In an Upfront interaction, Rohit Saboo, President and Chief Executive Officer at National Engineering Industries (NEI), talks about using the Covid-19 induced slowdown for a complete overhaul and finding ways to delight the customer.

Q. How did the company pace itself through the pandemic marred FY2021 on a QoQ basis? Give us a sense of the impact on production and sales?

A. We concentrated on other things rather than production. However, the recovery was promising in Q2FY2021, and especially during the festive season. I would say, it was very heartening to see the recovery in sales. By the last quarter, exports also improved. For us, Q3FY2021 turned out to be better in comparison to the same period last year (FY2020). It wouldn’t be wrong to say that the automotive industry could count itself among industries that witnessed a V-shaped recovery, and we consider ourselves fortunate to be a part of it. We did all we could to keep up production in line with the customer requirement. To break it up, during the first quarter, the focus was on setting the norms for the returning workforce on fronts like social distancing and Covid-19 appropriate SOPs. The slow pace was limited to the month of, I think, the end of May and to an extent in June. The focus then helped us in the subsequent quarters, and till now, we have kept the guard up and are lucky to have not had a single fatality.

Q. Could you share with us instances of going beyond the call of duty for the benefit of your key stakeholders and society at large in the hour of crisis?

A. As part of the CK Birla group, we prioritise social activities for the larger good. We contributed Rs.35 crore to the Prime Minister relief fund for starters at the Chairman’s level. Besides, we put in a lot of effort to ensure the wellbeing of our stakeholders with special permissions including distributing sanitisers and masks. We used our canteen, for instance, to prepare and distribute two meals a day. Led by our engineers in the R&D division, while we did not succeed in building a ventilator, we successfully developed a splitter. The latter, in effect, allows one ventilator to be used for two patients. It was very well appreciated by the local hospital staff. We also developed 3D printed shields used in airlines. These were distributed to all the Covid warriors including the medical fraternity and the police force. The entire staff and workforce contributed one day’s salary to the Chief Minister relief fund. Besides, the company made rupees one crore contribution. It energised our workforce and gave them a sense of involvement and commitment. It was a very humbling experience trying to help people, especially during those times in hindsight.

Q. You spoke of a 100 crore, three-year investment plan at the Auto Expo 2020. Did you have to factor in any rollbacks from the investment outlay in the aftermath of the pandemic?

A. There is no rollback. It has just been moved ahead by a period of at least six months. We requested all our machine suppliers to in turn delay their supplies by six months. The investment plan remains as it is; it is just that the timeline has shifted by six to nine months.

