The auto components industry is bracing for the future of auto. Team ACI looks at the synergies needed to tap the new wave.

Multiple industry conclaves have time and again laid emphasis on the future of auto opening up a new stream of opportunities. The need to collaborate and synergise is implied. Discussions on the future of auto have drawn attention to the proliferation of alternative propulsion systems led by hydrogen fuel cells, LNG, biofuels and flex-fuel. The addition to the mix that already involves Battery Electric Vehicles (BEVs) has the industry attention span diverted to value-adds like connected vehicles and degrees of autonomy through different levels of Advanced Driver Assistance System (ADAS). With the demand for such Advanced Automotive Technology (AAT), the supply-side, it is evident, is bracing the future. It is laying the groundwork to cater to this newfound pull.

Big data in the future is expected to flow seamlessly through the layers put in place, making vehicles connected to each other and to their surroundings in order to help drivers reduce the severity of accidents or prevent them from occurrence entirely. The data fed to the sensors entails information crucial to the driver like signal status at a junction wherein the vehicle must connect to the central hubs like Regional Transport Office (RTO) and traffic grid over cloud-based systems. Over The Air ( OTA ) updates are a given here. Onboard and off-board connectivity is expected to be the key building blocks.

The flow of such huge quantum of data needs to be ensured in real-time with minimum lag to ensure timely responses, actively. A 5G ecosystem must be developed with a cohesive approach throughout the touchpoints. The vehicle aspect of that will include vehicle architecture, software architecture, RF design packaging, technology and MNO partnership, functional landscape, and data security through means like partitioning and robust firewalls. The multi-access edge computing will include mobile edge computing partner, service orchestration and management, functions deployed to address latency and hyper localisation with a cellular base station. The OEM cloud must consist of scalability to manage data, functional orchestration and deployment and management of the software over the life cycle.

Teething issues

The key challenges hindering the progress have been identified. The task is cut out. The industry stakeholders need to focus their resources on tackling integration, validation, orchestration and operation. The approach that will overcome these challenges is expected to be solution-centric, and one applicable to the existing ecosystem with an end-to-end know-how. Gaurav Gupta, Chief Commercial Officer, MG Motor India speaking on the sidelines of the CII Summit cited the example of MG Motors entering the Indian market with the disruptive badging of “Internet Inside” on their products. It was their way of welcoming the future and connected, voice-command capabilities in their products. So much so, it is believed to have roped in purists who otherwise focused on the drivetrain to make their choices. It in a way set the benchmark for competition. Lalit Arora, India Head of Automotive Business Unit at Tata Communication expressed how the future of connectivity is not as far as it seems. Asserting that the company is taking long strides in keeping pace with the demands of the future, and preparing to deliver them at the earliest in a bug-free manner, he drew attention to the pull factors from the demand-side like the need for always being connected in a mobile driven economy coupled with continuous rollout of features, firmware upgrades, large chunks of data transfer, lower latencies and hacking threats to a perceived secure system.

Arora also brought forth the concern of how mobile networks are not structured for the requirement of automotive operations on a global basis. Key problems stand at fragmented telecom industry, varying regional regulations, non-transparent pricing schemes, variations in local network quality, ubiquitous network coverage, inconsistent operational interface and control, network lock-in and upgrading existing fleet seamlessly. Speaking about challenges in autonomous driving, Srinivas Aravapalli, CEO, Blue Binaries opined that the shift from current ADAS simulation environment to real life Indian traffic scenario would pose a challenge. It includes poor lane discipline, no signaling before turning, overloaded vehicles, signal violation and no road discipline in general. Some of the challenges which the industry could face while deploying ADAS and autonomous technology include data acquisition and data processing for vision-based systems which requires high bandwidth and are computationally intensive. The industry also lacks standards for embedded vision-processing algorithms, he pointed. Systems must comply with multiple industry guidelines or specifications, testing and validation is an enormous undertaking. ADAS development costs must also be brought down significantly, he said.

