Years after directing two-wheeler manufacturers, the calls for deploying flex-engines across automotive segments grow louder.

Story by: Ashish Bhatia

With inputs from Deepti Thore

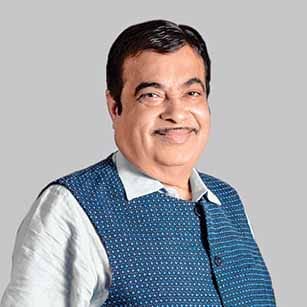

Flex-engines or dual-fuel engines are back in the spotlight. At the 60th SIAM Annual Convention, Minister of Road, Transport and Highways and Micro, Small and Medium Enterprises, Nitin Gadkari drew the Original Equipment Manufacturers (OEMs) and suppliers attention to the flex-engines yet again. Speaking on the Government willingness to handover the industry a longterm regulatory roadmap and extend support in helping build the requisite infrastructure, he opined that the changing and advancing technology in the country had the potential to pave the way to make India a global export hub. The union minister pinpointed the flex-engine technology as a globally proven one and one that was deployed successfully by manufacturers. “I urge the industry to introduce flex-engine technology, a proven technology already being used by several companies in Brazil, the US and in Canada,” he stated. Gadkari underlined the potential of flex-engines in helping the Government of India attain its twin-objective: curbing pollution and reducing crude oil imports. Among leading manufacturers of the Flex-Fuel Vehicles (FFVs) globally are Ford, Volkswagen, General Motors, Honda, Nissan, Audi, BMW, Mercedes, Yamaha and Toyota. Indian manufacturers like Maruti Suzuki and Tata Motors have also in the past, expressed the willingness to pursue alternative fuels starting with CNG as an intermediate step. Supporting OEMs in this endeavour are also component manufacturers like Bosch, BorgWarner and MAHLE.

Speaking highly of alternative fuel choices like Compressed Natural Gas (CNG), Liquified Natural Gas (LNG) and ethanol for the future, the minister, lauded the industry for its transition to Bharat Stage VI (BSVI) emission standards. Citing the leapfrog deemed impossible initially, he expressed confidence in the industry’s capability of being able to similarly manufacture flex-engines for India on par with global countries. “The production of biofuels will be increased given the production surplus of foodgrains. Why are companies not starting this in India? Think about it. Only a filter has to be changed,” he opined brushing aside apprehensions put forth by the industry of associated research work required to be carried out. The industry had advocated for a longer gestation period to be considered for existing technologies the industry is invested in, especially in the aftermath of the pandemic. The fuel filter referred to by the minister is crucial to dust holding capacity and filtration efficiency.

The last major instance of flex-engines being discussed with much enthusiasm was at the time of E100 bikes being prepared for launch in 2018. The TVS Apache RTR 200 Fi E100 was introduced as the only ethanol-powered production motorcycle powered by the SI, four-stroke, oil-cooled type engine. It featured the Twin-Spray-Twin-Port EFI, a closed-looped fuel injection system known to be controlled by a 16-bit Bosch microprocessor. Among its notable inclusions were the idling air controlled valve, manifold absolute pressure sensor, high-pressure twin spray, lambda sensor, temperature sensor and a fuel pump. It also featured the TVSM patented Oil-Cooled Combustion Chamber (O3C) with ram-air assist claimed to reduce the engine heat map by 10 per cent. The bike stood out with its green graphics and a prominent ethanol logo on its 12-litre fuel tank. Priced at Rs.1.2 lakh and made available in select cities, the bike shared its underpinnings with the petrol RTR 200 4V.

The India feasibility

The Union Minister was quick to reiterate the Government’s commitment to providing an integrated fuel roadmap that would include phase-wise introduction and support for a conducive ecosystem. To support his call for introducing flex-engines, Gadkari shared the government vision to increase the ethanol economy from Rs.20,000 crore to one lakh crore besides steps to encourage ethanol pumps across the country. On behalf of the government, the minister invited ideas and suggestions from the stakeholders in the interest of the overall sectoral recovery and growth.

