Continental AG used the capital market days to share the far-reaching aspects of its performance and strategy.

Story by: Ashish Bhatia

The ‘Capital Market Days’ are an ideal window to offer a broader perspective. Continental AG held it between December 8-16’ 2020 in a rather comprehensive schedule, claimed to be a first for the company. The objective was to ensure a more accessible and transparent communication for its stakeholders including the investors. Describing the inevitable transformation in mobility as challenging, Nikolai Setzer, Chief Executive Officer (CEO) at Continental AG called for the need to be prepared to deal with the change. “At Continental, we want to make use of this dynamic situation. Because the transformation, as challenging as it may be, it does at the same time present us with many opportunities,” he exclaimed. Elaborating on the positive effects to be expected as an outcome, the CEO spoke of a new aligned strategy. Sharing aspirations with cautious optimism, Setzer emphasised on the need to set realistic goals. Over the course of the exchange, ‘Automotive Technologies’, ‘Autonomous Mobility and Safety’, ‘Vehicle Networking and Information’, ‘Smart Solutions’ by ContiTech, Tyres, and ‘Sustainability and Environment’ were touched upon in greater detail. It gave a sense of the far-reaching aspects of the company’s performance and strategy.

The continental strategy according to Setzer is one based on three cornerstones: future portfolio strategy, operational performance and operation based on connected and sustainable mobility. Elaborating on the future portfolio, strategy, averred Setzer, “Strategically, we will differentiate it between two separate focal points: One is “growth” and the other is “value.” The goal of growth is, above all, the establishment of a strong position in fields featuring highly dynamic growth. “In contrast, value areas operate in saturated markets with stable growth. And the concentration here when it comes to value creation is above all on improved profitability and cash generation,” he stated. Resolving to continually strengthen operational performance, Setzer, committed to tapping opportunities in connected and sustainable mobility more than ever before. Of the opinion, that while hardware continues to be important, the software will make the difference going forward.

Future portfolio strategy

Attention was drawn to the company being the first automotive supplier to supply a High-Performance Computer (HPC) to OE customers of the company like Volkswagen, for instance. “These computers combine vehicle functions from the areas of safety, assistance, connectivity and entertainment. We have already received in total more than Euro four billion worth of orders from several automotive manufacturers for these computers,” claimed Setzer. Staying on course for value creation through its product portfolio, the company, according to Setzer, will leverage its strength in the domain of safety solutions, display and control systems, surface materials and the European passenger car tyre business. “Given a higher degree of maturity of their underlying markets, only limited outperformance above market is to be expected. That means that we must be selective when it comes to growth and focus closely on sustaining profitability and generating cash,” he opined.

Stated Wolfgang Schäfer, Chief Financial Officer at Continental AG, in the tyres business, the company continues to strive to expand its position. “We want to increase market share in the growth markets of Asia and North America in particular. We want to continue to expand the electric mobility segment. We also see further growth for truck and bus tyres as well as in the area of speciality tyres,” he said. Growth in ContiTech, as per Schäfer, comes on the back of increasing demand for digital and intelligent solutions. For instance, the company combines various materials with electronic components and individual services believed to present new business opportunities. In addition to experimenting with materials, the company banks on cloud and artificial intelligence to reduce unscheduled and cost-intensive downtimes. ContiTech is also said to have strengthened its plastics expertise through acquisitions.

Admitting to divestiture being considered, the CEO was quick to explain that the option would only be exercised after a thorough review and post considering potential dis-synergies. For instance, the spin-off, of Vitesco Technologies, into drivetrain technologies for both internal combustion engine and electric vehicles, is an outcome of a systematic review at the company.

Operational performance

Continental expects vehicle automation to deliver improved safety, greater freedom for the driver, and improved vehicle efficiency.

