent import dependence on China for key parts and accessories. It is blamed for creating a significant supply-side risk. Under Ind-Ra’s base case estimates, a sustained supply chain issue could increase the median net leverage of domestic producers by a margin of 0.3x due to the potential margin contraction and asset turnover pressure. The study also cautioned against any disruption related to a single component being exclusively or largely imported from China to negatively affect the entire chain of OEMs, tier-one and tier-two suppliers. Over 80 per cent of the imported components in Indian two-wheelers and truck-trailers are claimed to be from China. With this, the reliance on imported content is higher in the segment than other auto segments increasing the potential risk. In cars, buses and commercial vehicles, Chinese import concentration ranges between 17-25 per cent of the total imports.

China recovered as India locked down

Ironically, China, the first to suffer the wrath of the deadly virus, at the same time showed signs of a reversal. It showed signs of limping back to the new normal with the outbreak said to have passed its worst in the country. Albeit labour shortages in the initial stages continue to challenge a speedy recovery of China’s manufacturing activity. Taking a cue from China, the International Chamber of Commerce (ICC) and the World Health Organization (WHO) came together to work closely with an objective to ensure that tailored guidance reaches the global business community including in India.

According to Thomas, for starters, Indian manufacturers will have to cope with disruptions in intermediate inputs from China, necessitating near-term supply-chain diversification. As per the Ind-Ra study, in the event of a prolonged disruption in the supply of key components, the industry, could turn to procurement either locally or from other countries such as Germany, South Korea, Japan and Thailand and estimated to account for around 33 per cent of the total imports. The change in procurement channels, however, could prove to be both costlier and the supply could be insufficient to meet the demand.

Rajan Wadhera, President, SIAM : As per quick estimates, it is expected that the plant closure of Auto OEMs and components manufacturers will lead to a loss of more than Rs.2,300 crores in turnover for each day of closure.

Falling in line with the Government’s efforts to pull out all stops and break the multiplier effect of the dreaded human to human transmission, Indian Original Equipment Manufacturers (OEMs) resorted to taking bold decisions. From filling in for China, the country has had to emulate the production halts imposed across global automotive hubs. In line with Prime Minister Narendra Modi’s plea to use resolution and restraint as important tools to combat the pandemic, OEM, suppliers, dealer partners and ancillary measures took a range of measures spanning from deploying employee rotational shifts policy to restrict the on-site manpower utilisation to 50 per cent to partial production halts to adhering to complete lockdowns imposed by the government (most significantly of 21 days from March 24, 2020). Stated Rajan Wadhera, President, SIAM, “As per quick estimates, it is expected that the plant closure of Auto OEMs and components manufacturers will lead to a loss of more than Rs.2,300 crores in turnover for each day of closure.” Closure of 21 days with this quick assumption means a cumulative loss of Rs.48,300 crores. Companies excluding intangible costs could risk long term financial losses.

Crisis management

Guenter Butschek, CEO & MD, Tata Motors : As a manufacturing organisation we have a complex task at hand. We rolled out a three-tier response plan based on the incidence of infections in cities we operate and will continue to make proactive decisions should the need arise.

In India, automotive companies pulled out all stops to adhere to these guidelines and continue to do so with global crisis unfolding. For instance, Amara Raja Group of companies with their flagship company Amara Raja Batteries Ltd., based on the spirit of the GO from Government of Andhra Pradesh, shut down the manufacturing operations across units. The group initiated a train-the-trainers program to create a large scale spread of communication across the 16,000-strong employee community. A group corporate taskforce for Covid-19 with senior leadership and medical professionals were put in place to scan the entire operating environment (internal as well as external), to review the operating guidelines released by central/state governments and to formulate and execute the action plan devised. Rockman Industries Ltd., the auto-components arm of Hero Group, suspended all operations across seven facilities till March 31, 2020, in the early stages. The company has manufacturing units in Ludhiana, Haridwar, Bawal, Chennai, Tirupati and Halol from where it supplies aluminium die casting components and automotive chains to some of the leading automobile OEMs in India and overseas. The company is also a key supplier of two-wheeler alloy wheels with an installed annual capacity of 12 million wheels.

Ujjwal Munjal, Executive Director, Rockman Industries: All Rockman employees, contractual and permanent will be retained. Rockman has an employee strength of 7,200 spread across operations. It is imperative that we all come together to fight this pandemic.

