The global EV adoption gives a picture of ambitious followers, emerging EV markets and the starter nations. Ashish Bhatia looks at the factors driving the eluding parity between EVs and ICE vehicles and opportunities.

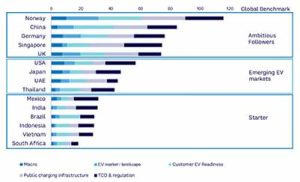

The global EV adoption continues to be “time displaced”. Every region has a different rate of adoption leading to Management Consulting firm, Arthur D. Little categorising them as ‘Ambitious Followers’, ‘Emerging EV Markets’ and ‘Starter Nations’ in the Global Electric Mobility Readiness Index – GEMRIX 2022. While Norway, China, Germany, Singapore and the UK lead the pack as ambitious followers at the top end of the spectrum, Mexico, India, Brazil, Indonesia, Vietnam and South Africa find themselves at the bottom of the pack as starter nations. Rajan Wadhera, Former President, of Mahindra Automotive Sector and Former President, SIAM admits to the eluding parity between nations has India finding itself with a low, two per cent rate of adoption despite a heightened optimism. “It is largely due to a huge price differential with traditional engine counterparts and the absence of adequate EV infrastructure in the country,” he opines. Stressing on the need to create indigenous solutions and support a domestic value chain, Wadhera backs India’s potential to become a global EV powerhouse led by the two-wheelers ecosystem and backed by suppliers.

The global EV adoption continues to be “time displaced”. Every region has a different rate of adoption leading to Management Consulting firm, Arthur D. Little categorising them as ‘Ambitious Followers’, ‘Emerging EV Markets’ and ‘Starter Nations’ in the Global Electric Mobility Readiness Index – GEMRIX 2022. While Norway, China, Germany, Singapore and the UK lead the pack as ambitious followers at the top end of the spectrum, Mexico, India, Brazil, Indonesia, Vietnam and South Africa find themselves at the bottom of the pack as starter nations. Rajan Wadhera, Former President, of Mahindra Automotive Sector and Former President, SIAM admits to the eluding parity between nations has India finding itself with a low, two per cent rate of adoption despite a heightened optimism. “It is largely due to a huge price differential with traditional engine counterparts and the absence of adequate EV infrastructure in the country,” he opines. Stressing on the need to create indigenous solutions and support a domestic value chain, Wadhera backs India’s potential to become a global EV powerhouse led by the two-wheelers ecosystem and backed by suppliers.

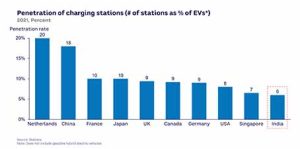

On the findings of the index (the study was first undertaken in 2018), Barnik Chitran Maitra, Managing Partner & Chief Executive Officer, India & South Asia, Arthur D. Little, says, “While studying global EV markets, we found that market readiness and EV adoption are driven by different factors in different regions. In some markets, environmental friendliness is the key, while in others, the cost of the EV. Many countries, especially those in our starter group including India, primarily focus on cost and environmental concerns rank lower,” he shared. According to the findings, in India, 40 different types of vehicles are on offer largely comprising two- and three-wheelers in comparison China offers 100 different models led by passenger cars. The report draws attention to competition in starter nations “growing significantly, driving prices down and pushing up quality”. On charging infrastructure playing a key role in the EV adoption in starter nations, attention was drawn to heavy investments required to build a robust DC charging infrastructure that can meet the fast charging requirements.

On the findings of the index (the study was first undertaken in 2018), Barnik Chitran Maitra, Managing Partner & Chief Executive Officer, India & South Asia, Arthur D. Little, says, “While studying global EV markets, we found that market readiness and EV adoption are driven by different factors in different regions. In some markets, environmental friendliness is the key, while in others, the cost of the EV. Many countries, especially those in our starter group including India, primarily focus on cost and environmental concerns rank lower,” he shared. According to the findings, in India, 40 different types of vehicles are on offer largely comprising two- and three-wheelers in comparison China offers 100 different models led by passenger cars. The report draws attention to competition in starter nations “growing significantly, driving prices down and pushing up quality”. On charging infrastructure playing a key role in the EV adoption in starter nations, attention was drawn to heavy investments required to build a robust DC charging infrastructure that can meet the fast charging requirements.

EV adoption in India

By 2030, it is estimated that 30 per cent of the Total Industry Volume (TIV)of 10 mn units would be attributed to EVs led by two- and three-wheelers with passenger vehicles at five per cent. India is expected to feature among the top 10 EV markets, globally. The need of the hour is for private and government institutions to work hand in hand and remove the barriers. A coming together of this sort can propel India’s EV adoption rate to 50 per cent with more than 17 mn EV units sold by 2030. In effect, one in every 10 EVs sold globally will be from India. The Indian government has set itself a goal of attaining 30 per cent of EV penetration in cars; 70 per cent in commercial vehicles and 80 per cent in two- and three-wheelers backed by the Faster Adoption and Manufacturing of Electric Vehicles (FAME) as per the report. The study pegs the EV adoption rate by 2030 for passenger vehicles at 10 per cent; three-wheelers at 95 per cent; two-wheelers at 35 per cent and commercial vehicles at 22 per cent. India remains one of the largest EV markets in Asia behind China and ahead of Japan.

