At the 14th Edition of Apollo CV Awards 2023, Barnik Chitran Maitra, Managing Partner and Chief Executive Officer of Arthur D Little (ADL), India and South Asia drew attention to big data. Ashish Bhatia deciphers the cues on mobility trends expected to impact components suppliers.

The 14th Edition of Apollo CV Awards 2022 had a special guest speaker. Barnik Chitran Maitra, Managing Partner and Chief Executive Officer of Arthur D Little (ADL), India and South Asia as the keynote speaker banked on big data to put his points across to the stakeholders of the CV industry. Not your typical mobility veteran, as the chief of one of the oldest global management consulting firms in the region, Barnik is credited for creating the fastest-growing management consulting firm in India. Scaling the firm from zero consultants in 2022 to over 100 consultants by the end of 2023. He brings with him the experience of having counselled Fortune 500 companies and leading Indian conglomerates on growth, innovation, technology and transformation. An experienced strategy and corporate finance practitioner and a well-known subject matter expert speaker, he is also the Board advisor for several large multinationals and family-owned businesses including Alphabet and Facebook.

The 14th Edition of Apollo CV Awards 2022 had a special guest speaker. Barnik Chitran Maitra, Managing Partner and Chief Executive Officer of Arthur D Little (ADL), India and South Asia as the keynote speaker banked on big data to put his points across to the stakeholders of the CV industry. Not your typical mobility veteran, as the chief of one of the oldest global management consulting firms in the region, Barnik is credited for creating the fastest-growing management consulting firm in India. Scaling the firm from zero consultants in 2022 to over 100 consultants by the end of 2023. He brings with him the experience of having counselled Fortune 500 companies and leading Indian conglomerates on growth, innovation, technology and transformation. An experienced strategy and corporate finance practitioner and a well-known subject matter expert speaker, he is also the Board advisor for several large multinationals and family-owned businesses including Alphabet and Facebook.

