Pricol Limited is banking on evolution for sustainable growth. Prateek Pardeshi looks at how the manufacturer is safeguarding the bottom line.

Pricol Ltd. has continued to evolve for sustainable growth since it first commenced operations in 1975. The automotive components and precision-engineered product manufacturer is coming off a tough pandemic marred fiscal with an even greater determination to succeed. It is determined to safeguard the bottom line with refined and well-oiled processes and practices with the help of its in-sync human capital. In a company release, stated Vikram Mohan, Managing Director, Pricol Limited, “We are going through challenging times in the automotive industry thanks to the lockdowns due to the pandemic compounded by the acute shortage of electronic components globally which is taking its toll on the company’s performance. Nevertheless, with prudent cost control and continual new business wins we are confident of delivering above-market growth rates and maintaining the bottom lines despite these challenges.”

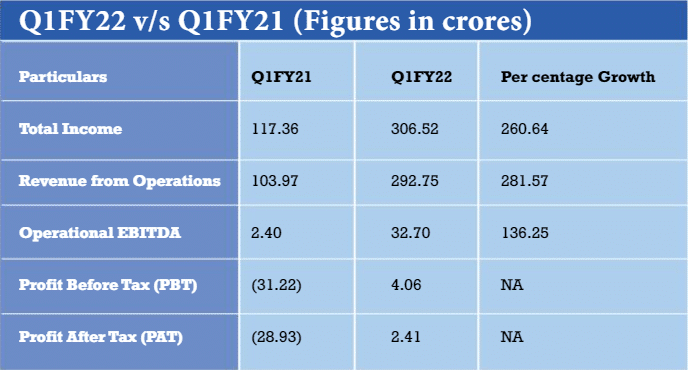

A testimony to the company doing everything in its capacity to safeguard the bottom line is the recent financial performance of the company. The first quarter of the financial year 2022 (Q1FY22) shows a marked improvement over the same period a year ago (Q1FY21) when lockdown restrictions rendered plants inactive, forcing production to come to a standstill (Refer to the table above). Despite comparing on a lower base, the recent turnaround assumes significance. The focus of Pricol, like peer manufacturers, has been on fast-tracking its recovery from the recent degrowth. The focus is to attain a growth momentum akin to the pre-Covid19 levels on a sequential basis before setting sight on new milestones. According to Mohan, the company is well aware of the need to keep strengthening its existing processes and practices to succeed on a mid to long-term horizon, excel and support the mid to long-term outlook. “Loss of sales due to potential further lockdowns and shortage of electronic components we believe will continue to impact the automotive industry in India for a few more quarters. But we remain bullish about the mid to long term prospects for our company due to the new business wins especially in the Electric Vehicle (EV) segment and growth in market share of the company.”

As per the table above, Pricol in Q1 FY22 registered a total income of Rs.306.52 crore compared to Rs.117.36 crore in Q1FY21. Here, revenue from operations was pegged at Rs.292.75 crore compared to Rs.103.97 crore in the same period the previous year. Operational Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA) accounted for Rs.32.70 crores over Rs.2.40 crore. Profit Before Tax (PBT) turned positive to Rs.4.06 crore as against degrowth of (-) 31.22 crore. Profit After Tax (PAT) turned positive to Rs.2.41 crore over degrowth of (-) 28.93 crores in comparison.

Setting aside the low-base effect of FY21 on the quarterly performance, on comparing Year-over-Year (YoY) growth of 2021 with 2020, the company’s net sales witnessed degrowth of (-) 11.67 per cent. The consolidated net profit grew by 142.03 per cent. The operating profit (PBDIT) exclusive of other income grew by 109.55 per cent positively impacting the consolidated net profit which in turn grew by 142.03 per cent. The company also fuelled its growth plans by investing higher. Investments rose from Rs.9.52 crore in 2020 to Rs.15.03 crore in 2021. On a standalone basis, the company witnessed a 17.3 per cent growth in revenue from operations in FY21 compared to the previous year

Strategic moves

The company is also known to have benefitted from hiving off the bleeding overseas operations known to have had a major impact on the bottom line right before the pandemic hit business. The strategic move is claimed to have been in line with the objective to become leaner and focus more on profitable geographies. With the business restructuring, the profitability of its business is banking on dashboard instruments majorly. A look at the pre-Covid19 contribution of finished goods to the sales turnover shows dashboard instruments accounted for a majority in the overall sales turnover at 55.70 per cent as of March 2019 superseding other products and service income, oil pumps, and other auto components (The figure stood at 38.60 per cent as of March 2018).

Fast forward to 2021, the trend continues. The new business wins are led by dashboard instruments too. These include two-wheeler connected LCD and TFT clusters; EV clusters; two-wheeler electronic digital clusters; passenger vehicles and commercial vehicles clusters. The company has also witnessed a pull for fuel pumps, e-purge valves, heavy-duty export pumps especially for export markets, and speed sensors. Today the company is banking on its high-value and high margin products for fast-tracking its growth trajectory. Low value and low volume products are known to have been discontinued in a bid to reduce the resources utilised for the same. Notably, new products are claimed to have accounted for ~ 40 per cent of the revenue driven by R&D spends at 1.80 per cent of sales.

Fast forward to 2021, the trend continues. The new business wins are led by dashboard instruments too. These include two-wheeler connected LCD and TFT clusters; EV clusters; two-wheeler electronic digital clusters; passenger vehicles and commercial vehicles clusters. The company has also witnessed a pull for fuel pumps, e-purge valves, heavy-duty export pumps especially for export markets, and speed sensors. Today the company is banking on its high-value and high margin products for fast-tracking its growth trajectory. Low value and low volume products are known to have been discontinued in a bid to reduce the resources utilised for the same. Notably, new products are claimed to have accounted for ~ 40 per cent of the revenue driven by R&D spends at 1.80 per cent of sales.

Pricol is also evaluating and adopting the global engineering process (like ASPICE) to enhance the product quality of all our electronic products. The company also continues to strategically align with new partners to further its aspirations. Recently, the company inked a strategic alliance with Candera, known for Human-Machine Interface (HMI) tools to cater to its global automotive and industrial customers. This strategic technology partnership with Candera is expected to enable Pricol to get access to global HMI solutions for its next-generation connected Driver Information System (DIS) products serving across all vehicle segments. “We are delighted to be partnering with Candera to enhance our capability to deliver next-generation connected high-end Thin Film Transistor (TFT) based Digital Information Archiving System (DIAS) (single and multi-display) that meet our customer’s ever-evolving technological needs,” concludes Mohan. ACI

Leave a Reply