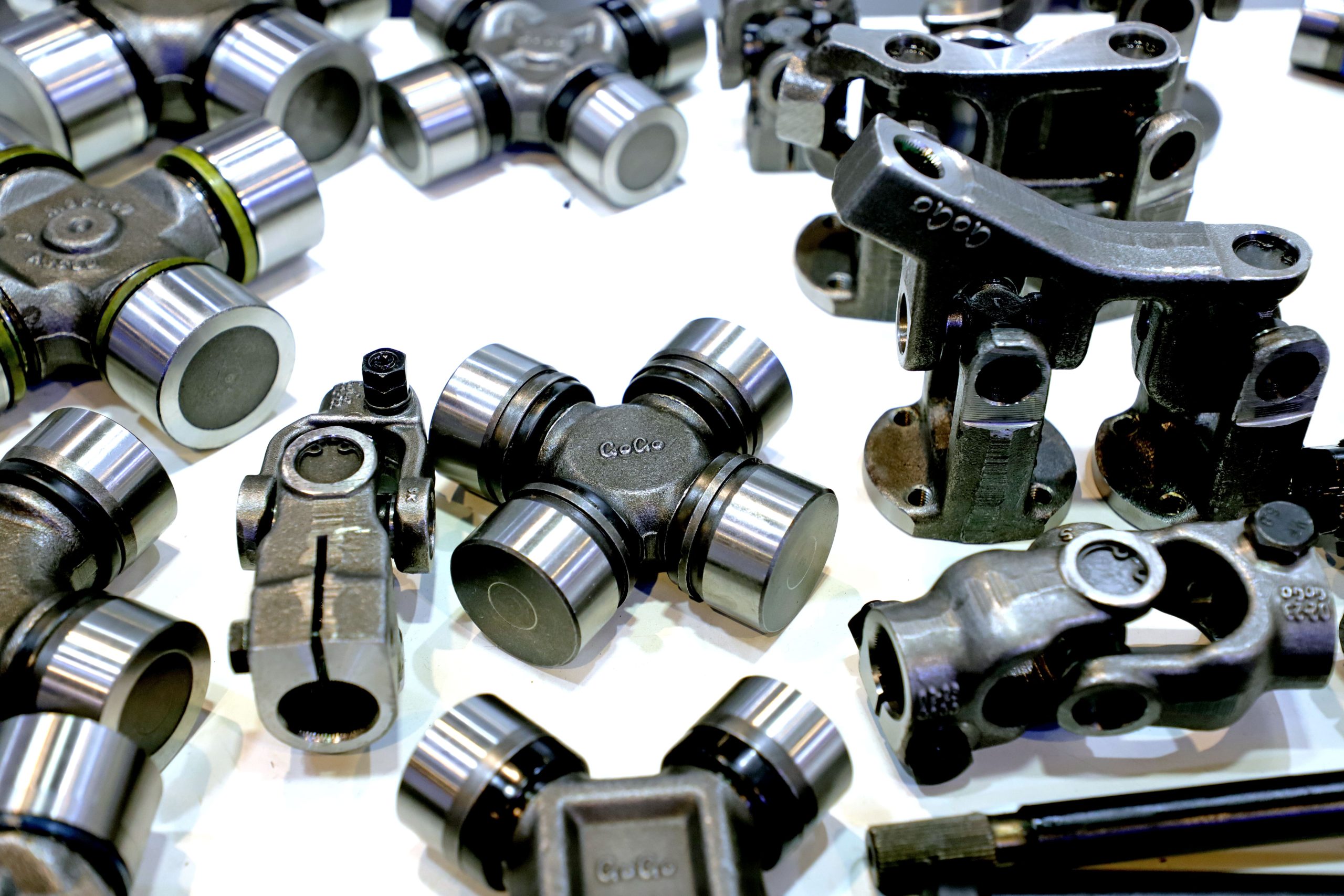

Q. How did you met the objectives associated with the launch of the needle bearing targeted at OEs and industrial applications for both the domestic and international markets?

A. This is a new project. Most of the machines were coming in from Japan. Due to the Covid induced lockdown and lack of shipping arrangements followed by the unavailability of Japanese experts for the installation, the project was delayed by four months. I am happy to share that we compensated for the nearly two and a half months of those four months lost by quicker installations. Using virtual meet software, we had people in Japan guide us through the installation. It is now that we are in much better shape.

Q. Could you elaborate on the outlook for shell bearings, weld cage roller assembly and turned cage

roller assembly?

A. It’s a little early for us to talk about the outlook since we are more involved in setting up the listing and production at this stage. We are talking to our customers and hope to develop the samples very soon, etc. I will be better placed to give you an outlook of these once we commence manufacturing.

Q. In hindsight, how do you look at the acquisition of Kinex bearings? Are you still as bullish on the prospects?

A. Yes, we are very bullish on the Kinex bearings acquisition. It helped us when we were in a state of lockdown. Luckily, Europe was still unlocked. While their sales were a little slow-moving the total cumulative sales made up for it. That really helped us! We used the time at hand for integrating remotely, and to connect at various levels across engineering and management. We are much more closely integrated today. There was a healthy exchange on the front of knowledge sharing and quality interactions in a two-way effort.