Mitigating teething issues

While presenting how to tackle the ADAS challenges, Srinivas pointed at four main pillars that include architecture, tools and simulation techniques, validation and systems, and frugal engineering and innovation. In terms of architecture, he stressed on the need to move to a centralised architecture, front loading of testing and innovation and competency development at BCC. In terms of validation methods and applications most common known trends include formal verification, virtual validation, hardware-in-loop testing and finally vehicle testing. It is important to test the model in realworld scenarios, test software in simulation driving, integrate ECU into the network and access functionality safety. He urged all safety critical tests be undertaken in real world scenarios for reliable performance across terrains.

Mass scaling EVs and electronics

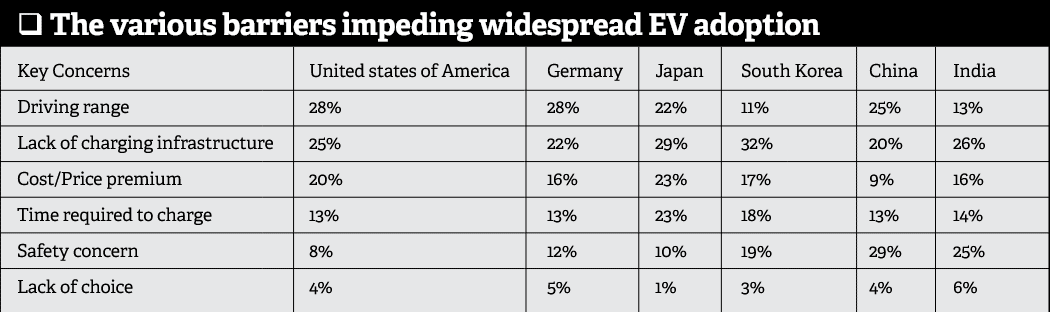

There are multifold barriers impeding the widespread adoption of EVs on the other end of the spectrum. Leaving the safety concerns out of the recent blazes aside, 13 per cent of it is the range anxiety related to EVs and 26 per cent is attributed to lack of charging infrastructure. The misconceptions and rumors regarding the susceptible risk of thermal runaway and explosions of battery packs cited above is pegged at 25 per cent. These along with minor concerns like lack of choice, overnight charge durations, cost per kilometre with the background of high acquisition costs are major deterrents to EVs becoming a mass mobility choice. To tackle the safety concerns, the Ministry of Road, Transport and Highways and apex bodies like the Niti Aayog have forced OEMs in case of two-wheelers to halt production until the accidents brough to notice are thoroughly investigated. It has forced manufacturers to recall suspect batches to avoid embarassments in the future.

There are multifold barriers impeding the widespread adoption of EVs on the other end of the spectrum. Leaving the safety concerns out of the recent blazes aside, 13 per cent of it is the range anxiety related to EVs and 26 per cent is attributed to lack of charging infrastructure. The misconceptions and rumors regarding the susceptible risk of thermal runaway and explosions of battery packs cited above is pegged at 25 per cent. These along with minor concerns like lack of choice, overnight charge durations, cost per kilometre with the background of high acquisition costs are major deterrents to EVs becoming a mass mobility choice. To tackle the safety concerns, the Ministry of Road, Transport and Highways and apex bodies like the Niti Aayog have forced OEMs in case of two-wheelers to halt production until the accidents brough to notice are thoroughly investigated. It has forced manufacturers to recall suspect batches to avoid embarassments in the future.

