When Wuhan in China was identified as the epicentre of Covid-19 pandemic, it was a watershed moment for the auto sector in India.

Manav Kapur, Executive Director, Steelbird International

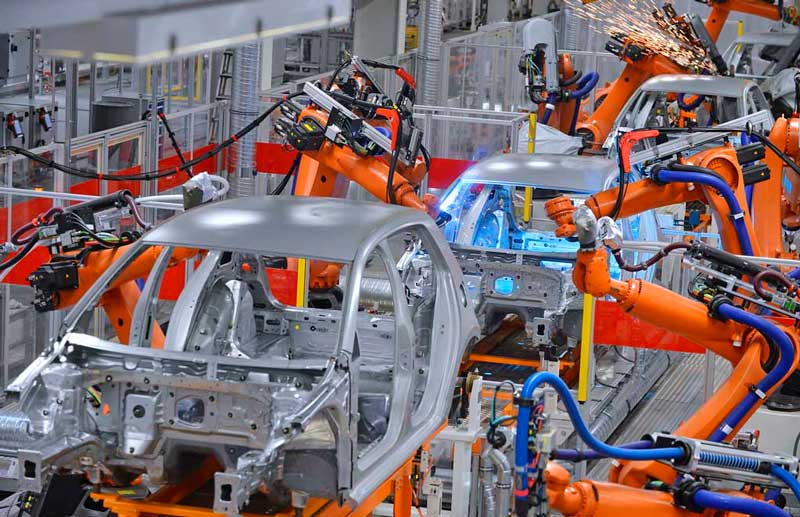

When Wuhan in China was identified as the epicentre of Covid-19 pandemic, the crisis was no less than a watershed moment for the automobile sector in India. A time to unleash the full potential, India can turn a new leaf from outsourcing various components from one of the world’s largest manufacturing hubs. A prosperous abode of USD 100-billion automotive industry; the fourth-largest in the world and an employer to more than 32 million people, the India automotive sector contributes nearly 7.5 per cent to the country’s overall Gross Domestic Product (GDP). With an estimated 50 per cent share in the manufacturing sector and owing to the significant importance held as a sector on the whole in the Indian economy, there is a huge potential waiting to be tapped.

No wonder the Government also acknowledges the importance of this sector. The automotive sector is counted among 13 priority sectors under the ‘Make in India 2.0’ programme. Unfortunately, due to various macroeconomic factors, this sector had to wither a tough phase in 2019. Just as the situation seemed to turn around a wee bit, another jolt hit it hard. Covid-19 literally challenged the immunity of India’s automotive sector looked by many as having the potential to turn a global manufacturing hub. On the lines of several global majors, countries are known to produce automobiles on a mass scale and in turn import, various parts from the world’s manufacturing capital, China, India until now has been heavily reliant on offshore manufacturing companies. A testimony to it is the statistic of India importing alloy wheels, electronic components, bearings pegged at a valuation of USD 17.5 billion from China, accounting for an estimated 27 per cent of the total components used in the sector on an annual basis. Eventually, domestic prices of several parts rose to 40 per cent amidst this pandemic, further denting the growth prospects of the already burdened sector. However, both global as well as Indian companies, it is expected have learnt a meaningful lesson to protect themselves against such future contingencies.

The auto industry realised its shortcomings. The stakeholders of the industry might have come to terms with their over-dependence on China pertaining to affordable parts procurement. Sadly, any environmental, political, or socio-economic disturbance in the region as it has been learnt the hard way has the potential to negatively impact the sector, and without a warning beforehand. On the positive front, a number of international and domestic brands in the sector are believed to be in the planning stages to invest in India’s growing component sector. As a result, they are looking to improve capacity utilisation and or add capacity. They are consciously looking at ways to improve output quality through the extension of long-term business support and advanced Research & Development (R&D) capabilities. Thereby, it wouldn’t be wrong to say that the crisis has emerged as a blessing in disguise to many domestic auto component players and is a good opportunity for the latter companies to showcase their competency in meeting the current market demands. If they succeed in this endeavour of meeting the demands of international Original Equipment Manufacturers (OEMs), in the near future, India could well be on its way to becoming a leading auto-components and ancillary exporter to global markets like Europe, America, Australia, and Africa.

The way the Indian automotive sector has so far dealt with the Covid-19 crisis has been well appreciated by many auto giants. When the virus became a grave concern for automobile industries all over the world, India deferred it to a great extent. Though domestic prices of several components rose up by an estimated 40 per cent amidst this pandemic, the overall effect has not proved severely detrimental to Indian OEMs on a relative basis. And, everyone knows that due to a robust auto-components sector, which is growing steadily at 10.6 per cent (CAGR), the sector has enough potential to not only satisfactorily meet the domestic demand but comprehensively meet the external demand arising out of the changing supply chain dynamics. The sector valued at an estimated USD 56.2 billion in FY19 has consistently enhanced its global footprint with well-directed efforts leading up to the pandemic crisis.

During a five-year period between 2014-19 India’s exports increased 8.34 per cent (CAGR). The country’s export revenue from auto-components alone is pegged at USD 15.17 billion in FY19 compared to USD 10.16 billion recorded in FY14. Based on this trend, the Automotive Component Manufacturers Association of India (ACMA) is expected to achieve a turnover of USD 100 billion by the final quarter of 2020. Moreover, this growth trajectory reaffirms how global automobile companies find India a better substitute for importing quality components. If the Government of India introduces some lenient taxation policies by reducing GST and ensuring robust financial liquidity in the market including for Small and Medium Enterprises (SMEs), Indian auto-component companies have the desired competencies to unleash the full potential as a global manufacturing hub and lead from the front in the world automobile market. ACI

The views expressed by the author are his personal opinions and do not necessarily reflect the views of the ACI magazine.

Leave a Reply