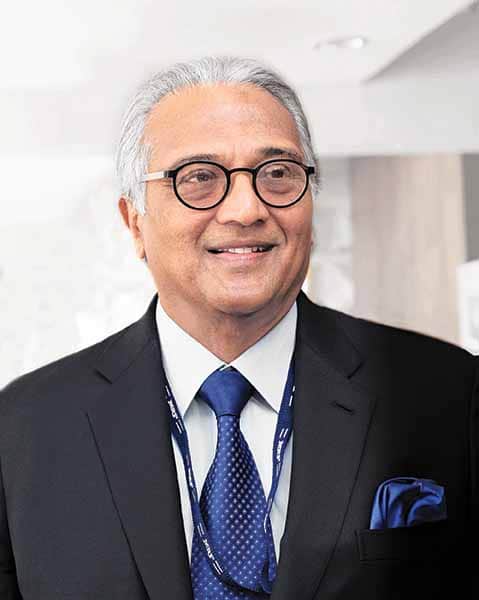

In an Upfront and exclusive interaction, K M Mammen, Chairman, Automotive Tyre Manufacturers Association (ATMA) speaks highly of the close-knit approach of tyre manufacturers taking along raw material partner suppliers and the OEMs. Ashish Bhatia gauges the sectoral impact on the coming quarters.

Q. You’ve been a proponent of the ‘Tyre Industry’ leading the march of India manufacturing for the globe? Did this belief hold good even in the pandemic marred Financial Year (FY2021) in hindsight?

A. In fact, the belief has only strengthened. The manufacturing prowess of the tyre industry has shown through during the tumultuous phase of the pandemic. As you know, tyre manufacturing was badly battered during the lockdown which had to be implemented urgently to prevent the spread of Covid-19. In solidarity with the government’s move, tyre plants shut down operations forthwith despite the fact that tyre manufacturing is a continuous process industry, and a sudden shut down of operations could deal a body blow to the work-in-progress and the raw material inventory. However, when the lockdown was lifted, the industry got down to business in the right earnest, braving all odds and disruptions. It goes to the credit of the industry that not only domestic demand was met squarely but sustained focus was also maintained on tyre exports. With economic stimulus, infrastructure received a boost and the tyre industry was privileged to be the wheels of the nation. Tyre production numbers are much healthier in the third quarter (Q3FY2021) of the current fiscal despite the pandemic as compared to the previous fiscal numbers.

Q. What will it take for the industry as a whole to align with this vision?

A. The tyre industry has seasoned entrepreneurs having been in the business for several decades. So the industry as a whole is aligned to the vision of ‘Make in India’ with its attributes of domestic manufacturing, employment and skill development.

Q. What is the near to medium term sectoral outlook?

A. The outlook is optimistic indeed. The economy is in a fast recovery mode and has shrugged off the pandemic blues. In the coming fiscal, India is looking at over 11 per cent growth which will be a historic high though it will be on a low base. As tyre industry’s fortunes are closely linked to economic growth, the outlook is positive in the near to medium term.

Q. In H2-2020, we’ve heard of a shortage of performance tyres for the aftermarket? How has the industry tackled this situation?

A. There was a large pent up demand as the process of unlocking was initiated so that might have led to some short-term disruptions in the supplies. Largely, the demand has been adequately met by the tyre manufacturers.

Q. Reflecting on the change in FY2021, how efficient did the supply chain turn out to be? Was there hand-holding of partner suppliers/ancillaries through the chain in these tough times?

A. The tyre is a raw material intensive industry and the growth of the industry is contingent on the close association between the industry and its raw material partners. Tyre manufacturing companies have forged a close association with raw material suppliers. A formalised framework was set up a few years ago to bring the tyre industry and raw material partners on one single platform and that led to the genesis of ‘ATMA Partner’s Summit’ which has been held annually. The consultations held over the years proved handy during the pandemic as the tyre industry and partner suppliers were able to support each other during the tough times.

Q. How did vehicle OEMs in particular handhold the tyre industry? Were they able to ensure sustenance in the chain, for tier1s to beyond with this intervention in hindsight?

