Varroc Group showcased a host of polymer, lighting and telematics-based solutions. Ashish Bhatia looks at the product-driven, focused strategy.

The Varroc Group put in a stellar team show to assert the competencies of its different verticals. The tier supplier showcased the next generation of product iterations, an outcome of the group having been in action all through the pandemic marred fiscal year 2020 to date. The three year time line meant that the vast exhibit spanned product categories like mirrors, lighting solutions, polymer chemistries, Advanced Driver Assistance Systems (ADAS) and from the ‘Varroc Connect’, telematics business unit of the group. Averred Arjun Jain, President, Electrical-Electronics Business & Whole-time Director, Varroc Engineering Ltd., the company is very bullish on the future. Emerging relatively unscathed from the challenges of Covid-19 that were worsened by the supply-chain bottlenecks that followed, it is far more secure in its prospects. The fundamental demand reduction in the developed world has only helped, he mentioned. Since 2018, the company is focused on its strategy of growing content per vehicle, successfully.

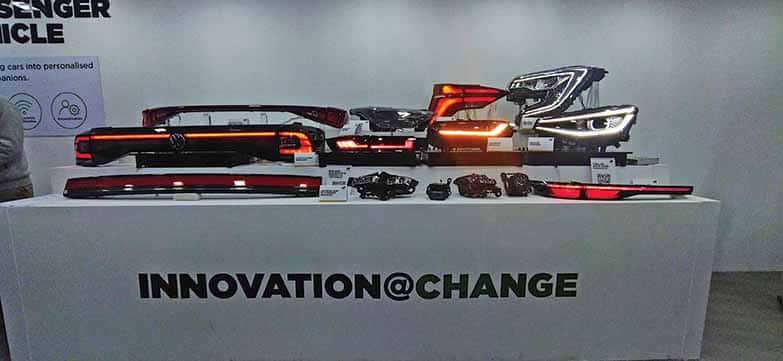

The two-wheeler and three-wheeler segments presented a huge opportunity for the group. Therein the demand for LED lighting was the bigger opportunity that had to be tapped in. Drawing attention to the growth in EV exhibits, Jain admitted to the opportunity resulting out of the emobility segment as being very significant. He stressed how the company was not looking to enter emobility but already supplying to meet the demands of the segment. From Fuel Injection (FI) systems to fully LED head lamps supplied for the XUV7OO, said to be high on localisation and performance to the EV components portfolio has the company mass producing. It is apt that the company, from hereon, builds on the early mover advantage it has gained, explained Jain. Independent of the Total Industry Volume (TIV) and the pace of EV transition versus ICE, the company in the words of Jain is well-positioned and well-diversified to grow.

A laser-sharp focus

Having principally decided on the future direction, the gestation period, even if it were to be deemed longer than anticipated, has the company resorting to a disciplined approach. This expands to bringing out product iterations most suited for market introduction. The chosen direction, informed Jain, was only a logical progression of the company’s legacy products. “For instance, the company makes a traction motor and on ICE we are the market leaders in AC generators and starter motors,” he explained. This leverage has the company taking its electrical capability a step forward. This further applies to electronics where Varroc happens to be among the first electronic suppliers in India. On pure play volumes, the company, informed Jain, was perhaps the largest automotive PCB manufacturer in the country. Keeping EV supplies aside, the company is credited as the only one driving the highly advanced FI systems. The ECU portfolio only expands further. This according to Jain is the fundamental building block for the company’s progression in EVs. The period of transition, therefore, is immaterial.

