The replacement of old and discharged batteries is expected to drive growth in the battery segment.

Story by: Ashish Bhatia

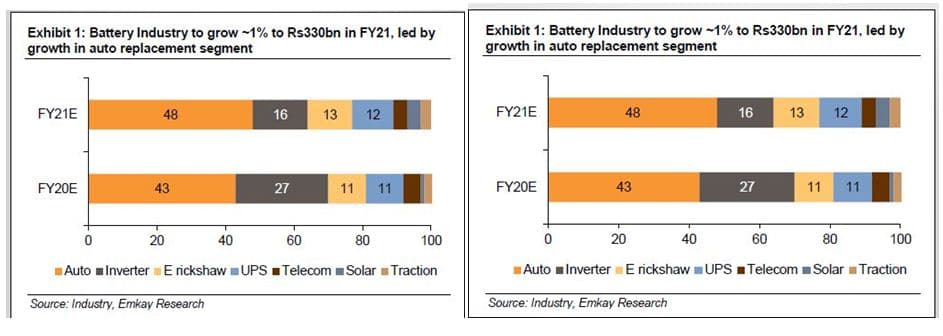

With the ongoing pandemic, there is a glimmer of hope for the aftermarket segment. Batteries are expected to be the outliers despite the overall weakness witnessed by the automotive sector. Especially Lead-acid Batteries (LAB). The LAB segment revenue is estimated to grow marginally (~ one per cent) to Rs.330 billion in FY21E. It is expected to be driven by the aftermarket volume growth of 14 per cent in two-wheelers and an estimated six per cent from other vehicular segment batteries. Non-utilisation of vehicles driven by lockdowns according to the Emkay Global report will translate to batteries discharging. Old batteries, it is expected would be replaced. This, in turn, will positively impact the aftermarket volumes. Here Original Equipment Manufacturer (OEM), Exports and Industrial battery segments will be an exception and continue to be under pressure.

With the ongoing pandemic, there is a glimmer of hope for the aftermarket segment. Batteries are expected to be the outliers despite the overall weakness witnessed by the automotive sector. Especially Lead-acid Batteries (LAB). The LAB segment revenue is estimated to grow marginally (~ one per cent) to Rs.330 billion in FY21E. It is expected to be driven by the aftermarket volume growth of 14 per cent in two-wheelers and an estimated six per cent from other vehicular segment batteries. Non-utilisation of vehicles driven by lockdowns according to the Emkay Global report will translate to batteries discharging. Old batteries, it is expected would be replaced. This, in turn, will positively impact the aftermarket volumes. Here Original Equipment Manufacturer (OEM), Exports and Industrial battery segments will be an exception and continue to be under pressure.

A shift in the share of unorganised players in FY2021 is expected. If customers move towards cheaper products due to the economic slowdown and priority shift towards greater cash conservation, it could particularly impact the commercial segment across taxis, three-wheelers, commercial vehicles and tractors. Replacement volumes are expected to grow at 14 per cent for two-wheelers and six per cent for others. The medium-term has favourable projections for the organised sector though. Previously, the share of the unorganised segment in replacement market reduced in two-wheelers from 39 per cent in FY2017 to 36 per cent in FY2020. In the case of other vehicular batteries, from 50 per cent in FY2017 to 45 per cent in FY20 due to a shift in customer preference toward better quality batteries and the launch of cheaper products by organised players. In FY2020, organised players commanded a share of nine per cent in passenger vehicles; 33 per cent in tractors; 36 per cent in two-wheelers; 55 per cent in commercial vehicles and 74 per cent in three-wheelers.

Stable growth in the aftermarket segment is attributed to the downgrade of battery service life attributed to higher starts per day (starts per day has increased from 11 per day in 2011 to 19 in 2018) and increase in electronic content of vehicles, pickup in the OEM segment onwards from FY2022E based on a low base, pent-up demand and gradual recovery in economic activity. Growth in industrial segments is expected to be led by UPS, e-rickshaw, solar and traction or Electric Vehicle Batteries (EVB). Automotive is expected to contribute 48 per cent compared to 43 per cent in FY2020. E-rickshaw is expected to contribute 13 per cent compared to 11 per cent. Traction motors are expected to contribute three per cent in the projected revenue mix. On the whole, it is expected to drive a Compound Annual Growth Rate (CAGR) of eight to 10 per cent.

Positive outlook

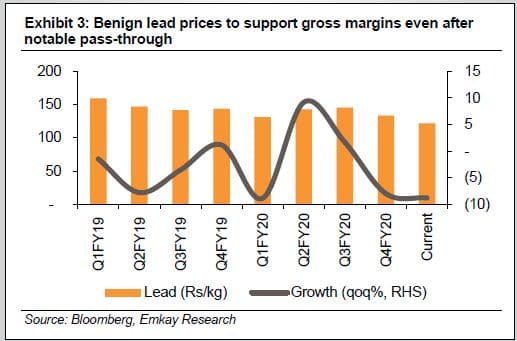

The report attributes the positive outlook on battery companies to expectations of quick recovery, low fixed costs at 11-12 per cent of normalised revenue, margin support from benign lead prices with a 15 per cent fall in Q4F2020 backed by a healthy liquidity position of select companies. The report blames the fall in global crude prices for the delay in EV penetration. It classifies it as a structural risk given the associated downside risks of delayed economic recovery, greater competitive intensity and adverse movement in commodity prices. Notably, the replacement demand will not increase warranty costs given that the replacement is expected from old batteries. The used car market, it is opined, will outdo the new car market over the next few years. Double-digit growth is expected to support the replacement demand for PV batteries. At eight per cent CAGR for two-wheelers and five per cent CAGR for other vehicular batteries over FY2020-25E, the growth in two-wheeler is attributed to the increased share of electric start vehicles. It is expected to remain stable over the medium term. The growth in the e-rickshaw segment is expected to be limited due to high competitive intensity.

