The tyre industry is banking on exports and replacement demand to drive growth. Ashish Bhatia weighs in on the tailwinds and the headwinds.

Satish Sharma, Chairman of Automotive Tyre Manufacturers Association (ATMA) and President – the Asia Pacific, Middle East & Africa (APMEA), Apollo Tyres Ltd.

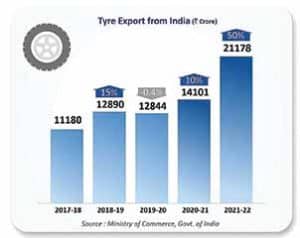

All through the pandemic marred fiscal, the tyre industry turned adversities into opportunities. If there were headwinds like the availability of Natural Rubber (NR) and the shortage of performance tyres, the industry tactically dealt with them to the extent possible with an emphasis on encouraging local produce by Indian growers. The segment also benefitted from the tailwinds like government interventions restricting high volumes of import, revised axle-load norms compelling OEMs to re-engineer, demand for replacement tyres and the buoyancy of Indian exports. At a time when international trade was faced with disruptions owing to the Covid-19 pandemic, tyre exports from India are known to register a 70 per cent growth. “The export performance bears testament to the ability of the Indian tyre industry to meet the rising expectations from India in the new geopolitical scenario despite the odds of challenging times”, averred Satish Sharma, Chairman of Automotive Tyre Manufacturers Association (ATMA) and President – the Asia Pacific, Middle East & Africa (APMEA), Apollo Tyres Ltd.

Compared to the Farm/Agri and Off The Road (OTR) tyres and or Industrial tyres as erstwhile the largest exported tyre categories from the country, the Truck & Bus Radial (TBR) tyre exports are said to have improved their ranking. The TBR exports have registered a 2.5X growth over the last three years, from Rs.1263 crore in FY19 to Rs.3095 crore in FY22. Sharma attributes the growth to the new radial facilities set up by Indian tyre manufacturers said to be attaining global, technology benchmarks for this impressive run. The renewed positioning is further bolstered by India’s global standing as a reliable supplier of products as a whole. “The industry is vastly helped by the Atma Nirbhar policy of the Government aimed at creating an enabling environment for the growth of the industry. The curb on indiscriminate import of tyres has helped the industry increase size and scale of production and align with global supply chains,” explains Sharma.

Compared to the Farm/Agri and Off The Road (OTR) tyres and or Industrial tyres as erstwhile the largest exported tyre categories from the country, the Truck & Bus Radial (TBR) tyre exports are said to have improved their ranking. The TBR exports have registered a 2.5X growth over the last three years, from Rs.1263 crore in FY19 to Rs.3095 crore in FY22. Sharma attributes the growth to the new radial facilities set up by Indian tyre manufacturers said to be attaining global, technology benchmarks for this impressive run. The renewed positioning is further bolstered by India’s global standing as a reliable supplier of products as a whole. “The industry is vastly helped by the Atma Nirbhar policy of the Government aimed at creating an enabling environment for the growth of the industry. The curb on indiscriminate import of tyres has helped the industry increase size and scale of production and align with global supply chains,” explains Sharma.

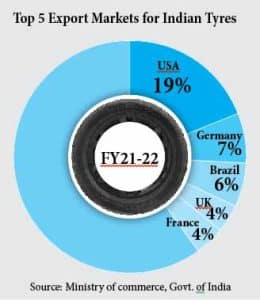

Notably, the Indian make tyres are exported to over 170 countries in the world including some of the most discerning markets in North America and Europe. Led by the US which dominates as the largest market for Indian tyres at 19 per cent of the overall tyres exports, the top five export markets in FY22 also included Germany, Brazil, the UK and France as per the Ministry of Commerce, Govt. of India data (Refer adjoining chart). Optimistic about the export potential, Sharma opined that the tyre industry has the potential of further doubling exports from India over the next three to four years (~ Rs.6190 crore).

Notably, the Indian make tyres are exported to over 170 countries in the world including some of the most discerning markets in North America and Europe. Led by the US which dominates as the largest market for Indian tyres at 19 per cent of the overall tyres exports, the top five export markets in FY22 also included Germany, Brazil, the UK and France as per the Ministry of Commerce, Govt. of India data (Refer adjoining chart). Optimistic about the export potential, Sharma opined that the tyre industry has the potential of further doubling exports from India over the next three to four years (~ Rs.6190 crore).