Having principally decided on the future direction, the gestation period, even if it were to be deemed longer than anticipated, has the company resorting to a disciplined approach. This expands to bringing out product iterations most suited for market introduction. The chosen direction, informed Jain, was only a logical progression of the company’s legacy products. “For instance, the company makes a traction motor and on ICE we are the market leaders in AC generators and starter motors,” he explained. This leverage has the company taking its electrical capability a step forward. This further applies to electronics where Varroc happens to be among the first electronic suppliers in India. On pure play volumes, the company, informed Jain, was perhaps the largest automotive PCB manufacturer in the country. Keeping EV supplies aside, the company is credited as the only one driving the highly advanced FI systems. The ECU portfolio only expands further. This according to Jain is the fundamental building block for the company’s progression in EVs. The period of transition, therefore, is immaterial.

The focus remains on leading the next generation of its product portfolio. With LED head lamps making capability deemed imminent for a head lamp manufacturer in this era, the company has spread out to all electrical components that help it establish itself firmly as an electronics manufacturing company. Having commenced the work on its EV portfolio, in 2016, the expected transition to EVs as of today, quipped Jain, has come in at a rate faster than anticipated and has got the group excited about the current and future prospects. The company is claimed to have closed in on previous peak volumes and is setting new benchmarks internally, Jain informed, the India business grew consistently all through the Covid-19 marred fiscals. And so, the company is confident of registering record revenues in FY23. The second quarter of FY23 (Q2-FY23) happened to be the record quarter in the history of Varroc India. Be it BSVI or the increasingly premium shift of vehicles, the company has focused long on such topics as an early mover of the industry. Despite the market volume being nowhere near the peaks of FY2018-19, the company continues to grow. Making a case in point, Jain gave the example of an LED headlamp priced 6x of the conventional bulb; FI priced at 4x the price of CRDi; digital/TFT cluster at five to 10x the price of an analogue cluster having worked in favour of the company. Today, the Varroc content in an EV is 10x the content of the company in an IC Engine platform. This translates to a product-driven, focused strategy at the company working to its advantage.

The focus remains on leading the next generation of its product portfolio. With LED head lamps making capability deemed imminent for a head lamp manufacturer in this era, the company has spread out to all electrical components that help it establish itself firmly as an electronics manufacturing company. Having commenced the work on its EV portfolio, in 2016, the expected transition to EVs as of today, quipped Jain, has come in at a rate faster than anticipated and has got the group excited about the current and future prospects. The company is claimed to have closed in on previous peak volumes and is setting new benchmarks internally, Jain informed, the India business grew consistently all through the Covid-19 marred fiscals. And so, the company is confident of registering record revenues in FY23. The second quarter of FY23 (Q2-FY23) happened to be the record quarter in the history of Varroc India. Be it BSVI or the increasingly premium shift of vehicles, the company has focused long on such topics as an early mover of the industry. Despite the market volume being nowhere near the peaks of FY2018-19, the company continues to grow. Making a case in point, Jain gave the example of an LED headlamp priced 6x of the conventional bulb; FI priced at 4x the price of CRDi; digital/TFT cluster at five to 10x the price of an analogue cluster having worked in favour of the company. Today, the Varroc content in an EV is 10x the content of the company in an IC Engine platform. This translates to a product-driven, focused strategy at the company working to its advantage.

Manufacturing footprint

The company has contributed to India’s growing manufacturing footprint since its early days as a plastic moulding supplier in 1990. “As of today, the company, in moulding and painting of the two-wheeler segment, holds a ~40-50 per cent market share. This makes our India footprint already comprehensive,” mentioned Jain. The manufacturing footprint spans multiple automotive hubs connected to every major customer. This large footprint has given the company an upper hand in terms of giving it the choice to manufacture at a chosen core location in regions like Maharashtra and Pantnagar or for that matter giving it the leeway to decide on what component requires the supplier to be closer to the OE. The painting business requires proximity to the customer, for instance. Emphasised Jain, it does not require the company to build its footprint ground up but expand on its existing footprint itself. This has given it an advantage of a high go-to-market speed. The company will continue to build on core capabilities like moulding, resin, electrical and electronics.

