The strategy to use one platform to underpin many models is expected to enable manufacturers to sustain business in the long run.

Story by: Ashish Bhatia

Vehicular platform consolidation is an exercise undertaken by manufacturers the world over to prune their number of platforms. For some, the objective is to reduce manufacturing and platform upgradation complexity while for others it’s a strategy to eliminate any redundancies that there may be in the ecosystem. Those focused on business economics would want to continue with the existing range of products however look at attaining a higher degree of localisation to meet the demographic demands and stay price competitive. Undertaking platform consolidation for meeting the taste of their customers is a given. Heavyweights like Toyota Motor Corporation, Suzuki Motor Corporation, Mahindra & Mahindra, Tata Motors, Ford Motor Company have at some point or the other given it a thought and pursued it with conviction. The strategy to use one platform to underpin many models, after all, is expected to enable manufacturers to sustain business in the long run.

According to a Granth Thornton in India, technological advancements are reshaping the automotive manufacturing. Add to it, disruptions, new product development and globalisation are driving the change. With the time to market in the automotive industry known to have dramatically reduced to under two years according to a majority of manufacturers, it is being said that the product development cycles of the automotive industry could well be moving in the direction of consumer electronics. The growing trend of faster time to the market according to the study is an outcome of manufacturers looking to address market demand, supply chain efficiencies and technological advancement. It is here that platform consolidation is being looked at as a key attribute to short development product life cycles. OEMs are said to be on the hunt for generic platforms in order to build agile systems to score on metrics like efficiency, scalability and sustainability.

Acquisitions and investments

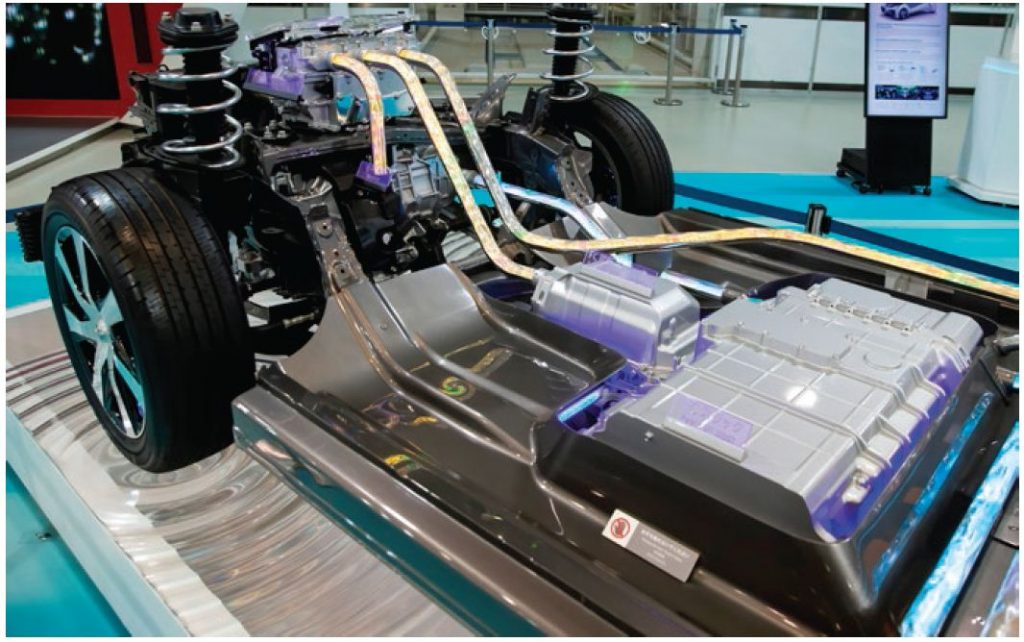

Among emerging trends said to have played a hand in driving the change are also the aggressive proliferation of electrification among others like connected car, vehicle-to-vehicle communication, and the shared mobility ecosystem that OEMs are working to keep up with. It has also resulted in acquisitions and investments gathering speed. For instance, in February 2018, Bharat Forge is known to have acquired a 45 per cent stake in Tork Motors in a deal known to be valued at USD five million. The former looking to leverage the latter’s knowledge in EV powertrains besides access to knowledge in the emobility space. Later in June the same year, the company also acquired a 35 per cent stake in Tevva, at a valuation of USD 14 million. Again, the focus was on EV powertrains both for India and worldwide and scalable to commercial vehicles.

Toyota Motor Corporation and Suzuki Motor inked a JV in November 2017 to produce EVs for the Indian market with the former also providing technical support. In March 2018, Mahindra&Mahindra and Ford Motor Company inked a JV for mutual benefits in the realm of manufacturing connected vehicles, electric battery vehicles, development of compact sports utility vehicles, B-segment electric SUVs and powertrains. Ford from 27 platforms in 2007 aimed to retain eight platforms for instance as per Ford’s corporate data. The company in the same year also acquired LG chem for developing a unique cell aimed at an India application explicitly. It was also to supply Li-ion cells based on Nickel Manganese Cobalt (NMC) chemistry with high energy density. Nissan and Renault have extended their alliance to become a leader in electrification. In the case of commercial vehicles, for instance, JBM Auto and Solaris Bus & Coach inked a JV for engineering, designing and developing fully electric and hybrid vehicles in India.

Challenges in reducing automotive cycles

Testing, supply chain and manufacturing is keeping companies on their toes as they strive to meet the demand of short product development cycles. From trends gauged between March 2015-19, the projection is that the already short product development cycles could turn shorter over the next half a decade. This has impacted tier 1 suppliers especially. 50 per cent of them are expected to drive New Product Development (NPD) after all. According to Alok Verma, Partner, Grant Thornton, “We have captured the views of both the OEMs as well as tier 1 suppliers and the shifts companies are making or expected to make in the light of the rapid changes in the automotive landscape such as multiple breakthrough technologies and changing consumer preferences as well as the regulatory environment.”

Testing, supply chain and manufacturing is keeping companies on their toes as they strive to meet the demand of short product development cycles. From trends gauged between March 2015-19, the projection is that the already short product development cycles could turn shorter over the next half a decade. This has impacted tier 1 suppliers especially. 50 per cent of them are expected to drive New Product Development (NPD) after all. According to Alok Verma, Partner, Grant Thornton, “We have captured the views of both the OEMs as well as tier 1 suppliers and the shifts companies are making or expected to make in the light of the rapid changes in the automotive landscape such as multiple breakthrough technologies and changing consumer preferences as well as the regulatory environment.”

New product development

There are several factors that impact NPD cycles. New technology adaption, new entrants in the ecosystem, change in OEM expectations, alliances to generate economies of scale, IoT led product development, bundling software and product development and changing customer preferences to name a few. Resources including R&D spend are especially being spent to understand and align with the latter’s preferences pertaining to both product development and experiential. It has also formed the basis for the outsourcing of R&D activities a domain where startups are said to be pioneering developments. ACI

Leave a Reply