The role of system integrators in the automotive value chain is crucial to bring component subsystems together and to function as a whole. Ashish Bhatia looks at this scope of linking OEMs to a wider supplier base.

The role of system integrators is deemed crucial, more than ever before! Be it hybrid or electric. With their strengths in integrating component subsystems, system integrators ensure that these subsystems function together as a whole. Such system integrator companies are known to offer an invaluable proposition to the process of automotive manufacture. The proposition includes and is not limited to developing and maintaining the system integrations and components, application to application integrations, services, internal and external API broadly. Such a platform on offer must offer scalability and flexibility, certified cloud and on-premise integrations, real-time data availability and monitoring, and the mobilisation of business processes. A typical system integration life cycle includes multiple stages including planning, system analysis, system design, development, implementation, integration and testing, operations and maintenance.

Linkage to a wider supplier base

When a European car manufacturer was looking for a partner to enable and deliver global connectivity of managing carrier networks and subscriptions, Tata Communications is known to have helped the OEM integrate the connectivity elements for it. Allowing the manufacturer to focus on vehicle development and manufacture, using the dual eSIM approach, Tata Communications through its MOVE eSIM Hub ensured seamless operations across different networks and between different vendors. It was made possible by a single API abstraction layer, independent of any single provider. The car manufacturer, in effect, was able to bundle services given the benefit obtained out of optimum connectivity costs. Others with stronger capabilities of design, development, manufacture for the OEMs offer integrated drivetrains (motor, inverter and transmission) for passenger vehicles including two and three-wheelers and commercial vehicles. The company, in this case, provides services to both India and global OEMs as well as tier1 suppliers.

In another instance, Visteon and ECARX are working together to commercialise an integrated cockpit project for a variety of vehicle platforms this year. The two will use Qualcomm® Snapdragon™ Automotive Cockpit Platforms to further develop such intelligent technologies. Sachin Lawande, President and Chief Executive Officer deems the digital content as “the battleground” for OEMs as human interfaces become more complex, connected technologies are increasingly turning important to improve the cockpit. “Visteon is pleased with the work we’ve done with ECARX and Qualcomm Technologies. Our teams have undergone rapid development, design and integration together, and are committed to delivering technology and creativity for a high-quality cockpit experience across multiple segments,” he stated. Ziyu Shen, Chief Executive Officer, ECARX mentioned, “ECARX has a leading position in China with a strong and an unique ecosystem structure, leading HMI, connectivity and infotainment.” “This is the latest example of a growth strategy that will continue to

create new and global business opportunities by engaging the best digital electronics and software talents in our technology industry,” he added.

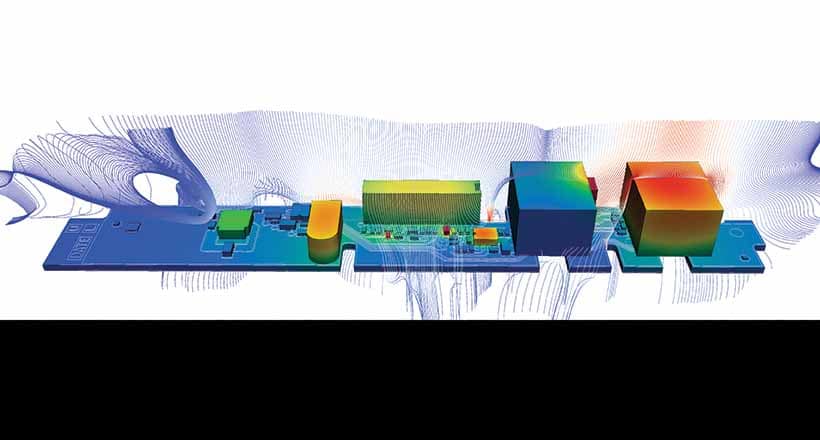

Altair, into simulation, high-performance computing and artificial intelligence through full system analysis tools offers integration of mechanical, thermal, electromagnetic and embedded code design flow with the PCB design. The upgraded simulation solutions boast new workflows claimed to simplify and automate structural stress analysis, vibration, thermal, and drop-test performance for non-experts thereby potentially widening the supplier base. The Altair SimLab™ applications,

a process-oriented multidisciplinary simulation environment, for instance, helps to accurately analyse the performance of complex assemblies. It is claimed to help reduce the time involved in the creation of finite element models and the interpretation of results.

Multiple physics including structural, thermal, and fluid dynamics can be easily set up using highly automated workflows as per James Scapa, Founder and Chief Executive Officer, Altair. Improved simulation and optimisation of wireless connectivity, including 5G and electromagnetic compatibility, visual firmware development supporting more widely used microcontroller families are among the notable upgrades. It also offers capabilities for PCB fabrication, assembly, and end-of-line testing besides the expanded workflows to simplify and automate analysis of structural stress, vibration, thermal, and drop-test performance for the non-experts. Through the expanded simulation-driven design for manufacturing, Altair has introduced manufacturing simulation in the early stages of concept design with its fast, accurate solvers and intuitive interfaces. It spans casting, stamping, moulding, extrusion, additive,

and foaming.

Mixed roles

Theoretically, it is the tier1 supplier that dons the hat of a system integrator. After all, it is the tier1 supplier that is deemed to have the capability to fully engineer, assemble and integrate automotive systems. These capabilities are known to span across multiple modules and sub-suppliers in turn. On ground zero, however, suppliers are also known to take up mixed roles. According to Roland Berger inputs in a University of Michigan study, as suppliers act as system integrators, tier1’s and even tier2s, their future strategies are largely defined by their primary business.

The rules of the game

Who will define the rules of the game? Will it be the system integrators or will they follow the Original Equipment Manufacturer? Questions on the pace of change and the factors influencing the acceleration or slowdown of such a change are among those that need to be answered. The study identifies tensions and the resultant dilemmas and drivers of the ecosystem. For instance, sharing or shielding proprietary information has been identified as a leading dilemma for system integrators. In the system integrator and OEM relationship, the level of confidence and commodity threat have been identified as the drivers. Lack of standardisation has led to the dilemma of building or dismantling of the proprietary network. Fuelled by technology constraints, third parties continue to gain competitive advantage, case-in-point being the Computer Aided Design (CAD) implementation of the 1980s. To give a backdrop here, it is alleged, back then, the practice of OEMs building their proprietary systems added to supplier complexities. Even as all stakeholders yearn for standardisation, it is said to be conflicted by the need to maintain such proprietary networks and in a bid to protect data.

Increasing value or decreasing costs is another business case dilemma the system integrators have faced. As per the study, while the system integrators are likely to implement the OE requirements, in case of developments above and beyond the customer requirements, the business case development is dependent on the decision of hard cost savings or the inherent potential to increase value. The lead in e-Business will determine the road ahead. Given the control of power over product development, OEMs are expected to continue to influence what power they surrender or retain. It continues to translate to more alliances or the latter shedding their engineering capabilities to increasingly rely on the system integrators. ACI

Leave a Reply