The company has contributed to India’s growing manufacturing footprint since its early days as a plastic moulding supplier in 1990. “As of today, the company, in moulding and painting of the two-wheeler segment, holds a ~40-50 per cent market share. This makes our India footprint already comprehensive,” mentioned Jain. The manufacturing footprint spans multiple automotive hubs connected to every major customer. This large footprint has given the company an upper hand in terms of giving it the choice to manufacture at a chosen core location in regions like Maharashtra and Pantnagar or for that matter giving it the leeway to decide on what component requires the supplier to be closer to the OE. The painting business requires proximity to the customer, for instance. Emphasised Jain, it does not require the company to build its footprint ground up but expand on its existing footprint itself. This has given it an advantage of a high go-to-market speed. The company will continue to build on core capabilities like moulding, resin, electrical and electronics.

Applicability to customers

On the government interventions, the company looks up to Original Equipment Manufacturers (OEMs) to deal with the finer nuances. “For any supplier, the government interventions trickle down to suppliers from what the OEMs decide to do and go ahead with,” opined Jain. Although it does imply that the company keep a close watch to decide on its R&D outflow, in Dollar terms for an example. The company continues to work in close quarters with the OEMs and is agile enough to be able to translate it into on ground results as may be desired. The company is well positioned on the export front too especially in the metallic business where it addresses multiple market segments from two-wheelers to commercial vehicles and the off-highway.

The focus continues to be on investing to attain a high degree of localisation in markets like India where it holds a definite advantage over scouting for new opportunities. The company hopes to capitalise on the tangible outcome of the plus one strategy as well. Fully aware of the macroeconomics, the company divested its Europe and North America as a near-term way to hedge against a challenged developed world demand. India and China remain the focus markets barring the two-wheeler segment exposure which hasn’t suffered and has the global OEs turning to procurement from India. The company continues to manage investments and capacity augmentation judiciously. “Even for segments with similarities but different use cases, we are largely well-placed with our core tech. We closely look at the requirements to make our highly engineered solutions work for the customer,” concluded Jain. ACI

Varroc Connect

A cloud-connected platform has the Varroc Group bringing end-to-end solutions through Varroc Connect. The combination of hardware and client-side mobile app. allow the customers to take advantage of big data-driven utilities like predictive analysis. This according to Chief Executive Officer, Sagar Apte, will help the vehicle evolve from being a black box earlier to a travel companion. It will allow the end user to manage multiple aspects, he mentioned. The platform, over a decade old, has proven its stability to both domestic and international sets of customers. Taking it many notches higher from a track-and-trace solution to being an analytic platform, it leverages the 4G and 5G networks to relay inputs from connected sub-systems. This in turn paves the way for critical, decision-making. Offering unlimited cloud processing capability, the data management platform target at OEMs is expected to influence integration. The data exchange, for instance, will allow OEMs to share data with insurance companies. With a focus on dumbing down data, especially in a complex world like automotive, data selection (automotive interpreter) is the platform’s USP. With 4G as the tipping point for turning customers into data consumers, the company hopes to leverage 5G capabilities. The features can be expanded to the vehicle handling large chunks of data. The electrification of vehicles is mandating the use of such platforms to track key performance metric like State of Charge (SoC) making it a must-have. The platform boasts of deployment on over ~400,000 connected vehicles. The next biggest tipping point continues to be data exchange which will help customers overcome security vulnerabilities. The company will leverage audit processes with insurance companies and has had in place, dedicated roles like Chief Security Officer (CSO) since 2016, in a forward looking strategy. The key aspects of considerations include OTA updates that are encrypted with digital certificate management at an enterprise, scalable and graded platform. Driven by RoI, the company goes on to help fleet operators to improve upon the safety, fuel theft, and misuse of vehicles in a time bound manner. The company hand holds customers and the penetration is higher and led by commercial vehicles. The company counts OEs like Nissan India, to name few amongst its clientele.

Also read, New manufacturing plant in Hyderabad-EXZOD

Leave a Reply