A. We were in it together. The disruption caused by the pandemic affected all the sectors. The tyre industry derives significant sales from the OE segment. However, when demand for vehicles started to pick up especially during the festive season, the tyre industry worked closely with the vehicle manufacturers to ensure availability of the entire range of tyres. Needless to say without a close collaboration between vehicle and tyre OEMs that would not have been possible.

Q. Did ATMA and member OEs empower the tier suppliers in the value chain to in turn make them more self-reliant and capable compared to the pre-pandemic years?

A. With the pandemic, a new normal has set in. The vision of a self-reliant India is for all of us to act upon. A self-reliant India is all about making the value chain competitive. Aligned with PM’s vision of an Atma Nirbhar Bharat and under the patronage of Minister of Commerce & Industry, the tyre industry under ATMA is working on a large project aimed at assisting thousands of Natural Rubber (NR) growers especially in the North East of India which has a large potential for growth of NR and in bridging the widening gap between NR production and consumption in the country.

Q. How did prices of commodity/input raw materials and import dependence add to the business complexities?

A. Both pricing and availability of raw materials is a matter of perpetual concern for the tyre industry. Yes, certain key raw materials used by the tyre industry are in short supply domestically and imports are the only source to meet the deficit. For instance, domestic NR production is able to meet only about 60 per cent of the domestic requirement. NR attracts a relatively high import duty of 25 per cent while tyres can be imported at a far lower rate of 15 per cent or even lower under FTAs. This inverted duty structure has affected the growth potential of the tyre industry in India.

Q. How have exports fared in comparison? Any impact of growing protectionism and the post-Brexit trade dynamics all through FY2021?

A. Notwithstanding disruption in international trade following Covid-19 pandemic and protectionist stance being adopted by countries, the Indian tyre industry managed to touch a figure of nearly Rs.6000 crore in exports in the first half of the ongoing fiscal. Export performance in Q2FY2021 compensated for the sharp drop of 23 per cent in tyre exports experienced in Q1FY2021 bringing the overall decline down to seven per cent in the first half of the current fiscal.

Q. What is your stance on the government ensuring a stable ecosystem through frameworks and tranches in FY2021? Have the most genuine requirements been met?

A. The government has taken cognisance of the concerns of the tyre industry in all sincerity. Especially the restrictions imposed on the import of tyres during FY2021 have provided a fillip to the domestic production. Indiscriminate import and dumping of tyres have been a bane of the tyre industry in India.

Q. How do you look at the phenomenon of label rated tyres for India on the lines of the advanced markets like the EU?

A. The Indian tyre industry conforms to the highest standards and norms as specified by the government. I am sure that will be the case with the label rating of tyres as and when it is introduced.

Q. Generally speaking, is there a lack of know-how from the buyers perspective resulting in inappropriate choices? Which segment is it most prevalent in? Is ATMA focusing on educating by way of experiential retail?

A. Tyres with certain specifications/ ratings are made for specific vehicles. Standardisation has enabled the customers to choose any brand of their liking as long as the specifications are met. However, it is the tyre care and maintenance aspect that leaves much to be desired.

Over the last few years, ATMA along with its technical wing Indian Tyre Technical Advisory Committee (ITTAC) is intensely involved in creating awareness on ‘Tyre Care’ and ‘Road safety’ through on-ground activations, ‘Tyre clinics’, ‘Safety seminars’, ‘Mass media messaging’, ‘Social media campaigns’, and participation at expos besides the launch of safety calendars, animation films, jingles and other possible interfaces to reach out to motorists.

During this journey, several leading organisations including Infosys, Honda Cars, ISRPL, Pipavav Port, Indian Oil, Haryana Tourism and Haryana Transport Department, etc., have joined hands with ATMA for tyre safety training for both the passenger as well as commercial vehicles.

Q. To conclude, how tricky is inventory management given the volatility of demand from both the OEM as well as the aftermarket perspective?

A. It’s a great balancing act that the tyre industry needs to pull off. The industry is constrained by volatility at both ends of the spectrum – NR (raw material) availability as well as demand for tyres. So inventory management in the tyre industry calls for a higher order of inventory efficiencies and practices such as time to market. ACI

———————————————

K M Mammen has held various executive positions in business associations in the country including as President of the Indo Australian Chamber of Commerce. He is an executive member on the board of FICCI and Chairman of the Board of Madras Christian College Association.

Leave a Reply