Text: Bhargav TS

The Indian tyre industry has been witnessing tremendous growth for the past few years on account of growth in automobiles demand, especially in passenger vehicles and two-wheeler segments. In fact, availability of raw material (natural rubber) and ultramodern production facilities have led the country to emerge as one of the world’s most competitive tyre markets. But the raising concern over the fall in rubber production for the third consecutive year, the tyre and rubber industries have sought urgent government intervention to stem the slide in domestic production. The second biggest threat for the Indian tyre companies comes from the cheap imported tyres from China.

While looking at the domestic automotive industry, it is witnessing a gradual recovery in 2015 following 2 year demand slowdown because of weak economic activity, rising inflation, poor consumption and tight liquidity constraints. The recovery has been primarily supported by the 2-wheeler and medium and heavy commercial vehicle (M&HCV) segments while demand for tractors, light commercial vehicles (LCV) and Mining and construction equipment (MCE) segments continue to remain weak. Buoyed by strong replacement demand, 2-wheeler volumes grew by a strong 11% YTD December 2014; performance of scooters was especially robust at 28% while the high volume motorcycle segment reported a modest 5.5% growth. The Passenger vehicle (PV) segment saw a modest growth (up 3.7% YTD December 2014) aided largely by replacement demand as demand arising from first-time buyers remained weak. Tractor demand saw a higher than expected de-growth (-6% YTD December 2014).

Following a 2% de-growth in 2012-13 and a muted 0-1% growth in 2013-14, research agencies feel that the domestic tyres demand to grow by 6-8% during 2015 driven by a 5-6% growth in the OEM segment and 6-7% growth in the replacement segment. M&HCV, scooters, motorcycles and passenger vehicles are likely to support the growth while negative growth is expected from tractor and LCVs segments. In tonnage terms, it is expected a 3-4% growth for 2015 due to the higher skew of product mix towards the smaller 2w, but higher tonnage growth is expected for 2015-16 contributed by M&HCV and MCE segments.

On the other hand India’s natural rubber production is likely to sink as much as 15% to its lowest in nearly 2 decades as farmers suspend tapping due to falling prices, said a senior official from Automotive Tyre Manufacturers’ Association (ATMA). Combined with growing local demand, the world’s second-biggest consumer of the commodity increases shipments from key exporters such as Thailand, Vietnam and Indonesia. Increased Indian imports would offer some relief to international markets, mired near 7 month lows due to faltering demand from top consumer China. The world’s fifth biggest rubber producer churned out 655,000 tonnes in the 2014-15. Output of this year could drop to its lowest since 1996-97 at 557,000 tonnes, he says. This coupled with the unfavourable realisations in domestic market has forced domestic rubber farmers to curtail production during the critical rubber tapping season.

The data for production released by Rubber Board showed a significant drop in production of 11% in the first 2 months of current fiscal. The fall in production comes to 16% drop in production in 2014-15 and 15% drop in 2013-14.

“This is the third consecutive year of fall in NR production. Domestic availability has emerged as a major concern for rubber consuming industries. With auto sector coming out of a long recession, the demand for NR is expected to go up during the current fiscal. Tyre industry has put in large investments to meet the pick up in auto demand but raw material concerns are likely to play a spoilsport in the Make-in-India story as far as tyre sector is concerned”, said Rajiv Budhraja, director general, Automotive Tyre Manufacturers Association (ATMA).

The consumption of NR increased by 4% in 2014-15 and has held steady during the current fiscal. As a result domestic production consumption gap in NR is widening. In the previous fiscal, the gap was more than 3.6 lakh tonnes. “Uncertainty in domestic NR availability is giving jitters to rubber MSMEs who do not have the wherewithal to have large inventories, “ said Mohinder Gupta, president All India Rubber Industries Association (AIRIA).

“On the one hand import duties on rubber have been increased, on the other there is constant fall in domestic production leading to its shortage. Small scale rubber sector has been caught in the midst of domestic shortage and high import duties on NR. The government needs to take into consideration the plight of MSMEs. The purchase tax of 5% on NR should be abolished with immediate effect”, says Gupta.