Continental will focus on operational performance to ensure future viability and competitiveness. Mentioned Setzer, “We are adjusting our cost structure to the global market conditions. We summarised these measures in our structural program and started implementing them in September 2019.” Admitting to few measures having a negative impact for instance on the workforce, he claimed, each measure was discussed and weighed at the executive board level. On enhancing productivity, the company in addition to adjusting the cost structure is also increasing automation and digitalisation in its production ecosystem. It has deployed 2000 cobots besides autonomous and driverless transportation systems to drive this objective. The company will leverage domain knowledge in sensor technology, autonomous driving and electromechanics, for instance, to its factories.

The company will leverage domain knowledge in sensor technology, autonomous driving and electromechanics for its factories.

Architecture and networking

For software-defined vehicles, Dr Dirk Abendroth, Chief Technology Officer- Automotive committed to attaining software and systems excellence across autonomous mobility, smart mobility, user experience and safety. To overcome the limitations of convention architecture and functions based on gateway, body controller and other ECUs, for instance, the company will adopt a more function-defined architecture based on ICAS1 (HPC), scalability across platforms and, new functionalities and value streams. The new approach will translate to use of fewer HPCs and zones, use of functions defined by software, approximately 50 per cent reduction of wires and staying always connected. It will aim to meet the consumer requirement of smart Internet of Things (IoT) devices.

Over the vehicle lifecycle, the company will look to build upon the use of electronics and software and system integration with software maintenance, new features and functionality and the deployment of cloud services. Continental to its credit has an order intake of greater than Euro four billion for Long Term Support (LTS). The order pipeline includes ICAS for Volkswagen and the 3D Cluster for Hyundai (encompassing body and cockpit). Continental is focussing on its capability to provide fully pre-integrated and cyber-secure functional stacks to help customers overcome challenges of integrating complex systems besides helping them overcome the lack of software expertise and manage new business models.

Software excellence

Maria Anhalt, Chief Technology Officer at Elektrobit drew attention to Continental performing in excess of 250 builds for its existing customer projects per day. Anhalt cautioned on faulty software turning fatal given that a typical car contains 100 microcontrollers, four displays, four operating systems, over 100 sensors and an upper speed limit of 250 kilometres per hour. She explained, the need of the hour is to overcome challenges like complexity, a high degree of variants, long product lifetimes, vague standards and areas involving safety concerns. Continental, according to Anhalt, covers differentiating and non-differentiating software in a 40:60 per cent ratio. The company is banking on its past acquisitions like that of Elektrobit, Zonar and Argus besides putting to use an inhouse-software academy and state-of-the-art learning units.

Maria Anhalt, Chief Technology Officer at Elektrobit drew attention to Continental performing in excess of 250 builds for its existing customer projects per day. Anhalt cautioned on faulty software turning fatal given that a typical car contains 100 microcontrollers, four displays, four operating systems, over 100 sensors and an upper speed limit of 250 kilometres per hour. She explained, the need of the hour is to overcome challenges like complexity, a high degree of variants, long product lifetimes, vague standards and areas involving safety concerns. Continental, according to Anhalt, covers differentiating and non-differentiating software in a 40:60 per cent ratio. The company is banking on its past acquisitions like that of Elektrobit, Zonar and Argus besides putting to use an inhouse-software academy and state-of-the-art learning units.

Efficient software development is ensured through the use of classical project setup with V-model (with a six-months iteration) and state-of-the-art flow development (with two to four weeks iteration). With hardware and function coupling, explained Anhalt, the software will be treated like hardware going forward. Continental will leverage its collaborations with NVIDIA, Qualcomm, Huawei, Intel, Samsung, Renesas, Infineon, NXP and STMicroelectronics for semiconductors. It will leverage partnerships with Adasis, Sensoris, ELISA Navigation Data Standard, VDA, TISA, ASAM, and ZVEI Safety Pool consortia. It will also leverage collaborations with technology partners in Dassault Systemes, HPE Pioneer, Sennheiser, Synopsys Ansys, dSpace, Siemens and IBM.

