Eaton is a global technology leader in power management solutions that make electrical, hydraulic and mechanical power operate more efficiently, effectively, safely and sustainably. The company sells its products in 175 countries. Eaton in India drives the company’s manufacturing capabilities and professional services to new areas. Krishnakumar (KK) Srinivasan, President – Asia Pacific, Vehicle Group, Eaton, in an exclusive interview with Bhargav TS described the company’s expansion plans across regions. Edited Excerpts:

Q: 2016 has started on a positive note. How do you visualise Eaton’s growth?

KK: The focus will be on how do we get business in India. Though China has slowed down, we were able to prove our strength across the APAC region. We outdid China last year and we hope that the curve would continue to show our good performance. We do have joint venture plants in China and outside China and put together we have 9 plants across APAC. We normally partner with our customers on technological grounds. We are ready to partner right from the drawing board stage to the design, production and product delivery.

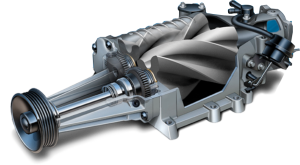

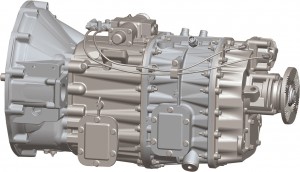

Our presence in India has become sizable now. We supply transmissions to all OEMs. We have penetrated well in off highway lines, haulage trucks and various other segments. We focus on making the products and adapting them in the right way to gain substantial market share. We have grown substantially in India after the acquisition of the Kirloskar plants. We are working to deliver future technologies like valve actuation, cylinder deactivation, variable valve lift technologies, super chargers, and niche products in air-conditioning lines.

Q: What is the growth trend that you expect in India?

KK: We have tremendous organic growth. Our hands are full with expansion lines in India and other countries. Inorganic growth is also decent-enough and we are looking for synergies within our portfolio and our team will work on the same to match the synergies.

Q: What are the latest products that drive Eaton’s domestic and global markets?

KK: Rephrasing latest products with latest technologies, we play well with the Dual Clutch Technology (DCT). As a technology, it has been there but its technological capabilities were displayed by us and a lot of engineering has gone into the product. When you drive a car, you will feel the quality and smoothness; that is what we have delivered in the product. We are working on a number of technologies on AMT, and DCT is one of them. We have in our portfolio the ‘Ultraship Plus’ and this technology goes to all segment of the vehicles. We have a technology called Cylinder Deactivation (CDA) where a cylinder can be switched off from the burning cycle depending on the load. By this you can save fuel. But with this CDA comes vibrations as the cylinder is cut-off from burning. That can be managed sitting with the customer and joining our hands from the designing stage. We need to work on engine mounts to fix the same. We have expert trainers in CAM operations and roller rockers are electronically controlled to avoid frictional losses and wear. In this entire process piston goes up and down, only the burning is stopped.

Q: How do you quantify the savings from this technology?

KK: We are not able to say the exact figures, but there a is sizable amount of saving. The entire system is managed with mechanical/electronic programme and options are on whenever power is needed to drive the maximum load as we have not removed the cylinder but we have only cut off the cylinder from burning. If required for high loads, the system can bounce back to its original texture with all 4-cylinders functioning.

Q: Are you in talks with any OEM for supplying this; what is the response?

KK: This technology could not be implemented overnight. We do have various validation cycles to pedal. We have experience in commercialising various valve-lift technologies and with that exposure we can do this too. We have to customise the technology vehicle-wise.

Q: For the Automated Manual Transmission (AMT) what makes you competitive in the market?

KK: Normally we go platform-wise. We have medium-duty 6 and 9 speed platforms and based on the customer needs we can convert the platform to AMT. We have a concept called modular which helps us in converting the platform to AMT. We play the ball game in China where we have 12, 13 and 18 speed too and we are able to play well in the market. In China, infrastructure is supporting us well and we expect Indian market will also wake up. Cars migration levels are obvious. The shift is a sudden happening and the same is expected in the commercial vehicles segment also. The performance of the vehicle will be improved and fuel efficiency solution is derived with hardly a few challenges. The bottom line is on the base we put XY shifter and control everything electronically and electrically with programmes and able to get right shifts and right torque levels.

Q: What impedes the Indian market from going big with AMTs?

