Jamna Auto Industries Ltd. is focusing on high value-accretive products like the BSVI compliant spring series.

Jamna Auto Industries Ltd. (JAI) commands a majority share in automotive suspension solutions. The regulatory-driven move towards Bharat Stage VI (BSVI) emissions norms has had the company leverage the mammoth 70 per cent market share (66 per cent for Q42020) it commands of the Original Equipment Manufacturer (OEM) business. JAI is the largest supplier to OEM clients like Tata Motors, Ashok Leyland and Daimler India Commercial Vehicles. Other major OEM clients include VE Commercial Vehicles, Mahindra & Mahindra, Force Motors, Isuzu Motors, SML Isuzu, Toyota and UD Trucks. The company with a well-planned portfolio expansion strategy is focusing on high value-accretive products expected to bring in gradual or incremental growth in value.

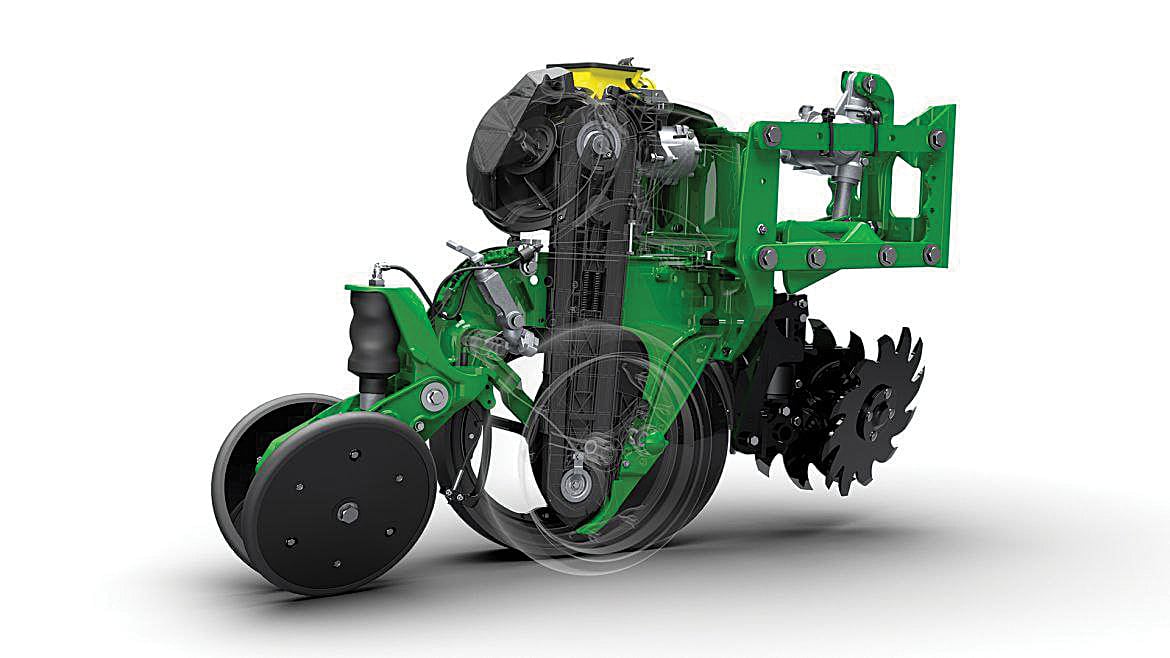

Adding to the existing product mix, new products, the company according to Randeep Singh Jauhar, Vice Chairman & Executive Director, Jamna Auto Industries is confident of significantly adding to the perceived USPs of BSVI vehicles over their BSIV counterparts. These include claims of a ride quality akin to passenger cars, redesigned cabins for greater driver comfort, computerised engine and better mileage to name a few. Besides contributing to the all-important estimate of up to 5x reduction in emissions that will drastically curb vehicular pollution. Of the product additions to its BSVI portfolio that include a lift-axle, stabiliser bar, pneumatic suspension, trailer suspension and allied products like U bolts, z springs, opined Jauhar, the company is confident of the modern BSVI compliant springs accounting for strong growth. Notably, leaf springs in the recent past accounted for approximately 91 per cent of the sales with the rest from lift axles and pneumatic suspensions.