Q. Would you like to share any value addition to the synergies that helped tackle the crisis cohesively? Including cross leveraging facilities, for instance, the plants in Slovakia (Bytca and Kysucke Nove Mesto) or vice versa?

A. We have some vacant area, and our Slovakia plant produces industrial bearings. So there is a scope that we can set up for automotive bearings there. It’s under consideration and we are thinking on the lines of mutually leveraging the strengths of each. It involves consideration of what we can develop together for the future. For instance, they are also into aerospace bearing, so there is a scope to bring the aerospace bearing into India in line with the Atma Nirbhar Bharat programme. We can use the technology, however not by import but through local manufacture. So we will learn from them. I think by early 2022, we will manufacture aerospace bearings.

Q. How did you add to the efficiencies of the supply chain including vendor management?

A. This was a perfect time for us to introspect. After the first week of lockdown, we were taken off guard. It led us to realise a need to initiate a massive cost reduction programme to be able to survive the year. Expected to have a significant impact on the company, we engaged our people as the key was to keep them involved. We sought various suggestions to execute the cost reduction. For example, it took us six to seven days to bring about improvements across the manufacturing and the non-manufacturing processes previously and today it takes maybe two hours. These improvisations helped us. We also gathered steam to progress in the direction of industry 4.0 and or digitisation which was initiated first two years ago. For it, we also included our suppliers pan India in the exercise. We trained approximately 70 suppliers and supply chain software was installed successfully, free of cost. It has led to the communication and processes with our suppliers turning seamless. A few suppliers remain in an 80:20 implementation digitising a majority.

Q. How did you add shopfloor efficiencies across the Jaipur, Newai (Rajasthan), Manesar (Haryana) and Vadodara (Gujarat) plants?

A. The focus was on process improvement. So a lot of process improvement trickled to the plants. We focused not only on efficiencies and productivity but also on further improving upon the quality. The better quality we produce, the fewer rejections we face. Data mining on productivity and operational efficiency has increased significantly. Overall, the processes today are leaner and agile. We also invested heavily in automation, connected machines, and used a data-centric approach to drive decision making. For instance, we implemented an entire energy management system. We know that a particular part of the plant or a specific machine is drawing more energy with a click of a button leading to proactive maintenance and energy saving.

Q. What sets the IGBC awarded Jaipur plant apart? Is it also your flagship plant?

A. Yes, Jaipur is our flagship plant. It is our central plant and also serves as the central office quarters including R&D and sales management under one roof. That’s what sets it apart. We will be celebrating our 75th (Semisesquicentennial) year of establishment next year. Notably, many parts of the buildings that got the IGBC Award were 70-75 years old, and that in itself is a significant achievement. We have implemented major green practices and the highest water and energy conservation standards at our plant. Waste management, CO2 emissions and reduction have been prioritised too. The activities over the last six to eight years have been able to save us almost six million litres of water per year. For instance, the effluent treatment plant treats the wastewater wherein the water is used for landscaping. There is zero discharge since the plant is based in the heart of the city. We have also installed a 1.5 megawatts solar roof powered system to help efficient air conditioning. Our carbon footprint has reduced by almost 38 per cent. So, it’s a major achievement for us, and we are very proud that we are amongst the environment-conscious companies. It’s just the start and not

the end.

Q. Have you felt the need to consolidate the product portfolio at any stage while adding to the efficiencies on the whole?

A. We continue to evaluate the market and customer requirements to either expand or consolidate; right now, we are in the expansion phase. Our tagline is a flexible solution, which means that we go out of the way to meet our customer expectations. We are closely associated with our customers and tailor our R&D efforts to meet the evolving demands.

Q. How has the transition to BSVI vehicles and the focus on EVs impacted your exposure to

the segments?