The Industry is also optimistic about the demand for replacement tyres (recommended to be changed every five to six years ) inclusive of the demand from the used Passenger Vehicles (PV) and the Commercial Vehicles (CV) business. Here, the estimates of the used PV market (at ~ 7X of the new PV market) and the used CV market (at ~ 3X the new CV market) are expected to play their part. The sector is known to derive 60 per cent of its volume from the replacement market and 27 per cent from Original Equipment Manufacturers (OEMs). The rest (~13 per cent) is attributed to exports. Setting expectations right, Anuj Sethi, Senior Director, CRISIL Ratings states in a study, “Demand from the replacement market is expected to

The Industry is also optimistic about the demand for replacement tyres (recommended to be changed every five to six years ) inclusive of the demand from the used Passenger Vehicles (PV) and the Commercial Vehicles (CV) business. Here, the estimates of the used PV market (at ~ 7X of the new PV market) and the used CV market (at ~ 3X the new CV market) are expected to play their part. The sector is known to derive 60 per cent of its volume from the replacement market and 27 per cent from Original Equipment Manufacturers (OEMs). The rest (~13 per cent) is attributed to exports. Setting expectations right, Anuj Sethi, Senior Director, CRISIL Ratings states in a study, “Demand from the replacement market is expected to  normalise to ~ four per cent growth this fiscal from ~12 per cent last fiscal. OEM demand should grow ~12 per cent driven by CVs owing to higher government spending on infrastructure and improving fleet utilisation. OEM demand from the PVs should be healthy given the rise in personal incomes and strong consumer preference for personal mobility. However, demand from the two-wheeler and tractor OEM segments will continue to be modest.” He drew attention to exports growing at the rate of 13-15 per cent on a high base of over 45 per cent growth last fiscal owing to cost-competitiveness, and benefits from China plus one strategy of global OEMs. He also cited the buoyant demand for OTRs in the US and Europe.

normalise to ~ four per cent growth this fiscal from ~12 per cent last fiscal. OEM demand should grow ~12 per cent driven by CVs owing to higher government spending on infrastructure and improving fleet utilisation. OEM demand from the PVs should be healthy given the rise in personal incomes and strong consumer preference for personal mobility. However, demand from the two-wheeler and tractor OEM segments will continue to be modest.” He drew attention to exports growing at the rate of 13-15 per cent on a high base of over 45 per cent growth last fiscal owing to cost-competitiveness, and benefits from China plus one strategy of global OEMs. He also cited the buoyant demand for OTRs in the US and Europe.

Supply chain bottlenecks

Like the affected industries, globally, weighed down by the supply-chain bottlenecks, the industry value chain is expected to be streamlined in due course of time. Sharma emphasises the need to address headwinds in the domestic market, on a war footing. “Certain roadblocks faced by the tyre industry domestically need to be addressed on priority to provide a fillip to the exports,” he mentions. The domestic issues cited are access to Natural Rubber (NR) a key raw material on which India needs to overcome a substantial deficiency. As an example, the tyre industry needs to adhere to pre-import conditions for NR import against (tyre) export obligation. According to Sharma, it makes the operations very constrictive with a direct bearing on the export performance. Echoing a similar viewpoint, Sethi cited the over 20 per cent surge in NR, and that of crude-based inputs such as carbon black and nylon tyre cord by 40-50 per cent. “These account for ~70 per cent of the raw material cost of tyre makers,” he informed. In a domino effect, growth realised on the exports front is expected to benefit the entire rubber value chain that includes key stakeholders like the million tyre growers largely dependent on the tyre industry’s growth prospects. On the supply-side, the industry expects operating margins to rise to ~ 12 per cent from a low of 10 per cent (2012 levels ) courtesy of price hikes to ease the inflationary pressures. The study expects better cash accruals should help fund higher capital expenditure and keep debt metric healthy at the top six manufacturers accounting for ~80 per cent of the Rs 75,000 crore sectorial revenue. Sethi concluded, that CapEx is expected to rise to ~Rs 5,000 crore this fiscal on the back of improving demand in comparison to ~ Rs.3,700 crore on an annual basis over the past two fiscal. Notably, capacity utilisation at manufacturers is still below 70-75 per cent pulling the CapEx outlay lower than the annual average of ~Rs.6,200 crore between 2018-20. All eyes will be on further waves of the pandemic, semiconductor shortages weighing on the PV demand and the raw material prices from hereon, concludes, Rajeswari Karthigeyan, Associate Director, CRISIL Ratings.

Leave a Reply