India’s automotive industry is in a period of significant transformation, balancing traditional market dynamics with evolving regulatory landscape and consumer preferences, writes Ashish Bhatia.

The sector faces a range of challenges and opportunities, including fluctuating demand, evolving consumer expectations, and a push towards greener, technologically agnostic vehicles. Puneet Gupta, Director of Mobility Forecast, India & ASEAN at S&P Global Mobility shared insights, examining the sector’s current status, challenges, and forward-looking strategies shaping the future of automotive in India.

Navigating market sentiments amid economic shifts

The Indian automotive market has been navigating short-term challenges with heavy discounting and high footfall in showrooms, yet struggles in converting foot traffic to retail sales. The industry has experienced a substantial increase in vehicle prices to the tune of 30-35 per cent over the past three years. It has impacted consumer purchasing power. As a result, many Original Equipment Manufacturers (OEMs) are recalibrating their pricing strategies, especially for SUVs, to address a high-cost ownership environment and align with consumer expectations.

While demand has tapered in the short term, the market remains resilient, showing a 34 per cent growth compared to 2019, even as global markets remain flat or in decline. However, the growth outlook for 2024 is predicted to be more moderate, with the industry expecting a stronger recovery by 2026 as major automakers expand production capacities. Brands like Hyundai and Maruti Suzuki are investing heavily in new manufacturing plants, which are anticipated to drive future growth and meet the demands of an increasingly complex and diverse consumer base.

Shortened product life cycles and adaptive OEM strategies

Historically, product life cycles in the automotive industry ranged from six to seven years. However, the pace of change in the auto sector has accelerated, reducing these cycles to adapt to rapidly shifting market conditions. OEMs have increasingly adopted quicker go-to-market strategies and cycle forecasting techniques, necessitating more collaborative approaches within the industry.

The shift is evident in the need for strategic alliances among OEMs, such as Mahindra with Volkswagen and Maruti Suzuki with Toyota, as well as potential partnerships with international players, including Chinese automakers. Collaboration is no longer a choice but a strategic necessity, as manufacturers look to share resources, reduce costs, and remain competitive in a crowded market, explained Gupta. This collaborative momentum is vital in achieving efficiency and innovation, helping OEMs keep pace with global standards and consumer demands in India’s fast-evolving auto landscape.

The role of regulatory compliance in market evolution

India’s regulatory framework has been a strong driver of change within the automotive industry. With a proactive government pushing for greener technologies and alternative fuel sources, Indian OEMs are adopting diversified fuel strategies, including electric, hybrid, and Compressed Natural Gas (CNG) options. This trend aligns with India’s vision for sustainability and reducing emissions, in line with global benchmarks.

The country’s fuel diversity reflects its societal diversity, with a wide range of consumer preferences across different income groups. By promoting fuel pluralism, the government has created a more flexible and adaptive regulatory environment, allowing OEMs to cater to varied consumer needs. This strategic move toward regulatory-driven innovation has set India apart on the global stage, positioning it as a leader in regulatory compliance and a model for emerging markets aiming to balance sustainability and growth in the automotive sector.

Striving for technological agnosticism in a multi-fuel future

One of the challenges OEMs face is maintaining technological agnosticism while providing consumers with an array of choices across traditional and emerging fuel types. With options like CNG, hybrid, electric, petrol, and diesel, the Indian market is moving towards a balanced fuel portfolio. This approach allows OEMs to address different consumer needs while gradually transitioning toward greener alternatives. However, it also presents the risk of spreading resources thinly across multiple technologies, potentially diluting the focus needed for mastery in any single area.

The Indian government’s approach has aimed to keep technology options open rather than mandating a single preferred solution, which can ensure wider adoption across different regions and income brackets. As consumer needs evolve, the industry’s ability to adapt to this technological pluralism will be critical in sustaining its momentum toward sustainable practices while catering to diverse market segments.

Global comparisons in electrification and the path forward for India

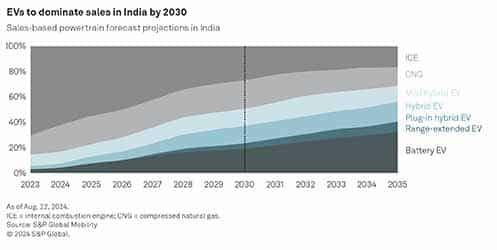

Compared to global players like the U.S. and Europe, which are aiming for 70-80 per cent electrification by 2035, India is more conservative, targeting around 30-32 per cent. Factors such as infrastructure readiness, consumer affordability, and a highly price-sensitive market mean that India’s electrification journey will likely be gradual. However, the transition is inevitable, with CNG and hybrid options serving as intermediary solutions that ease consumers into the new energy ecosystem.

India’s strategic emphasis on electrification aligns with global decarbonisation goals, and OEMs are proactively working towards this transition. As infrastructure, charging networks, and battery technologies advance, the adoption rate is expected to accelerate, pushing India toward its inflexion point for Electric Vehicle (EV) adoption within the next two to three years. The presence of hybrid and CNG vehicles will help mitigate initial infrastructure limitations, allowing the EV segment to expand organically without overwhelming the existing automotive landscape.

Emerging growth areas and market challenges

As India’s GDP per capita rises, and the economy shifts from an agriculture-based model to a service-driven structure, disposable incomes are expected to increase. This transition will likely support a surge in automotive demand, with more consumers able to afford passenger and commercial vehicles. The country is projected to become an upper-middle-class society by 2030, which will further drive demand for both personal and commercial transport solutions. Additionally, the number of high-income households is set to quadruple by 2030, creating new growth opportunities for premium and luxury segments.

However, challenges remain, particularly in sustaining first-time buyer interest, which comprises 55 per cent of the market. The penetration of cars in India is currently low compared to other markets, and attracting first-time buyers will be essential for maintaining growth momentum. Economic factors such as inflation, the cost of living, and fluctuating fuel prices may deter new buyers, requiring OEMs to devise more attractive financing options and entry-level models to bring more consumers into the market.

Embracing change

India’s automotive sector is at a crossroads, where traditional market forces intersect with regulatory transformation and consumer evolution. The industry’s path forward will depend on its ability to adapt to these changes, embracing shorter product life cycles, strengthening collaborations, and aligning with regulatory frameworks that promote fuel diversity. The shift towards EVs, while gradual, will be crucial for long-term growth and environmental sustainability.

The focus on technological agnosticism and a diversified fuel strategy allows OEMs to meet India’s varied consumer needs while fostering a market that is both resilient and adaptable. As disposable incomes rise and the economy transitions, the sector’s growth prospects remain strong, provided that it can effectively navigate the unique challenges and capitalise on the opportunities ahead. With a supportive policy environment and an increasingly sophisticated consumer base, India’s automotive industry is poised for an exciting journey that will shape the future of mobility in one of the world’s fastest-growing economies. ACI

Leave a Reply