Autonomous mobility and safety

Cristina Arias, Head of Sales, Business Unit Hydraulic Brake Systems at Continental AG exclaimed, “Safety is not negotiable.” Explaining the basis of Continental solutions on ‘Sense’, ‘Plan’ and ‘Act’, Arias classified the product portfolio broadly across hydraulic brake systems for safe stop and standstill capability, electronic brake system for stabilising and emergency braking, and a restraint system to mitigate the crash impact. “There is a need to assert position through portfolio refinement and extension and better the delivery of over 300 million sensors in 2019,” she stated. Continental will bank on high resolution, automated driving ready wheel speed sensors range by 2022; it will also develop battery sensors for electric vehicles by the same period.

On the tyre information system front, Arias drew attention to over 15 SOPs the company has established. Opined Aria, friction brakes with electronic brake systems will stay the dominating solution and hence a focus area for the company over ‘recuperation only’ braking. The former will help the company align with trends of corrosion robustness and brake dust reduction. The future brake systems will score high on integration into one unit and offer superior performance and full recuperation.They will be highly automated driving ready and be packaged better. For restraint systems, the company will provide new functions like pre-crash safety monitoring and adaptive deployment strategies.

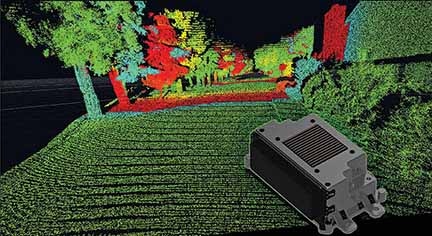

Frank Petznick, Head of Business Unit Advanced Driver Assistance Systems at Continental AG drew attention to to the company having delivered in excess of 100 million units of radars, camera, lidars and automated driving control units for over 300 models between 2017-2019 alone, resulting in a 15 per cent CAGR. With increasing content per vehicle, explained Petznick, software as a product with licenses and updates and system integration would be the key growth drivers for the company. Scalable software and computing platforms, high-resolution lidars (greater than equal to L3) besides additional integration in L2 plus systems, legislation compliance, high quantity in satellite cameras (camera belt), high quantity in radars (radar belt) in L2 plus systems, and the deployment of next-generation (4D) radars and ultrasonic sensors would be a focus area. The latter boasts of capabilities like sensing non-overridable ground obstacles, road boundaries, complex/dense traffic, underridable elevated objects, debris and potholes besides sensing capabilities of landmarks for which the company has ‘first to market’ SOPs (L2 plus) for 2021 and 2024 planned.

Leveraging domain expertise in 360 degrees automated driving, said Petznick, the company has plans in place for a 2022 SOP of a satellite camera platform in production since 2017 for customers like Volkswagen, JLR and Daimler. A 2024 target SOP has the company working on 360-degree vision systems for L2 plus systems to aid camera vision for cruising. Leveraging a strategic investment in the company — AEYE, the company’s long-range Lidar will target highway applications to offer a dynamic spatial resolution enabling concurrent far range, high resolution and high sensitivity at minimised power consumption. Among software stack and high-performance computing solutions on offer are planned SOPs from combinable surround view and assisted driving to integrated automated driving and parking HPC coupled with over the air updates.

The AI competence centre will be leveraged for the core development of AI technologies and rollout to product development teams. Additional business areas of interest include commercial vehicles where the company expects the first commercial vehicle fleet operations to commence. The company expects strong market growth over the next five years driven by policy push and aims to become a full system and solutions provider to support the fleet.

Vehicle networking and information

Continental will bank on high resolution, automated driving ready wheel speed sensors range by 2022.

Gilles Mabire, Head of Business Unit Commercial Vehicles and Services at Continental AG touched upon the growing need for smart mobility solutions. Covering the demand side of both passenger vehicles and commercial vehicles, Mabire, touched upon growth drivers in the digital logistics value chain, emission regulations, new mobility business drivers and cross-technology solutions. For instance, in commercial vehicles, the need of the hour is 100 per cent connected, digital logistics and big data. In the case of passenger vehicles, the need is for sharing and hailing, fleet vehicles managed as investment goods and total cost of ownership reduction. Through digital tachograph, the company will offer driver and rest periods tracking, speed, driver and weight information tracking, and compliance to cabotage, on-board weighing and CO2 regulation.

