In a Frost & Sullivan growth opportunity briefing, stakeholders of the auto industry discussed growth segments, resource optimisation and cost rationalisation across verticals for recovery.

Story by: Deepti Thore

Frost & Sullivan got key, global associate partners to discuss growth segments, resource optimisation and cost rationalisation across verticals for industry recovery from the pandemic. In the webinar titled, ‘Identify Growth Opportunities Across Automotive Verticals for Industry Recovery’ held on April 29, 2020, associate partners from the firm got together to weigh the impact of the Covid-19 pandemic on the global automotive fraternity including the Middle East, Europe and Asia-Pacific regions. The stakeholders built on the firms’ comprehensive scenario-based analysis prepared on the basis of challenges faced thrown at multiple automotive segments. Among topics touched upon were critical insights and directions to help organisations rebound and recover. The webinar focused on global economic analysis, the shift in powertrain preferences besides talking about emerging trends like in automotive retail. Automotive annual vehicle production projections, OEMs mitigations plans and decisive actionable roadmaps made for insightful takeaways from the session. With demand recovery posing a substantial challenge, the automobile sector is projected to experience a degrowth 24 per cent during 2020.

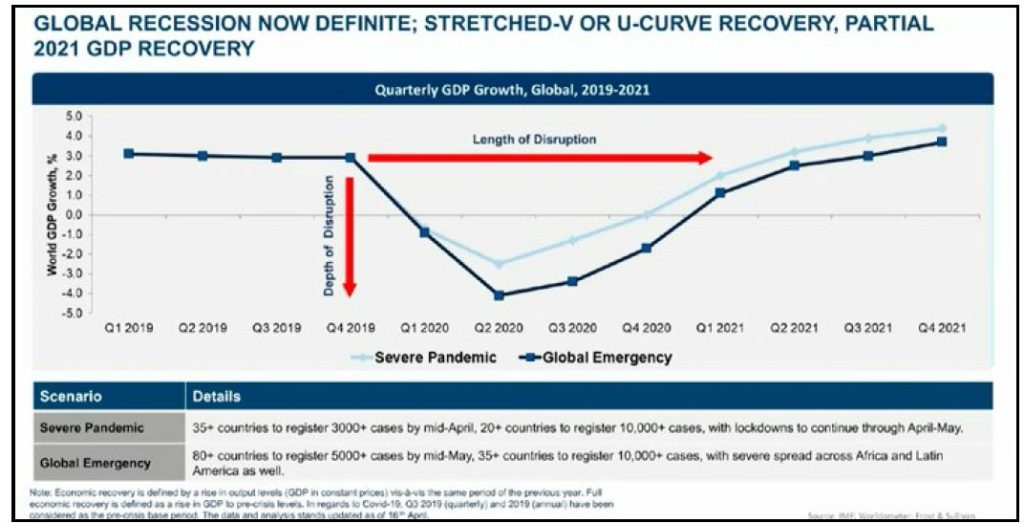

Global macroeconomics trends

Providing a quick overview of the global macroeconomic scenario, Sarwant Singh, Managing Partner – Middle East, Africa and South Asia, Frost & Sullivan started by highlighting three key factors regarded as important and pertaining to the recession. Depth of disruption, the length of recession and the speed of recovery. According to the analysis, the depth of disruption is expected to be anywhere between one to five per cent. The length of disruption is expected to span two to three quarters. In terms of global emergency scenarios, it could last until four to five quarters, opined Sarwant. Citing measures to restore normalcy, he cited various governments known to offer stimulus packages. For instance, the United States offered 1.5-2 trillion worth packages, the European government might consider offering stimulus of similar levels. Taking an optimistic view on recovery in the automotive sector from Q42020, Sarwant expressed it as a crucial time for recovery. As per a statistical graph, the industry is expected to make a V recovery. “It means once the market starts recovering we can come back to the original numbers very quickly,” he stated.

Adding that most of the western region was expected to be weighed down by a recessionary period, Sarwant mentioned that there could be exceptions. “The Asian region including China might escape it,” he said. Citing China’s 60 per cent dip in car sales relative to 2019, initial numbers that trickled in for April-January 2020, according to Sarwant, were 80-90 per cent lower in comparison to the last year. The panel also discussed how the auto industry staged a return from the global recession of 2008-09. Back then, the industry was resilient enough to bounce back within two years. In the current scenario, Sarwant predicted the market to decline to 10-15 million units. It was concluded that the target to reach 100 million car sales wasn’t realistic until 2025-26. Sarwant cautioned the industry of a recovery period of two to three years to get back to pre-recession levels.

