The Union Budget 2025, presented amidst a charged parliamentary session, maintained the course for India’s economic future and ended with a surprise forego to boost growth, writes Ashish Bhatia.

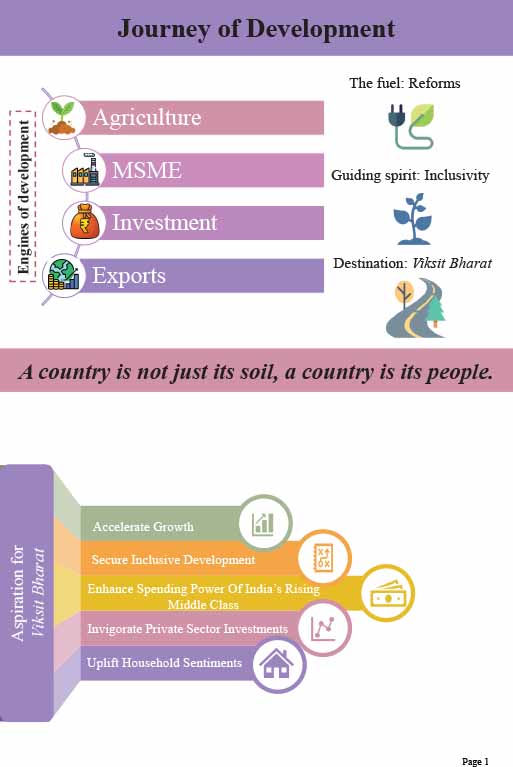

With a focus on accelerating growth, fostering inclusivity, and unlocking national potential, the budget pursued transformative reforms across key sectors. The vision of Viksit Bharat—zero poverty, a 100 per cent skilled workforce, and a self-reliant economy—was at the core of the budget’s roadmap and FM Nirmala Sitharaman’s eighth consecutive Union Budget speech.

Ø Economic outlook and growth trajectory

Emphasising India’s position as one of the fastest-growing major economies, the budget underscored the nation’s resilience amid global challenges. The next five years present a unique opportunity to drive balanced growth, strengthen domestic industries, and integrate further into global supply chains. India’s GDP growth remains strong, projected at 7.2 per cent for FY 2025, continuing its upward trajectory. Inflation has been managed within the four to five per cent band, and Foreign Direct Investment (FDI) inflows have seen a 15 per cent year-on-year increase. With a Capital Expenditure (CapEx) of Rs. 10.18 lakh crore, the government is prioritising infrastructure, manufacturing, and job creation. The budget also commits Rs. 1.5 lakh crore in interest-free loans to states for infrastructure projects under Public-Private Partnerships (PPPs).

Ø Key Sectoral Reforms and Initiatives

Agriculture & Rural Economy

A significant portion of the budget was dedicated to boosting agricultural productivity and rural prosperity. Krishi Yojana, a partnership with states to enhance productivity, diversify crops, and improve irrigation, benefitting 1.7 crore farmers. The Edible Oils Mission aimed at strengthening domestic production to reduce import dependence, aiming for a 30 per cent reduction in imports over five years. Self-sufficiency in pulses, a six-year mission to sustain India’s lead in pulse production, increasing acreage by 25 per cent. Through the Makhana Board in Bihar, it aims to improve production and marketing for an expected Rs.5,000 crore market expansion. Kisan credit cards, the short-term credit loan limits raised from rupees three to five lakh, impacting 2.5 crore farmers. Urea self-sufficiency, a new 12.7 lakh MT capacity plant in Assam, is aimed at reducing fertiliser imports by Rs. 10,000 crore annually.

Manufacturing, MSMEs, and Exports

With the toy industry push (of which mobility toys are a big chunk), India aims to be a USD 10 billion global manufacturing hub. Micro & Small Enterprises have been allocated an additional credit support of rupees five crore per enterprise, benefiting over 50 lakh MSMEs. The ‘Fund of Funds’ Initiative has a Rs.91,000 crore government-backed fund to fuel innovation and startup growth, adding one lakh new startups over five years. Labour-intensive manufacturing sectors will see special policies for high-employment sectors like textiles and electronics, targeting 50 lakh new jobs. PLI Enhancement has the government strengthening rupees two lakh crore PLI for critical sectors like semiconductors and green energy.

