Showing signs of recovery from the pandemic induced slowdown, MM Forgings is confident of growth with higher asset utilisation. Prateek Pardeshi links the recent performances with the vision to open up new revenue streams.

In the aftermath of the pandemic, closed die forging provider, MM Forgings Ltd. is regaining traction. Confident of opening up new revenue streams with streamlined and well-oiled procedures and practices, the company will leverage an in-sync human capital to realise its full potential. A testimony to efforts fructifying is the recent acknowledgement from CV major Ashok Leyland. Leyland awarded the company with the ‘Silver Award’ in the Cost Category, in 2021. Its expansion spree is also evident from recent acquisitions like that of Cafoma Autoparts for an estimated valuation of Rs.33 crore known to include a rupees five crore subordinated debt. Vidyashankar Krishnan, Managing Director, MM Forgings in the recent past has stated that the second half of FY2021-22 should be much stronger than the first half and also with the likely pickup in the CV market. The company expects to close to around 65,000-tonne in volumes this year.”

With cautious optimism, the company, as per recent reports, could realise a revenue stream of ~ Rs.1,100 crore for FY2021-22 with an incremental hike in projections the years thereafter. As per the company’s investor conference call, the company hopes to increase volumes from 60-tonne to 80-85,000-tonne before scaling up to 1-1.2 lakh tonnes in FY2023-24. It is banking on sweating the new press lines in comparison to the old press lines. The company also hopes to benefit from the growing EV exposure and expectations of the domestic business contributing a higher degree than the exports business compared to the contrasting equation as of current.

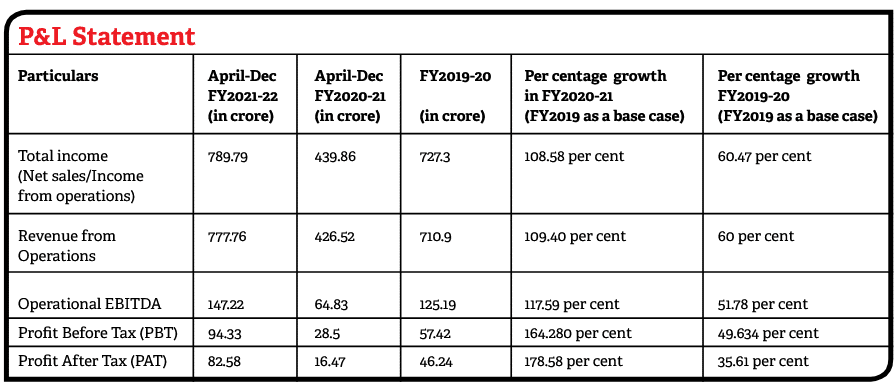

As per the company’s Profit and Loss (P&L) statements, on a YTD comparison basis for FY2021-22, the total income grew by 179 per cent over the same period the year ago (FY2020-21). The latter being an exceptional year and as a result a low base case. Operational revenue stood at Rs.777.76 crore with an operational EBITDA of 147.22 crore. PAT at Rs.82.58 crore had the company turn net positive with a total revenue of Rs.789.79 crore in a significant jump over April-Dec FY2020-21 at Rs.439.86 crore. In comparsion to FY2019-20, operational revenue grew by a margin of 109.40 per cent with growth in EBITDA and PAT at 117.59 per cent and 178.58 per cent respectively. The growth despite a raging pandemic can be attributed to the companies exposure to the export markets, majority being for the North American market where it supplies to Class 8 trucks expected to hold the company in good stead for FY2022-23 and FY2023-24.

Split focus

Traditionally, at MM Forgings, the core revenue is known to be accounted for by passenger cars, commercial vehicles, off-highway equipment, agricultural and engineering component segments. Here, the company caters to a diverse clientele including Original Equipment Manufacturers (OEMs) like Ashok Leyland BEML BHEL Audco Valves and Tractor Engineers as a tier1 supplier. It is able to do so courtesy a 100,000+ metric tonne capacity installed across nine manufacturing facilities spread across the country. From having in place two press, CNC FM hammer, maching plants in Singampunari and Viralimalai; a press, hydraulic press, maching plant in Padappai; Industrial automation division in Chennai; Crankshaft Machining at Rudrapur and an axle beams and stub axles maching plant in Lucknow. The latter being a greenfield facility in the state of Uttar Pradesh.