By 2030, it is estimated that 30 per cent of the Total Industry Volume (TIV)of 10 mn units would be attributed to EVs led by two- and three-wheelers with passenger vehicles at five per cent. India is expected to feature among the top 10 EV markets, globally. The need of the hour is for private and government institutions to work hand in hand and remove the barriers. A coming together of this sort can propel India’s EV adoption rate to 50 per cent with more than 17 mn EV units sold by 2030. In effect, one in every 10 EVs sold globally will be from India. The Indian government has set itself a goal of attaining 30 per cent of EV penetration in cars; 70 per cent in commercial vehicles and 80 per cent in two- and three-wheelers backed by the Faster Adoption and Manufacturing of Electric Vehicles (FAME) as per the report. The study pegs the EV adoption rate by 2030 for passenger vehicles at 10 per cent; three-wheelers at 95 per cent; two-wheelers at 35 per cent and commercial vehicles at 22 per cent. India remains one of the largest EV markets in Asia behind China and ahead of Japan.

Stakeholder partnerships

It is quintessential that all the stakeholder’s partner. Component suppliers, Original Equipment Manufacturers (OEMs), power generation and distribution companies, the government and the customers must come together. On the product innovation front, the study suggests OEMs look at the bespoke model or shared architecture/platform across different powertrain units. Drawing from global success models, the trend suggests providing larger interiors with a lesser footprint and offering a lesser cabin intrusion citing an example of VW ID3. Notably, it calls for components to be shared with other vehicle manufacturers as is the arrangement with Mahindra and Ford using the Volkswagen MEB platform.

It is quintessential that all the stakeholder’s partner. Component suppliers, Original Equipment Manufacturers (OEMs), power generation and distribution companies, the government and the customers must come together. On the product innovation front, the study suggests OEMs look at the bespoke model or shared architecture/platform across different powertrain units. Drawing from global success models, the trend suggests providing larger interiors with a lesser footprint and offering a lesser cabin intrusion citing an example of VW ID3. Notably, it calls for components to be shared with other vehicle manufacturers as is the arrangement with Mahindra and Ford using the Volkswagen MEB platform.

OEMs themselves can look at manufacturing key components like motors, batteries and chargers or source these from key suppliers. The two (OEMs and suppliers) must partner to ensure the security of supplies as they look to develop in-house capabilities over the medium- to long-term. The two must invest in innovative startups too! While OEMs can provide charging and swapping solutions, they must invest in secondary offerings to help augment industry and drive economic growth. A centralised network of equipment and supplies was identified as extremely critical in preventing “stockouts”. Specialised dealers must come in for complex repairs with trained personnel for an efficient after-sales service to customers. Here component manufacturers mustn’t shy away from building capabilities. They must partner with international players, where the need is on technology transfers, states Mitra.

Addressing safety and quality concerns

The low EV adoption rate in India is also attributed to the recent safety and quality concerns with ~7000 recall in electric scooters alone. The alleged battery explosions due to overnight charging in cases are said to have made customers wary. With 100 per cent FDI permitted, collaborations like the one between Magnis Energy Technologies and public sector company Bharat Heavy Electricals Ltd. (BHEL) to set up a one to 30 GWh manufacturing capacity are deemed as a testimony to India attracting foreign players. This has also led to PE funds supporting domestic EV companies with robust technology and plan of action. Notably, investments in India’s EV space are pegged at 255 per cent higher in FY22 compared to FY21.

Lowering acquisition cost

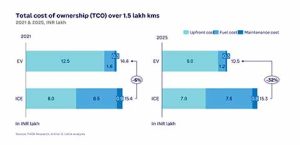

The Total Cost of Ownership could reduce from the current eight per cent to more than 30 per cent by 2030 owing to battery manufacturing cost-reducing with the evolution of Technology. If the estimates are right, owning an EV could be 30 per cent cheaper compared to ICE counterparts by 2025. For those criticising the intensive battery manufacturing and emission processes involved, the study claims that the production emissions can be undone in the first ~18 months of use. With evolution, better product design and energy capacity are expected to bring down costs and provide a more satisfactory experience for consumers. Li-ion cell manufacturing is also expected to evolve in stages, with phase one concentration on battery pack assembly, and manufacturing becoming more localised eventually.

The industry is closely watching the new prospects for various electronics and battery-related items, including controllers, capacitors, and so on. As per the study, component makers are recognising the importance of investing in EV component technology and capacity. It cites big investment announcements made by component players like Sundaram Fasteners, which announced a phase-wise investment plan of over Rs.100 crore over the next five years. Demand for required minerals such as lithium, cobalt, copper and nickel is also expected to increase with changes in component requirements. The demand for aluminium, for instance, is predicted to increase by a factor of 14. Hindustan Copper, NALCO and HINDALCO are being deemed as change agents, providing novel alloys like steel-aluminium blends that will lower total costs.

Leave a Reply