Bloomberg Philanthropies, in partnership with BloombergNEF released a report on India’s Clean Power Revolution. The report outlines the current successes and future potential of India’s clean energy economy.

Story by: Deepti Thore

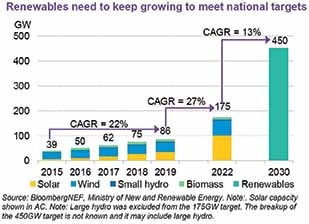

India is emerging as the numero uno market for clean energy investment. According to BloombergNEF’s Climatescope, the country has taken centre stage with declarations of ambitious renewable energy goals of 175 GW by 2022 and 450 GW by 2030 (a combination of solar, wind, biomass and small hydro). These ambitious targets are said to be backed by supportive government policies, openness to investors and the sheer volume of renewables auctioned in recent years. Lessons from India’s competitive clean energy auction market and overall progress could be benchmarked by other economies looking to achieve a green recovery according to Antha N. Williams, Global Head of Environmental Programs, Bloomberg Philanthropies. Afterall, green recovery is believed to have the potential to maximise economic, health and environmental benefits. The report is an attempt to outline investment in clean energy that has the potential to help increase energy access and supply and create jobs besides improving climate and air quality.

India is emerging as the numero uno market for clean energy investment. According to BloombergNEF’s Climatescope, the country has taken centre stage with declarations of ambitious renewable energy goals of 175 GW by 2022 and 450 GW by 2030 (a combination of solar, wind, biomass and small hydro). These ambitious targets are said to be backed by supportive government policies, openness to investors and the sheer volume of renewables auctioned in recent years. Lessons from India’s competitive clean energy auction market and overall progress could be benchmarked by other economies looking to achieve a green recovery according to Antha N. Williams, Global Head of Environmental Programs, Bloomberg Philanthropies. Afterall, green recovery is believed to have the potential to maximise economic, health and environmental benefits. The report is an attempt to outline investment in clean energy that has the potential to help increase energy access and supply and create jobs besides improving climate and air quality.

India’s expected growth in power demand till 2030 is estimated to be 80 per cent, and a flexible power system needs to be put in place. It calls for better coordination on land issues to ensure grid availability matches the commissioning of new projects. The financial health and resiliency of power distribution companies are required to be improved to enhance investor confidence. Coals role in the mix will continue to drop despite rising power demand. Here retiring old coal plants will improve utilisation rates of coal fleets and significantly reduce CO2 emissions. As per the report, a new clean power generation will enable India to avoid 499 million tonne of emissions a year by 2030. While challenges remain to be addressed, the renewable energy transition is expected to serve transitioning economies.

Demand v/s Supply

Power demand in India grew by 50 per cent in the last decade. Electricity consumption rose from 851 Twh in 2010 to 1285 Twh in 2019 at a CAGR of 4.7 per cent. India, notably, has become the world’s third largest consumer behind China and the United States. Domestic and industrial consumers combined, constitute 56 per cent of this demand. In comparison, the supply deficit narrowed from 79 Twh in 2010 to six Twh in 2019. A result of rapid expansion of generation capacity, transmission and distribution infrastructure. Interestingly, installed capacity has seen diversification though coal continues to dominate. To service the anticipated demand-supply capacity has been doubled as per a statistic. India’s net power generation capacity has been increased by 212 GW with 42 per cent of it coming from renewable energy sources. The report attributes this jump in capacity to falling technology costs. Solar is at the heart of this growth, it is claimed.

Power demand in India grew by 50 per cent in the last decade. Electricity consumption rose from 851 Twh in 2010 to 1285 Twh in 2019 at a CAGR of 4.7 per cent. India, notably, has become the world’s third largest consumer behind China and the United States. Domestic and industrial consumers combined, constitute 56 per cent of this demand. In comparison, the supply deficit narrowed from 79 Twh in 2010 to six Twh in 2019. A result of rapid expansion of generation capacity, transmission and distribution infrastructure. Interestingly, installed capacity has seen diversification though coal continues to dominate. To service the anticipated demand-supply capacity has been doubled as per a statistic. India’s net power generation capacity has been increased by 212 GW with 42 per cent of it coming from renewable energy sources. The report attributes this jump in capacity to falling technology costs. Solar is at the heart of this growth, it is claimed.

The private sector is said to have played a key role. The tipping point, it is said, was 2016 with capacity additions going clean. It is also attributed to the widening gap between the price of coal and cleaner power sources. Private Independent Power Producers (IPP), the report claims, built over 90 per cent of the wind and solar power projects in the past five years. A similar pattern has been studied in Europe. While coal continued to meet three-quarters of the country’s power needs in 2019, it was also the first time, absolute energy generated by coal registered a year-on-year decline. The share of natural gas power generation remains at below five per cent levels owing to it being expensive over coal power plants.

