ASK Automotive Limited, India’s largest brake shoe and Advanced Braking Systems manufacturer for two-wheelers in India, announced its financial results for the fourth quarter and full year ended 31st March 2024.

Key Financial Highlights:

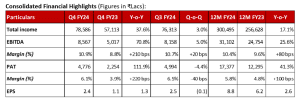

- Strong performance delivered in Q4 FY24 and recorded Consolidated Total Income of Rs. 78,586 lacs with +38% YoY growth. Total Consolidated Income for FY24 stands at Rs. 300,495 lacs and has grown by +17% YoY.

- All the three product segments performed well on delivering revenue growth in FY24. Sustained market leadership position in the Advanced Braking System business with +23% YoY growth in Q4 FY24 and +7% growth in FY24. The Aluminium Light Weighting Precision Solutions revenue grew by +73% in Q4 FY24 and +29% in FY24. The Safety Control Cable also recorded revenue growth of +32% in Q4 FY24 and +36% in FY24.

- Strengthened position in the EV segment and recorded revenue of Rs. 3315 lacs in Q4 FY24 with +91% YoY growth. FY24 revenue stands at Rs. 12,044 lacs with +133% YoY growth.

- Expanded export business significantly and delivered revenue of Rs. 14,664 lacs in FY24 with +58% YoY growth.

- EBITDA for Q4 FY24 stands at Rs. 8,567 lacs with +71% YoY growth and FY24 at Rs. 31,102 lacs in FY24 with +26% YoY growth.

- Achieved double-digit EBITDA margins at 10.9% in Q4 FY24 and improved to 10.4% in FY24 from 9.6% in last year. Improvement in margins during FY24 are mainly driven by better economies of scale due to higher volume, improved product mix and continued focus on cost optimization.

- Achieved PAT of Rs. 4,776 lacs in Q4 FY24 with +112% YoY growth. This includes a one-time deferred tax gain of Rs. 351 lacs recognised in ASK Automobiles Private Limited (wholly owned subsidiary of ASK Automotive Limited) in Q4 FY24. FY24 PAT stands at Rs 17,377 lacs in FY24 with +41% YoY growth.

- ASK share in Profit/Loss of ASK Fras le JV improved from losses of (Rs. 589 lacs) in FY23 to profit of Rs. 1,650 lacs in FY24. This includes a one-time deferred tax gain of Rs. 683 lacs in FY24.

- EPS Increased to Rs. 8.8, up +43% in FY24 against last year.

- The Board has recommended a dividend of 50% i.e. Rs. 1.0 per equity share of the face value of Rs. 2.0 each.

Key Initiatives of FY24:

- The Company has ventured into a strategic partnership for a new segment of ALLOY WHEELS for two-wheelers (2W) through High Pressure Die Casting (HPDC) with Technical Assistance from LIOHO Machine Work Ltd, Taiwan.

- The Company inked a strategic Joint Venture agreement in April 2024 with AISIN Group (ranked among the Top 10 Global Tier One Automotive Suppliers) to market and sell auto components in Independent Aftermarkets for Passenger Car Products.

- The Company has invested approximately Rs. 38,000 lacs up to March 31, 2024, in setting up its new largest manufacturing facility in Karoli, Rajasthan to cater to the upcoming demand of its customers. The Commercial operations of the plant have started and are ramping up fast. The plant is expected to generate cash profits from Q1 FY25.

- The Company also plans to invest approximately Rs. 20,000 lacs for setting up a new manufacturing facility in Bengaluru, Karnataka, to cater to the OEMs established in the Southern India. The plant is expected to be operational by Q4 FY25.

- With a clear focus on renewable energy, the Company is setting up a Mega Solar Power Plant of 9.9MWp in Sirsa, Haryana with investment of around Rs. 4,800 lacs for its captive consumption which is expected to commission by June 2024.

Commenting on the results, Kuldip Singh Rathee, Chairman and Managing Director said;

“During the financial year 2023-24, we delivered robust performance in all our business segments and recorded significant growth in revenue with double-digit EBITDA margins. This reflects the result of our continued focus on expanding value-added businesses and bringing cost efficiencies.

Led by the strong growth of 2W Segment driven by favourable macroeconomic conditions, we have achieved remarkable success in the domestic market and witnessed strong growth in exports. We are observing healthy order book. We aim to venture into new product segments while growing all our existing business segments on the back of strong demand in urban sector and recovery in rural sector. We would expect to continue with our legacy of outperforming the industry in future as well.

In this direction, we entered the new segment of High Pressure Die Casted Two-Wheeler Alloy Wheels by signing technical collaboration with LIOHO Machine Works Ltd, Taiwan. Also, we have inked new Joint Venture agreement with AISIN Group (a Top 10 Global Tier 1 Automotive Supplier) for marketing and sale of auto components in Independent Aftermarket of Passenger Car Products.

We will continue to focus on strengthening our position in EV segment with pipeline of new value-added products to serve EV OEMs in India. In line with our strategy, we are focusing on expanding our export business significantly with offerings of high-quality products to both Automotive and Non-automotive customers in US and Europe market.

We are expanding our production capacities to meet upcoming future demand of our customers. Our mega manufacturing facility in Karoli has started ramping up and is expected to generate cash profits from Q1 FY25. We are also in the process of setting up our 18th manufacturing facility in Karnataka to fulfil demand of southern customers.

I am extremely confident that our recent partnerships with global players and capacity expansion plans will immensely contribute to growth of the company in future.

We are committed to keep contributing towards the value creation for our Stakeholders and Investors. In this direction, we are glad that the Board has recommended a dividend of 50% i.e. Rs. 1.0 per equity share of face value of Rs. 2.0 each.

Leave a Reply