Export prospects for CV suppliers were limited, but opportunities existed amidst headwinds. Ashish Bhatia explored in this multipart series.

Export aspirations have faced significant challenges due to unprecedented and peculiar circumstances. These include geopolitical trade uncertainties, supply chain bottlenecks, recessionary trends, and a demand slump that threatens consumption. The Russia-Ukraine crisis has already impacted trade, and the Israel-Gaza crisis has further worsened matters. Additionally, the recent diversion of shipping traffic in the Red Sea following the Suez Canal fiasco is being closely watched and is expected to drive up costs by approximately 25-30% as a moderate estimate.

India is closely monitoring these developments and continuing its long-term efforts to reduce logistics costs by about 4% of GDP. Despite the near-term complexities weighing down on the industry, the on-highway and off-highway segments, with their advances and adherence to new compliances in the shift to green mobility, have kept prospects alive. The competition in the plus-one era of strategy can be overcome by localised, globally bench-marked products that generate substantial revenue.

However, at present, there are some complexities that are weighing down on the industry. For example, the destruction trail caused by Cyclone Michaung and heavy rains have battered the southern districts of Tirunelveli, Thoothukudi, Tenkasi, and Kanyakumari, resulting in severe inundation in the automotive hub.

The COVID-19 pandemic also continues to pose a challenge to businesses. Breakouts have been reported in Singapore, Kerala, Uttar Pradesh, and Goa, and the World Health Organization is studying a new “Variant of Interest” that is not yet a concern.

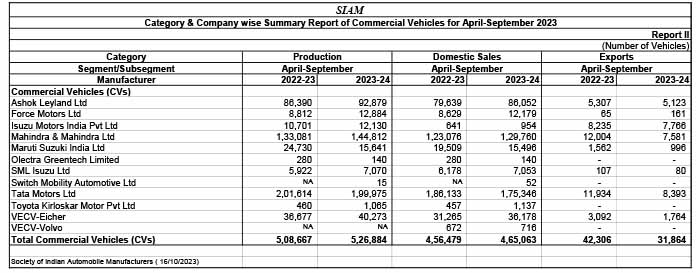

H1-FY24: A snapshot of exports

According to the Society of Indian Automobile Manufacturers (SIAM), looking at the commercial vehicle Original Equipment Manufacturers (OEMs) that focused solely on commercial vehicles, exports between April and September 2022 decreased to 31,864 units from 42,306 units in the same period the previous year. Tata Motors led with 8,393 units (down from 11,934 in 2021) during this period followed by Mahindra & Mahindra Ltd. with 7,581 units (down from 12,004 units in 2021). Ashok Leyland Ltd. sold 5,123 units (down from 5,307 units in 2021), while VE Commercial Vehicles Ltd. stood at 1,764 units (down from 3,092 units in 2021).

Previously, Daimler India Commercial Vehicles Ltd. celebrated the production of its 1000th BharatBenz bus, marking the end of a successful year in terms of sales and exports. According to the company’s annual press release for CY 2022, Daimler started 2023 on a strong note, despite facing supply chain challenges and an unfavorable cost environment in the previous year. The company reported a revenue growth of 37% and a sales growth of 25% in comparison to the previous year. In the calendar year, DICV sold a total of 29,470 trucks and buses in the domestic and export markets. Additionally, there were rumors of a new product launch from the company in the near future, but no official announcement had been made yet.

According to the interim report for Q2-2023, Daimler Truck experienced a significant year-on-year increase in unit sales during the first half of 2023. This growth was primarily attributed to a 49% increase in India (64% in Q2 2023). Meanwhile, Daimler Buses saw a 22% increase in Q2-2023 compared to the same period in the previous year. The company sold 11,751 buses in Q1-2023 and 6,181 buses in Q2-2023, thanks to market recovery in the EU30 (European Union, United Kingdom, Switzerland, and Norway) and Latin America regions, where there was a significant increase in unit sales in Brazil.

