The Bosch Group has started the new year with a good increase in sales. In the first quarter, sales grew by roughly 7%. After adjusting for exchange-rate effects, the increase was roughly 10%. For the current fiscal year, the global provider of technology and services expects its sales to grow 3 to 5%. “We continue to move forward with our traditional business and are opening up new fields of business. In so doing, we are benefiting from our broad technological and industrial expertise,” said Dr. Volkmar Denner, chairman of the Bosch board of management, at the company’s annual press conference. The Bosch Automotive Technology business sector continued its strong business performance of the previous year, growing impressively in the first quarter of 2014. “We have also seen clear growth in our other business sectors. With regard to the regions, business in Asia Pacific is developing especially well,” said Dr. Stefan Asenkerschbaumer, the Bosch CFO. Bosch also aims to further improve result in 2014.

Sensor technology

Sensor technology

Internet-enabled products and internet-based services are one of the focal points of the company’s future sales growth. With its hardware know-how and broad technological expertise, Denner believes Bosch is well prepared to move into this direction. “Bosch’s traditional strengths – our innovative strength, high standard of quality, international presence, and the integrative force of our corporate culture – are also valuable in the connected world,” Denner said. Moreover, the company is global market leader in the area of micromechanical sensors (MEMS), a key technology when it comes to networking things on the internet. Bosch’s strategic objective is to create solutions for connected mobility, connected industry, connected energy systems, and connected buildings.

Intelligent sensors

Sensors enable a new form of technical assistance in day-to-day life. Describing the strategic significance of sensor technology, Denner said: “Whether we are speaking of automated driving or the smart home, a new quality of comfort, safety, and efficiency is developing, and Bosch is creating the technical conditions for this change.” In 2013, the market leader produced one billion micromechanical sensors. This year, a further 30% increase is planned. Intelligent sensors are the next level of technological progress. These are equipped with a radio interface and a microcontroller. As a result, sensors are able to transmit relevant data via the internet, for instance to mobile end devices. “Smartphones will not be the only devices to be equipped with sensors. Any ‘smart’ object will feature internet-enabled sensor technology,” Denner said.

Automated driving

Automated driving

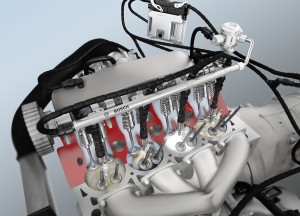

Sensor technology is also a major technological prerequisite for future driving. Modern driver assistance systems require ultrasound, radar, and video sensors. This year, Bosch will produce nearly 50 million ultrasound sensors, 25% more than the previous year. The number of radar and video sensors produced will double to more than two million units. As early as 2016, sales of driver assistance systems will exceed one billion euros. By 2020, the company aims to enable automated driving at higher speeds on freeways. In the coming decade, fully automated driving using an autopilot function could become possible. “Automated driving is a technology that saves lives. At the same time, it can spark drivers’ enthusiasm, since it offers them support with tiresome driving tasks,” Denner said.

Connected road traffic

For driving to be automated, there has to be connected traffic as well as car-to-x communication. By 2025, almost every new car will be equipped with wireless data communication technology. Even now, the connected vehicle makes a broad range of services possible. In 2013, Bosch began offering its eCall emergency call system. When sensors record that a vehicle has had an accident, an automatic emergency call is made. Last year, the Bosch monitoring center processed a good 30,000 emergency calls. In the area of telematics, the company offers fleet management services for leasing and insurance companies. “For us, connectivity on the roads not only means efficiency and comfort, it also means safer driving,” he said.

Doubling sales in Asia and the Americas by 2020

Doubling sales in Asia and the Americas by 2020

Asia continues to be Bosch’s number one growth region. By 2020, the company aims to double its sales in the region. For this reason, the level of capital expenditure will remain high. From 2010 to 2014, Bosch will have invested some 3.3 billion euros in the region. The company also aims to double its sales in North and South America by the end of the decade. In addition to expanding its manufacturing capacity, it is strengthening its local development activities. In Guadalajara, Mexico, the company is currently opening a new development and software center. In Africa, too, Bosch aims to significantly increase its sales in the years ahead. In 2014, the company will further expand its presence on the continent. In Europe, Bosch aims to grow faster than the market despite the region’s economic situation, which continues to be weak. As it expands its international presence, Bosch is also developing a growing number of products and services that are tailored to local customer needs.