The backdrop

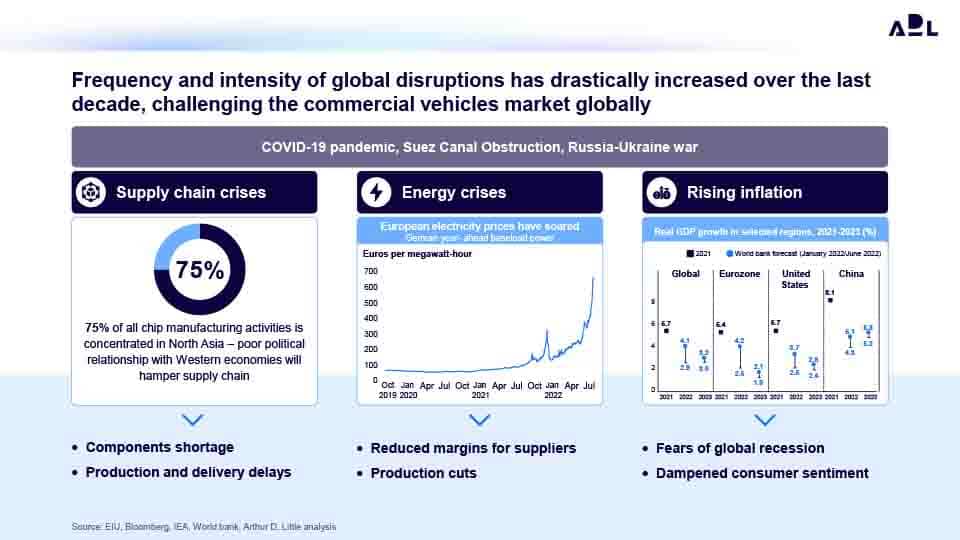

Barnik began his speech by thanking Next-Gen Publishing Pvt. Ltd. and the Commercial Vehicle Magazine. He shifted gears to cite how the frequency and intensity of disruptions had drastically increased over the past decade. “This has challenged the commercial vehicles market globally,” he stated. Pointing to the disruption in the market, he went deeper into challenges thrown the industry’s way against the grim backdrop of Covid-19, Suez Canal obstruction and the Russia-Ukraine war businesses have had to deal with. He dived deeper into the headwinds like the supply chain crisis, energy crisis and rising inflation. His presentation drew attention to 75 per cent of all chip manufacturing activities concentrated in North Asia – poor political relationships with Western economies hamper the supply chain. The result of which is a component shortage and a direct bearing on the production and delivery timelines with delays imminent. He gave an example of European electricity prices known to have soared owing to the energy crisis. Reduced margins for suppliers and production cuts as a result. He also touched upon real GDP growth in select markets that have instilled fears of recession and negatively impacted consumer sentiment.

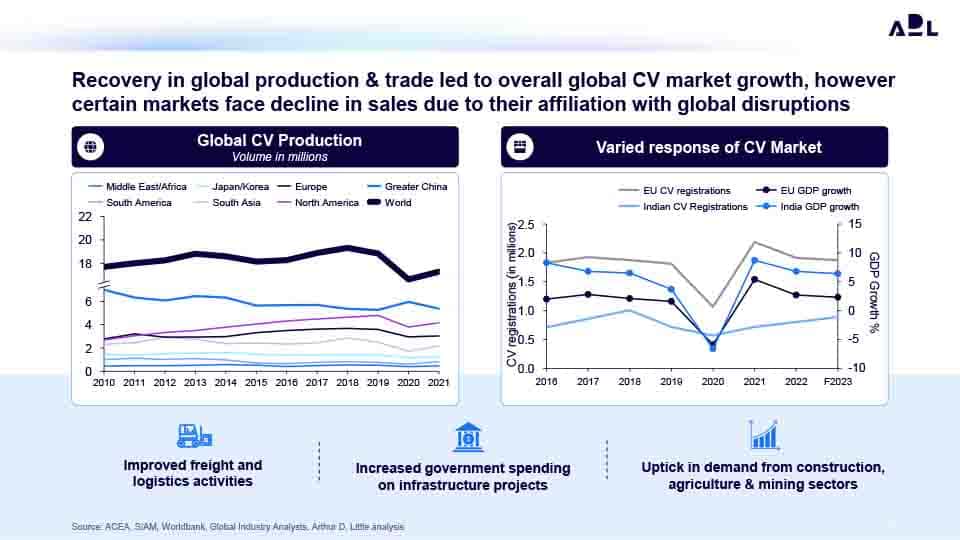

Against this low base, he moved on to the recovery in global production and trade leading to overall global CV market growth. “However certain markets face a decline in sales due to their affiliation with global disruptions,” he cautioned. Comparing global CV production of varied geographies against the response of different regions with CV registrations as the defining metric. He highlighted improved freight and logistics activities, increased government CapEx on infrastructure development-related projects and the resultant uptick in demand from the construction, agriculture and mining sectors. Infrastructure CapEx alone increased by 33 per cent in the Union Budget 2023.