The private sector is said to have played a key role. The tipping point, it is said, was 2016 with capacity additions going clean. It is also attributed to the widening gap between the price of coal and cleaner power sources. Private Independent Power Producers (IPP), the report claims, built over 90 per cent of the wind and solar power projects in the past five years. A similar pattern has been studied in Europe. While coal continued to meet three-quarters of the country’s power needs in 2019, it was also the first time, absolute energy generated by coal registered a year-on-year decline. The share of natural gas power generation remains at below five per cent levels owing to it being expensive over coal power plants.

Most attractive emerging market

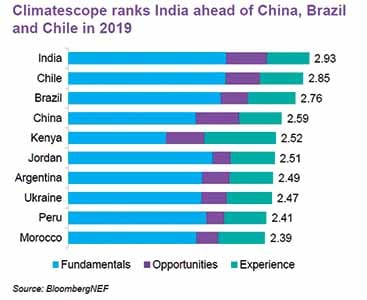

With India’s renewables among cheapest in the world, India is said to have become the most attractive emerging market for clean energy investment. As per Climatescope, India ranks ahead of China, Brazil and Chile. From 104 emerging markets that is said to account for 82 per cent of the world’s population, covering two-thirds of CO2 emissions, India was scored on 167 indicators. On fundamentals like clean energy policies, power sector structure, regulations and barriers to renewables; on opportunities like power demand, price attractiveness, short and medium-term prospects; on experience like installed clean energy, historical investment and state of value supply chains. Here, the emphasis on decentralised small renewables and boosting domestic manufacturing are stated as having the potential to generate more employment.

With India’s renewables among cheapest in the world, India is said to have become the most attractive emerging market for clean energy investment. As per Climatescope, India ranks ahead of China, Brazil and Chile. From 104 emerging markets that is said to account for 82 per cent of the world’s population, covering two-thirds of CO2 emissions, India was scored on 167 indicators. On fundamentals like clean energy policies, power sector structure, regulations and barriers to renewables; on opportunities like power demand, price attractiveness, short and medium-term prospects; on experience like installed clean energy, historical investment and state of value supply chains. Here, the emphasis on decentralised small renewables and boosting domestic manufacturing are stated as having the potential to generate more employment.

The need of the hour is to address challenges pertaining to auction cancellations creating uncertainity among participating developers. Newer auction designs are said to already be addressing these challenges. The introduction of Goods and Services Tax (GST) is blamed for confusion in the solar industry pertaining to the applicable tax rate, in July 2017. Safeguard Duty (SGD) in July 2018 for cells and modules sourced from China and Malaysia apart from other developed countries is said to have been the cause of spike in capex costs. Developers impacted are said to be compensated for the additional costs by the offtakers. An offtake agreement helps secure a market for its future output as an agreement between the producer and the buyer. Renegotiation of contracts and asset quality of low tariff projects have been the other big concern areas. It is also true that India’s large tender pipeline has given developers strong bargaining power pertaining to negotiating prices with equipment suppliers. India’s levelised auction tariffs for both wind and solar are additionally said to be lowest in the world inspite of high borrowing costs and absence of hidden subsidies. The Levelized tariff calculation converts a local currency structured tariff to a common 2019 USD/MWh base after accounting for inflation, the currency of payment, project life and expected date of commercial operation.

The need of the hour is to address challenges pertaining to auction cancellations creating uncertainity among participating developers. Newer auction designs are said to already be addressing these challenges. The introduction of Goods and Services Tax (GST) is blamed for confusion in the solar industry pertaining to the applicable tax rate, in July 2017. Safeguard Duty (SGD) in July 2018 for cells and modules sourced from China and Malaysia apart from other developed countries is said to have been the cause of spike in capex costs. Developers impacted are said to be compensated for the additional costs by the offtakers. An offtake agreement helps secure a market for its future output as an agreement between the producer and the buyer. Renegotiation of contracts and asset quality of low tariff projects have been the other big concern areas. It is also true that India’s large tender pipeline has given developers strong bargaining power pertaining to negotiating prices with equipment suppliers. India’s levelised auction tariffs for both wind and solar are additionally said to be lowest in the world inspite of high borrowing costs and absence of hidden subsidies. The Levelized tariff calculation converts a local currency structured tariff to a common 2019 USD/MWh base after accounting for inflation, the currency of payment, project life and expected date of commercial operation.

How renewables became cost-competitive?

