Story by: Sircharan R

EOS, the global technology leader for industrial 3D printing of metals and polymers, is working with various OEMs to set up consultancies and training programmes in India. This is to raise people’s knowledge to a higher platform and to have experience in additive technology.

“I think it is very important to bring the knowledge level of the people to a higher platform. So, we are working with OEMs, institutes like IGTR, CTDC, SIPET and many more, to see if we can create a curriculum that can be transferred to the engineers and even to the corporates. We feel there is need for learning in additive manufacturing. Though people know that additive will do something to the market, they do not know what it is. We are focusing on how to bring up the knowledge level in the market,” EOS India, Country Manager, Anand Prakasam, told Auto Components India.

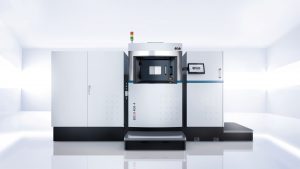

Founded in 1989, the 3D printing company is a pioneer and innovator for holistic solutions in additive manufacturing. Everything EOS does is founded on the cornerstones of corporate responsibility and sustainability, both inward and outward-facing. They are also mastering the interaction of laser and powder material and providing all essential elements for industrial 3D printing. Though there is a potential for growth of the new technology in the market, many consider this as a major disadvantage because of the cost. Anand contradicts this saying it is the perception that is in the problem.”

“You have to start the idea right from the design phase. The first step is with 3D printing. If you are taking a part of CNC design manufacturing and trying to manufacture it in 3D printing, it is not going to bring any benefit. Because, additive manufacturing can give you a whole lot of other advantages like weight reduction, less volume per part, keeping the same functionality. So, if you can design a part and start, you will have cost benefit. Second, we need to identify the right parts. Not all parts are for metal 3D printing. This is where our consultancy department comes into play. It offers training to industry on 2 things. One, what are all the parts that are suitable for the new technology. There is a template and we explain them on how to identify them. It is the wrong approach if you think that we can print every part. Second, after you have selected the part we need to take advantage of 3D printing in terms of cost, technicality etc., For this, you need to redesign the part. We offer this as a training programme called DFAM. When these two issues are taken care of, 90% of your cost issues are sorted out. There will be a 10% issue, which is common in all the component industry. The additive manufacturing brings in a lot of value for the aerospace industry. When you go to automotive industry, though there might be a design change in components, it may not hold economic viability,” Anand said.

About the capex margin, he said, as the number of machines increases it could come down. “In the Indian market from a metal perspective we may have 20 machines a year. Once this increases to 200 machines, the cost will also come down. Also, we have a special model called BOOT (Build, Own, Operate and Transfer). If a customer has good requirement and utilisation but does not want to invest in the capex, he can sign a 2-3 years contract with us. Through which, we locate the machine and run it for him. He has to pay as per his use. He should meet a certain threshold of utilisation in them to avail this. With this, the user addresses the entry barrier of cost and we are the only one to offer this.”

About the capex margin, he said, as the number of machines increases it could come down. “In the Indian market from a metal perspective we may have 20 machines a year. Once this increases to 200 machines, the cost will also come down. Also, we have a special model called BOOT (Build, Own, Operate and Transfer). If a customer has good requirement and utilisation but does not want to invest in the capex, he can sign a 2-3 years contract with us. Through which, we locate the machine and run it for him. He has to pay as per his use. He should meet a certain threshold of utilisation in them to avail this. With this, the user addresses the entry barrier of cost and we are the only one to offer this.”

Old, but new

From a global perspective, additive manufacturing is not a new trend. It is already in the pre-production phase. The technology has been there for more than 20-25 years and used a lot for prototyping. Now, it is getting into layer manufacturing because of the industries like aerospace, medical etc. In India, there is a lot of discussion in the maturity of the product and technology to meet the manufacturing demands. More customers and companies are realizing that additive manufacturing is here to stay and they have witnessed a lot of developments in this. People have shown interest to adapt and the learning phase is still going on.

Anand feels that many stating this technology as a disruptive is not true. The technology is disruptive for people who can take this from prototyping to spare parts. People who hold a small volume and a large mix of components as in the aerospace domain can use this and bring in a change. This is because the number of pieces they require would be a few thousands. It will also be disruptive in the special purpose machines. But, this might not be the solution for mass manufacturers of 1-2 lakh pieces. 3D printing can play a huge part in prototyping as far as mass production is concerned. Apart from this, the big benefit that the OEMs hold is that they would require no tooling. They can print parts as per demand.

“We are talking to a company that wants to print a certain component for a motorcycle. The yearly requirement is only 5000 pieces and they are not sure about the market for this variant. The market for this may be less than 5000 or they might change the design or even stop the variant. For them, additive manufacturing makes sense as they do not need to spend a lot of money on tooling of different parts. The concept of agile manufacturing and ability to adapt becomes very easy with this process,” Anand said.

What’s new

EOS has a deep commitment to customers and their needs. System, material and process parameters are intelligently harmonised to ensure a reliable high quality of parts and thus facilitating a decisive competitive edge. Furthermore, customers benefit from deep technical expertise in global service, applications engineering and consultancy. At their R&D centre in Germany and Finland, EOS is working on machines to increase its throw-put, as it is the need of the hour. The company is working on many things including, multi-lasers, new materials, larger bed size and machines that can process high-temperature materials. The high-temperature machines will help to process a certain grade of nickel alloys for the aerospace industry. The additive manufacturing company spends about 14% of its turnover on R&D which will be close to 50-55 million Euro.

“To set up an R&D centre in India, we need to understand the market needs. If the market here grows exponentially, the company would invest in R&D here. This applies to the manufacturing facility too. At present, it is being imported from Germany. We will have a good price benefit if we start a facility here. But, this is niche technology and finding a supplier locally to build only 20 components in a year is going to be a challenge. There needs to be a supplier base around you and he should have enough business to be motivated to deliver the highest quality. For a supplier who supplies small components, 20 components a year might not be a huge thing. So, to have a full-fledged set-up, we need to have more input from the market,” he said.

Leave a Reply