Among under development products are ‘Key as a service’ wherein the company will offer access and authorisation via smartphones, a secure cloud backend and highest security besides short loop communication. Claiming to be the only integrated tyre and vehicle electronics player in the market, Continental, according to Mabire, will offer integrated smart systems and services like Conti360, ContiLifeCycle, ContiPressureCheck and ContiConnect.

On the user experience front, the company will continue its focus on user experience. Spanning across audial, visual, software and system, system integration, tactile inside (Shytech and haptic controls) and outside (secure digital car access via key or phone). Explained Mabire, while the customer satisfaction and willingness to pay is linked with the ease of use, the OEM satisfaction is linked with the high-value interior as a new key brand identifier especially given that the traditional differentiators are fast losing significance. Hardware value creation and parts refinement here is expected to hold the company in good stead. For instance, across backlit mechanical components, backlight LED PCB, electronic PCB, camera and infrared illumination and die-cast housings. The MB S-Class, Hyundai Genesis, Volkswagen ID.3 in the luxury segment and Citroen C4 in the entry segment are a testimony to this, he pointed.

Material science

To help customers overcome challenges like the BEV range and battery temperature, remote area breakdowns, IoT in production, on-demand information, metal structures in cars, automated tooling recognition and digital integration in the interior, Continental has planned solutions. They span across active battery management, interior sensor integration, predictive maintenance, metal replacement composites for weight reduction and smart tooling. Here engineered thermoplastics, rubber thermoplastics, hybrid materials and composites like fibres are being focussed on with 800 per cent increase in content per vehicle, explained Dr Jens Högermeier, Head of Advanced Technology Development at the company.

Sustainability mobility

Continental is committed to making its global business for emission-free vehicles, carbon-neutral beginning 2022. By 2050, it aims to attain 100 per cent emission-free mobility and industry, 100 per cent circular economy and 100 per cent responsible value chains. Dr Steffen Schwartz-Höfler, Head of Group Sustainability at Continental AG and Thomas Sewald, Head of Group Environmental and Climate Protection at Continental AG stressed on the need to turn challenges coming the industry’s way into opportunities. They stressed on the need for a systematic approach based on ownership, integration and KPIs. These were demonstrated through components used in Volkswagen ID.3. For example, the drive control unit in ID.3 is sourced from Vitesco Technologies. On the autonomous mobility and safety front, the drum brake, brake hoses, long-range radar, damper control unit, intelligent battery service, and wheel-speed sensors were put to good use. In the case of vehicle networking and information, in-car application services, a 10-inch centre information display unit, sensor-actuator product besides seat and door control units play an important role too. ContiTech is known to have provided the battery thermal management pack beside next-generation air-conditioning and heating.

Through ‘Rubberway’, a supply chain initiative, Continental with its JV partner Michelin, together with IT agricultural expert Smag has been mapping sustainability practices. Continental will adhere to the RE 100 project which entails the use of high-quality renewable energy sources by accredited certificate systems. The technology roadmap 2040 will entail measures to decarbonise and drive material cost savings through energy efficiency drives. It will also entail a reduction of water intensity driven by a risk-based approach and striving for closed resource cycles to mitigate the negative impact on the business. By 2022, the company aims to neutralise the CO2 backpack, from raw materials, production, logistics to the end of the product life cycle pertaining to the Zero Tailpipe Emissions Vehicles (ZTEV) business. ACI

Through ‘Rubberway’, a supply chain initiative, Continental with its JV partner Michelin, together with IT agricultural expert Smag has been mapping sustainability practices. Continental will adhere to the RE 100 project which entails the use of high-quality renewable energy sources by accredited certificate systems. The technology roadmap 2040 will entail measures to decarbonise and drive material cost savings through energy efficiency drives. It will also entail a reduction of water intensity driven by a risk-based approach and striving for closed resource cycles to mitigate the negative impact on the business. By 2022, the company aims to neutralise the CO2 backpack, from raw materials, production, logistics to the end of the product life cycle pertaining to the Zero Tailpipe Emissions Vehicles (ZTEV) business. ACI

Leave a Reply