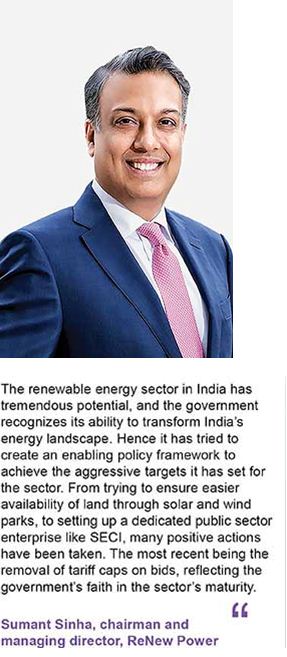

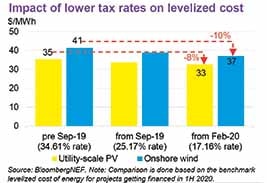

The report credits government policies for turning renewables cost-competitive. Lower corporate tax, acceleration depreciation, Inter-State Transmission System (ISTS) waiver and 100 per cent Foreign Direct Investment (FDI) are all said to have helped Government policies become cost-competitive. For instance, the tax rate for new power generators at 17.2 per cent down from 34.6 per cent prior to the renewables boom has levelised cost of solar and wind by eight to 10 per cent. An accelerated depreciation rate of 40 per cent has reduced investor income tax burden. Wind and Solar projects commissioned before 2022 are exempted from ISTS charges and losses reduced delivered cost of electricity for offtaker by 0.65 rupees per kWh. The 100 per cent FDI has ensured foreign utilities, VC/PE investors, sovereign wealth funds, pension funds and oil and gas majors participated in the boom. Renewables today according to the study command a priority dispatch.

The report credits government policies for turning renewables cost-competitive. Lower corporate tax, acceleration depreciation, Inter-State Transmission System (ISTS) waiver and 100 per cent Foreign Direct Investment (FDI) are all said to have helped Government policies become cost-competitive. For instance, the tax rate for new power generators at 17.2 per cent down from 34.6 per cent prior to the renewables boom has levelised cost of solar and wind by eight to 10 per cent. An accelerated depreciation rate of 40 per cent has reduced investor income tax burden. Wind and Solar projects commissioned before 2022 are exempted from ISTS charges and losses reduced delivered cost of electricity for offtaker by 0.65 rupees per kWh. The 100 per cent FDI has ensured foreign utilities, VC/PE investors, sovereign wealth funds, pension funds and oil and gas majors participated in the boom. Renewables today according to the study command a priority dispatch.

The emission norms for new coal and gas power project are said to be strictest in the world. A weak implementation though has led to a new compliance deadline of December 2022. With coal plants needing an estimated USD 12 billion to install SO2, NOX and particulate matter control equipment, the going is expected to get only tougher for coal plants. Water availability for coal plants is another barrier. Lithium-ion battery prices falling over 87 per cent in the last decade. By 2024, BloomberNEF has predicted prices to be below USD 100 per kWh on a volume-weighted average basis.

Long-term outlook

The New Energy Outlook (NEO) study, an annual study of BloomberNEF looks at the global power systems. An in-depth analysis of 20 countries, the outlook based on the least-cost technology options to meet future electricity demand highlighted India’s pledge in Paris. India has pledged to attain 40 per cent of its installed capacity from non-fossil fuel-based resources by 2030. India is aiming for 55-60 per cent levels at the current rate of over 37 per cent according to Raj Kumar Singh, Union Minister of State (Independent Charge), Ministry of Power and Ministry of New and Renewable Energy. Interestingly, despite the growth in demand, demand from electric vehicles is pegged at less than 0.5 per cent by 2030 when one expects to see early growth indicators. It is noteworthy, that even by 2030 the initial target of going fully electric would have to realign with the country projected to have lower than Brazil’s per-capita demand then. This does not take away from the growth potential albeit.

The New Energy Outlook (NEO) study, an annual study of BloomberNEF looks at the global power systems. An in-depth analysis of 20 countries, the outlook based on the least-cost technology options to meet future electricity demand highlighted India’s pledge in Paris. India has pledged to attain 40 per cent of its installed capacity from non-fossil fuel-based resources by 2030. India is aiming for 55-60 per cent levels at the current rate of over 37 per cent according to Raj Kumar Singh, Union Minister of State (Independent Charge), Ministry of Power and Ministry of New and Renewable Energy. Interestingly, despite the growth in demand, demand from electric vehicles is pegged at less than 0.5 per cent by 2030 when one expects to see early growth indicators. It is noteworthy, that even by 2030 the initial target of going fully electric would have to realign with the country projected to have lower than Brazil’s per-capita demand then. This does not take away from the growth potential albeit.

India is expected to save USD 78 billion cumulatively in electricity generation costs from now to 2030. It is possible by following the least-cost path to meeting electricity demand according to the study. The Covid-19 has led to the share of renewables going up by an estimated 30 per cent compared to 14-18 per cent levels pre-lockdown. However, the report suggests that the pandemic is not expected to alter India’s path to 450 GW renewables supported by government policies. Among financial measures by IPP to keep tariffs lower at newer types of auctions for renewable power include Low IRR expectations for first few projects, benefit from global price decline for PV modules and batteries, lower finance costs from Covid-19 recovery measures and selling off excess power to third party.

A robust grid will be essential to integrate 450 GW renewables and serve end-users. There is a greater opportunity to ramp up manufacturing of energy storage technologies given the expected demand from sectors like automotive. The government is trying to support manufacturing by putting out tenders with domestic content requirements, import duties and lower corporate taxes for new units. The government intends to offer dedicated manufacturing parks to attract foreign firms with advanced technology and a will to diversify their global manufacturing bases. ACI