A. As far as bearings are concerned, neither BSIV nor BSVI has led to a difference in bearing consumption. We are not affected from that perspective. On EVs, NBC was one of the frontrunners in developing a solution for the EV motor transmission. We started working on it at an early stage and today most EV companies in India and some in Europe use our solutions. We are already supplying EV bearings.

Q. Have you been able to meet the objectives associated with the 2018 announced preset hub assembly? For instance, replicating the traction in international markets?

A. It is progressing in line with our expectations. As domestic OEMs are focused on launches, cost-efficiency is high on their agenda. Mainly for the trucks, the preset hub assembly requires us to continue educating our prospective customers. We are hoping for customers to make the transition as they prioritise ROI going forward.

Q. With OEMs prioritising RoI on BSVI investments, have EV plans been stretched?

A. There was a phase of about a year and a half when the EV market witnessed a slight dip. There is no doubt now that EVs are here to stay. If you see the recent past, a lot of announcements have been made about EV reveals. With new entrants like Ola into the mix, the trend is looking very positive. I think the first segments to turn fully electric would be the two-wheelers and three-wheelers.

Q. How do you expect the call for flex-fuel engines and higher ethanol blends to impact bearing material selection? For instance durability of sliding bearings has been a concern area?

A. Yes, only the sliding bearings used in engines is a concern area. However, there are coating solutions and technologies available, which we have to adapt when the time is right to allay all the fears.

Q. How has the China+1 strategy played out both from an import and export perspective? How do you aim to enhance your contribution to a self-reliant India?

A. This is very interesting. A little over the last one and a half years customers are looking for alternatives to China. Therefore, India, especially the auto component market stands to benefit from it. India auto component exports account for more than USD 15 billion. Quality-wise we don’t lag either. It makes us a perfect substitution market for most global OEMs. The near 100 per cent spike in inquiries is a testimony to this renewed interest. However, you must know, in automotive, for new customers, there is a time lag involved for validation. So, I think many of our new applications are currently under testing and hopefully, in the future, it would translate to new orders. In the past, many of our companies were dependent on China be it for raw material or for intermediate components. China was leading in technology. The recent trade dynamics have compelled us to source locally. We have all already reduced our dependence on China, I would not say it is zero, but we are moving towards it. Since any raw material change has to be approved by the customer, change takes a long time in the automotive industry. The government should understand that and therefore give us more time for the transition. The Indian raw material suppliers also need to rise to the opportunity and develop the capability to supply to us.

Q. A word on the government support extended to the industry in FY2021 and what is it that you expect to come your way?

A. So, according to the policy draft, the Production Linked Incentive (PLI) scheme will help accelerate the pace of manufacturing, overall. In PLI, A huge sum of about Rs.45,000 crore is allocated to the auto and auto component industry. That should give a great fillip. It just remains to be seen how efficient it will turn out to be and how easy it will be to take advantage of the underlying schemes. Schemes like global sourcing scheme, component champions scheme besides PLI ranging from two to 12 per cent, should make us more competitive globally. It’s a great initiative by the government. From the OEM perspective, the demand for a reduction of GST from 28 per cent to 18 per cent if met will translate to a great run for the automotive industry.

Q. What are the near to medium term priority focus areas for the company, and what is your expectation of returning to benchmark profitability?

A. Fifty per cent of our people are still working from home. Our key objective is to keep all the people engaged, keep them safe and distinct because whatever said and done, Covid is still not over. Given the size of a country like India, it could take anywhere from six months to one year to vaccinate everybody. So the first thing is to keep our people safe and engaged. And with that, we will further improve our services to the customer. It essentially means faster turnaround, faster development, improved production services and shorter product development cycles and so on and so forth. As mentioned earlier, we are looking at partnering suppliers from India. So we would also like to partner with the raw material suppliers for some newer material, which can help shave costs. Industry 4.0 or digitisation also remains a key focus area. It will contribute to our agility and we hope to accelerate it even further in the coming months. ACI

Leave a Reply