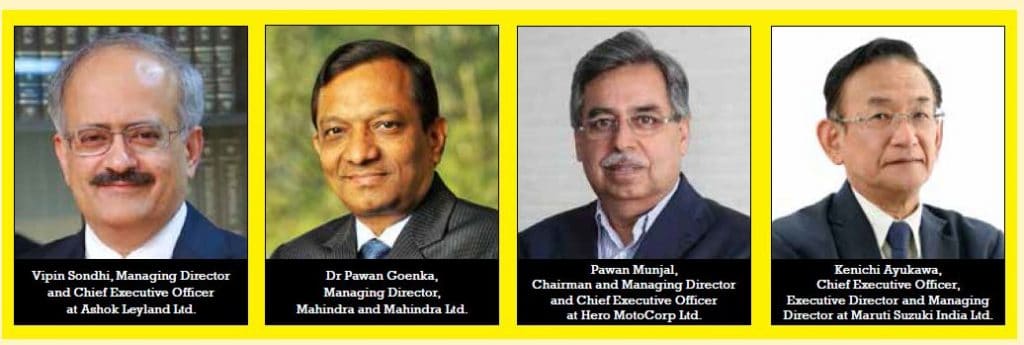

Acknowledging the minister’s call for introducing flex-engines in India, Kenichi Ayukawa, Chief Executive Officer, Executive Director and Managing Director at Maruti Suzuki India Ltd., called upon the need to put the groundwork in place before making the leap. “There is a need for maximising production with a higher degree of localisation to be able to meet the export aspirations,” he exclaimed. Pawan Munjal, Chairman and Managing Director and Chief Executive Officer at Hero MotoCorp Ltd., said, “Engineering, innovation and research and development are the need of the hour.” Dr Pawan Goenka, Managing Director, Mahindra and Mahindra Ltd., stated, “The export aspiration is an opportunity for the supply chain and we should move ahead with optimism.” Opined Vipin Sondhi, Managing Director and Chief Executive Officer at Ashok Leyland Ltd., “We need to participate in the creation of international standards. Only intellectual property will drive the change we are hoping for.”

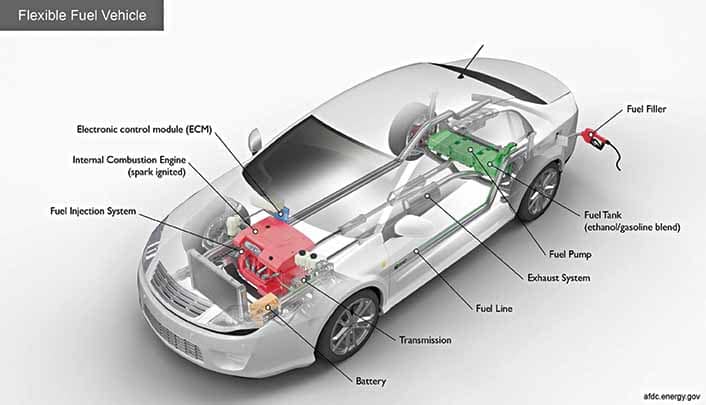

Found in FFVs, flex-engines have existed for a long time the world over and can be traced back to the 1990s with over a 100 offsprings. A flex-engine or dual-fuel internal combustion engine differs from conventional engines as it can run on fuels other than gasoline-like ethanol and methanol. It can be extended to a desired ethanol or methanol to gasoline ratio from the same tank (for example 85 per cent ethanol and 15 per cent gasoline). Notably, according to Indian Sugar Mills Association (ISMA), the all India average of blending ethanol with petrol is pegged at 5.09 per cent for the period December 01, 2019, to June 22, 2020, compared to 0.67 per cent in 2012-13. For 2020-21, the government of India is targeting an average of 7.5 to eight per cent ethanol blend with petrol.

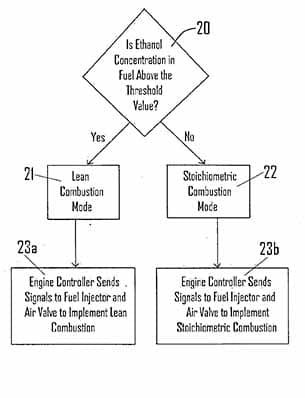

The flex-fuel internal combustion engine system is designed to sense the alternative fuel concentration (ethanol) in the fuel. If the concentration of the alternate fuel is higher than desired, the system adjusts the engine for lean fuel combustion. The after-treatment system kicks in to remove the unwanted emissions through the exhaust. In case of a lesser concentration, the fuel injector and air intake valve are controlled to maintain a stoichiometric air to fuel ratio (the ideal ratio of air to fuel where all the fuel is burnt with no excess air for a gasoline engine is 14.7:1). The engines are specially built to withstand the higher ethanol octane rating (110 octanes) and corrosive properties including altered oxygen sensors.

The flex-fuel internal combustion engine system is designed to sense the alternative fuel concentration (ethanol) in the fuel. If the concentration of the alternate fuel is higher than desired, the system adjusts the engine for lean fuel combustion. The after-treatment system kicks in to remove the unwanted emissions through the exhaust. In case of a lesser concentration, the fuel injector and air intake valve are controlled to maintain a stoichiometric air to fuel ratio (the ideal ratio of air to fuel where all the fuel is burnt with no excess air for a gasoline engine is 14.7:1). The engines are specially built to withstand the higher ethanol octane rating (110 octanes) and corrosive properties including altered oxygen sensors.