Financial support and revamp measures

Most of the OEMs and components manufacturers have successfully revamped or are in the process of revamping their production lines to manufacture medical equipment, PPE kits etc. With learnings from the Great Recession (2008-09), the auto industry has been very quick to adapt. In terms of liquidity, suppliers it was said were at a greater risk compared to OEMs. Gathering insights from case studies across manufacturing plants across North America and Europe, it is learnt that most of the model variants are being deferred. It is also learnt that most OEMs are cutting down on complexity levels to sustain. With customers expected to resume buying in a quarter’s time, OEMs could work out a flurry of promotions and incentives to lure the customer post the lockdown ends. Among other initiatives, relief programs, new payments terms, Flexi EMIs and heavy discounting could be on the anvil. In finance, credit line extension measures are expected to be taken. Second generation stimulus packages will include a lot of benefits for capital spending and electric vehicles will also benefit from these stimulus packages.

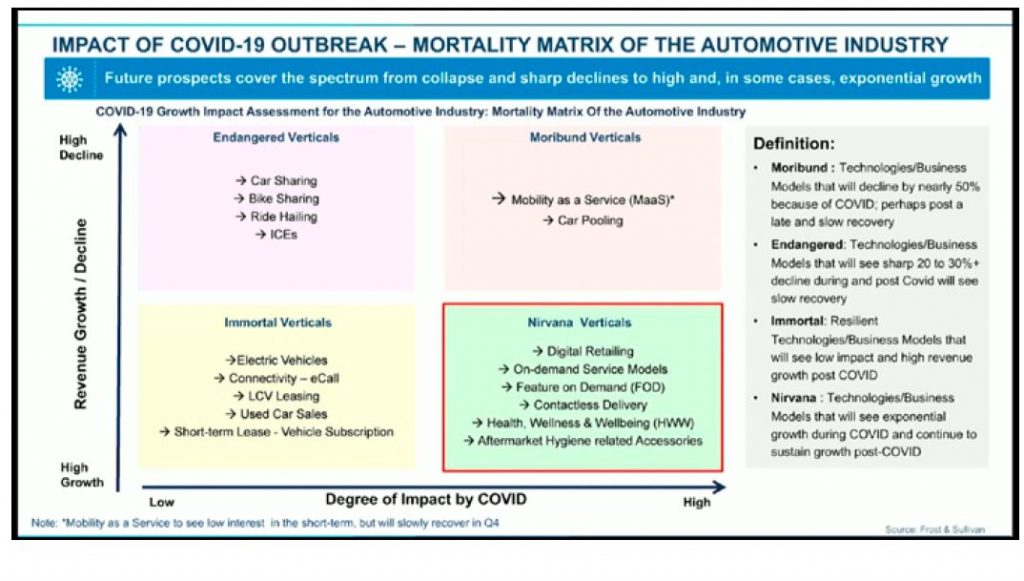

Mortality matrix

As per the F&S mortality matrix developed on the basis of impact on and growth opportunities in different verticals, industries have been divided into four different quadrants namely ‘Endangered Verticals’, ‘Immortal Verticals’, ‘Moribund Verticals’ and ‘Nirvana Verticals’. While carpooling, bike pooling, ride-hailing and ICE-powered vehicles were classified as Endangered, Mobility as a Service(MaaS) and Carpooling were appended to Moribund. Immortal Verticals included electric vehicles, connectivity, LCV leasing, used car sales and short-term lease subscription. Nirvana vertical included digital retailing, on-demand service models, Feature on Demand (FOD), contactless delivery, Health Wellness and Wellbeing (HWW) and aftermarket hygiene-related accessories. Companies working on the development of ionisers and ozonisers as standard for the cars were spoken off extensively in the panel discussion.

Digital Retailing

Talking about digitisation and retail becoming a reality, Dr Julia Saini, Associate Partner Mobility, Frost & Sullivan mentioned that physical visits to the showroom had declined by 80-100 per cent depending upon the region. “Digitisation will be a ticket to survival as it is already seen that around 50 per cent dealers are able to acquire complete online vehicle sales over the phone or by doing home delivery,” she said. Urging the industry to look at out of the box solutions to recover from the slump, Saini gave the example of Skoda. In the UK, Skoda engaged in imparting online guidance, experiential virtual tours and demonstrations to customers. In the first month of the lockdown itself, the manufacturer is said to have delivered 2000 hours of product demonstration online enabling it to generate an estimated 200 crores in just one working week. Renault, on the other hand, launched a new platform providing special showroom tours and remote signature processes. Dealers can now participate in it and receive a full margin and final commission on each sale without the customer having to visit the showroom. From an aftersales perspective, the proliferation of pick up and drop of vehicles, service options, sanitisation programs and good warranty options to show brand loyalty has been witnessed. OEMs and retailers are focusing on investment strategy with digitisation as plan A.