Infrastructure & Urban Development

Through Public-Private Partnerships, ministries are encouraged to present project pipelines for funding, unlocking rupees five lakh crore in private investment. Urban Challenge Fund has rupees one lakh crore to develop cities as economic hubs, benefiting 100 tier2 and tier3 cities. Affordable Housing focus was reflected through the Swami Fund 2 with Rs.15,000 crore to facilitate one lakh new homes for the middle class. Shipbuilding Incentives included credit support for shipbuilding and clusters to encourage Rs. 50,000 crore investment in maritime infrastructure. UDAN Expansion had 120 new regional air destinations, facilitating four crore additional passengers annually.

Energy & Sustainability

100 GW Nuclear Power Goal by 2047 driven by the private sector participation to drive clean energy, with an immediate Rs.20,000 crore outlay for research and development. Small Modular Reactor R&D with an investment of Rs.10,000 crore to develop new nuclear technologies. Green Manufacturing has policy support for clean technology industries, targeting a 30 per cent increase in domestic EV battery production.

Education & Skill Development

Under the IIT Expansion drive, Infrastructure boost for five IITs, including IIT Patna, with Rs.5,000 crore allocation. Three new Centres of Excellence in AI, each with Rs.1,000 crore in funding.

Tourism & Trade Facilitation

50 Tourism Destinations will be developed in collaboration with states, targeting rupees two lakh crore in tourism revenue by 2030. Medical Tourism Promotion entails streamlined processes for international patients, aiming for a Rs.50,000 crore revenue boost. Through the Bharat Trade Net, a unified platform for trade documentation, the government aims to reduce paperwork and improve export efficiency by 30 per cent. Under the Export Promotion Mission, Rs. 25,000 crore allocation will support MSME exports.

Taxation & Fiscal Policy

Taxation took centre stage towards the end of the budget speech. Under Direct Taxes, a new Income Tax Regime was announced to boost consumption amongst the middle class. The slabs were revised and slotted between nil and 30 per cent based on income brackets. Upto 12 Lakh per annum income was exempted from tax.

The standard Deduction limit raised to Rs. 75,000 is expected to benefit five crore taxpayers. The Nil Tax Slab has raised from rupees five lakh to 12 lakhs, bringing relief to an estimated 10 crore middle-class families. TDS/TCS Reforms entailed simplified compliance and extended filing timelines, reducing administrative burden.

Indirect Taxes & Customs

Tariff Rationalisation saw the removal of seven tariff rates for easier trade. In a move for Lithium-Ion Battery Support, lowered customs duty on EV battery components to five per cent is expected to boost domestic production by 40 per cent. Railways and Aviation MRO Expansion drew in incentives for domestic repair operations, reducing reliance on foreign maintenance hubs.

Fiscal Discipline & Growth Outlook

The budget maintains fiscal discipline while ensuring high capital expenditure. The FM announced a total expenditure of Rs. 47.1 lakh crore. Capital Expenditure was pegged at Rs. 10.18 lakh crore (an increase of 13 per cent over the previous year). Fiscal Deficit was kept on a declining trajectory to sustain economic stability, aiming for 5.8 per cent of GDP.

Conclusion

The Union Budget 2025 sets a robust foundation for India’s economic transformation. By fostering self-reliance, promoting innovation, and ensuring inclusive growth, it paves the way for Viksit Bharat—a developed and self-sufficient India. With a strategic blend of investments in infrastructure, manufacturing, technology, and human capital, the government aims to drive long-term sustainable growth, making India a global economic powerhouse by 2047. The reduction of BCD on certain export items created a fear of higher anti-dumping for which the fine print needs to be looked into. Overall the Union Budget 2025 with its focus on boosting consumption is seen as a trade off given the flat capex curve with the long-term goals touched upon in the July 2024 full budget stuck to. ACI

““The focus on MSMEs, innovation, exports and supply chain resilience will provide a strong impetus to the auto component industry. Further, the proposals for personal Income Tax will put more money in the hands of people thus fuelling consumption and leading to economic growth.”

Shradha Suri Marwah,

President, ACMA.