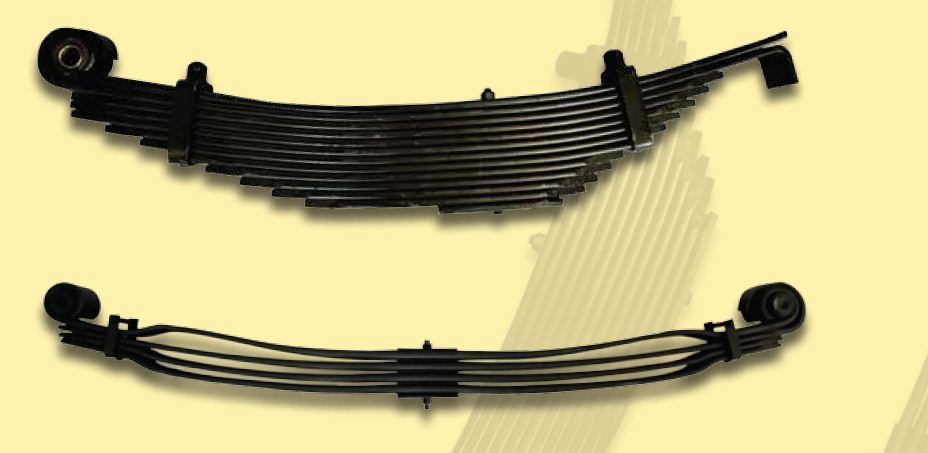

BSVI spring range

JAI manufactures multi-leaf springs from three kilograms to 200 kg to cover a wide product range suited to commercial vehicles and special application vehicles. The DNA of the JAI BSVI compliant spring range is made using the 51CrV4 material used as the raw input for manufacturing the springs. Known to be high strength quench and tempered steel, it can withstand the field severity associated with springs deployed in the heavy-duty commercial vehicles. As per the European patent office study, a number of leaf spring and spring steels are classified in accordance with international standards with a tensile strength ranging between 1300 MPa and 2000 MPa. The values are said to depend considerably on the thickness of the part. The highest values as per the study are limited to springs that are not very thick. For instance, in general, coil springs manufactured from cold and hot-formed wire rod. In case of the very thick suspension elements like the leaf springs used in heavy commercial-industrial vehicles, very high-quench hardenability steels like the 51CrV4 make for an ideal choice.

The main leaf of the JAI spring series is known to be a hybrid of the conventional and parabolic spring. It is claimed to be lightweight and said to have a capacity to carry higher payloads striking a perfect balance for the heavy-duty performance expected of it. Light-weighting is claimed to in turn lead to higher fuel-efficiency and mileage in line with the company’s commitment to contribute to a greener environment with its next generation of products according to Jauhar. The new series is claimed to lead to less tyre wear and tear besides eliminating the need for an overhaul with grease. Grease overhauling is typically associated with the older generation of squeaky springs.

Corporate declarations and financial snapshot

In a SEBI disclosure, the company declared that the Promoter Group company – MAP Auto Ltd acquired 1,00,000 shares (0.02 per cent of the total share/voting capital wherever applicable) carrying voting rights. As per the statement of the company’s audited consolidated financial statement for the quarter and the year ended March 31, 2020, the company recorded a total operating income of Rs. 23,749.43 lakhs compared to Rs.22,858.99 lakhs for the previous quarter (Q32020) exclusive of the other income. A sharp decline from the Rs.54,283.50 lakhs recorded in Q32019. On an annual basis, the company recorded an operating income of Rs.112,895.15 lakhs against Rs.213,481.23 for the year ended March 31, 2019. Total Comprehensive Income for the period stood at Rs.1124.57 lakhs for Q42020 against Rs.1014.22 for the previous quarter (Q32020). A sharp decline from Rs.3190.36 lakhs in the quarter ended March 31, 2019. On an annual basis, the total comprehensive income stood at Rs.4,797.02 lakhs against Rs.13,607.86 lakhs the previous year (March 31, 2019). In FY2020, the company attained 32 per cent revenue from its new products and 24 per cent revenue from new markets. Return On Capital Employed (ROCE) for FY2020 stood at 16 per cent. The company sustained a dividend payout for the ninth consecutive year at 40 per cent.