Revenue generated by online vehicle sales and aftermarket sales is expected to grow from USD 120 billion to 605 billion by 2025 as per a projection. Online used vehicle market alone is also expected to grow by a margin of 3x by 2025. Parts and accessories business globally is expected to reach a valuation of USD 78 billion with online service generation revenue pegged at USD four billion driven largely by retailers and the aggregators. In terms of unit sales, online would account for six million units by 2025. While Europe tops the list of online vehicle sales as per recent data, China could catch up through a locally built platform with retailers like Alibaba leading the path. It is noteworthy, in 2016, Alibaba is claimed to have sold a whopping 100,000 cars online within 24 hours. Since utilisation rates have nosedived, garages were advised to operate at 80-90 per cent utilisation levels to turnaround business.

Connectivity platforms

Connectivity is about building more communication with customers to deliver relevant digital features, prioritising development and rolling out more relevant features. Taking the example of General Motors leveraging their ‘OnStar’ platform with telematics powered, free emergency services known as ‘Crisis Assist’, a case was made for advanced connectivity platforms, open-sourced and scalable in nature. “To be able to monetise some digital features around the topic of health and well being which is in demand is also a good opportunity”, advocated Franck Leveque, Partner & Business Unit Leader Mobility, Frost & Sullivan. Leveque batted for pay-as-you-go features gaining more prominence in the near to medium term.

Health Wellness and Wellbeing

Topics such as Health Wellness and Wellbeing (HWW) have already been identified as a megatrend for the automotive industry and the current COVID situation, it was said, would only help further accelerate the proliferation. Automobiles will have more built-in solutions which are active and embedded in vehicles, brought-in types of solutions that leverage devices and wearables. Beamed-in solutions which are cloud-enabled, including location-based service, on-demand features and so on. Companies like Tesla are offering filters with biodefense mode as an attractive value proposition. Location-based tracking for hotspot or emergency services will gain prominence. Monitoring of vital parameters using sensors and cameras for the vehicles to respond and analyse is also crucial. Cabin sterilisation is one of the many features considered by MG motors in India with ‘MetLife’. Surface shield protection is another emerging domain.

EV ecosystem

In markets like Italy and Europe, the demand for electric vehicles has been higher than the demand for ICE-powered vehicles. “We have recession combined with possible relaxation of regulations and low oil price which under any circumstances will be a recipe for a disaster situation,” said Franck Leveque, Partner & Business Unit Leader Mobility, Frost & Sullivan. Adding that demand for EVs stands to be hit hard, the production model applied to EVs, supply chain solutions and consumer confidence associated with EVs will eventually become its biggest allies to rebound. Skateboard manufacturing platform characterised by a low flat battery that is the structural belly of the car according to the panel emerged as the ideal choice for joint manufacturing and licensing. Such collaborations are expected to drive the volume back once the market corrects itself. “Consumer demand changes constantly and for self-sufficiency, it is necessary to open doors not just for EVs but for the entire ecosystem that comes with it,” he opined. Since most vehicle manufacturers planned EV launches for 2021 and 2023, Leveque was of the firm belief that there would be a limited impact. He, however, cautioned startups on the road ahead. With support from the government, auto companies can rethink the fundamentals of the business model in terms of value creation, vehicle sales or throughout the lifecycle of a vehicle. ACI

In markets like Italy and Europe, the demand for electric vehicles has been higher than the demand for ICE-powered vehicles. “We have recession combined with possible relaxation of regulations and low oil price which under any circumstances will be a recipe for a disaster situation,” said Franck Leveque, Partner & Business Unit Leader Mobility, Frost & Sullivan. Adding that demand for EVs stands to be hit hard, the production model applied to EVs, supply chain solutions and consumer confidence associated with EVs will eventually become its biggest allies to rebound. Skateboard manufacturing platform characterised by a low flat battery that is the structural belly of the car according to the panel emerged as the ideal choice for joint manufacturing and licensing. Such collaborations are expected to drive the volume back once the market corrects itself. “Consumer demand changes constantly and for self-sufficiency, it is necessary to open doors not just for EVs but for the entire ecosystem that comes with it,” he opined. Since most vehicle manufacturers planned EV launches for 2021 and 2023, Leveque was of the firm belief that there would be a limited impact. He, however, cautioned startups on the road ahead. With support from the government, auto companies can rethink the fundamentals of the business model in terms of value creation, vehicle sales or throughout the lifecycle of a vehicle. ACI

Leave a Reply