The company also commissioned a 7000-tonne press in the year 2019, which was dedicated to heavy forging. The company has been able to develop important, high-value-added goods primarily to innovative application of new technology as per the Annual reports made public by the listed company. Front Axle Beams are created utilising an 8000-tonne forging press with the help of the latest technology and a reduced roll design compared to competitors said to use a 12000-tonne forging press. The company boasts of a wide variety of equipment, consisting of mechanical forging presses (1600- to 8000-tonne), CNC forging machines and hydraulic presses going by the spread of facilities at dedicated plants.

With the acquisition of Cafoma Autoparts, the company will look to leverage the latter’s technical prowess in manufacturing, machined crankshafts for the tractor and industrial markets. To give a perspective, Cafoma has a monthly production capacity of 15,000 crankshafts. It currently produces 5,000 crankshafts, per month, on a job-to-job basis. By delivering forged crankshafts to Cafoma, in turn, the company is hopeful of unlocking synergies. The company aspires to grow into a full-fledged provider of machined crankshafts to a wide range of industries with a major focus on automotive including the commercial vehicles segment and farm mechanisation in keeping with the needs of the agriculture sector in the country.

Risk neutral

To hedge against the cyclical nature of performing automotive segments back home, the focus on exports has paid rich dividends to the company given its focus in the North American and European markets. The company continues to be a net earner of foreign currency in an indication of the risk neutral strategy paying off. The current year’s net foreign exchange earnings were estimated at Rs.338.66 crore. To succeed in the stringent quality focused export markets, there is great emphasis on Total Quality Management, at MM Forgings. The company has attained the ISO 9001 and TS 16949 certifications to win customer confidence. Export sales at Rs. 354.89 crore and domestic sales at Rs.356.58 crore is proof to the company’s risks well distributed holding it in a good stead.

Commercial Vehicles (CVs) are an important sector to the company as per Krishnan. With the CV market expected to see a good traction in the United States among other exports markets for the company, the risk neutral exposure might see through the company realising its vision in the foreseeable future. Notably, CV sales account for a majority at 75 per cent of net sales followed by passenger vehicles at 18 per cent with the rest constituting the remaining seven per cent of sales for the company.

Commercial Vehicles (CVs) are an important sector to the company as per Krishnan. With the CV market expected to see a good traction in the United States among other exports markets for the company, the risk neutral exposure might see through the company realising its vision in the foreseeable future. Notably, CV sales account for a majority at 75 per cent of net sales followed by passenger vehicles at 18 per cent with the rest constituting the remaining seven per cent of sales for the company.

Scaling up operations to be able to manufacture 60,000 crankshafts per month, the company is hopeful of breaking onto the top league of integrated crankshaft suppliers in India with its in-house forging and machining facilities. The company, as per its annual report, is looking to sweat its assets optimally and utilising the excess unutilised production capacity to attain its projected outputs over FY22-23 and FY2023-24. The aspirations are backed by cost and material consumption reduction efforts at the Research and Development (R&D) level to reconfigure input costs like that of steel, fuel, and on the front of power utilisation at the plant level.

Axle beams, steering knuckles, crankshaft, axle spindles, gear blanks, sockets, front hubs, ball studs, cross, differential spiders are among the closed die forgings manufactured by the company. Of these the front axle beams, knuckles, and crankshafts will continue to be a major focus area. The business is now working on a complex front axle beam in an 8000-tonne forging press. Using advanced FEA software, the team was able to reduce the load in a mechanical forging press by around 9.5 per cent while maintaining the front axle beam’s performance characteristics. The stress and deflection levels of both designs have been checked, and the optimised design’s stress and deflection levels are within acceptable limits. The focus on technology absorption, adaptation and innovation will continue to drive its growth going forward. ACI

Also read, Safeguarding The Bottom Line

Leave a Reply