Renewed outlook

The homegrown top leaf spring brand ranks second in the world with a manufacturing capacity of 2,40,000 metric tonne per annum. A complete suspension solution provider for commercial vehicles, the company has nine state-of-the-art plants strategically located in close proximity to OEMs at Yamuna Nagar, Malanpur, Jamshedpur, Pune, Chennai (leaf springs and suspension), Pilliapakkam, Hosure and Pant Nagar (assembly plant), Lucknow ( both under subsidiary entity). The company has additionally built capabilities at two new locations in Indore and Adityapur. The company is known to have 5000+ part numbers of leaf springs in the aftermarket space. The Company’s reflection on Quality Standards is its recognition of the highest Quality Management System standards for the Automotive Sector – ISO/TS16949:2009 and ISO 9001:2008. All major operations are known to have been set up with Poka-Yoke systems to ensure the highest quality standards with highly reliable mistake-proofing or inadvertent error prevention.

The agreement with Tinsley Bridge Ltd., the UK for transfer of extra lite spring technology and special steel technology is believed to give it a technical edge over its competitors. With an indigenous Research and Development centre capable of catering to design of all automotive applications, explained Jauhar, GM Sales, Jamna Auto Industries there is a facility of in-house validation and testing of products using Servo Actuator to simulate actual vehicle conditions. Using CNC automatic parabolic rolling machines imported from Japan and Germany, the company according to Jauhar has ensured high levels of consistency for instance in the stiffness in the springs.

The agreement with Tinsley Bridge Ltd., the UK for transfer of extra lite spring technology and special steel technology is believed to give it a technical edge over its competitors. With an indigenous Research and Development centre capable of catering to design of all automotive applications, explained Jauhar, GM Sales, Jamna Auto Industries there is a facility of in-house validation and testing of products using Servo Actuator to simulate actual vehicle conditions. Using CNC automatic parabolic rolling machines imported from Japan and Germany, the company according to Jauhar has ensured high levels of consistency for instance in the stiffness in the springs.

As the company resumes operations at plants and offices basis customer orders and as per permissions received from authorities and in adherence with the social distancing norm and Governments guidelines, the company is banking on its strong aftermarket network for growth in the BSVI era. Through its subsidiary JAI Suspension Systems LLP (JSS LLP), the company finds itself in a good state to cater to the domestic aftermarket demand. With 3000+ distributors, 6000+ retailers and 15000+ mechanics across 465 cities in India, at more than 16,000 touchpoints the company has a valid reason to believe so. In the immediate near term, demand for the company’s product is however directly dependent on production levels of OEM’s and the commercial vehicle utilisation scale in the domestic and export markets signed-off Jauhar. The Group maintains capex plans of Rs.80-85 crore per annum going forward.

ICRA outlook

As per the consolidated view by ICRA of Jamna Auto Industries Limited (JAI) and its subsidiaries, the revision in outlook factors for long-term/short-term: Fund based and non-fund based to AA-/A1+ reaffirmed; outlook revised to negative from stable is stated to be in course with an expected continuation of weak demand trends in the Commercial Vehicle (CV) industry over the near term. It is also an outcome of the weak macroeconomic environment coupled with the price hikes on account of transition to BSVI emission norms effective April 2020. The M&HCV (truck) volumes contraction by 42.3 per cent (11M FY2020) and other dampening factors like the revision in axle load norms (from July 2018), weak economic activity and infrastructure spending together with the weak financing availability as a result of the liquidity constraints faced by NBFCs. ICRA cites the implementation of GST and E-way bills leading to the faster turnaround time of trucks resulting in surplus capacity in the trucking system. The surplus capacity has hurt the demand for new vehicles. This weakness in the M&HCV demand according to ICRA resulted in moderation in sales of JAI Group to CV original equipment manufacturers. The decline in its aftermarket sales in 9M FY2020, as transport operators deferred replacement cycle, marked a sharp 44.2 per cent decrease in overall sales. JAI on its part is known to have negotiated the headwinds through several cost control initiatives. The rating reaffirmation has taken timely measures by the management into consideration. Going forward, ICRA expects the Group to benefit from its increased focus on replacement and export market as well as new product development. It is expected to present the company with medium-term growth opportunities with content per vehicle rising. While the strong business position with CV OEMs, a favourable shift in sales mix towards higher-value accretive products and comfortable credit profile hold the company in good stead, the credit challenges, the company needs to address on priority include high segment dependency exposing it cyclicity, high client and product concentration and elongation of receivable days leading to a higher working capital requirement.