Q: Is FTA a necessary evil? Are there possibilities to look at it positively, build upon the strengths and utilise it as an opportunity?

Q: Is FTA a necessary evil? Are there possibilities to look at it positively, build upon the strengths and utilise it as an opportunity?

HL: Yes, definitely. When EU, Japan or Korea sign FTA the companies in the respective countries immensely involve in drafting the agreements. For example, Toyota is fully involved in drafting the Japanese FTA and Hyundai with Korea’s. They make sure their business interests are protected. Similarly, today we have associations like SIAM and ACMA working better with the government to take care of our welfare.

“Export is a good opportunity. If the rupee maintains the 58-62 bandwidth to a dollar, the Indian component manufacturers can definitely be competitive.”

Q: Why are we not contemplating on establishing FTA with countries where the strengths could complement each other?

HL: I think Brazil is definitely an interesting market and opportunities there are opening up. The country is looking for local manufacturing operations as it wants investments to come in. That is why it has now increased import duties on auto-components significantly. Though it has been done within the WTO framework, it is a step back from the free trade standpoint.

Q: Is Brazil a good market for Indian component manufacturers to enter?

HL: Certainly; some companies are exporting but it is necessary to know the customers and quantum of business in order to set up a plant. In the future, Mexico will be an attractive country for Indian exporters. Today the US is in the top of the list for exports and if the volume of business reaches a certain size then they would like you to manufacture within the country.

Q: What about investing in Turkey, which is a conduit between Asia and Europe?

Q: What about investing in Turkey, which is a conduit between Asia and Europe?

HL: The importance of setting up plants in Turkey is that customers would have better access; but I don’t think it is equal to Mexico. For example, in Eastern Europe, Poland and

Romania have benefitted much from the EU than from Turkey. TRW, Rane’s partner, has eight plants in Poland with over a billion dollars of sales coming from there.

Q: What about exports as an option to counter slowdown in the domestic market?

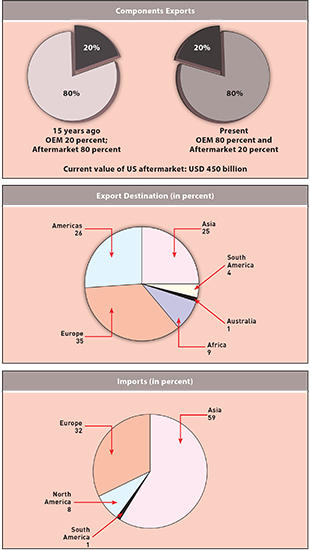

HL: Export is a good opportunity. If the rupee maintains the 58-62 bandwidth to a dollar, the Indian component manufacturers can definitely be competitive. Therefore, I expect exports to pick up but keep in mind that the product development lead time for us is anything from 15 to 24 months.

Q: Can you update on ACMA’s cluster programme?

HL: Cluster programme is one of the most important initiatives of ACMA delivered through ACT (ACMA Centre of Technology). About 400 plants in India have gone through the cluster programme. It helps companies in their introspection process especially during downturn. We have funds provided by UNIDO and we will cover SMEs in the auto-component space. We have recently allowed non-ACMA members to also participate in this programme. If they apply for a cluster programme, they automatically become ACMA members, the costs have been reworked so that they don’t have to pay anything significant for the membership.

Q: What is the update on ACMA’s collaborative approach with NSDC?

HL: The Automotive Skill Development Council (ASDC) under the National Skill Development Council started off on the right note with small development centres across the country. Even private companies can set up training schools by facilitating through NSDC. The ASDC President is an ACMA member from this year and under his leadership we plan to strengthen the skill development initiatives. Centres have been opened across the country in few places including Bangalore and NCR.

Q: Even the machine tool industry is working on these lines since 60 to 70 percent of their customers are from the automotive sector. Is there a possibility for ACMA and the IMTMA to collaborate?

HL: Yes, definitely it’s possible but the two associations have not discussed this so far.

Q: Your comments on people getting into the non-automotive business.

HL: It’s a good initiative. Even in Rane we are looking at non-automotive business but it’s not going to be more than 10 to 15 percent. You must have core competency in your business and you can have nonautomotive up to 20 percent, to take care of the bad years ACI

Leave a Reply