The report attributes the positive outlook on battery companies to expectations of quick recovery, low fixed costs at 11-12 per cent of normalised revenue, margin support from benign lead prices with a 15 per cent fall in Q4F2020 backed by a healthy liquidity position of select companies. The report blames the fall in global crude prices for the delay in EV penetration. It classifies it as a structural risk given the associated downside risks of delayed economic recovery, greater competitive intensity and adverse movement in commodity prices. Notably, the replacement demand will not increase warranty costs given that the replacement is expected from old batteries. The used car market, it is opined, will outdo the new car market over the next few years. Double-digit growth is expected to support the replacement demand for PV batteries. At eight per cent CAGR for two-wheelers and five per cent CAGR for other vehicular batteries over FY2020-25E, the growth in two-wheeler is attributed to the increased share of electric start vehicles. It is expected to remain stable over the medium term. The growth in the e-rickshaw segment is expected to be limited due to high competitive intensity.

The report expects the duopoly of Exide Industries and Amara Raja Batteries to continue. Dominating the LAB segment, the two command an 80 per cent market share in the organised replacement market attributed to strong brand recall and retail presence. Exide and Amara Raja have a market share of 29 per cent and 22 per cent respectively in the two-wheeler segment. In other segments, they hold a 27 per cent and 16 per cent share respectively. In e-rickshaws, Exide has a 16 per cent share as per the Emkay Research statistic. With a gradual scale of EV penetration, the LAB industry is expected to peak in FY40. The estimate is on the assumption of EV share in annual volumes at 45 per cent in two-wheelers and three-wheelers by FY2039, 30 per cent for passenger vehicles by FY38, 10 per cent for commercial vehicles and three per cent for tractors by FY38.

New technologies

The LAB industry is also expected to shift towards newer products. Dominated by Conventional Flooded (CFBA) and VRLA batteries in FY2019, the stricter emission norms are expected to drive the market towards Enhanced Flooded Batteries (EFB) in passenger vehicles. It is projected that the acceptance of EFB over CFB will drive realisations by 15-20 per cent. The industry is evaluating new products like Gel VRLA at a price multiplier of 1.8-2x over the VRLA; Bipolar at a price multiplier of 0.8-0.85x; Ultra at a price multiplier of 1.2x and Spiral at a price multiplier of 3.5x. In Gel VRLA, an electrolyte that has a silica additive is converted into a gel. It enhances the LAB with an ability to withstand high temperatures coupled with high resistance to deep discharges. On its future adoption, cranking capabilities severely impacted in lower temperatures are being studied. Bipolar batteries feature a conductive plate with both sides serving as positive and negative electrodes. Reducing the lead requirement, the products can be adapted for Indian standards. Ultra, a hybrid combination of traditional battery and carbon-based capacitor known to boost dynamic charge acceptance leading up to 75 per cent reduction in charging time will find application in micro and mild hybrids for the medium term with applicability limited to SLI in the medium term. The spiral wound that uses tightly rolled, spiral plates into cylindrical cells that are packed in a condensed space offer a higher cranking power and better vibration resistance. Finding application in the premium segment, the high price differential could limit its adoption. The report predicts electric vehicles to use lead-acid batteries with less power (75-80 per cent reduction). ACI

The LAB industry is also expected to shift towards newer products. Dominated by Conventional Flooded (CFBA) and VRLA batteries in FY2019, the stricter emission norms are expected to drive the market towards Enhanced Flooded Batteries (EFB) in passenger vehicles. It is projected that the acceptance of EFB over CFB will drive realisations by 15-20 per cent. The industry is evaluating new products like Gel VRLA at a price multiplier of 1.8-2x over the VRLA; Bipolar at a price multiplier of 0.8-0.85x; Ultra at a price multiplier of 1.2x and Spiral at a price multiplier of 3.5x. In Gel VRLA, an electrolyte that has a silica additive is converted into a gel. It enhances the LAB with an ability to withstand high temperatures coupled with high resistance to deep discharges. On its future adoption, cranking capabilities severely impacted in lower temperatures are being studied. Bipolar batteries feature a conductive plate with both sides serving as positive and negative electrodes. Reducing the lead requirement, the products can be adapted for Indian standards. Ultra, a hybrid combination of traditional battery and carbon-based capacitor known to boost dynamic charge acceptance leading up to 75 per cent reduction in charging time will find application in micro and mild hybrids for the medium term with applicability limited to SLI in the medium term. The spiral wound that uses tightly rolled, spiral plates into cylindrical cells that are packed in a condensed space offer a higher cranking power and better vibration resistance. Finding application in the premium segment, the high price differential could limit its adoption. The report predicts electric vehicles to use lead-acid batteries with less power (75-80 per cent reduction). ACI

Leave a Reply