The flex-engines are deemed better to consumers buying conversion kits, another alternative to run the engine on dual-fuels. The fuel kits are claimed to offer ease of installation requiring connection to the injector connectors. Kit providers are offering technical support for 24 months from the date of purchase of the kit. In the case of the flex-engine, the fuel lines, gaskets, seals, injectors and rubber fuel hoses are all built to offer high corrosion-resistance. The internal engine components, valve seats, piston rings, valves among other components are also engineered to insulate against the high conductivity levels of ethanol. Electronic Control Module (ECM) that controls the fuel mixture, ignition timing and emission system is a key inclusion as per an alternative fuels data centre study. While FFVs share most components with the conventional ICE-powered vehicles and are claimed to be easy to produce, questions continue to be raised on the overall running efficiency and release of the plant-based (over petroleum-based) CO2 emissions released back into the atmosphere.

India’s global standing

According to the SIAM white paper on alternative fuels for vehicles, two-wheelers and passenger vehicles, 2008 onwards, have been material compatible with 10 per cent ethanol-blended fuel. All vehicles manufactured before 2008 do not have such a capability which increases their dependence on low renewable ethanol blends like E5. Diesel passenger vehicles and commercial vehicles, in comparison, are known to be material compatible with five per cent bio-diesel blended diesel. Two-wheelers and passenger gasoline vehicles are not compatible with methanol blended fuels. In India, OEMs and suppliers will need to make material changes and specifically calibrate the engines and components to be compatible with higher methanol blends for instance. The industry will also have to address operational challenges like cold start ability and hot re-start ability.

According to the SIAM white paper on alternative fuels for vehicles, two-wheelers and passenger vehicles, 2008 onwards, have been material compatible with 10 per cent ethanol-blended fuel. All vehicles manufactured before 2008 do not have such a capability which increases their dependence on low renewable ethanol blends like E5. Diesel passenger vehicles and commercial vehicles, in comparison, are known to be material compatible with five per cent bio-diesel blended diesel. Two-wheelers and passenger gasoline vehicles are not compatible with methanol blended fuels. In India, OEMs and suppliers will need to make material changes and specifically calibrate the engines and components to be compatible with higher methanol blends for instance. The industry will also have to address operational challenges like cold start ability and hot re-start ability.

In comparison to India, the US brought out the Open Fuels Standard Act in 2011. Aimed at putting a full stop to the oil monopoly, the country pushed for 50 per cent of cars to be run on flex-fuels by 2015, and up to 80 per cent by 2018 despite strong opposition. In another move to create a pull, retailers installing E85 pumps were handed over complimentary kits to educate motorists. By 2018, the FFV population in the US is known to have breached the 24 million mark and is claimed to be catered to by an approximate 4500 pumps providing E85 among other ethanol blends. In Brazil, with the 40-year history of ethanol usage, ethanol stocks have hit a record high in May 2020, soaring by 82 per cent to 4.63 billion litres, attributed to low fuel demand. It is also known to have signed a Memorandum of Understanding (MoU) with India for promoting and assisting the latter’s ethanol programme. Together with the US, Brazil accounts for 75 per cent of the global ethanol production with 80 per cent of its fleet known to run on flex-engines. In Europe and China, interestingly, the call for looking beyond internal combustion engines in light-duty vehicles has cast a cloud over the FFVs strategy.

Proposed roadmap

By 2025, based on fuel availability and infrastructure, two-wheelers can be expected to be E10 material compliant subject to a consistent year-round supply of fuel across all dispensing stations in the country as per SIAM recommendations. These vehicles will also be made compliant to three per cent methanol blend (M3). By 2030, the two-wheeler compatibility needs to go up to E20 and M3. In the case of three-wheelers, by 2025, the target is to attain E10 material and M3 spark ignition (S.I.) compliance. In the case of compression ignition engines (C.I.), the industry is targeting seven per cent bio-diesel compliance. By 2030, S.I. three-wheeler E20 compliant engines on CNG or LPG are expected to be introduced. Between 2030 and 2047, the S.I. engine vehicles if on a dual-fuel system, will be specifically built for E20 compliance. By 2025, all new vehicles must be E10 material compliant besides being material compliant to gasoline fuel with M3. By 2030, E20 compliant S.I. cars will be produced and also made M3 compliant across the country. Between 2030-2047 E20 vehicles along with other types must continue to help the government reduce its crude dependence.

Even as India moves towards flex-engines in a bid to curb crude imports, the country remains heavily reliant on the United States, the largest ethanol supplier to India for six straight years. As per the India Biofuels Annual 2019 report, the country’s five-year average consumption has surpassed its average production for the corresponding period with the ethanol imports likely to exceed 750 million litres. As the government encourages domestic second-generation (2G) ethanol production from biomass and other wastes and creates an ecosystem for flex-fuel, there is a lot left to do before India becomes a net producer of alternative fuels and benefits from flex-engines as envisioned. The government has a key role to play as it redirects OEM and supply resources in an already trying business environment. ACI