Tailwinds

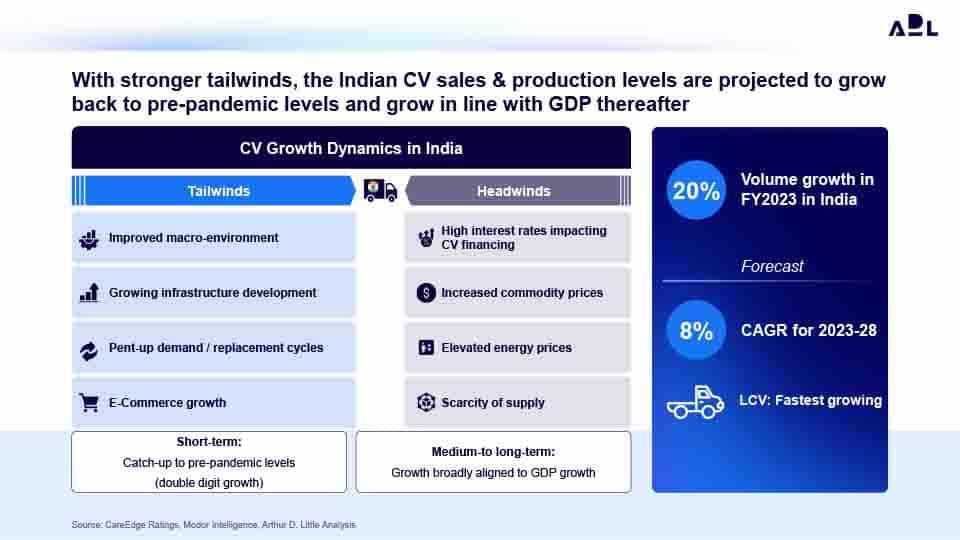

The tailwinds, as per Barnik, would only lead to the CV industry attaining pre-pandemic levels and growing in line with the GDP from thereon. The industry is forecasted to register a volume growth by a 20 per cent margin in FY23 at a CAGR of eight per cent. He attributed this to tailwinds like an improved macroeconomic environment, growing infrastructure on one end of the spectrum and pent-up demand and replacement cycles, and e-commerce growth on the other end of the spectrum. The industry will play catch up to the pre-pandemic levels in the short term and is expected to grow at double-digit scales, he opined.

The growth will come from the Light Commercial Vehicles (LCV), the fastest-growing segment as per the study. In addition to the development in India’s e-commerce sector where e-LCVs are the answer to the pledges of fleet decarbonisation, the study attributed the demand from FMCG and infrastructure for further fueling the growth of the LCV sector post-pandemic. LCV sales grew by a margin of 59 per cent on a Year-over-Year (YoY) basis in the first half of 2023 (H1-FY2023). On headwinds, Barnik drew attention to the high-interest rates impacting CV financing and increased commodity prices as well.

Definite trends

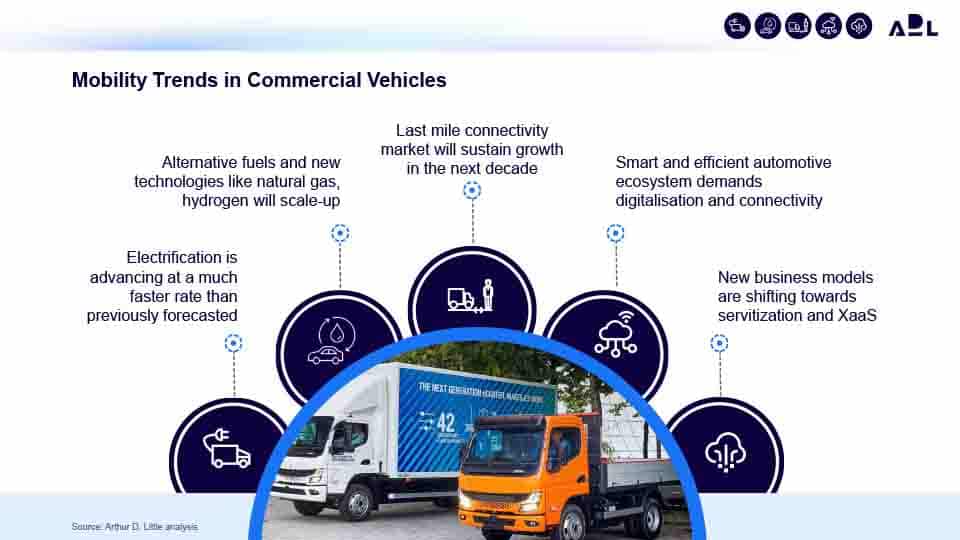

The Arthur D. Little analysis pointed to mobility trends to align decision-making with. The rate of electrification is faster than expected earlier. The scale of alternative fuels and new technologies like natural gas will only go up. The last-mile connectivity market is expected to sustain growth over the next decade and last but not least. The demands of digitalisation and connectivity will only go up courtesy of a smart and efficient automotive ecosystem. Barnik also pointed at the heightened shift to servitization and XaaS. Where the focus is on vehicle sales, adjacent services present an opportunity. Vehicle-as-a-service, Energy-as-a-Service and Logistics-as-a-Service are the other ecosystem-centric opportunities.