Maxxis India as an initial preventive measure suspended its manufacturing operations at the Sanand facility, in Ahmedabad till April 14, 2020. The largely preventive measures taken in view of the lockdown to contain the pandemic are expected to be followed up by carefully planned and strategic measures to break the supply chain deadlock. In a show of solidarity, JK Tyre’s Leadership team had the Chairman and whole-time directors of the company take a voluntary cut in their salary of 25 per cent. Other senior management personnel are also said to have taken a voluntary reduction in their salary by 15-20 per cent with the pay cuts said to be applying to global operations too. The company admitted to both sales and profitability getting impacted. Apollo Tyres’ top management also took a 15-25 per cent pay cut in a move said to be an outcome of the significant decline in business due in key markets like Europe, North America including in India.

Ashish Harsharaj Kale, President, FADA : Owning to situations which are beyond our control and the fact that many of our members may face dealership closures if leftover with unsold BS-IV stocks, FADA has once again approached the apex body and hopes to get an urgent hearing.

Among OEMs, Toyota Kirloskar Motor halted production in the Bidadi plant, in Karnataka following the latest directions from the Government of Karnataka. The latter is known to import Vellfire, Prado, Land Cruiser and Prius as Completely Built Units. The company with a 6500 employee base has an annual production capacity of 310,000 units out of which Bidadi alone has a total installed production capacity of 100,000 units. TVS Motor Company halted all manufacturing operations at its plants in India and Indonesia. The company assured dealers and suppliers of all support to help tackle the unprecedented crisis. To provide uninterrupted services to customers, Hyundai Motor India Limited, offered 24×7 roadside assistance to help in case of any emergency if required. Further, for customers unable to avail of vehicle’s warranty / extended warranty / free Service due to health emergency or dealership shutdown in affected cities, HMIL committed to offering extended support of two months. The company deployed more than 1000 doorstep advantage bikes and emergency road service cars from dealers to reach customers for assistance in case of emergency and minor repairs. HMIL is critical to the Group company’s global export hub with exports directed to a total of 88 countries across Africa, Middle East, Latin America, Australia and the Asia Pacific. Yamaha Motor India (YMI) Pvt. Ltd. suspended its manufacturing operations at its Chennai plants, in Tamil Nadu, Surajpur in Uttar Pradesh and Faridabad in Haryana in line with the respective state government notifications. Honda Motorcycle & Scooter India Pvt. Ltd. shut down operations across all its four manufacturing plants. Mahindra & Mahindra Ltd., suspended manufacturing operations at its Nagpur, Chakan and Kandivali plant keeping a close eye on the developments. Several other measures including the highest standards of hygiene and promoting social distancing at all the offices and manufacturing locations across the country were taken by the company.

Tata Motors rapidly scaled-down activities in Maharashtra starting with the Pune site. It did not rule out a pan India closure if the situation warrants. For Tata Motors domestic, the transition out of BSIV is claimed to be almost complete. It is the materials management to support the ramp-up of BSVI that has become a daily affair for the OEM. Here the company claims to see improved availability position as vendors come on stream in China. With some flexibility in the mix (models, trim levels) current visibility is said to be in a position to protect production volumes up to mid-March. For Tata Motors domestic business, Q4FY2020 performance is said to have factored in significant impacts due to the switchover from BSIV to BSVI. It is the shortage of parts that is likely to have some additional impact on specific BSVI models that the manufacturer expects to secure in the coming months. Tata Steel, known to be dependent on China, on the basis of a risk assessment, switched to sourcing some of its consumables from Turkey and Brazil in a tactical move.

With uncertainties in the further planning horizon that the company expects to mitigate to a large extent, Tata Motors expects to limit the volume losses in the fourth quarter (Q4FY2020). The timeline for a complete rebalancing of supply and demand is dependent on the further developments in the coming weeks. In China, the company is continuously monitoring the evolving coronavirus situation closely and responding appropriately in accordance with relevant government requirements and advice in China and other jurisdictions it operates. Production at the company’s Shanghai-based JLR China & Chery Jaguar Land Rover will be ramped up as the number of employees returning to work and demand increases. The spread of the virus to other markets such as South Korea, Japan, and Italy is also expected to impact sales in

those markets.

Amidst steps to mitigate the supply chain crisis, Federation of Automobile Dealers Associations (F A D A) approached the Apex Body with a request for permission of sale and registration of BSIV vehicles till May 31’ 2020 with a hope to get an urgent hearing in the Hon’ble Supreme Court owing to the criticality of the issue and the deadline of March 31, 2020. With the overall extent of the negative impact OF Covid-19 on the automotive industry in India and globally yet to play out, the industry is expected to announce a slew of measures to better manage the supply chain crisis in the coming days. Until then the industry needs to be lauded for its underlying belief of being able to rapidly resume production and assembly as well as sales and service when the time calls for it.

Leave a Reply