Ravi Bhatkal, Managing Director, MacDermid Alpha, took the case study of EV powertrains. Power electronics which is considered to be the heart of the EV after the battery includes the converter, lead frames, heat sinks, connectors, busbars, boosters, and housing to name a few. He drew attention to sintering as a new and emerging technology based on solid state diffusion. “The main attribute of advanced bonding technology based on silver sintering is high thermal and electrical conductivity, and high temperature stability,” he explained. By moving to sintered silver, and adopting the changes needed in the manufacturing process, the opportunity exists to realise significant performance and reliability gains with current silicon die technology and establish a production platform for optimising silicon carbide in the very near future, according to Bhatkal. Reliability is increased by upto 30 times, he claimed. He also mentioned the need to refine the use of preforms, a solution wherein certain applications need more solder for a proper SMT joint formation. For assemblies of EVs, heatsinks are crucial. “For assembly, the surface needs to be prepared. Here the surface of heatsink should be clean and it needs to be chemically treated with coolants. Few requirements of a heatsink’s corrosion protection are coating the inner areas, solderability and brasing for a high level of productivity.

R Velusamy, Senior Vice President , Head -Automotive Product Development ,Mahindra Research Valley, Mahindra & Mahindra Ltd.

Market ready solutions

Companies are working on commercialising their technologies deemed fit for the future of auto. Arora highlighted how Tata’s journey reflects evolving automotive demands through a slew of acquisitions and investments the company has made. Claimed to be at par with the ever changing demands along with integrating connected services to its products, the company boasts of multiple data entry and exit points through its connected tech for vehicles. On camera provision to enable local analytics, it is ready with smart HD cameras capable of functioning w/o WAN, and edge video platform in store to run analytics for real time use cases like predictive maintenance, a 5G cloud RAN, intelligently positioned near edge that supports multiple stores and enables multi latency. Last but not the least, the company also ensures access and pre-aggregation POPs, central office, metro POPs, central cloud for big data and object storage. All the above mentioned intervention will help in reduced app latency, backhaul cost savings, keeping data local and security close to origin.

Shivalik Prasad, Vice President- Strategic Alliance and sales at Sibros in recent times showcased the company’s approach at solving the automotive software and data problem. It was brought down to three main pillars: scalability, reliability and efficiency. The company presented Software as a Service (SaaS) capable of efficiently managing terabytes of data with high levels of security.. The company tackles the connected platform with in-vehicle products and cloud portal. The cloud portal in turn comprises of a deployment manager, inventory manager, datascope and command centre, whereas the in-vehicle products include deep updater, deep logger, command manager and bootloaders to name a few.

S.N. Sridhara, Vice Chancellor at Hindustan Institute of Technology and Science drew attention to fundamental blocks. He said, “Future of mobility boils down to basic elements such as communications, security, object detection, intersection navigation and collision avoidance.” He brought forth concepts like intra-vehicle connectivity, intervehcile connectivity, vehicle to internet connectivity and vehicle to vehicle connectivity. “All this will work in tandem to make a cohesive network much like the internet itself that will ensure safe and fast mobility in the future,” he explained. “In the future, a vehicle on an average may house around 200 sensors. These sensors will relay information on the cloud to the passengers in real time and vice versa while helping in ADAS functions as well,” he added.

Palanivelu further mentioned that market acceptance of new technology is crucial to generate new opportunities for the industry. Srini Adiraju – Senior Director Autonomous Driving at Visteon Corporation drew attention to safety features for new energy vehicles. Active safety applications adapted to Indian conditions provide many opportunities and also bring along their own set of challenges. The need is for System on Chip (SoC) advancements to enable domain convergence. He drew attention to autonomous safety features for Indian conditions and introduced the Visteon DriveCore Platform offering a cost optimised ADAS solution. It is built upon an open scalable platform architecture enabling state-of-the-art vision processing. He also announced that Visteon partnered with American Center for Mobility (ACM) to develop Autonomous Driving test facility aimed at helping drive development of autonomous vehicles.

Speaking about SmartCore Cockpit Domain Controller Technology, Srini mentioned that it will be a more pragmatic solution for the Indian market. This technology offers intelligent cockpit experience across conventional and electric vehicle applications by seamlessly supporting multiple displays along with integrated infotainment, safety and security features. It also offers full support of artificial intelligence-based speech recognition and camera-domain integration.