Global emobility market

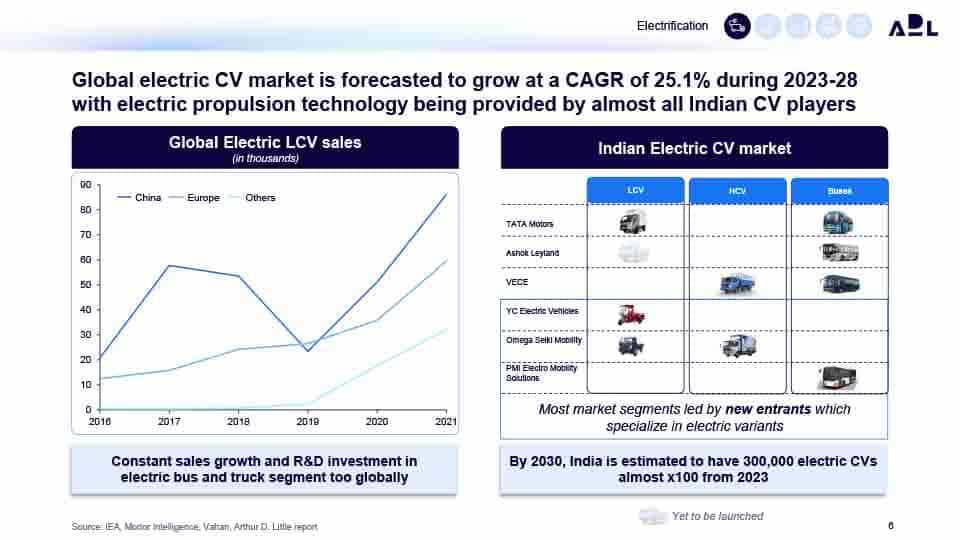

The global electric CV market is forecasted to grow at a CAGR of 25.1 per cent during 2023-28. Barnik pinpointed the use of electric propulsion technology provided by a majority of Indian CV players. Barnik drew parallels with the traction witnessed in India and the constant sales growth and R&D investment in the electric bus and truck segment globally. He projected that by 2030, India is estimated to have three lakh electric CVs almost 100x with 2023 as the base. “It is noteworthy that most market segments are led by new entrants specialising in electric variants,” he mentioned. The study covered a diverse mix of players, from majors like Tata Motors, Ashok Leyland and VE Commercial Vehicles to new entrants like YC Electric Vehicles, Omega Seiki Mobility (OSM), and PMI Electro Mobility Solutions.