“For me most importantly, the budget focuses on upping the index of ‘Ease of Doing Business’, with regulatory reforms, good governance and incentivisation of investments. By prioritising the ‘Ease of doing Business’, technology access, and MSME growth, this initiative will drive industrial competitiveness across sectors, including the auto components industry.”

Akash Passey, President,

ZF Group in India.

“The Union Budget 2025-26 lays a strong foundation for India’s continued economic resilience and manufacturing excellence. Thrust on green energy transition, manufacturing and ease of doing business will propel the automotive and tyre industries forward.”

Dr Raghupati Singhania,

Chairman & MD, JK Tyre & Industries

“The proposed income tax cuts could boost the middle class’s spending power, potentially increasing demand for two-wheelers, three-wheelers, and small cars. Further, the government’s commitment to fostering a sustainable automotive ecosystem is demonstrated through its strategic initiatives, which are poised to deliver substantial benefits to the electric vehicle (EV) industry.”

Saurabh Agarwal,

Partner & Automotive Tax Leader,

EY India

“Introducing a ‘National Manufacturing Mission,’ with an 89 per cent increased allocation to Rs.16,092 crore, highlights our government’s dedication to improving domestic production capabilities. The much-needed tax reforms, like higher exemptions and simplifying tax slabs, will improve consumer sentiment and spending, invariably stimulating demand for various manufactured goods.”

Niranjan Kirloskar,

MD – Fleetguard Filters Ltd.

“The mining reforms introduced in the budget position India as a key player in the critical minerals sector. As India’s largest and the world’s second-largest integrated zinc-lead producer, we are optimistic about the transformative impact of these initiatives which will enhance the competitiveness of India’s critical minerals sector while supporting industries such as electric vehicle manufacturing and renewable energy storage.”

Arun Misra,

CEO – Hindustan Zinc Ltd.

“The changes in tax slabs under the new tax regime are expected to significantly boost consumer demand, thereby enhancing the purchasing power of individuals. This shift will undoubtedly have a positive impact on overall auto sales in India, stimulating growth in the sector. Additionally, the exemption of scrap materials such as lithium-ion batteries, lead, zinc, and 12 other critical minerals will further accelerate the growth of the e-mobility sector.”

Amit Jain,

CEO and Co-Founder, CarDekho Group

“At Nippon Paint India, we see this as a great opportunity to contribute to clean energy innovation and sustainable manufacturing. We’re committed to expanding local production, investing in advanced facilities, driving R&D efforts for next-generation products, and partnering with industry leaders to build a robust ecosystem for growth.”

Sharad Malhotra,

President,

Automotive Refinishes & Wood Coatings, Nippon Paint India

Box

The Economic Survey 2023-24 projects India’s real GDP growth between 6.5-7 per cent for 2024-25, following an 8.2 per cent growth in FY24. This positive outlook is underpinned by a 9.5 per cent growth in the industrial sector, which includes manufacturing—a key component of the commercial vehicle and auto components industries.

Key Highlights Impacting the Commercial Vehicle and Auto Components Sectors:

Production-Linked Incentive (PLI) Scheme

The PLI Scheme for the Automobile and Auto Component Industry has a budgetary outlay of Rs.25,938 crore. It incentivises various categories of electric vehicles, including two-wheelers, three-wheelers, four-wheelers, buses, and trucks. This initiative aims to boost manufacturing capabilities and promote the adoption of electric mobility in the commercial vehicle sector.

Infrastructure Development

Significant investments have been made in road infrastructure, with projects worth over Rs.5,000 crore inaugurated in Uttar Pradesh, Odisha, Assam, Jammu & Kashmir, and Tamil Nadu. These developments are expected to improve connectivity and stimulate economic growth, thereby positively impacting the commercial vehicle industry by enhancing logistics efficiency.

Electric Mobility Promotion

The Electric Mobility Promotion Scheme 2024, with an outlay of Rs.778 crore, provides incentives to buyers of electric two-wheelers and three-wheelers. This scheme, along with the PLI initiative, is designed to accelerate the adoption of electric vehicles, which will have downstream effects on the auto components sector, especially in areas related to electric drivetrains and battery technologies. These initiatives reflect the government’s commitment to strengthening the commercial vehicle and auto components sectors through targeted incentives and infrastructure development, fostering a conducive environment for growth and innovation.

Leave a Reply