Emerging Technologies

Drawing attention to the current ADAS and autonomous driving landscape, Aravapalli highlighted some of the key trending technologies including Adaptive Cruise Control (ACC), Advanced Emergency Braking and traffic sign recognition in terms of forward driving, blind spot monitoring, lane assist and cross traffic alert in terms of side and rear approach, apart from surround view with object detection for in control parking. In India, features like automatic parking assist, automatic emergency braking, blind spot warning system, adaptive cruise control, lane departure warning system, high beam assist, driver drowsiness system, forward collision warning, intelligent headlamp control are some of the prominent ones which have been deployed. According to the Roland Berger forecast, to analyse market penetration and deployment of ADAS, by 2025, L3 and above do not comprise more than ~10-15 per cent penetration and L2 or higher levels will be over 30 per cent penetration across all regions. Some of the key Indian players having adopted such technologies include Tata Motors, BMW, Mercedes-Benz, Volvo to name a few. Some of the global automotive players having adopted such technologies include Honda, Toyota, Tesla, and Jaguar. Tata Safari, Hyundai Creta, Kia Seltos are some of the vehicles on the passenger vehicle side known to be equipped with such technology.

Drawing attention to the current ADAS and autonomous driving landscape, Aravapalli highlighted some of the key trending technologies including Adaptive Cruise Control (ACC), Advanced Emergency Braking and traffic sign recognition in terms of forward driving, blind spot monitoring, lane assist and cross traffic alert in terms of side and rear approach, apart from surround view with object detection for in control parking. In India, features like automatic parking assist, automatic emergency braking, blind spot warning system, adaptive cruise control, lane departure warning system, high beam assist, driver drowsiness system, forward collision warning, intelligent headlamp control are some of the prominent ones which have been deployed. According to the Roland Berger forecast, to analyse market penetration and deployment of ADAS, by 2025, L3 and above do not comprise more than ~10-15 per cent penetration and L2 or higher levels will be over 30 per cent penetration across all regions. Some of the key Indian players having adopted such technologies include Tata Motors, BMW, Mercedes-Benz, Volvo to name a few. Some of the global automotive players having adopted such technologies include Honda, Toyota, Tesla, and Jaguar. Tata Safari, Hyundai Creta, Kia Seltos are some of the vehicles on the passenger vehicle side known to be equipped with such technology.

According to Ashim Sharma, Partner & Group Head at NRI Consulting & Solutions, ADAS helps make vehicles safer and it is crucial given that India accounts for 10 per cent of global road accidents, highest globally! It has immense potential in CVs especially city buses and it acts as a key differentiators across vehicle classes. Amit Agarwal-Director Technical in ANSYS Software Pvt. Ltd. spoke about software integration for ADAS systems.While indicating that simulation plays a crucial role in electrified, connected and autonomous vehicles, he drew attention to the importance of developing high performance vehicles. He especially focused on the importance of 5G in-vehicle capability, design of high performance semiconductor chips and electronics, development and integration of sensors capable of performing in varied conditions.

He called for the need to put in place a high quality model based embedded software to comply with functional safety and advancing battery technology, capacity and management systems. It is also important to use new material platforms, make stronger, lighter and quieter vehicles, developing EVs with lower coefficient of drags to extend range and create stronger and lighter structural assemblies with additive manufacturing to seize the opportunity, he opined. Moving on to challenges in electric and connected vehicles, he took the opportunity to cite the market potential.

According to Sharma, battery packs will present a USD 33.2 bn opportunity by 2030. Electric powertrain components will be another USD 2.5-3 bn. India is at 4.4 chargers per 100 EVs compared to the global average of 12.3. The large pool of two-wheelers is expected to provide the necessary scale. The adoption of electric and connected vehicles also brings in a few challenges. Prices of battery active material are expected to surge 30-40 per cent across lithium, nickel and cobalt over the next five to seven years. Add to it, there is a broad scale absence of cell level manufacturing in India. Other major challenges include raw material supplies which have not been secured. The TCO is unfavourable in some segments and there is range anxiety and limitation in terms of fast charging of NMC, he informed.