2013 – improved sales and earnings

In fiscal 2013, Bosch increased its sales by 3.1%, to 46.1 billion euros (based on an adjusted previous-year figure of 44.7 billion euros). The disclosed sales figure takes the exit from crystalline photovoltaics into consideration as well as consolidation effects resulting from changed accounting policies and acquisitions in the previous year. After adjusting for exchange-rate effects, sales grew 6.3%. As a result of negative exchange-rate effects to the tune of some 1.5 billion euros, the strong euro had a very negative impact on the sales figure. Excluding burdens from photovoltaics, Bosch disclosed a 6% EBIT margin. This translates into EBIT of 2.8 billion euros. The positive developments in the automotive technology business sector made a significant contribution to the improvement in result. “Also thanks to our many efforts to cut costs, we have taken an important step toward achieving our target EBIT margin of 8%,” Asenkerschbaumer said. Even including the extraordinary burden of 1.3 billion euros resulting from photovoltaics, EBIT margin increased to 3.2%. Bosch has discontinued the activities in the area of crystalline photovoltaics. The company has now sold most of its activities in this area. The sale of the remaining activities is planned to be finalized in the first half of 2014.

Headcount increased in 2013

Headcount increased in 2013

In 2014, Bosch expects headcount requirements to increase mainly in the Asia Pacific growth region. Altogether, some 9,000 university graduates will be hired around the world. In Germany, the company is planning to hire some 800 university graduates. The number of new apprentices in Germany will be same as the previous year, at around 1,400. In 2013, the Bosch Group’s workforce grew by about 8,500, to 281,000 (*adjusted previous-year figure: 273,000).

Europe – growth in a difficult economic situation

In Europe, Bosch sales grew despite the ongoing difficult economic situation. The company’s sales in the region increased 2.2% (2.9% after adjusting for exchange-rate effects) to 25.5 billion euros. Sales increased slightly in Germany as well. Bosch invested 1.6 billion euros in Europe in 2013. Especially in eastern Europe, the company is currently expanding its manufacturing capacity. Last year, Bosch invested more than 900 million euros in Germany.

The Americas – strong growth in North America, recovery in South America

In the Americas, sales in nominal terms varied considerably in 2013. In North America, Bosch sales grew by 3.5% (6.8% after adjusting for exchange-rate effects) to 7.8 billion euros. This was in part the result of an increase in vehicle production. In contrast, sales in the South American market decreased by 3.6%, to 1.7 billion euros. However, after adjusting for exchange-rate effects, sales increased 8.9%. Bosch invested some 280 million euros in North and South America in 2013.

Asia Pacific – improvement in China, severe currency effects

In Asia Pacific, Bosch achieved sales growth of 5.8% (13.8% after adjusting for exchange-rate effects) to roughly 11.1 billion euros. Especially in the Chinese growth market, demand for automotive and industrial technology picked up significantly over the course of the year. Demand for automotive technology was also high in Southeast Asia. In India, poor economic conditions meant that business developed less well than forecast. The same applied to Japan. In 2013, Bosch again made considerable investments in Asia Pacific. With some 620 million euros spent, Bosch focused especially on expanding its manufacturing capacity for automotive components.

Research and development expenditure remains high

Last year, Bosch spent some 4.5 billion euros, or 10% of sales, on research and development. Bosch researchers filed nearly 5,000 patents over the course of 2013, some 20 per working day. The company plans to continue expanding its research and development capacity this year. By the end of 2014, Bosch will have some 45,000 researchers and engineers on board. More than 2,000 additional researchers will be hired in Asia Pacific, for instance. The company is also boosting its innovative strength in Germany, with a new center for research and advance engineering in Renningen, near Stuttgart.

Maintaining cutting-edge research – rapid transfer to industrial application

Denner, whose responsibilities on the Bosch board of management also include research and development, called for greater political commitment to promoting innovation: “Policymakers need to set their sights higher.” While Germany is close to spending 3% of GDP on research, the private sector has played a greater role in this achievement than the public sector has. Denner deplored the fact that universities were chronically underfunded. In some cases, he said, there was not enough money to pay for the buildings’ upkeep. For him, the result was obvious: top researchers were leaving Germany in favor of research institutes in other countries. Denner went on: “In research and development, Germany and other European countries have to measure up to the world’s leading countries.” He said that funding must above all benefit basic research, as well as its rapid transfer to industrial application. “Top universities make the regions they are located in more appealing. Companies indirectly benefit from this as well.” Bosch itself is an active member of 250 university research partnerships.

Leave a Reply