KK: The major impediment is cost. Our market is much sensitive to cost. The feel and the comfort could be the selling points with passenger cars. But on the commercial vehicle side everything should be quantified with currency. For instance the AMT implementation in commercial vehicles could be quantified with- driver’s comfortability in steering for long hours, driver headcount reduction accorded owing to capability of drivers and increase in fuel efficiency. These quantified figures should be assimilated in the fleet owner’s mind. Only then AMT gets steered in the vehicles.

Q: Can we expect low-cost AMTs from Eaton?

KK: We already give AMTs at low-cost tallying against the returns. From the time we started working on the concept, our cost has been bending low. Cost is driven by the market. If you are not competitive, it implies that you shoot your own leg. We have to start working backwards on cost. We do a good job in the market and outdo the end-market in a faster pace.

Q: India transforms to electric vehicles and hybrid vehicles. What is your take on it?

KK: During the Commonwealth Games in India, Tata took up the challenge and made parallel hybrid vehicles. We partnered with Tata and supplied transmission system and the parallel hybrid vehicles still run in India. For parallel hybrid not much infrastructure is required but for series hybrid and combined hybrid it is not the case. We call ourselves as a pioneer in China for all parallel hybrids. Over a period of time we got to know that the battery life becomes a major challenge in China but we stepped in that zone and derived 3-5 times more efficiency in battery life. We were backed by the Chinese government to achieve this. Also government of China gives good incentives for those who adapt hybrids and till the market gets used to electric hybrids the incentivisation scheme will continue. The Indian government also should come up with such initiatives to have the electric vehicles on road.

Q: Do you think you have scope to supply components to OEMs like Scania, Volvo and Mercedes in India?

KK: If they are going to manufacture in the country, yes we are ready to supply them. But today a lot of Completely Knocked Down (CKD) units are coming in. People just involve in plugging and dispatching them across. Economies of scale is the major reason for that. When volume picks up and the manufacturing units get established we are ready to step in.

Q: How do you rate India compared to other growing markets?

KK: Given BRICS for comparison, India has a big advantage. Brazil is down in terms of currency. We do have issues in Russia, especially with end-markets. China is equally competent with India. The growth is rated at 5% with China and it is good enough and statistically 5% relates to 1.2 million addition of vehicles per year. Unless we localise, we cannot sustain and grow the business. We will outpace the market with fairly high investment from our end.

Q: What is the localisation strategy for Eaton India?

KK: Many of our products are localised based on the economies of scale. But we continue to import, as our CBA report instruct us to do. For an instance, we have a product which is rated cheaper in Korea than in India and if the import cost is not much, we continue to import from Korea. Except for a few products everything is localised in transmission. Valve needs are 100% localised. We have future products like valve actuation, super chargers, which are now looking for localisation.

Q: Are you planning to introduce any new products?

KK: Yes, we work on various solutions for product up gradation. We work on superchargers for customers and with that we can downsise the engines. A 1-litre engine can be downsised to 650cc and pull out the same power. When we downsise we cannot have the turbochargers to work because of high exhaust temperatures and as a result we continue to evolve with solutions to customers and ensure promising solutions.

Q: How does Eaton achieve downsising?

KK: If you take a medium duty, say 6 or 9 speed transmission, we move from cast iron to aluminium for the outer enclosure. For clutch products to reduce the inertia and weight we have coded new design in most of the products. We can continuously maneuver the move in different areas based on the demands from the OEMs.

Q: The Government is goal posting to implement BS-VI. What is you view on it and do you think it is achievable?

KK: External pressure is up now and this was the case with China for 3-5 years. Together they battled and came up with the solution. Vehicle manufacturers should get this done as it is the right thing for our environment too. About fuel, it is difficult, but doable. Huge amount of investment is needed from the government and everybody should promise to keep up with the deadlines.

Q: Do you have new products for commercial vehicle industry?

KK: We have CDA technology, hollow valves, super turbo combination technology, and AC lines to increase efficiency. These products are already available outside India and we are now in the phase of defining the products for India.

Q: Going forward how do you target to increase the revenue in the Indian market?

KK: Established in 2008, we try to get introduced in new areas with our technologies and I am sure we can sustain our outdo strategy. The end- market is what we target. Normally there is a growth of 5%. We have a lot of new products getting introduced. Since India is a cost-sensitive market, we have to work continuously on cost reduction. In transmission we have taken out so much of cost and added several technical inputs.

Leave a Reply