Decarbonising the CV sector

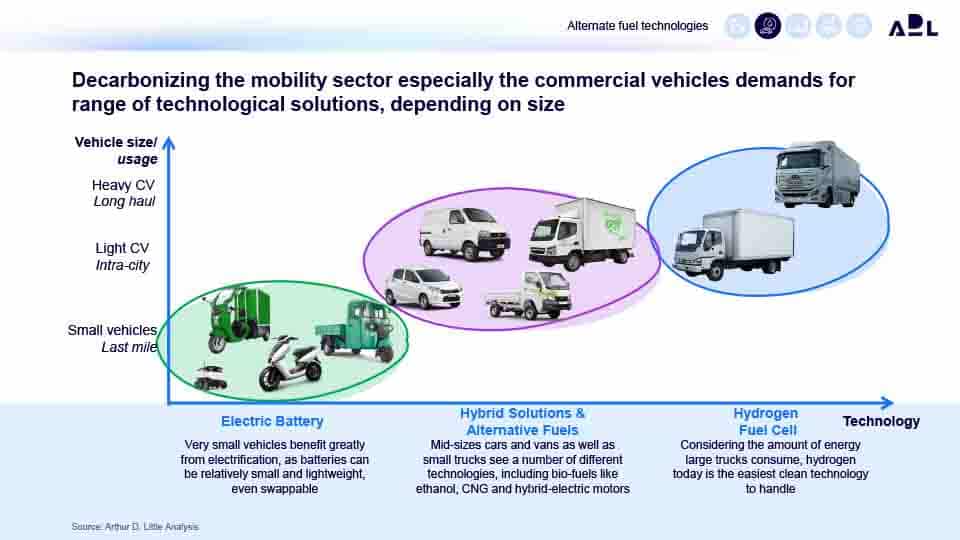

For the CV sector to be decarbonised, a range of solutions is required. “Size matters,” quipped Barnik. Electrification will be most suited to smaller vehicles given that these vehicles offer greater flexibility in terms of using smaller and lighter battery packs, and the option to swap. Speaking on the way forward with hybrid solutions and alternative fuels, he gave the example of mid-sized cars (applicable to fleet operations), commercial vans, and trucks to make a case for different technologies being deployed. This spans the universe of bio-fuels like ethanol, CNG, and hybrid electric motors. Making a case for hydrogen fuel cells, he reasoned that with the large energy consumption of Heavy-Duty trucks, there is a ready-use case for the “easiest, cleanest fuel to handle.”

Fully integrated solutions

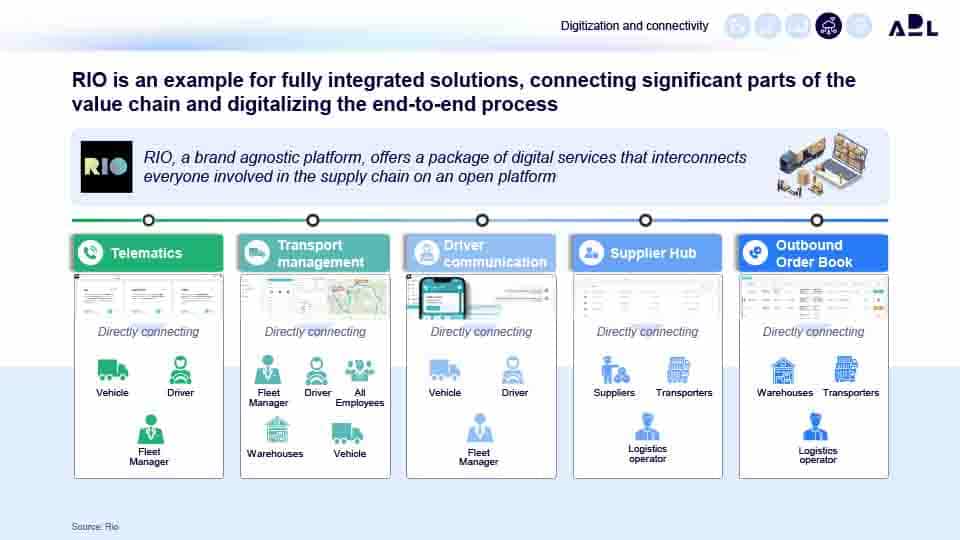

Case-in-point a fully integrated solution, Barnik gave the example of RIO that covers significant parts of the value chain and said to digitalise the end-to-end process. The claimed, brand-agnostic platform, works such that it offers a package of digital services that in turn interconnect everyone involved in the supply chain on an open-source platform. From telematics to transport management, driver communication, and supplier hub to outbound order book.

In the concluded leg of his address, Barnik summarised by urging the industry to make the most of the opportunities at hand. He suggested that to cater to the e-mobility ecosystem, the industry could look at developing in-house capabilities or partnerships. They continue to invest in different fuel technologies across segments to sustain a net zero future. Prioritise enhanced logistics and customer experience to capture last-mile connectivity demand. Acquire or partner with software/IOT players and develop in-house software capabilities. Understand primary and target customers to explore new-age business models like XaaS. ACI

Read more, The Aftermarket Landscape

Leave a Reply