The biggest limiting factor for connected vehicles according to Sharma is the poor network connectivity, unavailability of bandwidth and frequency, lack of data security and privacy in absence of cybersecurity. Mounting issues include high system costs due to low localisation levels of electronics. Addressing the issue of cyber attacks in terms of connected vehicles, Prabaharan Palanivelu – Senior Principal Engineer – Mahindra & Mahindra Research Valley expressed hope as he gave an example of chip today enabled with cybersecurity features. The connected vehicles market is expected to grow at a projected CAGR of 25 per cent (USD 18-22 bn) by 2030. It will also help generate new revenue streams for OEMs. The Commercial Vehicle (CV) segment offers immense potential with the advent of telematics and data analysis, he emphasised. EVs with battery swapping need a cloud interconnected network as a backbone, he shared.

Catching up with technology

Aditya Nagarajan, Vice President- Investment Promotion, Guidance spoke about electric mobility and the investments involved. 26000 charging stations is what the country requires in terms of infrastructure requirements, he advocated. Sadaf Arif Siddiqui – Marketing Initiative Manager – Keysight Technologies drew attention to the need for customisation of technologies to suit Indian conditions as a crucial factor. The Indian electrification journey can be traced to its roots back in 1996 when electric scooters were first introduced in the country and even sold 100 units. This was followed by launches like that of the M&M Reva which was launched in 2001. In the span of a decade many players across segments from e-bicycles to two-wheelers to three-wheeler cargo vehicles upto heavy commercial vehicles can take pride in introducing EVs. For off-highway and four-wheelers, electrification will be slow drawn process, as per a supporting data shared by Gajanan V Gandhe, Vice-President and Country Head, DANA India. He explained, “The two-wheeler market will approach two million vehicles by 2025. Followed by three-wheelers at 175,000 and SCVs at 25,000. PVs come in at 215,000 units.” He urged the stakeholders to look at increasing renewable energy sources to boost the EV prospects of the nation.

Further TCO of EVs will fast approach ICE vehicles with help of Government and localisation of major components. India will become a major offshore provider of electrification design and engineering services similar to the IT boom, he opined. As India is in transitional phase from ICE to EV, various other markets can be looked at for references. For example, Europe was in a similar transitionary phase three- to four-years ago. Notably, diesel share was above 40 per cent in contrast to above 18 per cent today. Petrol accounts for 40 per cent and BEVs account for almost 10 per cent in this transition driven by customers demanding for superior products. R Velusamy, Senior Vice President , Head -Automotive Product Development ,Mahindra Research Valley, Mahindra & Mahindra Ltd., opined, “Battery cell technology is the key driver for EVs. It is utmost important that cell manufacturing be localised in India.” Commenting on the software driven vehicle, he forecasted that development on driver assists system such as ADAS L2 will come to Indian shores sooner than later. “Fully autonomous has still a long way, but developing level 2 ADAS is easy on EV as compared to ICE,” he stated. Hubs like Tamil Nadu make a perfect brewing ground for EVs, opined Ambrin, Vice President, Economic Analysis & Policy at Guidance Tamil Nadu. The established automotive hub has a capacity of rolling out one car every 20 seconds, and one CV every 90 seconds. The state accounts for ~ 35 per cent of India’s auto components production, he informed. The state also accounts for nearly 10 per cent of EVs in India, and by 2030, the number is expected to only go up further, he added. Setting a benchmark for other states, looking to increase the EV adoption, State Government of Tamil Nadu is known to have launched its EV policy among other stateslike Maharashtra. As an emerging hub, Tamil Nadu has investment committments and expression of interests worth Rs.20,000 crore with a potential of offering jobs for over 50,000 people across the value chain. ACI

Also read, Automotive cyber-security & OEM: How they are interconnected

Leave a Reply