As per the interim Q3-2023 report, unit sales in the Trucks Asia segment decreased by eight percent to 38,052 trucks. This decline was attributed to market developments in Indonesia, as well as bottlenecks in the supply chain. In comparison to the same period the previous year, Trucks Asia recorded a significant decrease in unit sales in Indonesia (-34%) and in the EU30 region (-23%). However, Trucks Asia achieved a significant increase in unit sales in India (+65%) to 6,208 units.

In 2020, sales of BA, the first bus model to be produced for the FUSO brand from the DICV Oragadam commenced (pilot sales began in December 2019). The company quickly hit the 100-unit milestone for the EuroV-compliant bus, which was produced for customers in the UAE market and based on the BharatBenz staff bus built for student and staff transportation requirements.

To provide some background, the number of commercial vehicle (CV) exports decreased from 92,297 units to 78,645 units in FY23. As the industry looked towards the fourth quarter of FY24, Vinod Aggarwal, President of SIAM and MD & CEO of VE Commercial Vehicles Ltd., spoke about the growth during the festive season. He praised the performance in the festive season ending in early November and stated that the three-wheeler segment saw high double-digit growth, while commercial vehicle sales matched last year’s levels. Rajesh Menon, Director General of SIAM, highlighted the growth of the three-wheeler segment, reporting a growth of 30.8% compared to the previous year, with sales of approximately 0.60 lakh units in November 2023, just below the peak of November 2017. The industry was optimistic about ending the year 2023 on a high note, and the trend was expected to continue into 2024, supported by strong economic growth.

Three-wheelers

Exports of three-wheeler vehicles decreased from 499,730 units to 365,549 units in FY23. From April to November 2023, the industry exported a total of 206,834 three-wheelers, including 204,753 passenger carriers and 2,081 goods carriers. Bajaj Auto Ltd. was the leading exporter with 103,928 three-wheelers, followed by TVS Motor Company Ltd. at 90,819 units. Piaggio Vehicles Pvt. Ltd. came in third position with 7,480 units exported.

Diego Graffi, Chairman & Managing Director at Piaggio Vehicles Pvt. Ltd., mentioned that three-wheeler sales had returned to normal, and commercial vehicle sales as a whole were doing well, considering sales up to Q2-FY24. He believed that India’s G20 presidency and the positive sentiment boded well for the industry, as long as the ecosystem’s stability and contributing factors like raw material prices remained favorable. Graffi was of the opinion that even a small improvement in these factors would have a positive impact on the industry’s prospects.

India’s elevation in global stature was reflected in the G20 consensus, which supported India’s status as a place to invest and produce. The economic crisis in China and the government’s support for green mobility in India had set the foundation for India to become a global manufacturing hub in the next three years.

India incentivized global manufacturers, giving a push for quicker setup in favor of ‘Made In India’ for the globe, as per Graffi. Graffi admitted to the possibility of widening the scope of eligibility for the PLI scheme to include more stakeholders of the value chain. He suggested that it would be more helpful to encompass other cleaner fuel options beyond hydrogen fuel cells and BEVs. Graffi also touched upon the penetration of pure ethanol in the three-wheeler segment as a technically feasible option in the long run. He opined that, although the cost of operations is higher in the near term compared to CNG due to mileage deterioration, a powertrain intervention can bring it to par. As the year marked the return of three-wheelers, the sales between L3 and L5 categories touched all-time highs. Despite the low base in the export segment, the OEM expected that the stabilization of the economic situation in countries like Africa would aid in further recovery by 2024. He stated that a technology-agnostic approach and preparedness augur well for the industry. The company has prepared to comply and invested to align with the requirements of the next two years, anticipating new safety requirements to come up.

Graffi also touched upon the blurring of lines between three-wheelers and four-wheelers below the rated payload of 1.5 tonnes. He explained how the transition from BSIV to BSVI and the cost implications led to the acquisition price differential narrowing down, which has made the customer indecisive. For now, the company won’t re-enter the four-wheeler mini-truck segment, but instead, hopes to capture a greater share of the largely diesel-dominated mini-truck segment through its diversified three-wheeler portfolio. ACI

——————————————————-

Watch out for part 2 of this series where we look at the other segments with expert commentary on the future exports outlook.*

Leave a Reply