The import duty on rubber was increased last May after growers complained that shipments from overseas had lowered domestic prices. But the increase in import duty on natural rubber to 25% has failed to curb shipments of the commodity to India as international prices remain subdued and domestic growers have yet to intensify tapping, discouraged by low rates. Domestic production declined 11% to 45,000 tonne in April from a year earlier, according to data released by the Rubber Board. Consumption improved marginally to 82,000 tonne. An official from Rubber Board said, “most of the growers are not interested in tapping unless the prices improve to Rs 135-150 per kg, which is not likely to happen in the near future. So the production fall is likely to continue.”

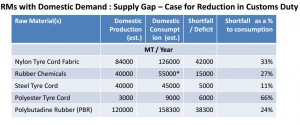

Tyre and rubber industries have criticised the increase in import duty on natural rubber to 25% which according to them has led to worsening of inverted duty structure since tyres and other finished rubber goods can be imported at 10% and even lower rate of duty. Rubber consuming industries have therefore termed the decision to increase the duty as business unfriendly and a dampener on future investments in the rubber and tyre sector.

Raghupati Singhania, Chairman, Automotive Tyre Manufacturers Association said, tyre industry has been bearing the brunt of inverted duty structure for a long time. While import duty on natural rubber, the principal raw material was 20%, tyres as finished products could be imported at as low as 5% duty under various trade agreements. Increasing the import duty on natural rubber will worsen the inverted duty scenario, increasing the threat of large scale dumping of tyres in India. The decision to increase duties goes against the spirit of rational taxation and will impact more investments in the growing tyre and rubber sector, he said.

The news of increase in import duty has come as a rude shock to the MSME rubber sector comprising over 5500 rubber units. The duty on import of natural rubber in India is already amongst the highest in the world. Small scale sector is finding it difficult to retain competitiveness against invasion of cheap import of rubber goods. Increase in duties on NR will add to the cost of production in India making it tougher for MSMEs to compete both in domestic and international markets. Exports will be impacted.

In January 2015, the US Commerce Department’s International Trade Administration levied preliminary ADD on Chinese tyres in the US market – duty rates varying between 19.17% and 87.99%. Incidentally, Chinese tyre makers have been dumping stocks in India which has led to a 15% surge in tyre imports in H1, 2014-15. Representation from Automotive Tyre Manufacturers’ Association (ATMA) to the Government of India (GoI) continues towards increasing the customs duty on tyres from 10% at present to 20% as the industry remain affected by the inverted duty structure.

Recently J.D. Power Asia Pacific released its annual tyre study on Indian Original Equipment Tyre Customer Satisfaction Index. According to the study there has been a significant reduction in customer-reported problems with original equipment (OE) fitted tyres 5 years now indicating improvement in the quality of OE fitted tyres. The study, now in its 15th year, measures satisfaction among original equipment tyre owners during the first 12 to 24 months of ownership across 4 factors (listed in order of importance): appearance (870 on a 1,000-point scale); ride (869); durability (866); and traction/ handling (866).

The overall incidence of problems cited by customers has dropped significantly to 9% in 2015 from 18% in 2010. That decline is primarily due to a notable reduction in the percentage of reported problems with frequent punctures—the most commonly cited problem—to 57% from 77% in 2010. “With the continuous quality and performance improvement of OE fitted tires over the past 5 years, customers are increasingly satisfied,” said Mohit Arora, Executive Director, J.D. Power Asia Pacific. “This bodes well for the tyre industry considering that demand in the replacement tyre market is driven by customer perceptions of their original equipment tyres. Customers who are satisfied with their OE tyres are more likely to repurchase the same brand again.”

For the next 1 year, 2-wheeler demand remains on track for healthy growth on the back of favourable demographics and moderate penetration while growth in passenger cars segment is expected to revert to its long term growth trends as the underlying cyclical variables turn favourable. Tractor demand for next 1-2 quarters remains sluggish and growth from there on will hinge on the monsoons. Overall, the industry expects the automotive industry to improve demand sentiments, which is likely to translate to a more broad-based growth in 2015-16.

Data: Automotive Tyre Manufacturers’ Association(ATMA)

Inputs: ICRA, JD Power Asia and ATMA ACI

Leave a Reply