As per a Frost & Sullivan report, utilities will employ demand response and coordinated charging to overcome grid capacity constraints.

Team ACI

Greater vehicle electrification has given rise to the use of disruptive technologies like Vehicle-to-Grid (V2G) and peer-to-peer blockchain trading says a Frost & Sullivan report – Larger Electric Vehicle Parc to Generate Investment Opportunities in the Utility Grid Infrastructure. According to the report, it has led to higher expectations from utilities. Utilities are expected to employ smart charging and demand response programs in a bid to cope with the growing demand for energy. As per a recent statistic, cumulative Electric Vehicle (EV) sales could rise from 34 million in 2025 to 121.2 million in 2030. By 2040, it is expected to reach 636.7 million. In effect, this means that the cumulative power demand could spike from 11,612.6 TWh in 2018 to 19,756.8 TWh in 2040. Avers Vasanth Krishnan, Research Analyst for Energy & Environment at Frost & Sullivan, “Utilities will play a bigger role in the transportation electrification revolution with offerings such as EV-specific dynamic pricing, integration with decentralised storage units, Vehicle-to-Anything (V2X), and workplace charging incentives.” “Collaborative efforts between various stakeholders in the automotive and energy value chain are critical for utilities to offer competitive bundled services and products,” he adds.

Critical Elements of EV Power and Utility Ecosystem

The fall in battery prices, stringent emission regulations and rapid increase in public charging stations coupled with innovation in eMobility business models are regarded as drivers of growth pertaining to the electrification of transport over the next decade. Lack of standardisation and interoperability between various EV chargers, load management with the looming threat of overloading of local distribution transformers due to EV addition and peak load problems coupled with a lack of customer awareness about tax credits and utility programs have been identified as the restraints for the EV-Power Ecosystem. While the overall increase in electricity consumption is said to be lower than people’s expectations, it is expected to pose a huge challenge for the power grid post-2030. On the other hand, the proliferation of EVs is expected to generate new revenue opportunities for energy service companies on the lookout for a clear roadmap for the utilities to capture the value offered by the flexibility of EVs.

Supply deficit and opportunity

Supply deficit and resultant opportunities are key to the growth of EVs. Avers Jonathan Robinson, Research Manager for Energy & Environment at Frost & Sullivan, “China and the US are likely to face a supply gap in the early-to-mid 2030s, while Germany and Japan have around five years longer before the situation becomes critical.” “EV’s will bring considerable variable load onto the grid, which is an opportunity – as long as there is an investment in the 2020s to handle this,” he adds.

Grid Investment

Utilities in key markets are known to be exploring options when it comes to EV charging and tariffs. With a majority of the grid, investment said to be focused on the distribution side, the end objective is to increase capacity. To tap the greater investment opportunities, utilities will look to innovate business models in order to incentivise customers to inturn charge EVs. The charging solution providers, utilities, technology solution providers and EV manufacturers are recommended to engage in dialogue and in working groups to ensure standardisation and availability. The report also recommends investments to be made in digital support applications for charging solutions which provide users with real-time updates on electricity pricing and slots available at charging stations. Calling for partnerships with the OEMs and battery manufacturers to design efficient batteries that can be used as a valuable grid asset or a backup solution, the study calls for deploying charging infrastructure with distributed energy resources and smart buildings in a bid to make the most of the flexibility of EVs while stabilising the electric grid. Another recommendation calls for offering a fixed monthly price to the customers for various products and services. It may include EV chargers, smart thermostat, V2G services, demand response and more.

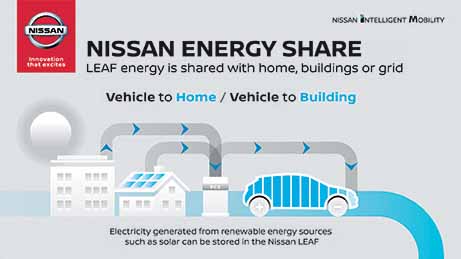

YOKOHAMA, Japan (Nov. 28, 2018) – Nissan has created a vision to make electric vehicles even more useful to customers by introducing new convenient ways to utilize their batteries’ ability to store and share energy.

GIL India Summit 2019

In the 11th edition of Frost & Sullivan’s Growth Innovation and Leadership (GIL) India 2019 Summit, a discussion on the future of utilities and the need for charging infrastructure had Amot Kotwal, Senior Director, Frost & Sullivan, draw attention to the challenges faced by the utilities. The poor financial health of the DISCOMs stressed distribution networks and lack of regulations standards for EV charging services were brought to the fore. Among the recommended benefits that the utilities can leverage, distributed renewable generation and peer-peer transactions through blockchain technology found a mention. Speaking of the potential ibn the EV components industry, opined Kaushik Madhavan, Vice President, Mobility Practice, Frost & Sullivan that the market size for the EV components industry is estimated to reach USD 4.8 billion by 2025. He added that one-third of the EV motor market would emerge directly from the demand projected in EV buses in India by 2025. Here, the passenger vehicle segment will hold a 67 per cent share in the battery market by 2025. The two-wheeler segment is expected to hold a share of 61 per cent in the power electronics market by 2025. The demand for a lithium-ion battery pack according to Madhavan is estimated to be pegged at 15.6 million KWh by 2025.

In another Frost & Sullivan report titled – Impact of Electric Vehicles on Power Demand, Forecast to 2040 – A Perspective on Key Global Markets, the company provides a holistic view of EV Penetration and the resulting impact on energy demand. The report analyses its effect on stakeholders such as EV manufacturers, battery suppliers, power utilities and infrastructure, EV end-users, regulators and external actors, and EV aggregators. The report further brings to the fore recommendations on the strategies for energy service providers and the action plan for utilities covering the geographical markets of the US, Europe and the UK, Germany, China and Japan. ACI