BorgWarner today announced its intention to execute a tax-free spin-off of its Fuel Systems and Aftermarket segments into a separate, publicly traded company (“NewCo”).

“The BorgWarner Board believes a strategic spin-off of our Fuel Systems and Aftermarket segments would be the best path forward to further the transformation of our company. The intended separation supports optimizing our combustion portfolio and advancing our electrification journey while NewCo would be able to pursue growth opportunities in alternative fuels, such as hydrogen, and in Aftermarket,” said Alexis P. Michas, Non-Executive Chairman of the BorgWarner Board of Directors. “Ultimately, we expect the intended separation to maximize shareholder value by having two focused and strong companies, each pursuing their respective strategies.”

“We are incredibly proud of the progress we are making in executing our ‘Charging Forward’ strategy,” said Frédéric B. Lissalde, President and Chief Executive Officer, BorgWarner. “At the same time, our electric vehicle (EV) business is accelerating. We believe we are already on track to exceed our 2025 organic EV sales target, and over the last two years, we have announced or completed four acquisitions. The intended separation of our Fuel Systems and Aftermarket segments would be an important next step to further our pivot to EVs and advance our vision of a clean, energy-efficient world, while at the same time creating a new, focused entity with strong financials to support its future. With Fuel Systems growing faster than the market and Aftermarket expected to benefit from favorable long-term trends, we believe NewCo would also be well positioned for success as a standalone public company.”

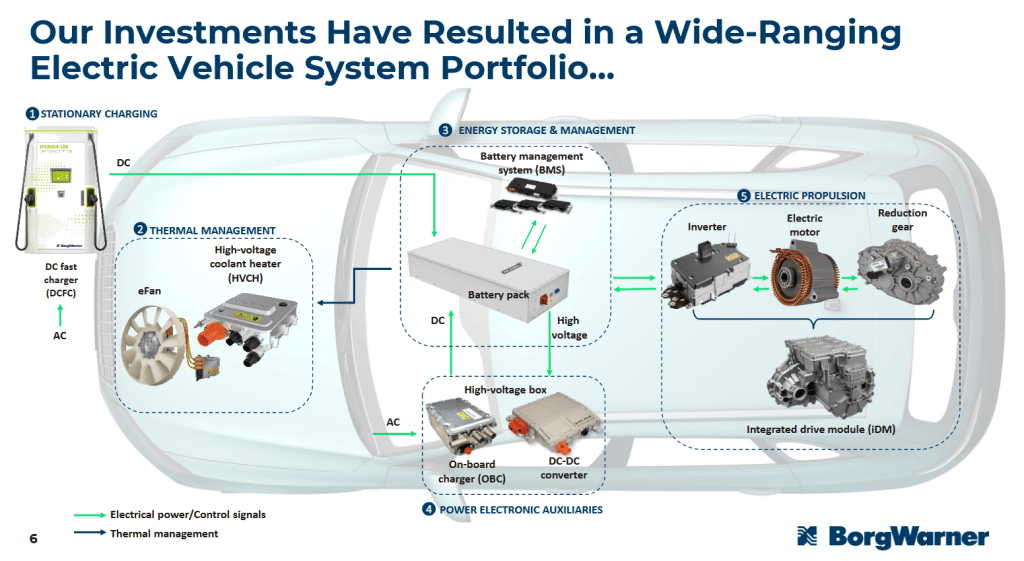

BorgWarner: A Leader in Electrification – Following completion of the intended separation, BorgWarner would consist of the Company’s current e-Propulsion & Drivetrain and Air Management segments. The Company believes it is positioned to be a market leader in EV propulsion, with long-term, secular growth opportunities and an enhanced focus on the development and commercialization of EV technologies, while continuing to deliver top-quartile margins and strong cash generation. The Company expects that the intended separation would better allow BorgWarner to focus resources on attractive organic and inorganic opportunities that position it to deliver and even exceed the goals underlying “Charging Forward.” The Company estimates that, after giving effect to the intended transaction, it is already on track with its organic bookings and acquisitions to date to deliver more than 22% of its revenue from electric vehicles by 2025, less than two years into the execution of its five-year strategy. With continued execution of its electrification growth initiatives, the Company believes that it would ultimately achieve or exceed its stated target of 25% of revenue from electric vehicles by 2025. Through the first nine months of 2022, BorgWarner’s Air Management segment generated revenue of approximately $5.5 billion and segment adjusted operating margin of 13.7%, while its e-Propulsion and Drivetrain segment generated revenue of approximately $3.9 billion and segment adjusted operating margin of 6.9%. The midpoint of the Company’s guidance provided on October 27th included approximately $12.3 billion in revenue, after considering inter-segment eliminations, from BorgWarner’s e-Propulsion & Drivetrain and Air Management segments for the full fiscal year 2022.

NewCo: Combustion-Technology Leader Poised to Capture Long-Term Opportunities in the Global Vehicle Parc

Following the intended separation, NewCo would consist of the Company’s current Fuel Systems and Aftermarket segments. NewCo is expected to be a product leader in fuel systems and aftermarket distribution with balanced and synergistic exposure among Commercial Vehicle (CV), Light Vehicle (LV) and Aftermarket end markets, as well as have broad regional exposures. NewCo is expected to benefit from its embedded relationships with global OEMs and focus on the global vehicle parc, which would be predominantly combustion-based through 2040. NewCo would also plan to capitalize on the growth trends in Gasoline Direct Injection (GDI) and Hydrogen Injection Systems. The Company’s current Fuel Systems and Aftermarket segments have delivered significant operational and segment margin improvement over the last couple of years, despite the challenging industry volume environment. We expect NewCo to maintain its strong, double-digit operating margin profile, which the Company believes should enable it to deliver solid free cash flow. Finally, it is anticipated that NewCo would have moderate leverage and solid liquidity, providing it with the financial flexibility to support its current business operations and longer-term strategies that further enhance shareholder value. Through the first nine months of 2022, the Fuel Systems segment generated revenue of approximately $1.7 billion and segment adjusted operating margin of 11.3%, while the Aftermarket segment generated revenue of just under $1.0 billion and segment adjusted operating margin of 14.5%. The midpoint of the Company’s guidance provided on October 27th included approximately $3.3 billion in revenue, after considering inter-segment eliminations, from the Fuel Systems and Aftermarket segments for the full fiscal year 2022.

Transaction Details – Immediately following completion of the intended transaction, BorgWarner shareholders would own shares of both companies. The transaction is intended to qualify as a tax-free spin-off for U.S. federal income tax purposes. The Company expects to complete the transaction in late 2023, subject to satisfaction of customary conditions, including among others, final approval from the BorgWarner Board of Directors, filing and effectiveness of a registration statement on Form 10 with the U.S. Securities and Exchange Commission, receipt of a tax opinion, satisfactory completion of financing, completion of information and consultations processes with works councils and other employee representative bodies, as required, and receipt of necessary consents and other regulatory approvals. There can be no assurance regarding the ultimate timing of the intended transaction or that it would be completed.

Leave a Reply